This form is a Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith-Jury Trial Demand. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Wyoming Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand

Description

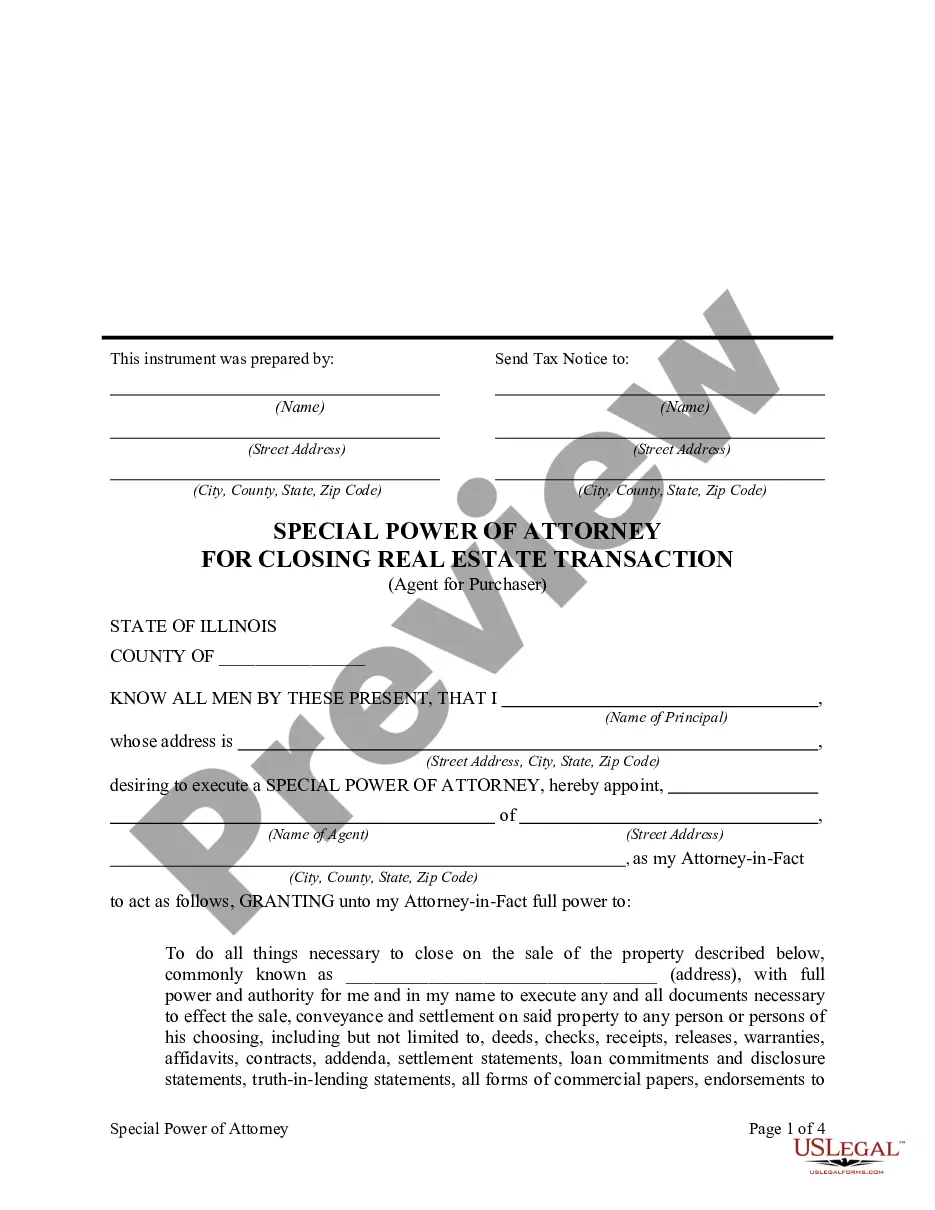

How to fill out Complaint For Wrongful Termination Of Insurance Under ERISA And For Bad Faith - Jury Trial Demand?

If you have to full, down load, or produce authorized record web templates, use US Legal Forms, the most important collection of authorized forms, which can be found on-line. Use the site`s simple and practical search to obtain the papers you require. Various web templates for enterprise and person purposes are categorized by categories and states, or keywords and phrases. Use US Legal Forms to obtain the Wyoming Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand in just a few clicks.

If you are previously a US Legal Forms client, log in in your profile and click the Down load option to have the Wyoming Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand. Also you can entry forms you formerly delivered electronically inside the My Forms tab of the profile.

Should you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have selected the shape to the correct metropolis/land.

- Step 2. Make use of the Preview solution to look over the form`s information. Never neglect to read the explanation.

- Step 3. If you are not satisfied with the form, utilize the Look for industry towards the top of the display to locate other types of the authorized form design.

- Step 4. After you have discovered the shape you require, go through the Purchase now option. Choose the prices strategy you choose and add your credentials to register for the profile.

- Step 5. Approach the purchase. You may use your bank card or PayPal profile to perform the purchase.

- Step 6. Pick the structure of the authorized form and down load it on your own gadget.

- Step 7. Full, modify and produce or indication the Wyoming Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand.

Each authorized record design you buy is yours permanently. You have acces to each and every form you delivered electronically with your acccount. Select the My Forms section and choose a form to produce or down load yet again.

Remain competitive and down load, and produce the Wyoming Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand with US Legal Forms. There are many specialist and status-specific forms you can use for your personal enterprise or person demands.

Form popularity

FAQ

Examples of Insurance Bad Faith: Denying a claim without giving a reason. Failing to conduct a prompt and complete investigation. Offering less money than a claim is worth. Delaying or denying decisions on claims or requests for approval for medical treatment.

Arizona, Arkansas, Florida, Georgia Illinois, Indiana, Kentucky, Louisiana, Maryland, Massachusetts, Missouri, Nebraska, New Hampshire, New Mexico, New York, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, South Dakota, Tennessee, Utah, Washington, Wisconsin, and Wyoming.

There are two types of bad faith insurance claims: first-party and third-party. First-party insurance claims are those that policyholders bring against their insurance company for not covering their damages. In these cases, plaintiffs believe their insurance provider withholds payment on a claim they shouldn't.

A claim of third-party bad faith may lie where the insured voluntarily stipulates to a judgment in excess of policy limits without the insurer's consent.

Bad faith refers to dishonesty or fraud in a transaction. Depending on the exact setting, bad faith may mean a dishonest belief or purpose, untrustworthy performance of duties, neglect of fair dealing standards, or a fraudulent intent.