US Legal Forms - among the greatest libraries of authorized forms in the States - offers a wide range of authorized document web templates you can down load or print out. Making use of the website, you can get a large number of forms for company and specific uses, sorted by categories, suggests, or search phrases.You will find the most recent models of forms much like the Wyoming Security Agreement in Accounts and Contract Rights in seconds.

If you already have a membership, log in and down load Wyoming Security Agreement in Accounts and Contract Rights from the US Legal Forms library. The Acquire switch will show up on every type you perspective. You gain access to all formerly acquired forms within the My Forms tab of the accounts.

If you would like use US Legal Forms the very first time, here are basic guidelines to help you started off:

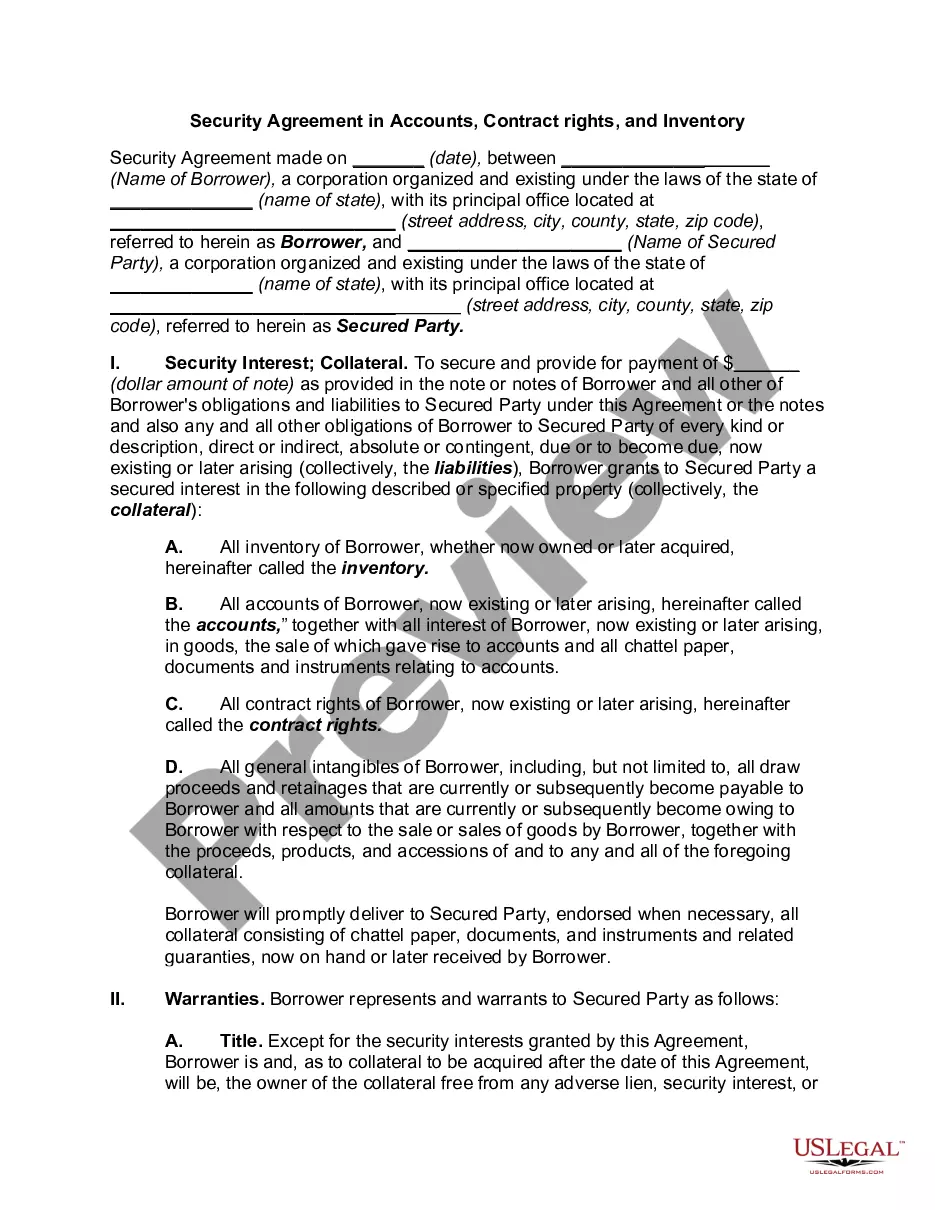

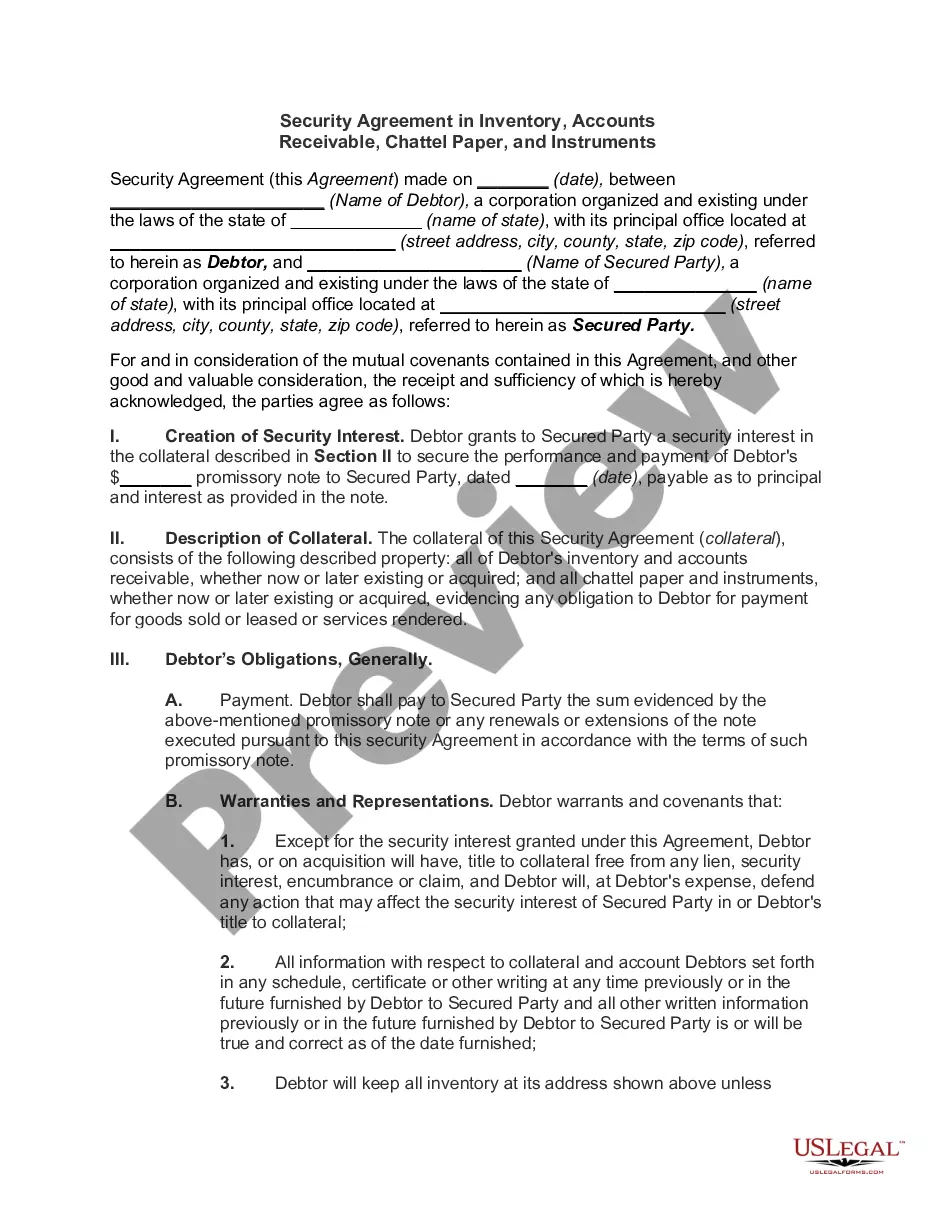

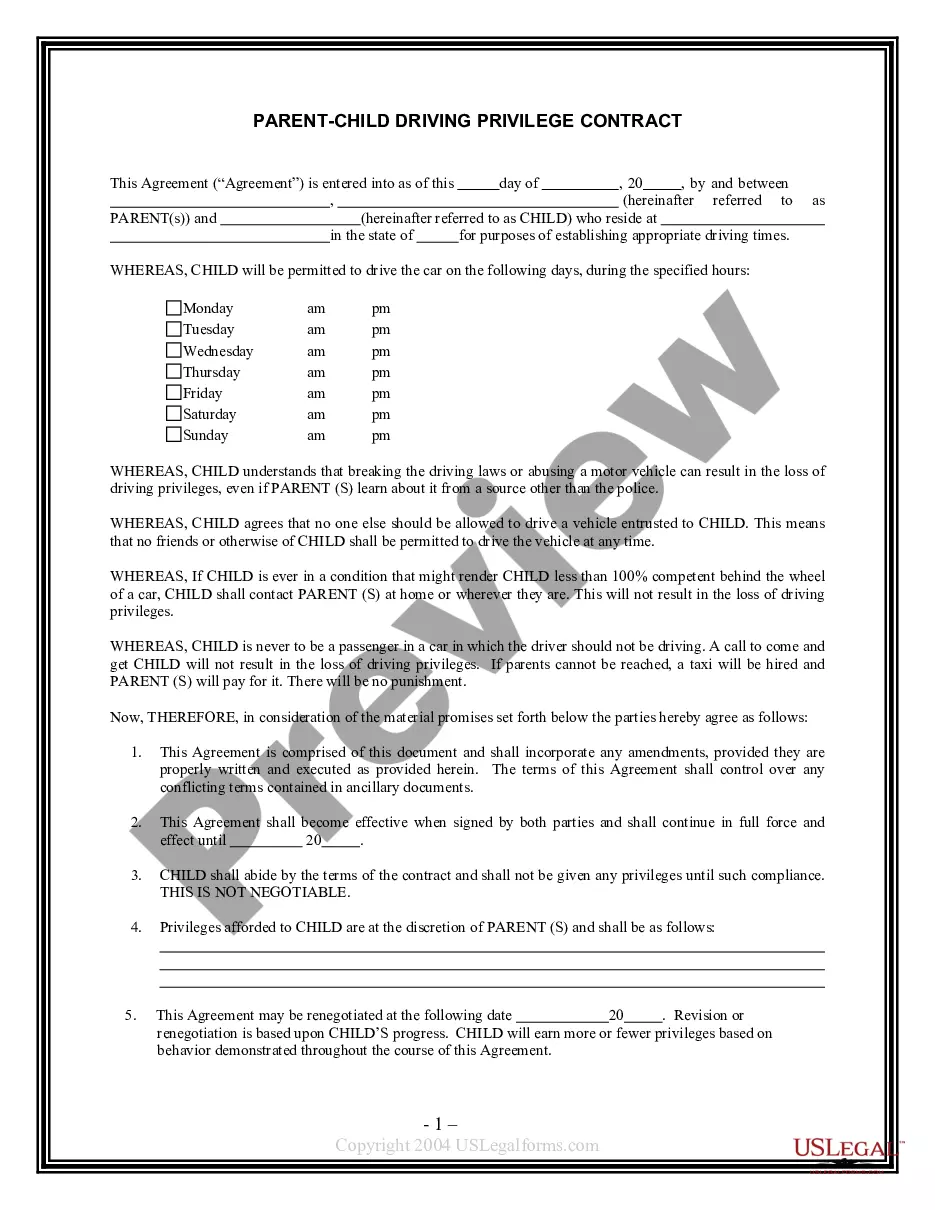

- Be sure you have selected the proper type for your personal area/region. Select the Preview switch to analyze the form`s content material. Browse the type description to actually have chosen the appropriate type.

- If the type doesn`t satisfy your needs, take advantage of the Look for discipline at the top of the monitor to discover the one that does.

- In case you are content with the form, validate your decision by clicking the Purchase now switch. Then, choose the prices plan you favor and provide your qualifications to sign up for an accounts.

- Method the purchase. Use your bank card or PayPal accounts to perform the purchase.

- Choose the structure and down load the form on your system.

- Make modifications. Fill up, modify and print out and indicator the acquired Wyoming Security Agreement in Accounts and Contract Rights.

Each template you put into your money does not have an expiry particular date and it is the one you have permanently. So, if you want to down load or print out an additional duplicate, just visit the My Forms segment and then click on the type you will need.

Gain access to the Wyoming Security Agreement in Accounts and Contract Rights with US Legal Forms, one of the most substantial library of authorized document web templates. Use a large number of specialist and status-particular web templates that satisfy your organization or specific requires and needs.