This is a form for return of merchandise by a customer.

Wyoming Merchandise Return

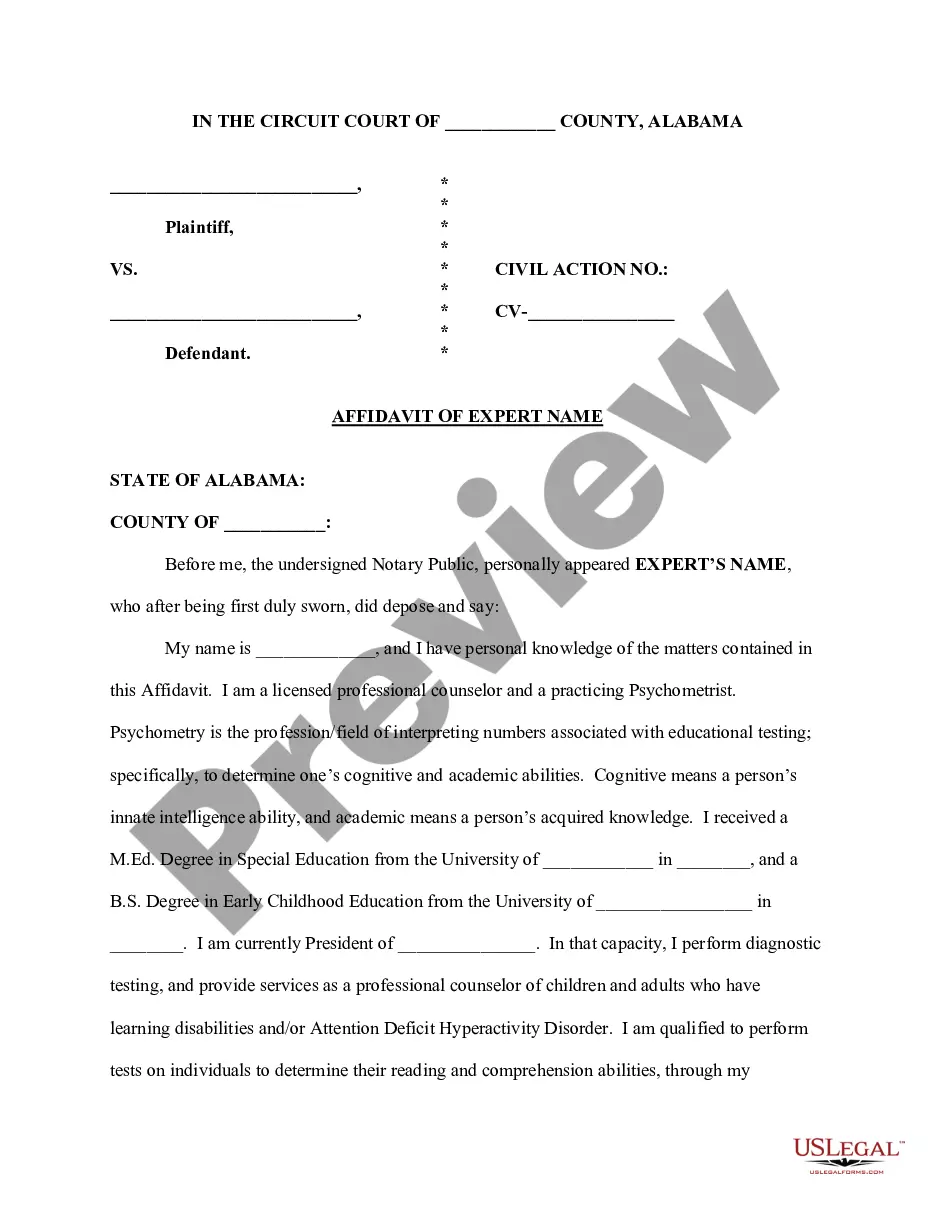

Description

How to fill out Merchandise Return?

Are you in a location where you require documents for either business or particular purposes nearly every day.

There are numerous legal document templates accessible online, but finding versions you can trust isn’t straightforward.

US Legal Forms offers a wide array of form templates, such as the Wyoming Merchandise Return, which is designed to comply with federal and state regulations.

If you find the appropriate form, click on Acquire now.

Choose the payment plan you prefer, enter the required details to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and possess a free account, simply Log In.

- After that, you can download the Wyoming Merchandise Return template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it corresponds to the correct city/state.

- Use the Review button to examine the form.

- Check the details to confirm that you have chosen the right document.

- If the form isn’t what you’re looking for, use the Search field to locate the document that fits your needs.

Form popularity

FAQ

Wyoming offers several exemptions from sales tax, encompassing different categories. For instance, necessities like groceries and prescription medications are exempt, enhancing budget-friendly shopping options. Additionally, certain services and goods related to educational or charitable purposes also qualify for exemptions. With resources such as Wyoming Merchandise Return, you can easily navigate these exemptions and ensure compliance.

In Wyoming, labor is typically not subject to sales tax, but there are exceptions to this rule. Services related to the sale of tangible personal property can incur tax obligations. It's important to understand the context of the service provided and how it interacts with tangible goods. Utilizing a platform like Wyoming Merchandise Return can help clarify these complexities for businesses and individuals.

Not all labor is taxed in Wyoming, which can sometimes create confusion. Generally, services that involve labor are distinct from tangible goods. However, there are exceptions where certain labor might be subject to tax, so it's wise to review specific cases. For more detailed assistance, consider exploring resources like Wyoming Merchandise Return.

Wyoming exempts certain services from sales tax, including many professional services. This exclusion can be beneficial for LLCs offering specific types of consulting or advice. Understanding these exemptions can influence your financial planning, especially regarding products related to Wyoming Merchandise Return. Consulting uslegalforms can clarify any specific concerns.

In general, a Wyoming LLC is not required to file a state tax return. This is an advantageous feature for many business owners. However, federal tax considerations remain crucial, and some LLCs may have other reporting needs. For more information about related processes, including your Wyoming Merchandise Return, explore options at uslegalforms.

Typically, a Wyoming LLC does not have to file a state tax return due to the absence of state income tax. However, it is essential to assess individual circumstances as federal requirements still apply. This simplicity can make navigating your Wyoming Merchandise Return obligations easier. Platforms like uslegalforms can help clarify your responsibilities.

Yes, Wyoming does require an annual report for LLCs, which is filed each year. This report includes basic information about your business, such as its address and contact details. Filing the report maintains your LLC's active status. Doing so confidently supports your Wyoming Merchandise Return processes.

No, Wyoming does not require businesses to file a state income tax return. This makes it a favorable location for LLCs, especially those involved in retail and services. However, ensure you’re aware of any local taxes that may apply. For clear guidance on Wyoming Merchandise Return requirements, consider uslegalforms as your resource.

An LLC can potentially avoid filing a federal tax return, but it may still face state obligations. In Wyoming, there is no state income tax, which simplifies tax considerations for LLCs. However, it is important to review local regulations and comply with any necessary filings. Utilizing platforms like uslegalforms can assist you with these requirements.

Yes, filing an annual report for your LLC in Wyoming is a requirement. The state uses this report to keep your business information current. It is essential for maintaining your good standing and helps avoid penalties. Understanding the Wyoming Merchandise Return process can streamline your filing experience.