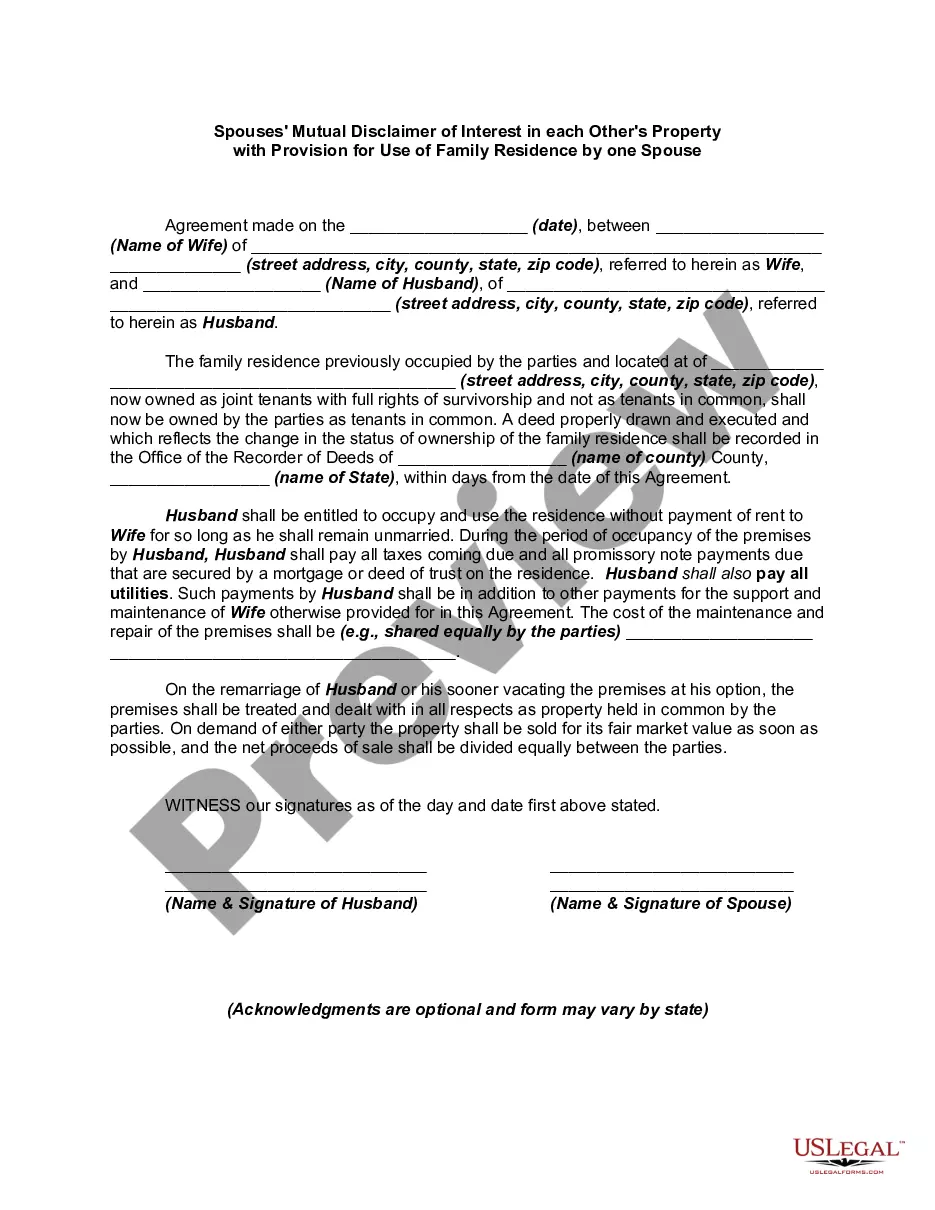

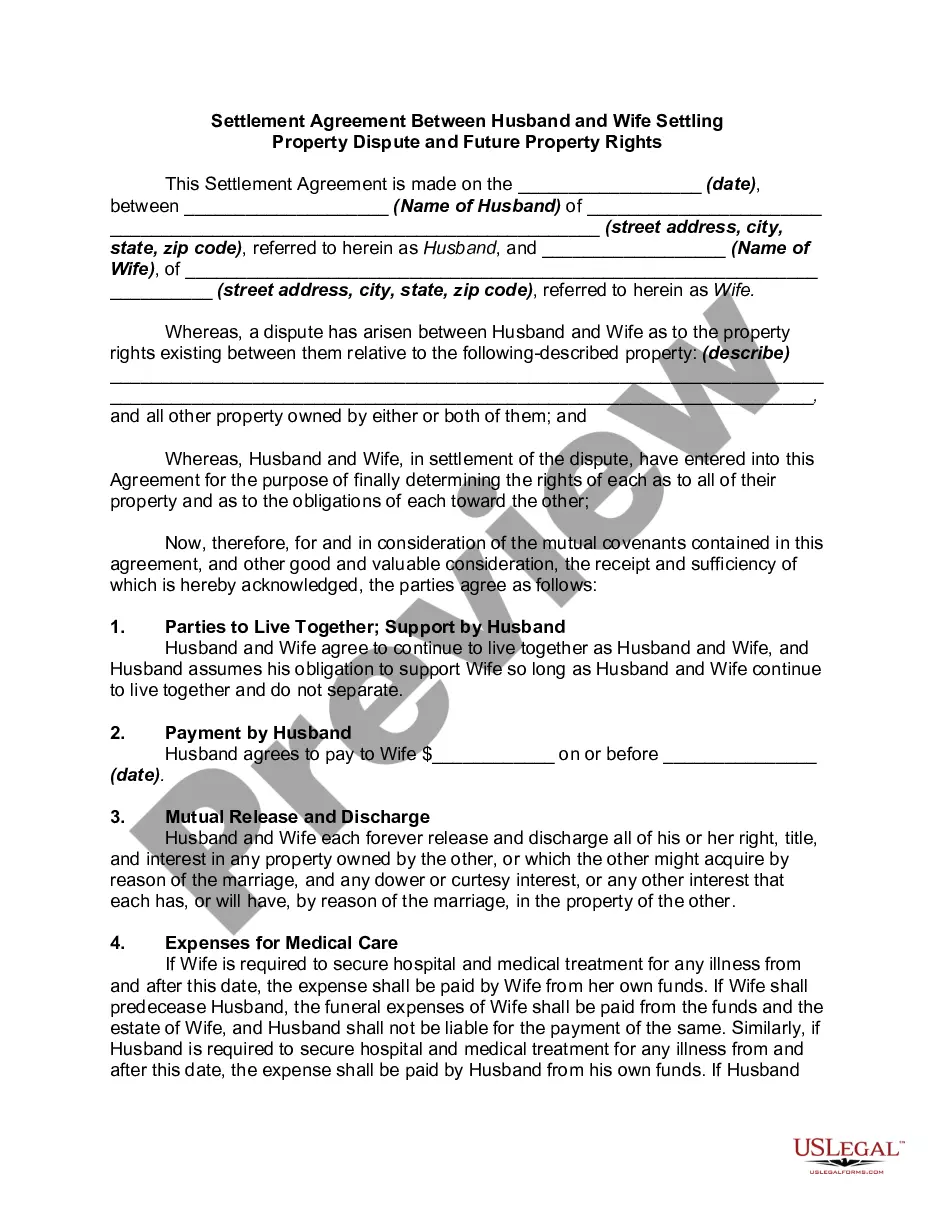

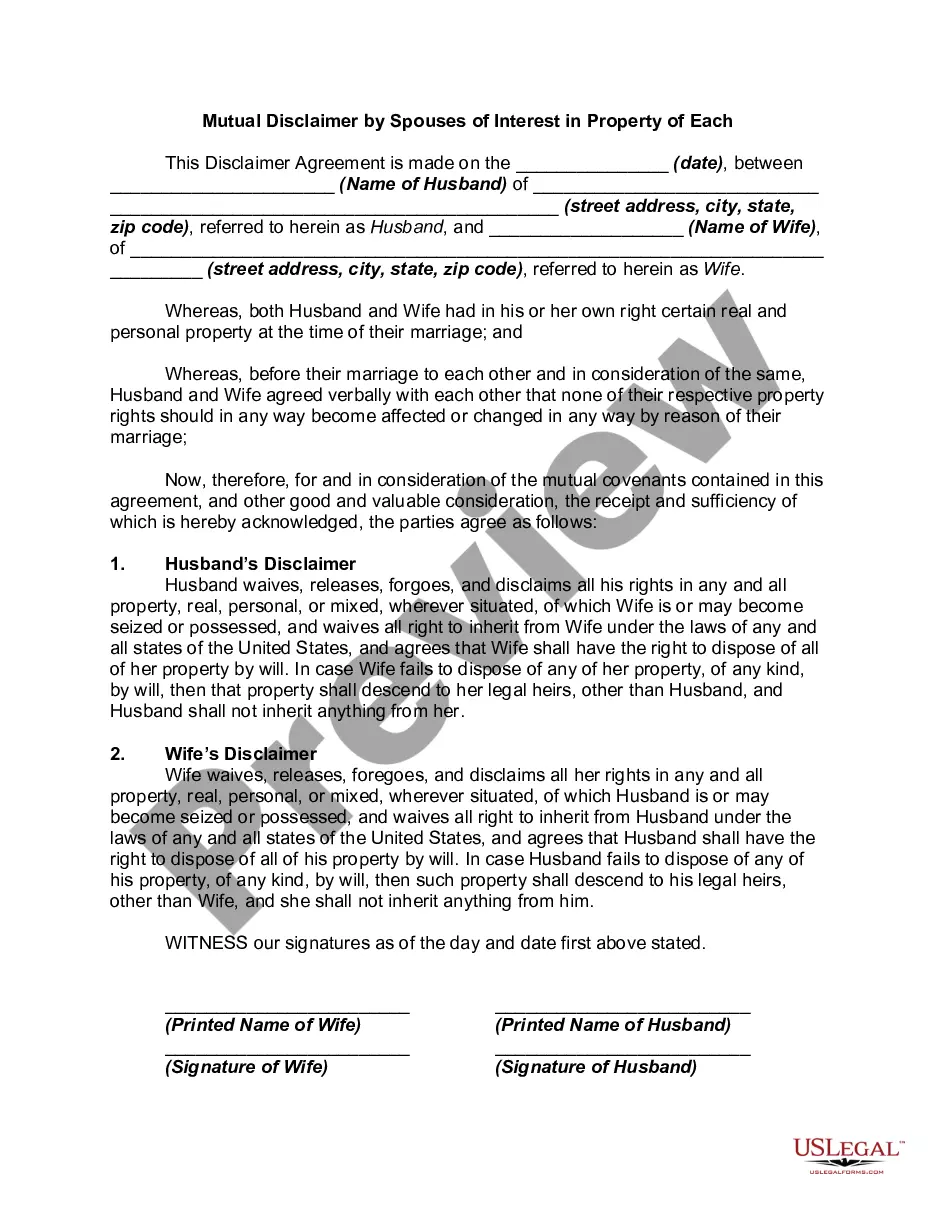

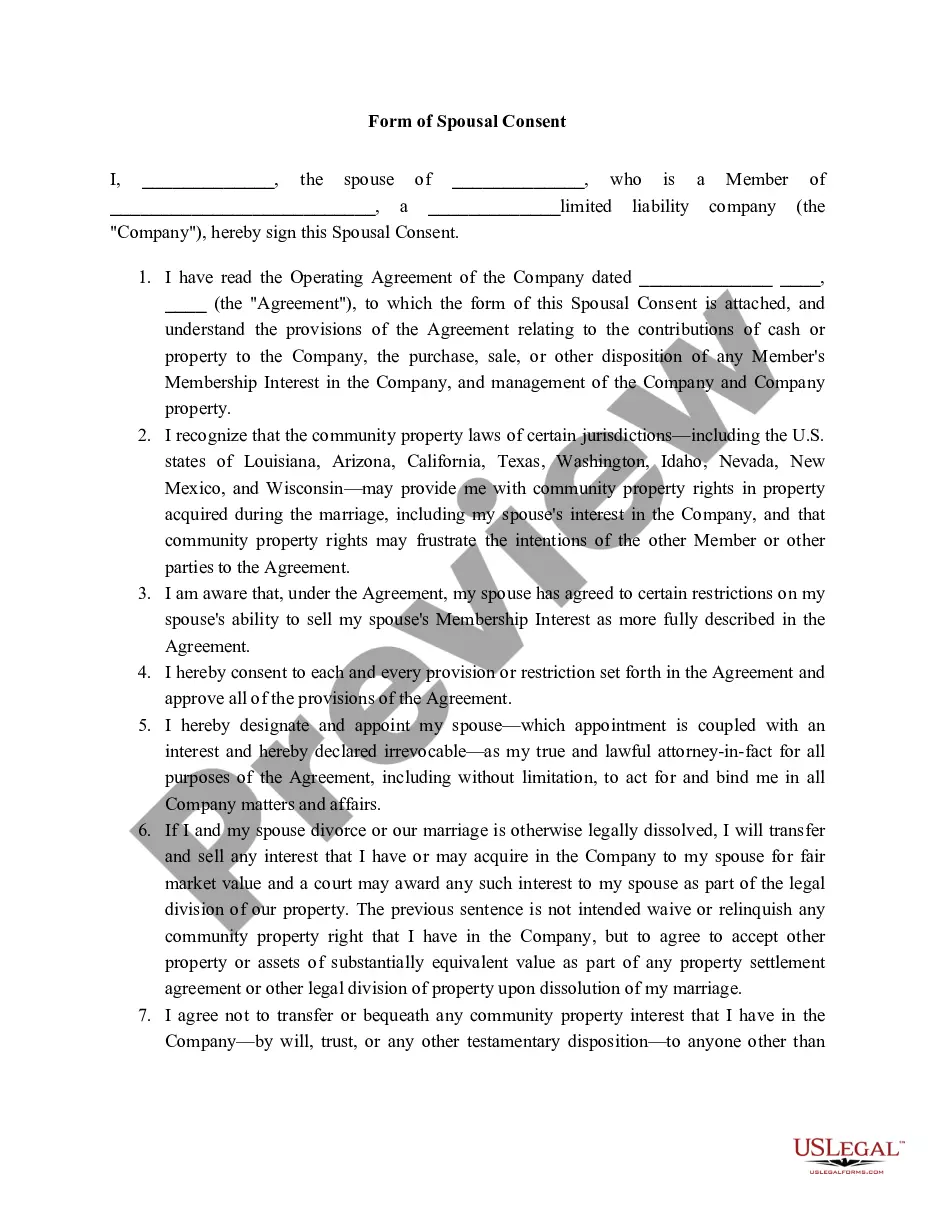

This form is a post-nuptial agreement between husband and wife. A post-nuptial agreement is a written contract executed after a couple gets married, to settle the couple's affairs and assets in the event of a separation or divorce. Like the contents of a prenuptial agreement, it can vary widely, but commonly includes provisions for division of property and spousal support in the event of divorce, death of one of the spouses, or breakup of marriage.

Wyoming Spouses' Mutual Disclaimer of Interest in each Other's Property with Provision for Use of Family Residence by one Spouse

Description

How to fill out Spouses' Mutual Disclaimer Of Interest In Each Other's Property With Provision For Use Of Family Residence By One Spouse?

Selecting the appropriate legal document template can be rather challenging. Naturally, there are numerous designs accessible online, but how can you find the legal form you need.

Utilize the US Legal Forms website. The platform offers an extensive array of templates, including the Wyoming Spouses' Mutual Disclaimer of Interest in Each Other's Property with Provision for Use of Family Residence by One Spouse, which you can utilize for both business and personal requirements. All documents are reviewed by professionals and comply with federal and state regulations.

If you are currently registered, Log In to your account and click the Acquire button to obtain the Wyoming Spouses' Mutual Disclaimer of Interest in Each Other's Property with Provision for Use of Family Residence by One Spouse. Use your account to browse through the legal forms you may have purchased previously. Check the My documents section of your account and download another copy of the document you need.

Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Wyoming Spouses' Mutual Disclaimer of Interest in Each Other's Property with Provision for Use of Family Residence by One Spouse. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to download properly crafted documents that adhere to state regulations.

- First, ensure that you have chosen the correct form for your city/county.

- You can review the form using the Review button and read the form description to confirm it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the right form.

- Once you are confident that the form is appropriate, click the Buy now button to purchase the form.

- Select the payment plan you prefer and enter the necessary information.

- Create your account and pay for your order with your PayPal account or credit card.

Form popularity

FAQ

For various reasons, spouses often sign Wills that leave out their surviving husband or wife. In other words, a spouse is disinherited. Is this legal? Yes, but steps can often be taken to effectively get around the Will.

Under Hindu Law: the wife has a right to inherit the property of her husband only after his death if he dies intestate. Hindu Succession Act, 1956 describes legal heirs of a male dying intestate and the wife is included in the Class I heirs, and she inherits equally with other legal heirs.

Community property with right of survivorship is a legal distinction that allows two spouses to equally share assets through marriage as well as pass on assets to the other spouse upon death without going through probate.

Under Hindu Law: the wife has a right to inherit the property of her husband only after his death if he dies intestate. Hindu Succession Act, 1956 describes legal heirs of a male dying intestate and the wife is included in the Class I heirs, and she inherits equally with other legal heirs.

The main difference between joint tenants vs community property with right of survivorship lies in how the property is taxed after the death of a spouse. In joint tenant agreements, the proceeds from the sale of a property (after the death of a spouse) would be subject to the capital gains tax.

If you and your spouse are married in community of property, this means that you share a joint, undivided estate that is made up of your respective assets and liabilities, including those that accrued prior to the date of your marriage.

In California, a community property state, the surviving spouse is entitled to at least one-half of any property or wealth accumulated during the marriage (i.e. community property), absent a pre-nuptial or post-nuptial agreement that states otherwise.

A house can be owned by one person or can be owned jointly by multiple people. All owners must be listed on a house's title. Because your name was not on the title prior to your husband's death, the house was not considered your property at that time.

No, the deceased cannot leave the estate to someone else without their spouse's permission. My late grandfather wrote in his will that the house my mother and I live in should go to my uncle, although the property was never transferred to his name.

Property held in joint tenancy, tenancy by the entirety, or community property with right of survivorship automatically passes to the survivor when one of the original owners dies. Real estate, bank accounts, vehicles, and investments can all pass this way. No probate is necessary to transfer ownership of the property.