Wyoming Purchase Agreement by a Corporation of Assets of a Partnership

Description

How to fill out Purchase Agreement By A Corporation Of Assets Of A Partnership?

If you require to finalize, obtain, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Utilize the site’s straightforward and efficient search function to discover the documents you need.

Various templates for commercial and personal purposes are categorized by type and jurisdiction, or keywords.

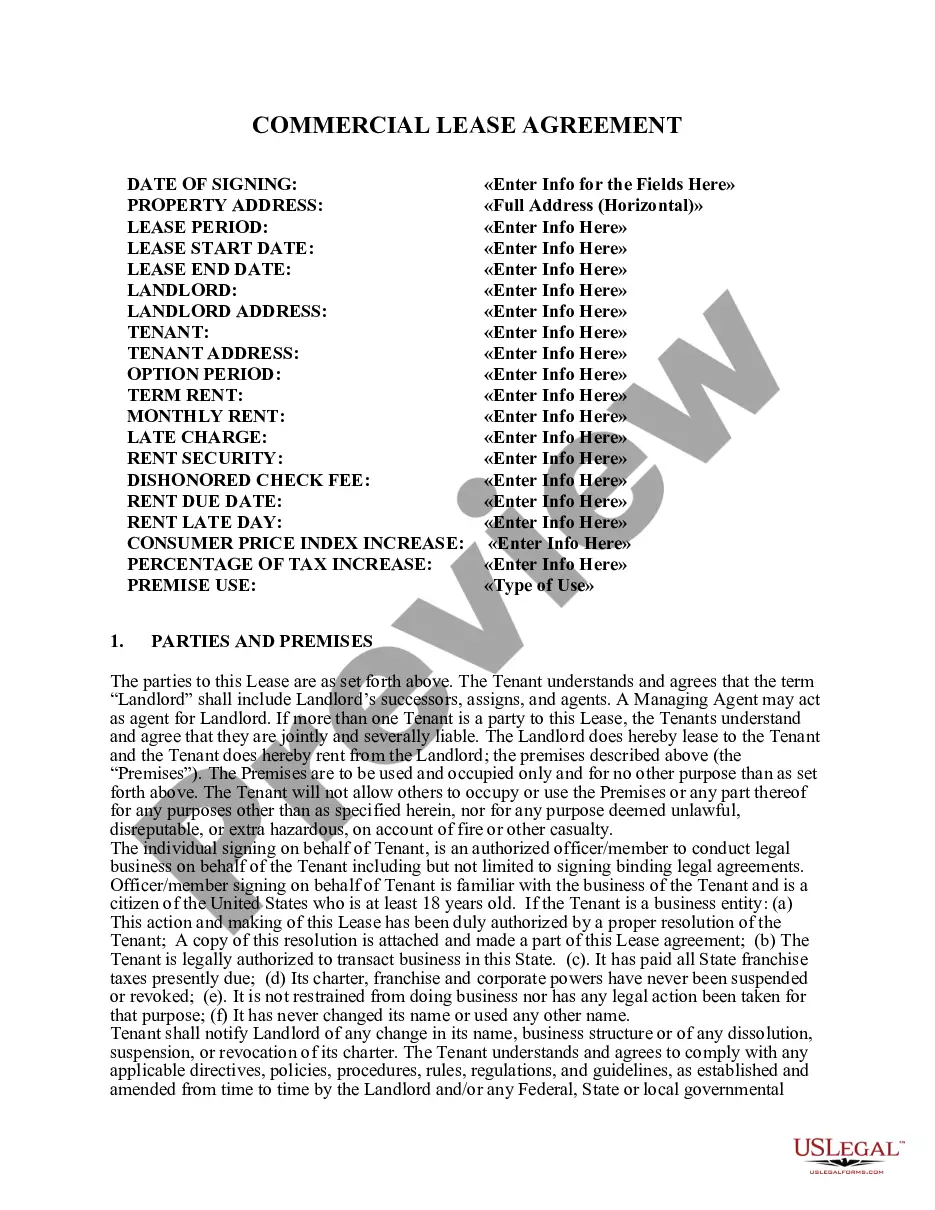

Step 4. After identifying the form you need, click the Get now button. Select your preferred pricing plan and provide your information to register for an account.

Step 5. Complete the payment. You may utilize your Visa or MasterCard or PayPal account to finalize the transaction. Step 6. Retrieve the format of the legal form and download it to your device. Step 7. Fill out, modify and print or sign the Wyoming Purchase Agreement by a Corporation of Assets of a Partnership. Every legal document format you purchase is yours indefinitely. You have access to every form you have saved in your account. Navigate to the My documents section and select a form to print or download again. Stay competitive and download, and print the Wyoming Purchase Agreement by a Corporation of Assets of a Partnership with US Legal Forms. There are numerous professional and jurisdiction-specific forms available for your business or personal needs.

- Utilize US Legal Forms to locate the Wyoming Purchase Agreement by a Corporation of Assets of a Partnership in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to obtain the Wyoming Purchase Agreement by a Corporation of Assets of a Partnership.

- You may also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the instructions outlined below.

- Step 1. Ensure you have selected the correct form for the relevant city/state.

- Step 2. Utilize the Review option to examine the form’s content. Remember to read the summary.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form format.

Form popularity

FAQ

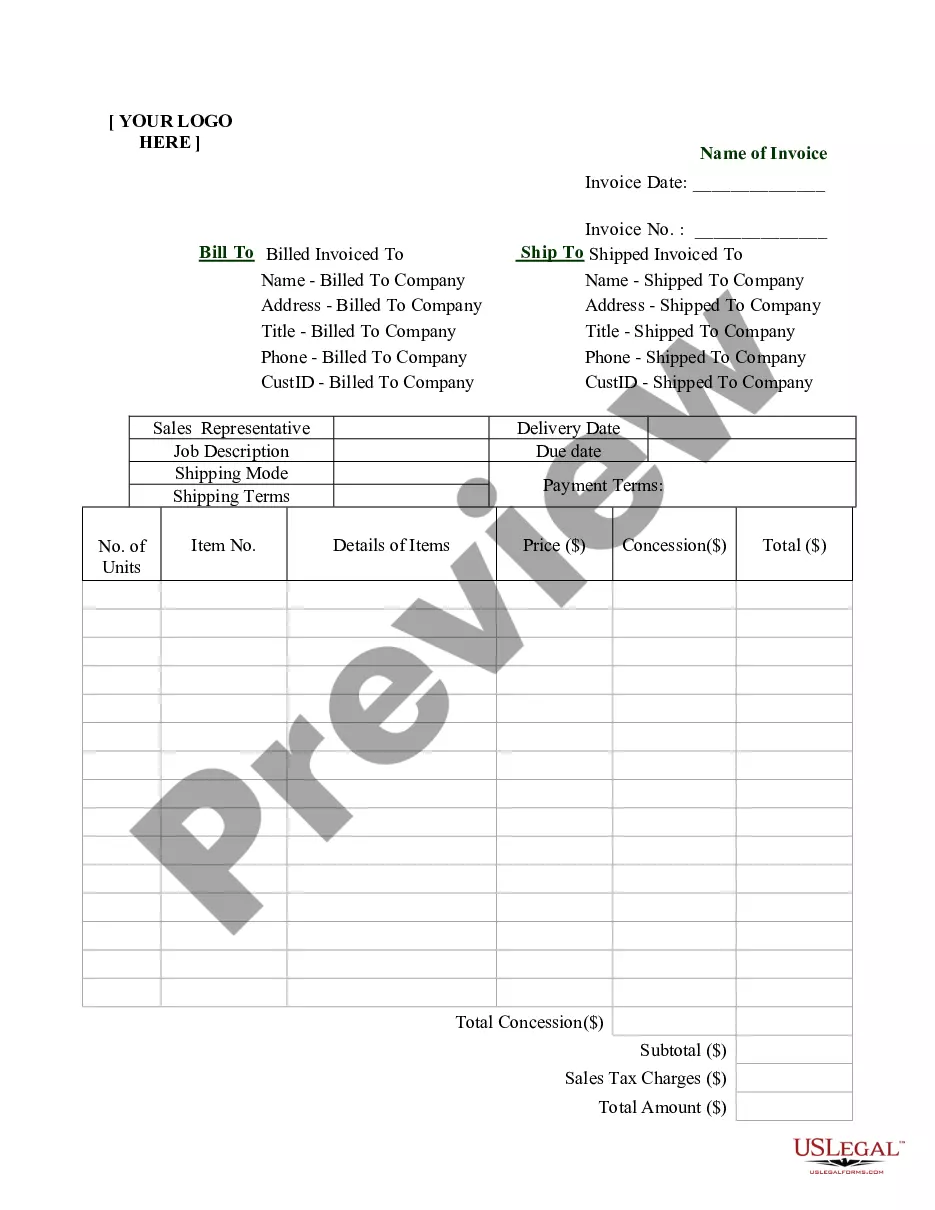

Your sale and purchase agreement should include the following:Your name(s) and the names of the seller(s).The address of the property.The type of title (for example, freehold or leasehold).The price.Any deposit you must pay.Any chattels being sold with the property (for example, whiteware or curtains).More items...

An LLC Membership Purchase Agreement is a document used when a member of an LLC (a limited liability company) wishes to sell their interest, or a portion of their interest, to another party.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

Since a contract for deed does not require the title work that a traditional contract for sale does, buyers risk buying a property with bad title. Sellers do not have to deliver clean title until the final payment, so buyers are not certain that they will receive good title to the property.

Wyoming is currently 1 of 7 states that do not impose a personal income tax. This means the members of your LLC will not file a state-level return in Wyoming.

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

Pros and Cons of a Contract for DeedPro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

Since Wyoming does not collect an income tax on individuals, you are not required to file a WY State Income Tax Return. However, you may need to prepare and efile a Federal Income Tax Return.

Wyoming is one of only a very few states that does not have a personal income tax or a corporation income tax. Consequently, for most LLCs, including those that may have elected to be taxed as corporations, no state income taxes are due.