A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

Wyoming Notice of Default and Election to Sell - Intent To Foreclose

Description

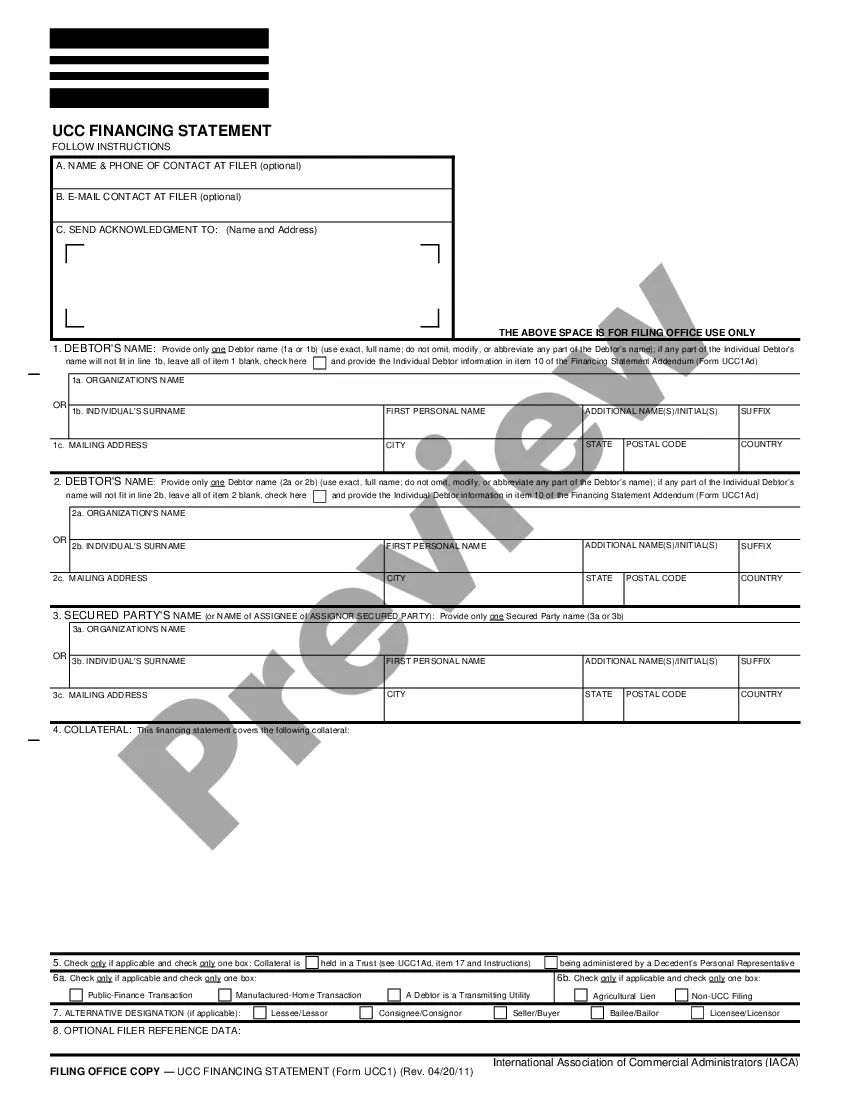

How to fill out Notice Of Default And Election To Sell - Intent To Foreclose?

It is feasible to dedicate hours online seeking the sanctioned document format that meets state and federal requirements you will need.

US Legal Forms provides thousands of legal templates which are reviewed by experts.

You can conveniently download or print the Wyoming Notice of Default and Election to Sell - Intent To Foreclose from your account.

If available, utilize the Preview button to view the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can complete, edit, print, or sign the Wyoming Notice of Default and Election to Sell - Intent To Foreclose.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any acquired template, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure you have selected the correct document format for the desired county/town.

- Review the template description to confirm you have chosen the right type.

Form popularity

FAQ

If you're behind in mortgage payments, you might be wondering how soon a foreclosure will start. Under federal law, in most cases, a mortgage servicer can't start a foreclosure until a homeowner is more than 120 days overdue on payments.

Federal law generally requires the servicer to wait until the loan is over 120 days delinquent before officially starting a foreclosure.

Under federal law, the servicer usually can't officially begin a foreclosure until you're more than 120 days past due on payments, subject to a few exceptions. (12 C.F.R. § 1024.41). This 120-day period provides most homeowners with ample opportunity to submit a loss mitigation application to the servicer.

Part of the reason for the lengthy California foreclosure process is because the borrower has 90 days to pay the lender the balance owed after the lender files the Notice of Default with the county.

As of July 1, 2019, Wyoming law gives the purchaser from the foreclosure sale a limited right to inspect the home during the redemption period. The purpose of this law is so that the purchaser can ensure that the property doesn't significantly deteriorate during the full redemption period.

If you default on your mortgage payments in Wyoming, the lender may foreclose using a judicial or nonjudicial method.

Foreclosures in some states take considerably longer than in other states....Which States Have Long Foreclosure Timelines?Hawaii (2,491 days)New York (1,529 days)Pennsylvania (1,502 days)Louisiana (1,476 days), and.Florida (1,378 days).

Foreclosure is what happens when you can't pay your mortgage and the lender takes over owning your home. The lender then sells your home to pay off what you owe them. You have no control over how the home is sold and will be given notice to leave the property, sometimes even before it's sold.

The notice of intent to foreclose must be published once a week for three (3) successive weeks, the last publication to be not less than fourteen (14) days before the day of sale, in a newspaper having a general circulation in the county in which the mortgaged property is located.