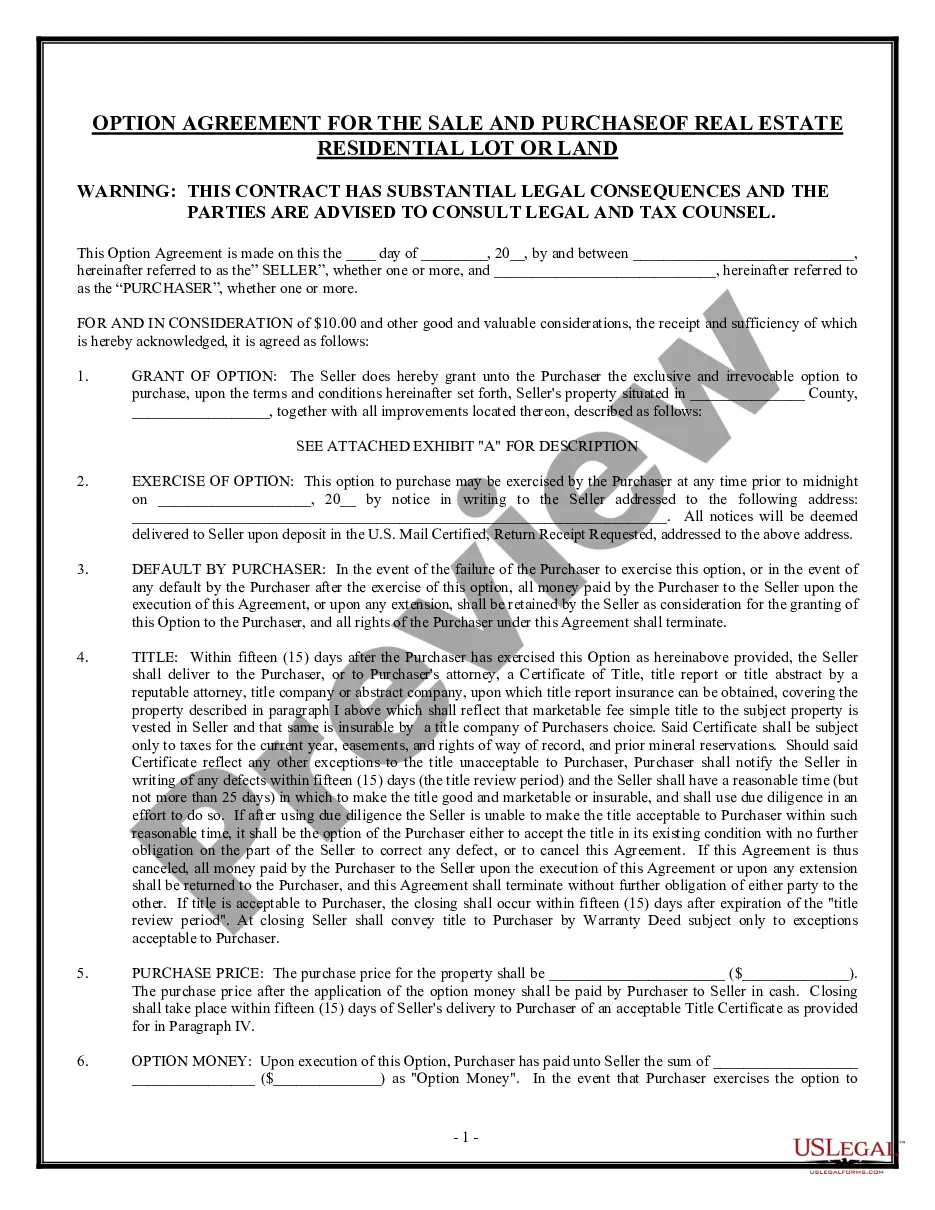

Wyoming Option For the Sale and Purchase of Real Estate - Residential Lot or Land

Description

How to fill out Option For The Sale And Purchase Of Real Estate - Residential Lot Or Land?

Are you currently in a location where you require documents for either professional or personal use every single day.

There are many legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms provides a multitude of template options, such as the Wyoming Option For the Sale and Purchase of Real Estate - Residential Lot or Land, which are crafted to meet federal and state regulations.

Choose the pricing plan you prefer, enter the required information to create your account, and pay for your purchase using your PayPal or Visa or Mastercard.

Select a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Wyoming Option For the Sale and Purchase of Real Estate - Residential Lot or Land template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Utilize the Review button to inspect the form.

- Check the description to confirm that you have selected the right template.

- If the form is not what you are looking for, use the Lookup area to find the template that suits your needs and requirements.

- Once you have found the correct form, click Acquire now.

Form popularity

FAQ

To make an offer on land for sale by the owner, start by researching the property to ensure it meets your needs and budget. Prepare your offer in writing, including proposed terms, conditions, and a timeline for closing. Deliver your offer directly to the owner, expressing your interest and openness to negotiations. Remember, using forms from US Legal Forms can help you draft a comprehensive offer that covers all necessary details.

One of the highlights of looking to purchase land in Wyoming can definitely be attributed to the many tax benefits. No income, estate, inheritance, real estate, excise tax, and low property taxes make this investment a no-brainer for most. When comparing Wyoming's taxes with other states, the value will be undeniable.

Parts of Wyoming can have some very large ranches that seem relatively inexpensive compared to ranches in other areas and other states. This may be because the land is not as productive, a long ways from a major town, and may have limited water or other resources.

One of the highlights of looking to purchase land in Wyoming can definitely be attributed to the many tax benefits. No income, estate, inheritance, real estate, excise tax, and low property taxes make this investment a no-brainer for most. When comparing Wyoming's taxes with other states, the value will be undeniable.

As mentioned above, in Wyoming, when two or more people jointly own, and reside in, a homestead property, each is entitled to his or her own exemption. This means that if a married couple jointly owns their home, they can claim a total homestead exemption of $40,000.

For each of the last three years the value has held steady at $660 per acre. Cropland values in Wyoming declined in 2017. The average value of cropland is $1,350, a 1.5% decline from 2016.

Some of the best are Gillette, Jackson, and Cody. The Brook Companies offers expansive ranch land in Wyoming near some of the very best cities. Call 877-468-9802 today for more details about buying ranch land near some of the best places to live in Wyoming.

Below is a long list of the reasons why:Wyoming has no income tax or corporate tax.Wyoming has no estate or inheritance tax.Wyoming does not tax out- of -state retirement income.Wyoming has no excise tax.Wyoming has no real estate tax.Wyoming has no tax on mineral ownership.Wyoming has no State gift tax.More items...?