Wyoming Obtain S Corporation Status - Corporate Resolutions Forms

Description

How to fill out Obtain S Corporation Status - Corporate Resolutions Forms?

You can invest hours online attempting to locate the valid document template that adheres to the federal and state standards you require.

US Legal Forms provides thousands of valid forms that have been evaluated by professionals.

You can easily download or print the Wyoming Obtain S Corporation Status - Corporate Resolutions Forms from their service.

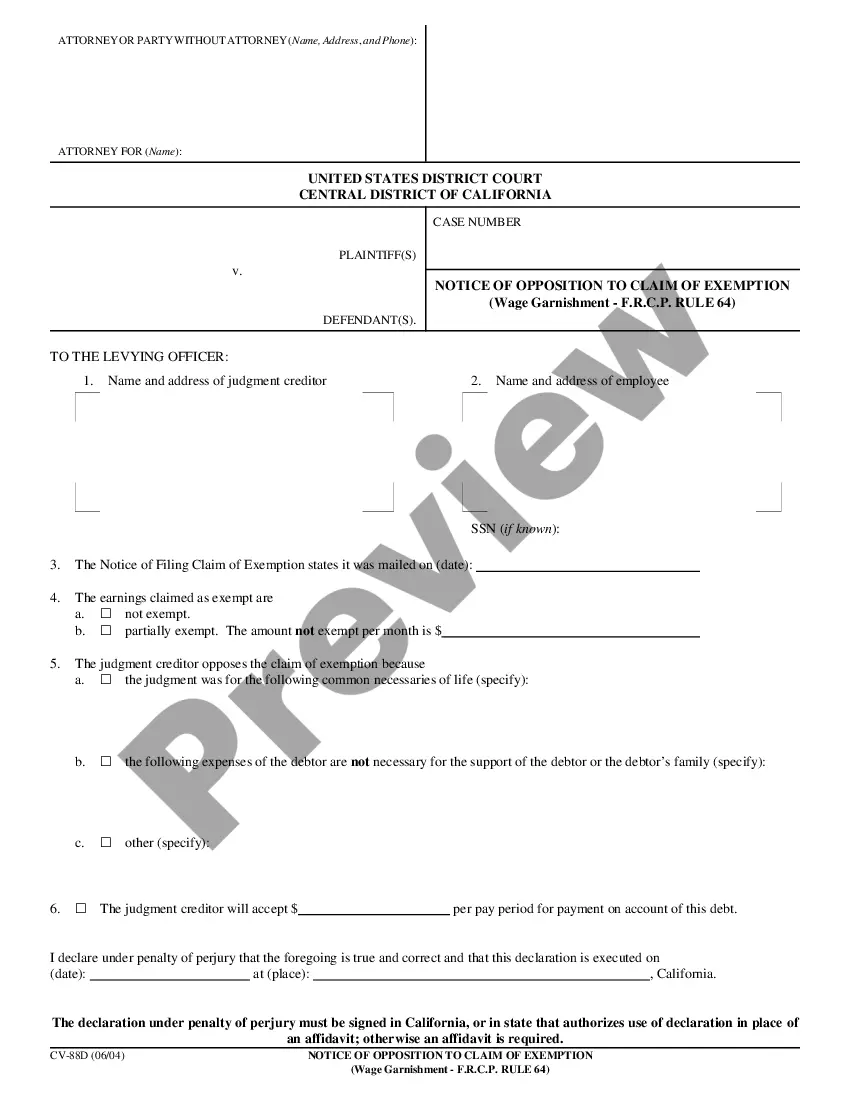

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- Next, you can fill out, modify, print, or sign the Wyoming Obtain S Corporation Status - Corporate Resolutions Forms.

- Each valid document template you receive is yours permanently.

- To obtain another copy of any downloaded form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your county/town of choice.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

To file an S Corporation in Wyoming, start by forming your corporation through the Articles of Incorporation. Once established, you must file IRS Form 2553 to elect S Corporation status. This step is crucial, as it allows your corporation to avoid double taxation. Utilizing uslegalforms can assist you in obtaining S Corporation status and ensuring compliance with all state and federal requirements.

Articles of Incorporation are filed with the Wyoming Secretary of State's office. You can submit your documents online or by mail, depending on your preference. The Secretary of State maintains records of all incorporated businesses in Wyoming. Using uslegalforms can streamline this filing process, ensuring your corporation achieves S Corporation status without delays.

Wyoming statute 17 16 1501 addresses the formation and management of corporations within the state. This statute provides crucial guidelines, empowering corporations to operate effectively while maintaining compliance. Understanding this law is essential as you work towards Wyoming obtain S Corporation status - corporate resolutions forms. With uslegalforms, you can find the tools to assist you in this compliance process.

A statutory close corporation in Wyoming is a type of corporation that allows for a more flexible management structure and limits the number of shareholders. This structure is beneficial for small businesses looking for minimal formalities while still enjoying corporate protection. If you're interested in this option, understanding how to Wyoming obtain S Corporation status - corporate resolutions forms can enhance your business strategies.

Companies choose to file in Wyoming due to its business-friendly climate, which includes low fees and minimal regulations. Additionally, Wyoming offers strong asset protection and privacy for business owners. These factors considerably enhance the appeal of obtaining S Corporation status here. With uslegalforms, you can streamline the filing process and obtain the necessary corporate resolutions forms efficiently.

Section 17 16 821 outlines provisions related to corporate governance in Wyoming. This section details the guidelines for shareholder meetings, director responsibilities, and corporate actions. Understanding these regulations is essential for compliance and smooth operations. By utilizing uslegalforms, you can easily navigate these regulations and prepare the necessary corporate resolutions.

A Wyoming corporation offers several advantages, including zero state income tax, strong privacy protection, and a favorable business environment. By choosing to form in Wyoming, you can benefit from lower operational costs while maintaining limited liability. Moreover, with the ability to easily obtain S Corporation status, you can optimize your tax situation. This makes the process to Wyoming obtain S Corporation status - corporate resolutions forms particularly straightforward.

To obtain your S corporation status, first ensure your business is fully incorporated at the state level. Next, file Form 2553 with the IRS, ensuring you meet all eligibility requirements. This process is crucial for accessing the tax benefits linked to the Wyoming Obtain S Corporation Status - Corporate Resolutions Forms. Platforms like uslegalforms are available to assist you in this process, providing easy-to-use tools and resources.

To have your LLC treated as an S corporation for tax filing, you need to file Form 2553 with the IRS, within the allowed timeframe. Make sure all members consent to the S corp election and that you meet the eligibility criteria. This decision can enhance your tax strategy, especially when ensuring compliance with your Wyoming Obtain S Corporation Status - Corporate Resolutions Forms. Using uslegalforms can simplify this election process with helpful templates.

Forming an S corporation in Wyoming involves first creating a traditional corporation, as S corp status applies to federal tax treatment of corporations. You must file the Articles of Incorporation with the Wyoming Secretary of State, follow compliance requirements, and then file Form 2553 with the IRS to elect S corp status. This process is vital for those seeking to enjoy benefits while maintaining their Wyoming Obtain S Corporation Status - Corporate Resolutions Forms. For streamlined guidance, uslegalforms offers resources tailored to your needs.