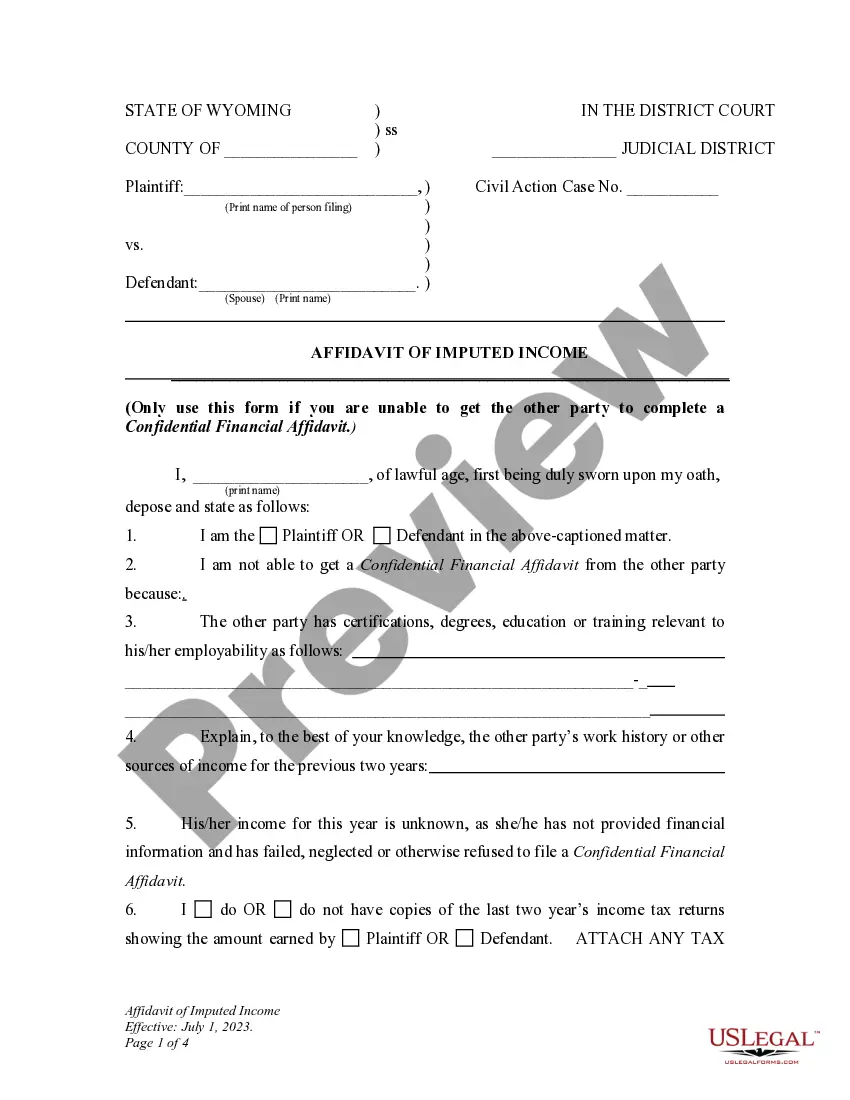

This is an official form from the Judicial Branch of Wyoming which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Wyoming statutes and law.

Wyoming DWCP 14. Child Support Computation Form & Net Income Calculation

Description

How to fill out Wyoming DWCP 14. Child Support Computation Form & Net Income Calculation?

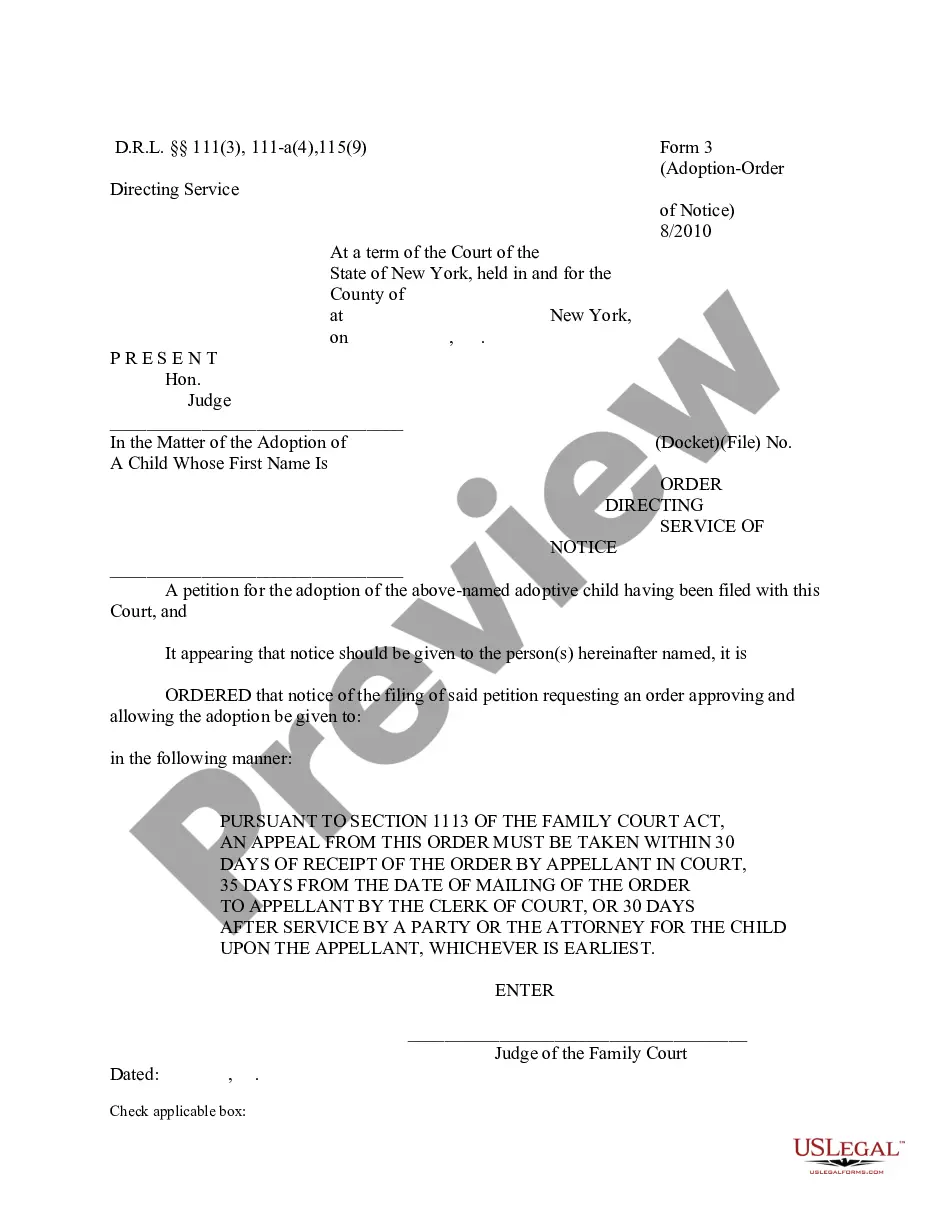

Use US Legal Forms to get a printable Wyoming Child Support Computation Form and Net Income Calculation. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most comprehensive Forms catalogue on the internet and offers affordable and accurate templates for customers and legal professionals, and SMBs. The templates are categorized into state-based categories and some of them might be previewed prior to being downloaded.

To download templates, users need to have a subscription and to log in to their account. Hit Download next to any form you need and find it in My Forms.

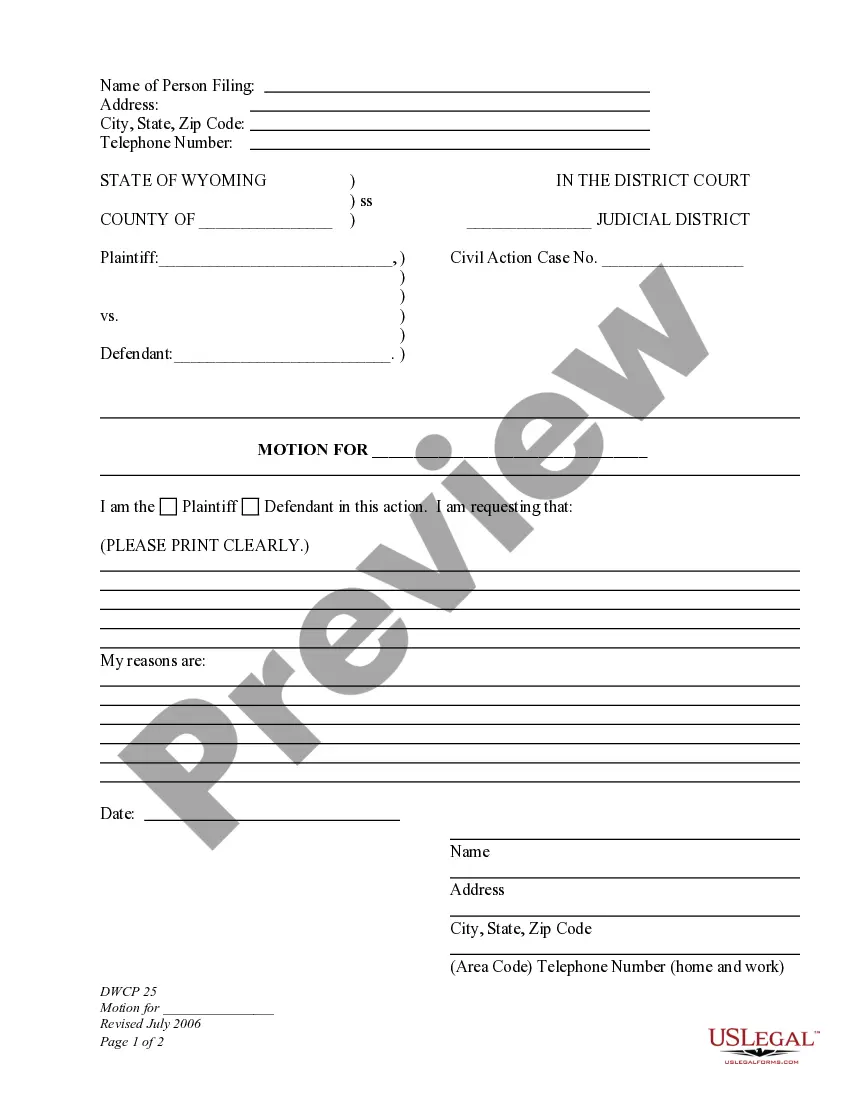

For people who don’t have a subscription, follow the tips below to easily find and download Wyoming Child Support Computation Form and Net Income Calculation:

- Check out to ensure that you have the proper template with regards to the state it’s needed in.

- Review the form by looking through the description and using the Preview feature.

- Hit Buy Now if it is the document you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search engine if you want to find another document template.

US Legal Forms provides thousands of legal and tax templates and packages for business and personal needs, including Wyoming Child Support Computation Form and Net Income Calculation. Over three million users already have utilized our platform successfully. Choose your subscription plan and get high-quality documents in just a few clicks.

Form popularity

FAQ

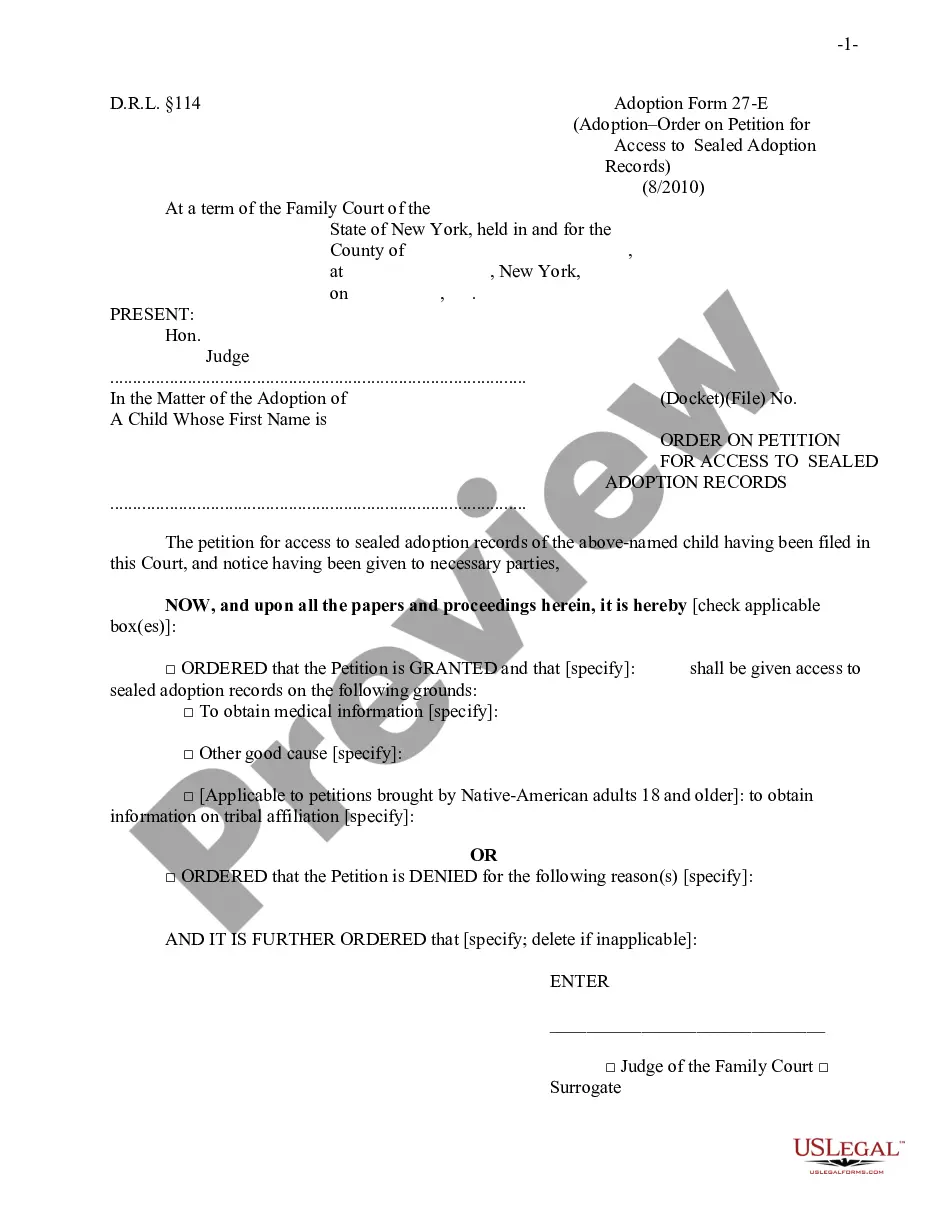

Deductions of child support are made after tax withheld deductions and formal salary sacrificing. This is before other deductions such as voluntary superannuation, health fund and loan repayments. Once you make a deduction from your employee's or contractor's pay, you're legally required to pay it to us.

The income that is used to determine child support is called your guideline income. In many cases, that is the person's gross annual income, either from line 150 of their last years' tax return, or based on their current year-to-date income. However, there are some cases when a different amount may be used.

According to the guidelines, for two kids, you must pay between 20% to 36.8% of your net income, plus an additional percentage of any income above a certain baseline amount. The baseline for our example net income of $2,500) is $2,083. The percentage of child support due on $2,083 is 35%.

Your child support is not affected by your purchase of a home. He has no interest in the home, as it is not being purchased jointly and he is not contributing. However, your purchase of a home does not provide you with a basis to decrease...

CHILD SUPPORT BASED ON GROSS INCOME CSA advises parties that this is what the children would be entitled to if the two parents were still together. But they would only be entitled to a net amount if the two parents were still together.

When a court calculates child support, it usually doesn't care what you do with your money after you earn it. If you spend a bundle on a vacation in Venice, you'll owe the same amount as you would if you had saved the money. Most courts include income from a wide variety of sources, however, so savings can factor in.

In determining a parent's income for child support purposes, courts typically look at the parent's gross income from all sources. They then subtract certain obligatory deductions, like income taxes, Social Security, health care, and mandatory union dues.

We work out each parent's income percentage by dividing each income by the combined total.We subtract the cost percentage from the income percentage for each parent. We call this the child support percentage. The result will determine if a parent pays or gets child support.

Assets are generally excluded from the computation of child support since what the CSA needs is the taxable income of the parents. Assets will only come into the picture if the parent has no other source of income or has insufficient income and he cannot meet his child support obligations.