Wyoming General Form of Revocable Trust Agreement

Description

How to fill out General Form Of Revocable Trust Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide range of legal paper templates that you can download or print.

Using the website, you can access numerous forms for business and personal purposes, organized by categories, states, or keywords. You can retrieve the latest versions of forms such as the Wyoming General Form of Revocable Trust Agreement in a matter of seconds.

If you already possess a subscription, Log In and download the Wyoming General Form of Revocable Trust Agreement from the US Legal Forms catalog. The Download button will appear on every form you view. You can access all previously acquired forms from the My documents tab in your account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make modifications. Fill in, edit, and print, then sign the obtained Wyoming General Form of Revocable Trust Agreement. All templates added to your account do not expire and are yours permanently. So, if you want to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Wyoming General Form of Revocable Trust Agreement with US Legal Forms, one of the most extensive collections of legal document templates. Utilize numerous professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have selected the correct form for your city/region.

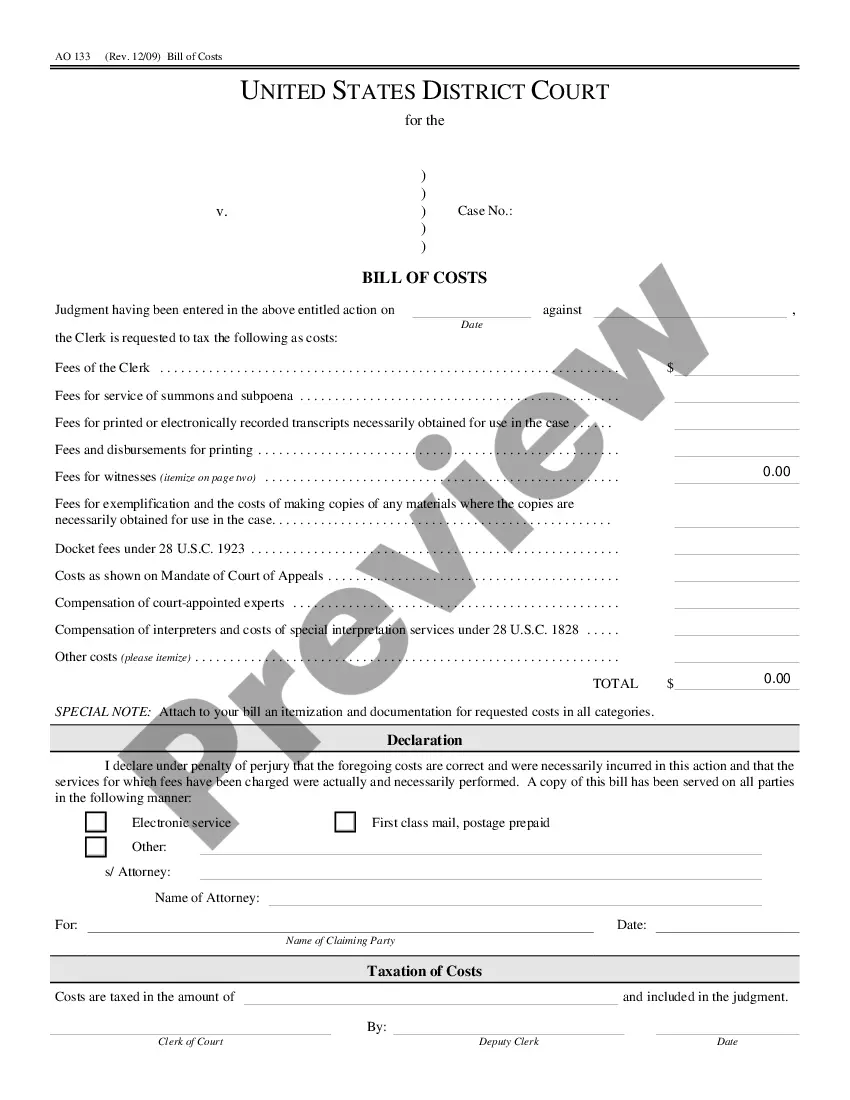

- Click the Preview button to review the form's content.

- Check the form description to confirm you have chosen the right document.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, validate your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

In your Wyoming General Form of Revocable Trust Agreement, avoid including assets like certain retirement accounts, personal savings accounts, and assets subject to transfer taxes. These items typically require designated beneficiaries or have their own specific distribution rules. By keeping these assets out of the trust, you can simplify your estate management and ensure compliance with tax regulations.

Filling out a certificate of trust is a straightforward process that begins with identifying the trust's name, date of establishment, and trustee information associated with your Wyoming General Form of Revocable Trust Agreement. You will need to include details about the trust's powers and any restrictions, ensuring that you follow your specific legal requirements. This document can provide essential proof of the trust's existence without revealing all trust assets.

You should consider placing real estate, valued personal property, and investment accounts in your Wyoming General Form of Revocable Trust Agreement. By doing so, you enhance the estate's manageability and ensure a smoother transfer process for your heirs. It also helps prevent the lengthy probate process, giving your beneficiaries quicker access to their inheritance.

When creating a Wyoming General Form of Revocable Trust Agreement, it is advisable not to include your retirement accounts, health savings accounts, or life insurance policies. These assets have their own designated beneficiary designations. Including them in your trust may complicate the distribution process and lead to unintended tax consequences.

Yes, placing your bank accounts in a Wyoming General Form of Revocable Trust Agreement can help streamline the management of your assets. This arrangement allows you to maintain control over your accounts while simplifying the distribution process after your passing. It is essential to ensure that the accounts are titled correctly in the trust's name.

To set up a revocable trust in Wyoming, begin by choosing a reliable name for your trust. After that, utilize the Wyoming General Form of Revocable Trust Agreement as a foundational document, making necessary modifications to reflect your wishes. Next, designate your assets and select a trustee. Finally, execute the trust document in front of witnesses to ensure its legality, solidifying your estate plan in compliance with Wyoming laws.

Starting a trust in Wyoming involves several key steps. First, determine the type of trust you wish to create, such as a revocable trust. Next, you need to draft the trust document, and here, the Wyoming General Form of Revocable Trust Agreement can serve as a helpful template. Finally, you should fund the trust by transferring assets into it, ensuring your trust is set up according to Wyoming law.

To file a revocable trust tax return, you typically must report the trust's income on your personal tax return. The IRS requires that you use Form 1041 for the trust if it generates income. However, most revocable trusts do not need to file this form while the grantor is alive, as all income is reported on your personal tax return. For complete guidance, consider using the Wyoming General Form of Revocable Trust Agreement, available through uslegalforms, to ensure everything aligns correctly with tax regulations.

A revocable trust document is a legal instrument that outlines how your assets will be managed during your lifetime and distributed after your death. With the Wyoming General Form of Revocable Trust Agreement, you maintain control over your assets while designating beneficiaries and instructions for asset distribution. This document provides clarity and direction, helping to avoid potential conflicts among heirs.

When managing a revocable trust, you may need specific tax forms to comply with IRS regulations. The primary form is the IRS Form 1040, where you will report the income generated by the trust. It's important to consult a tax professional for guidance on additional forms that may be required based on your unique situation involving the Wyoming General Form of Revocable Trust Agreement.