Are you currently in the situation where you require paperwork for possibly organization or person purposes just about every time? There are a variety of legitimate file themes available on the Internet, but getting kinds you can trust is not simple. US Legal Forms delivers a huge number of kind themes, such as the Wyoming Assignment of Life Insurance Proceeds to a Funeral Home for the Purpose of Pre-Arranging a Funeral, which are created to satisfy federal and state requirements.

Should you be previously knowledgeable about US Legal Forms website and also have a free account, simply log in. Afterward, it is possible to download the Wyoming Assignment of Life Insurance Proceeds to a Funeral Home for the Purpose of Pre-Arranging a Funeral design.

If you do not have an bank account and need to begin using US Legal Forms, adopt these measures:

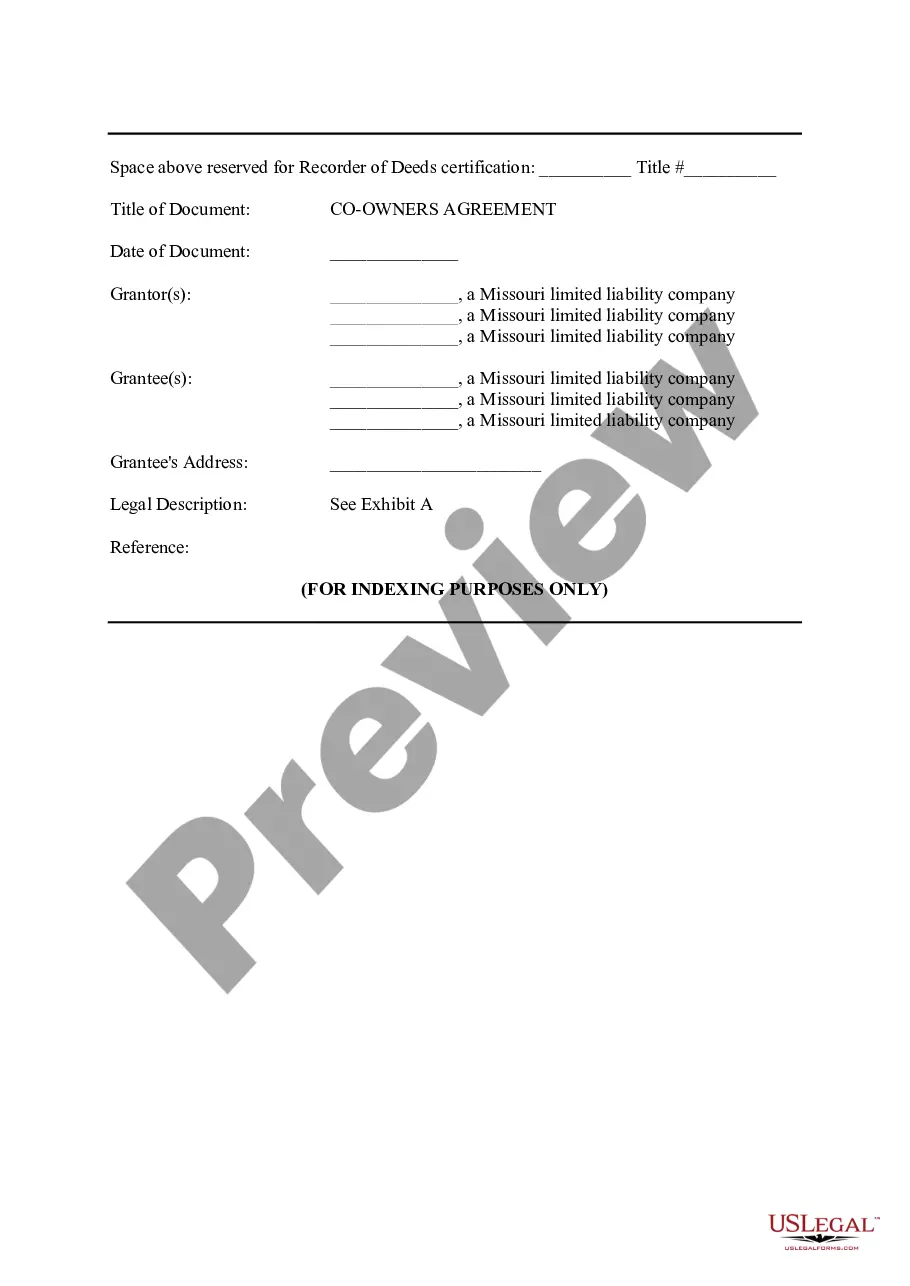

- Discover the kind you will need and ensure it is for that right metropolis/area.

- Utilize the Preview option to analyze the form.

- Read the outline to ensure that you have selected the correct kind.

- In the event the kind is not what you are seeking, make use of the Search area to find the kind that meets your requirements and requirements.

- When you get the right kind, simply click Buy now.

- Pick the pricing program you desire, fill in the desired info to generate your money, and purchase your order utilizing your PayPal or charge card.

- Select a convenient document file format and download your backup.

Find all of the file themes you possess purchased in the My Forms menu. You can aquire a further backup of Wyoming Assignment of Life Insurance Proceeds to a Funeral Home for the Purpose of Pre-Arranging a Funeral whenever, if possible. Just go through the required kind to download or printing the file design.

Use US Legal Forms, probably the most considerable variety of legitimate forms, in order to save time as well as steer clear of mistakes. The support delivers professionally produced legitimate file themes that can be used for an array of purposes. Generate a free account on US Legal Forms and begin making your way of life easier.