This is an official form from the Judicial Branch of Wyoming which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Wyoming statutes and law.

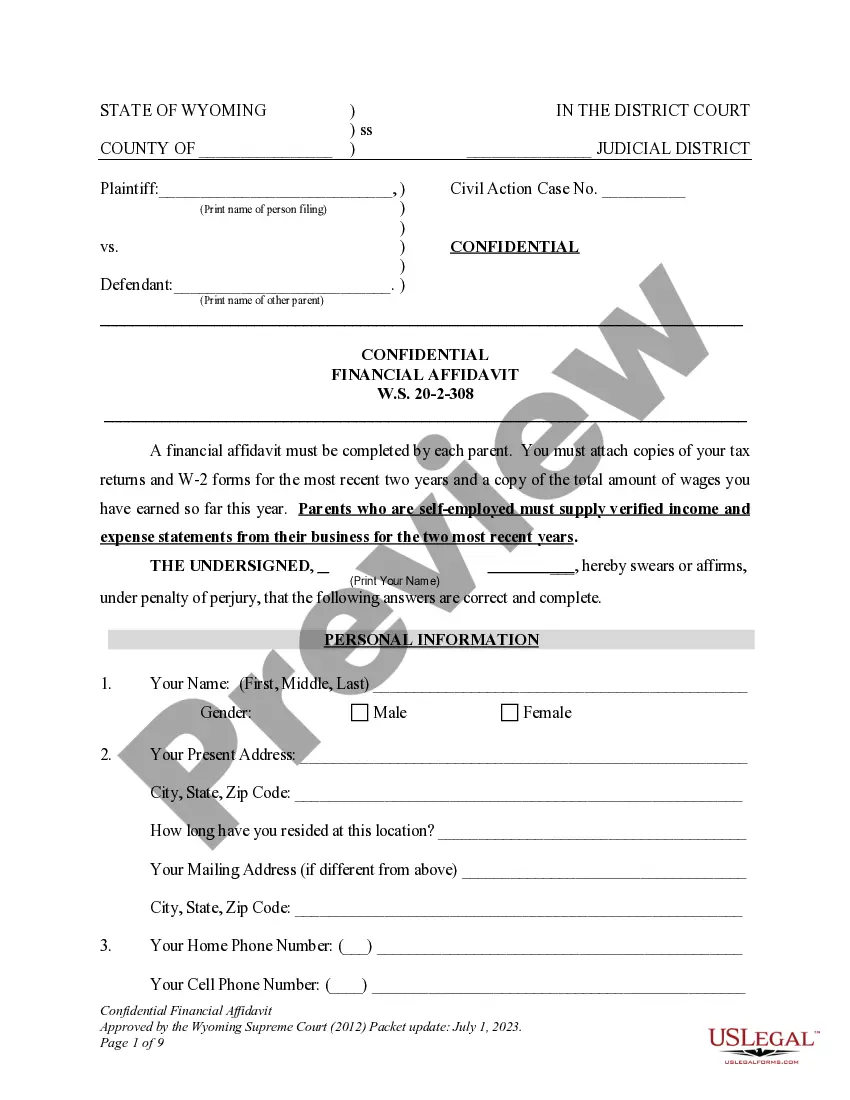

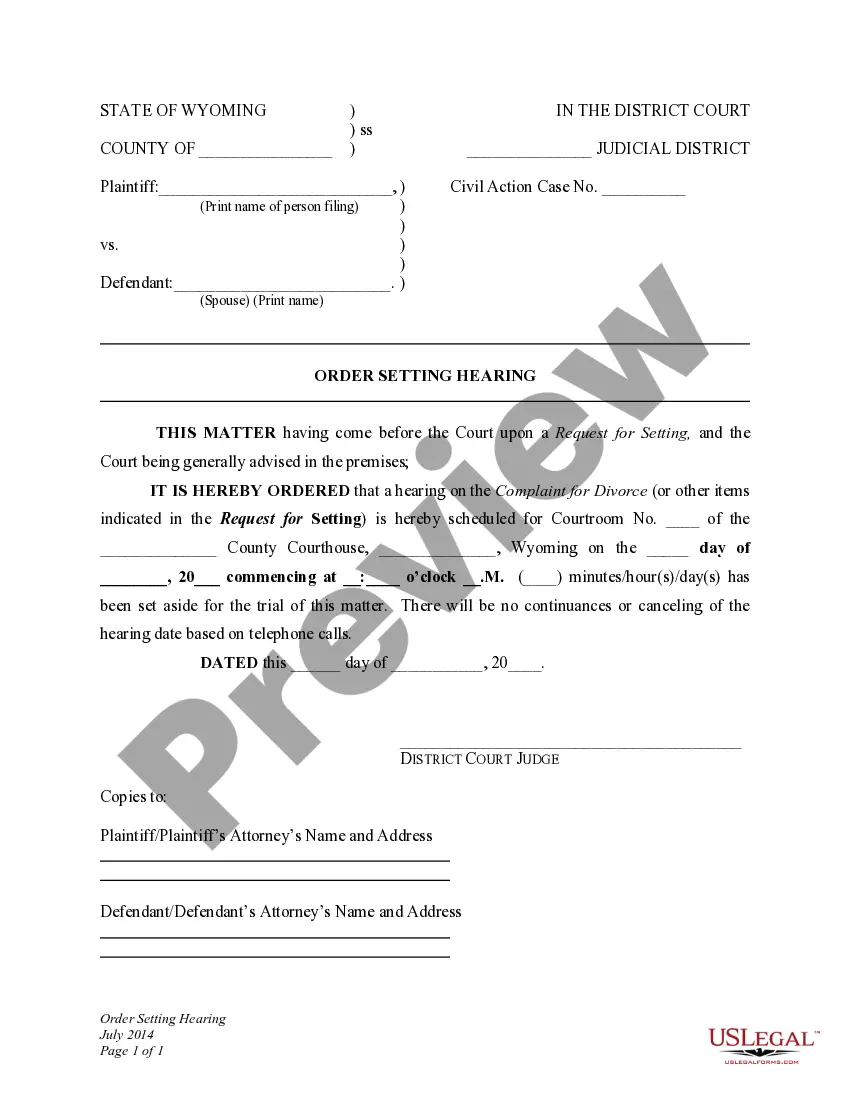

Wyoming DWCP 9. Confidential Statement of Parties for Child Support Order

Description

How to fill out Wyoming DWCP 9. Confidential Statement Of Parties For Child Support Order?

Use US Legal Forms to obtain a printable Wyoming Confidential Statement of Parties for Child Support Order. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most comprehensive Forms catalogue on the web and provides affordable and accurate samples for customers and legal professionals, and SMBs. The templates are categorized into state-based categories and many of them might be previewed prior to being downloaded.

To download samples, users need to have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For people who do not have a subscription, follow the tips below to quickly find and download Wyoming Confidential Statement of Parties for Child Support Order:

- Check to ensure that you have the right template in relation to the state it’s needed in.

- Review the document by reading the description and by using the Preview feature.

- Click Buy Now if it is the document you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Use the Search engine if you want to get another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including Wyoming Confidential Statement of Parties for Child Support Order. Over three million users have already utilized our service successfully. Select your subscription plan and obtain high-quality forms in a few clicks.

Form popularity

FAQ

Just in case you didn't believe it was complicated, here is the formula California uses to calculate child support: CS = K (HN - (H%) (TN)). Here's what the letters mean: CS is the child support amount.

CHILD SUPPORT BASED ON GROSS INCOME CSA advises parties that this is what the children would be entitled to if the two parents were still together. But they would only be entitled to a net amount if the two parents were still together.

According to the guidelines, for two kids, you must pay between 20% to 36.8% of your net income, plus an additional percentage of any income above a certain baseline amount. The baseline for our example net income of $2,500) is $2,083. The percentage of child support due on $2,083 is 35%.

The flat percentage of the non-custodial parent's income that must be dedicated to child support is 25% percent for one child. The non-custodial parent will pay $625 a month.

The guideline states that the paying spouse's support be presumptively 40% of his or her net monthly income, reduced by one-half of the receiving spouse's net monthly income. If child support is an issue, spousal support is calculated after child support is calculated.

Child support is a percentage (roughly 20% for 1 child, and an additional 10% for each additional child) of the combined gross income of the parents, which is then split between both parents, depending on other factors.

Child maintenance payments It all depends on the child maintenance rate being paid and the number of shared care nights there are. If the day-to-day care of a child is shared equally between the paying parent and the receiving parent the paying parent will not have to pay any child maintenance for that child.

In flat-rate states, even in a 50/50 child custody arrangement, one parent is designated the residential or primary custodial parent for child support purposes and the other parent is paying a percentage of their income in accordance with the law regardless.

Using the amount on line 150 on your income tax return (or notice of assessment from the Canada Revenue Agency), and then minus any union dues from that amount. Looking at your pay stubs for a full year and adding up what you were paid each month (before all the taxes were taken off)