Wyoming Petty Cash Journal

Description

How to fill out Petty Cash Journal?

If you desire to be thorough, acquire, or print officially sanctioned document templates, utilize US Legal Forms, the largest assortment of legal forms that are accessible online.

Employ the site's straightforward and convenient search tool to locate the documents you require.

Many templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Acquire now button. Select the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Use US Legal Forms to find the Wyoming Petty Cash Journal within a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to access the Wyoming Petty Cash Journal.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the directions below.

- Step 1. Ensure you have selected the form for the correct city/state.

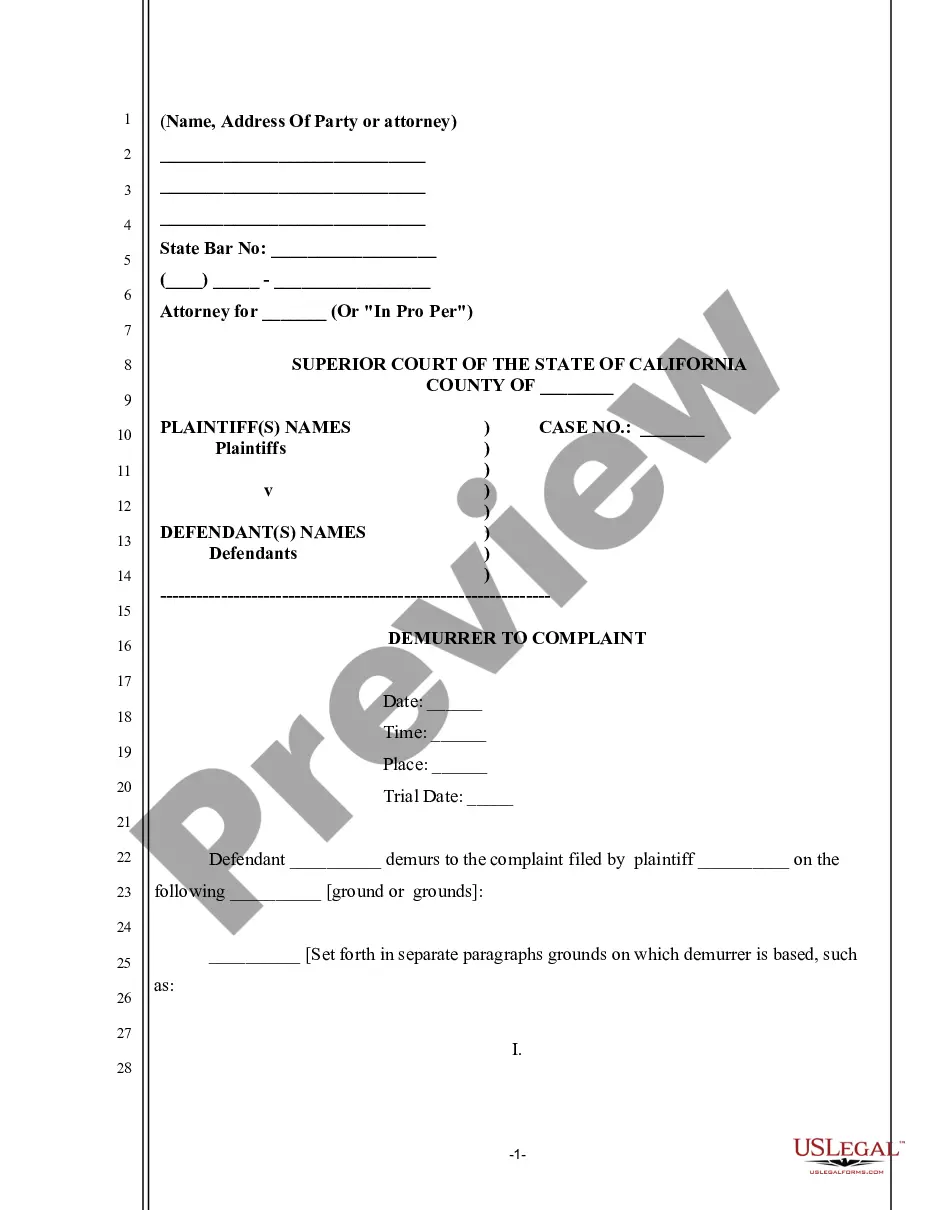

- Step 2. Use the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to look for alternative templates in the legal form repository.

Form popularity

FAQ

Definition of Petty Cash Petty Cash is also the title of the general ledger current asset account that reports the amount of the company's petty cash. The amount of petty cash will vary by company and may be in the range of $30 to $300.

Petty cash is a small amount of cash that is kept on the company premises to pay for minor cash needs. Examples of these payments are office supplies, cards, flowers, and so forth. Petty cash is stored in a petty cash drawer or box near where it is most needed.

To show this, debit your Petty Cash account and credit your Cash account. When the petty cash fund gets too low, you must refill it to its set amount. Then, create another journal entry debiting the Petty Cash account and crediting the Cash account.

The four steps to do petty cash accounting and recording are:Establish Petty Cash Policy & Procedures. The first thing you need to do is document your petty cash procedures and communicate them to all employees.Set Up a Petty Cash Log.Create Journal Entries to Record Petty Cash.Reconcile the Petty Cash Account.

There are two primary types of entries in the petty cash book, which are a debit to record cash received by the petty cash clerk (usually in a single block of cash at infrequent intervals), and a large number of credits to reflect cash withdrawals from the petty cash fund.

A simple petty cash book is just like the main cash book. Cash received by the petty cashier is recorded on the debit side, and all payments for petty expenses are recorded on the credit side in one column.

Journal entry for putting money into the petty cash fund To show this, debit your Petty Cash account and credit your Cash account. When the petty cash fund gets too low, you must refill it to its set amount. Then, create another journal entry debiting the Petty Cash account and crediting the Cash account.

Log or Voucher After making his purchases, the person will return with receipts and change. In your log, record the change in the debit column and enter the amount spent in the balance column. On the next line, subtract the balance amount from the opening balance to keep a running total of the amount in petty cash.

The petty cash journal entry is a debit to the petty cash account and a credit to the cash account. The petty cash custodian refills the petty cash drawer or box, which should now contain the original amount of cash that was designated for the fund. The cashier creates a journal entry to record the petty cash receipts.