Wyoming Sun Tanning Bed Agreement and Release Form

Description

How to fill out Sun Tanning Bed Agreement And Release Form?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a range of legal templates that you can download or print.

Through the website, you can access thousands of forms for professional and personal use, organized by categories, claims, or keywords.

You can quickly obtain the latest forms like the Wyoming Sun Tanning Bed Agreement and Release Form in just seconds.

If the form does not meet your needs, utilize the Search field at the top of the page to find the one that does.

Once you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose the payment plan you'd prefer and enter your details to register for the account.

- If you have a subscription, sign in and download the Wyoming Sun Tanning Bed Agreement and Release Form from the US Legal Forms library.

- The Download button will be available on every form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- To use US Legal Forms for the first time, here are some simple steps to get you started.

- Ensure you have selected the correct form for your city/state.

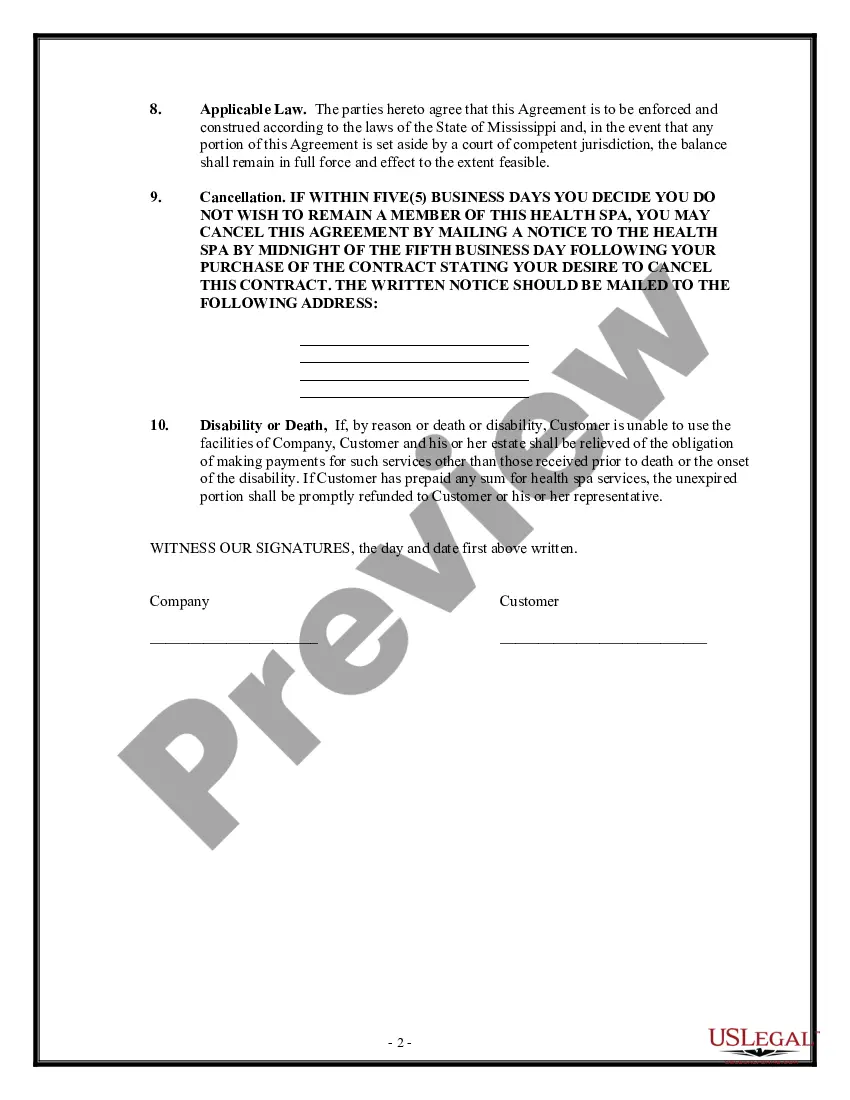

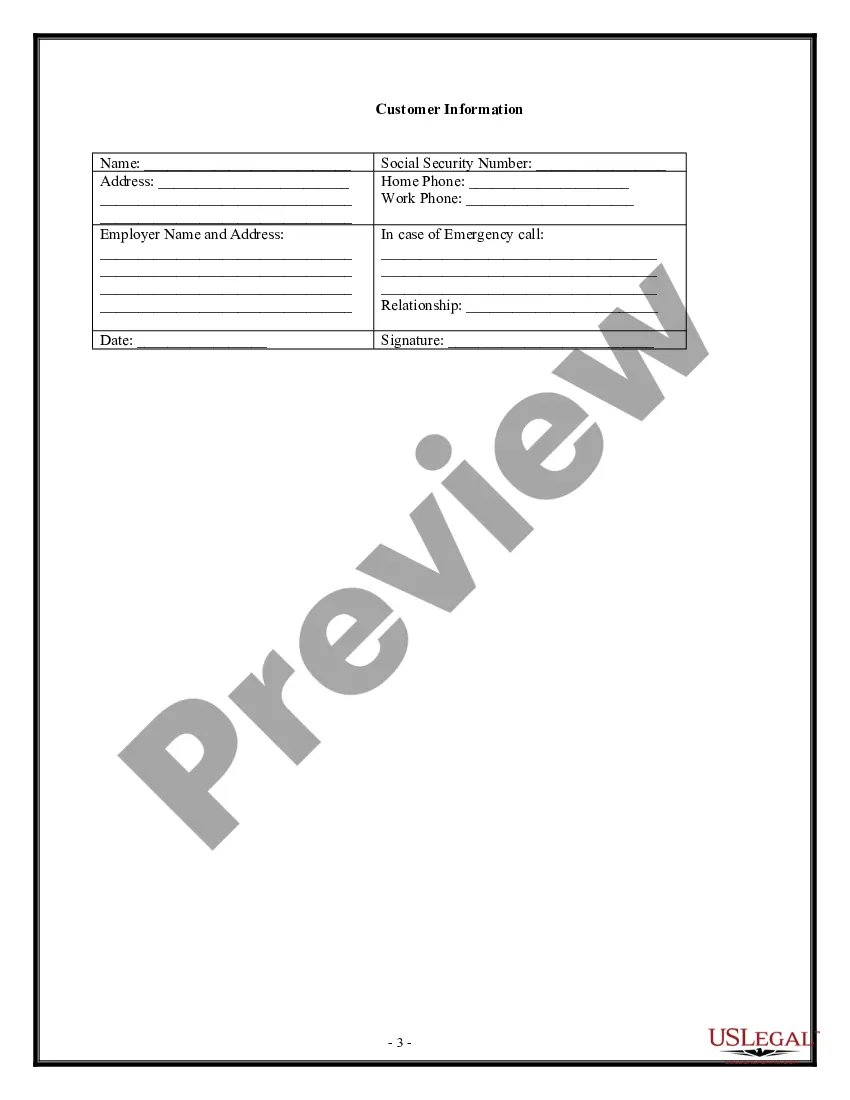

- Review the Review option to inspect the content of the form.

Form popularity

FAQ

Starting a sunbed service involves selecting the right equipment and setting up a safe tanning environment. Make sure to use essential legal forms, like the Wyoming Sun Tanning Bed Agreement and Release Form, to protect your business and your clients. Finally, create a welcoming atmosphere that emphasizes customer comfort to encourage positive experiences.

To start a sunbed business, begin with comprehensive market research to understand your target demographic. It's essential to prepare all necessary legal documents, including the Wyoming Sun Tanning Bed Agreement and Release Form, to ensure compliance with industry regulations. Once you establish a strong foundation, focus on marketing, service quality, and customer satisfaction to foster growth.

Owning a sunbed shop typically requires liability insurance to protect against potential claims. Additionally, you may want coverage specifically tailored for tanning salons, which often includes aspects like the Wyoming Sun Tanning Bed Agreement and Release Form. Always consult an insurance agent to determine the best options for your business needs.

Opening a tanning salon involves thorough planning and understanding of the market. First, secure necessary legal documents, like the Wyoming Sun Tanning Bed Agreement and Release Form, to offer a safe experience. Then, consider location, equipment, and staff training. Proper advertising and community outreach will help you attract customers from the start.

Tanning beds can be highly profitable, with owners often seeing significant returns on investment after initial setup costs. By utilizing essential documents like the Wyoming Sun Tanning Bed Agreement and Release Form, you can create a trustworthy environment that encourages repeat business. The key is to manage operations efficiently and engage clients through promotions and quality experiences.

Yes, tanning salons are still in business and continue to serve a dedicated clientele. Many establishments have adapted to current trends by incorporating services like the Wyoming Sun Tanning Bed Agreement and Release Form, which ensures customer safety and compliance. By staying updated on regulations and promoting health-conscious practices, tanning salons can thrive in this niche.

Yes, a sunbed shop can be quite profitable, especially in regions with warmer climates. By offering services like the Wyoming Sun Tanning Bed Agreement and Release Form, you can attract clients looking for a safe tanning experience. Additionally, with the right marketing strategies and customer service, you can build a loyal client base that enhances your revenue.

The current tax rate on tanning salons is set at 10% of the total charges for indoor tanning services. This rate applies to all customers receiving tanning services in a salon. This tax is designed to contribute to health initiatives while also encouraging safer tanning practices. To help manage compliance, consider using the Wyoming Sun Tanning Bed Agreement and Release Form in your operations.

The tax on tanning salons, often referred to as the TAN tax, is a 10% excise tax on indoor tanning services. This tax applies to all tanning bed services and is collected directly from customers. Understanding your responsibilities as a salon owner regarding this tax is vital. Utilizing tools such as the Wyoming Sun Tanning Bed Agreement and Release Form can help streamline your tax processes.

To calculate the TAN tax, you first need to determine the total amount of tanning services provided by your salon. After that, multiply this figure by the applicable tanning tax rate. It’s essential to keep detailed records of your transactions to ensure accurate calculations. Utilizing forms like the Wyoming Sun Tanning Bed Agreement and Release Form can help facilitate this process.