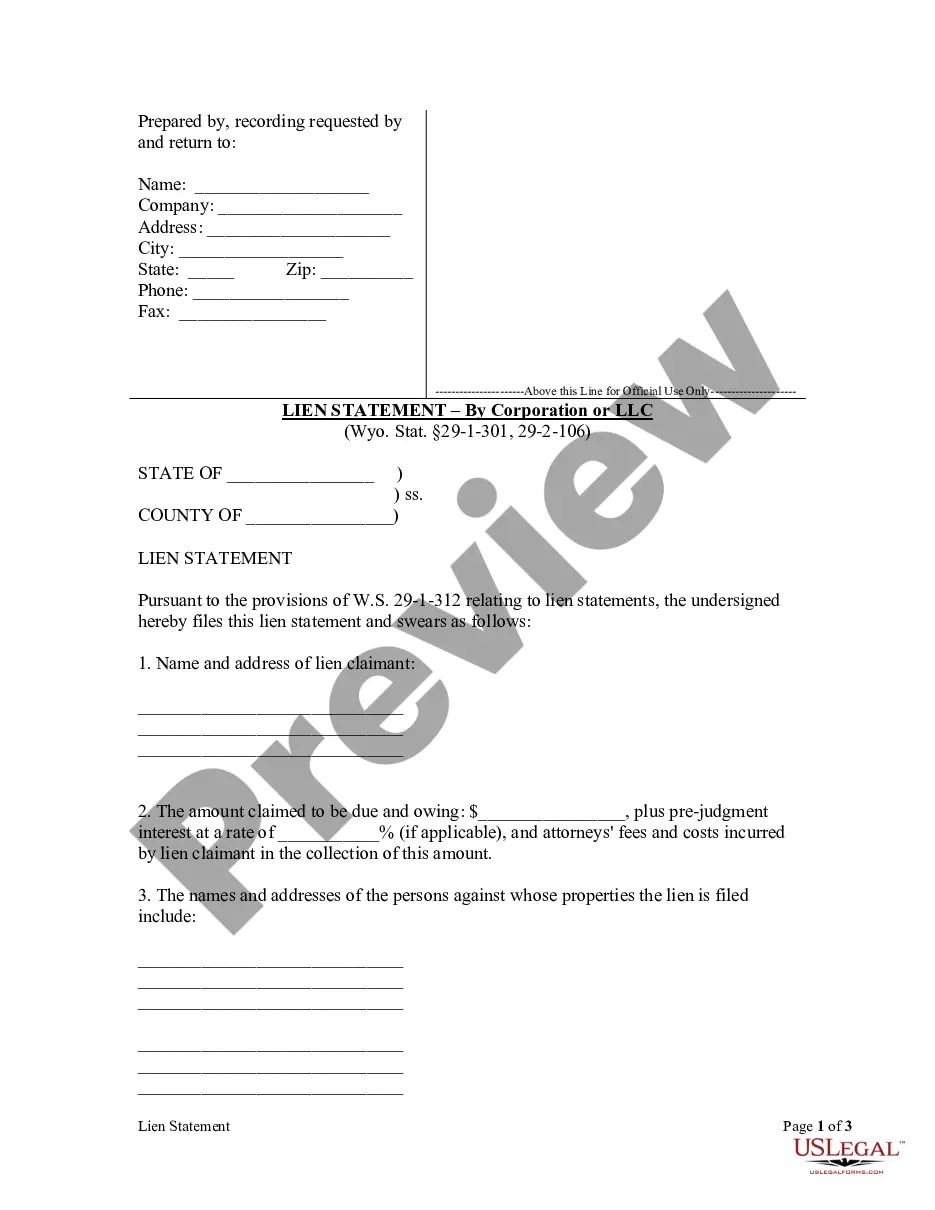

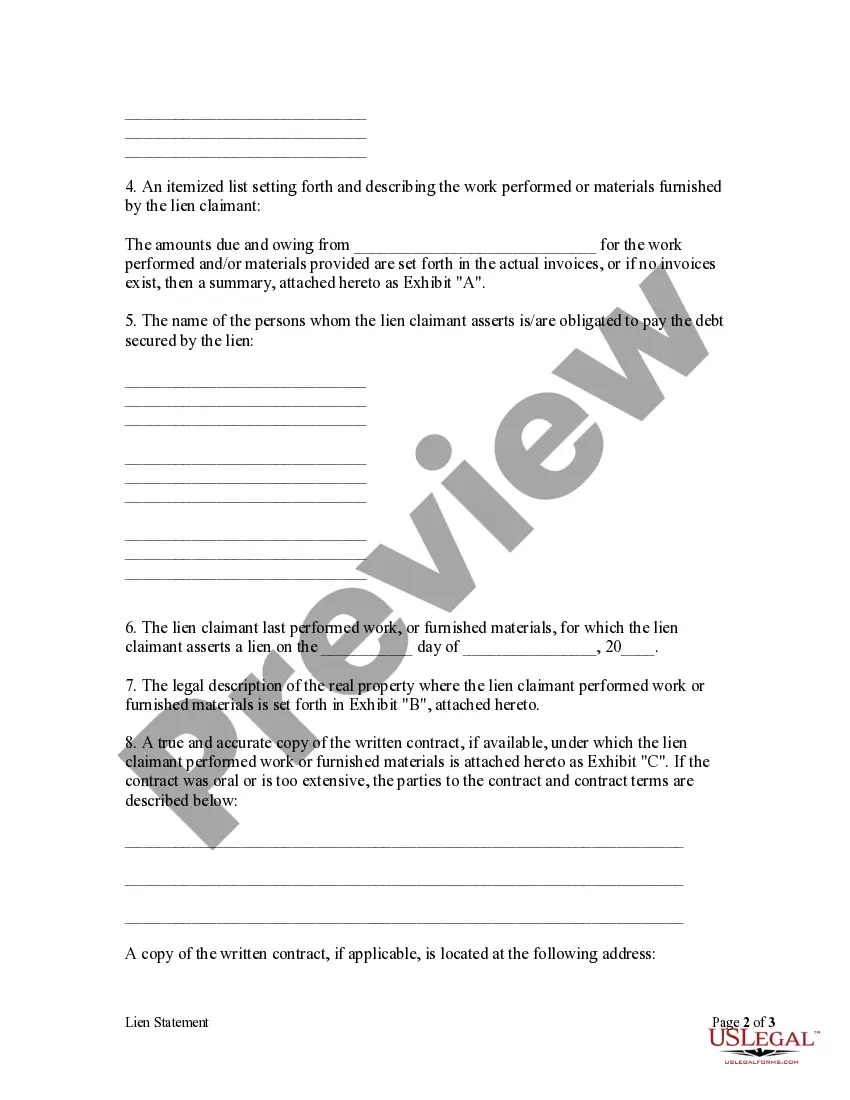

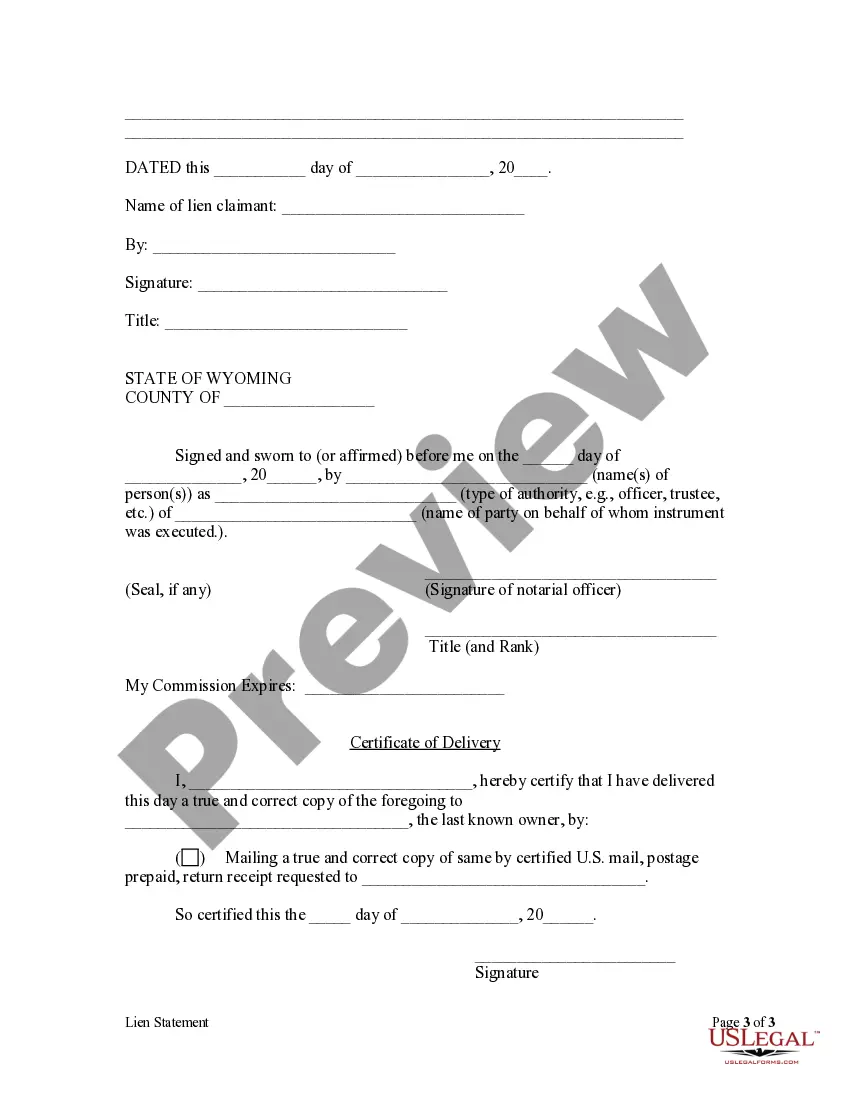

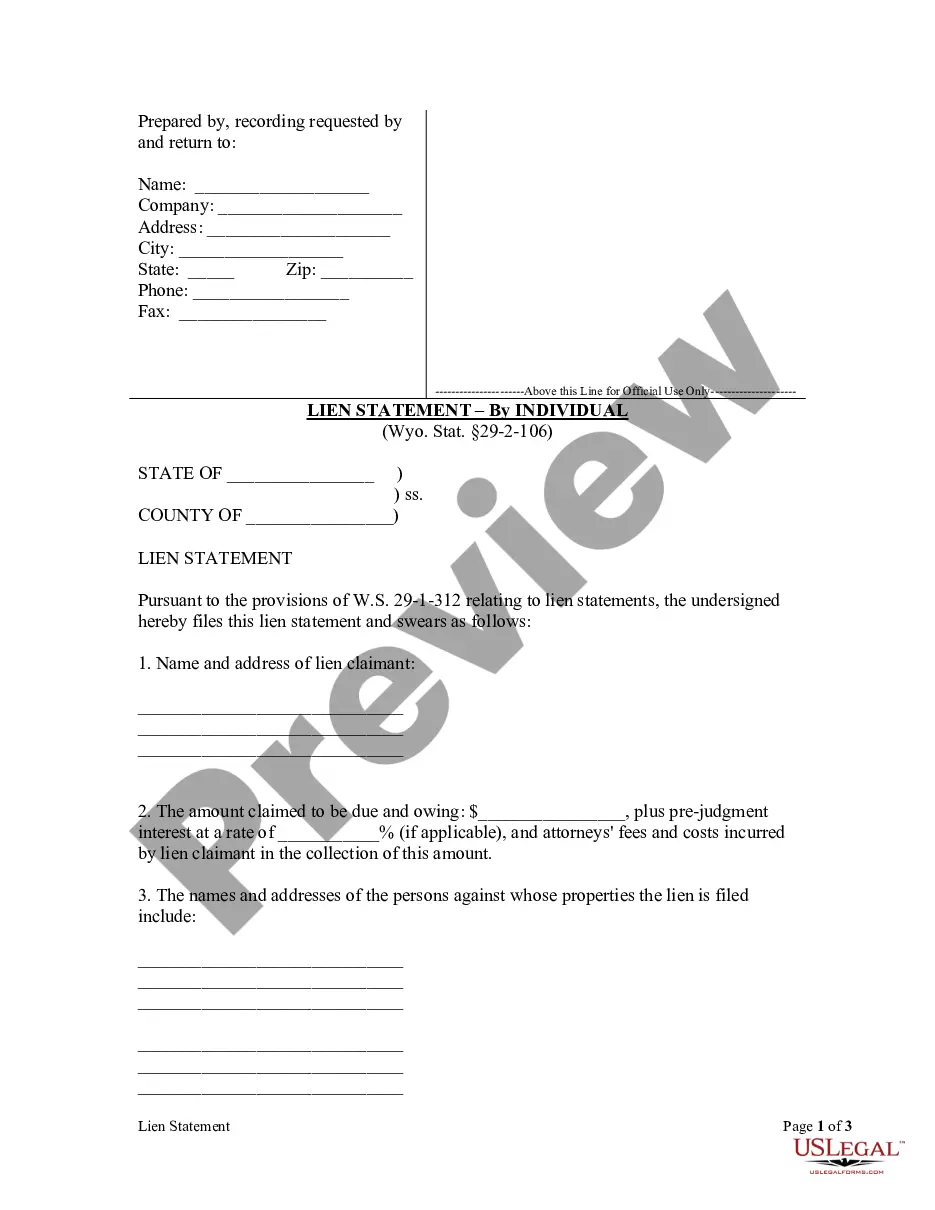

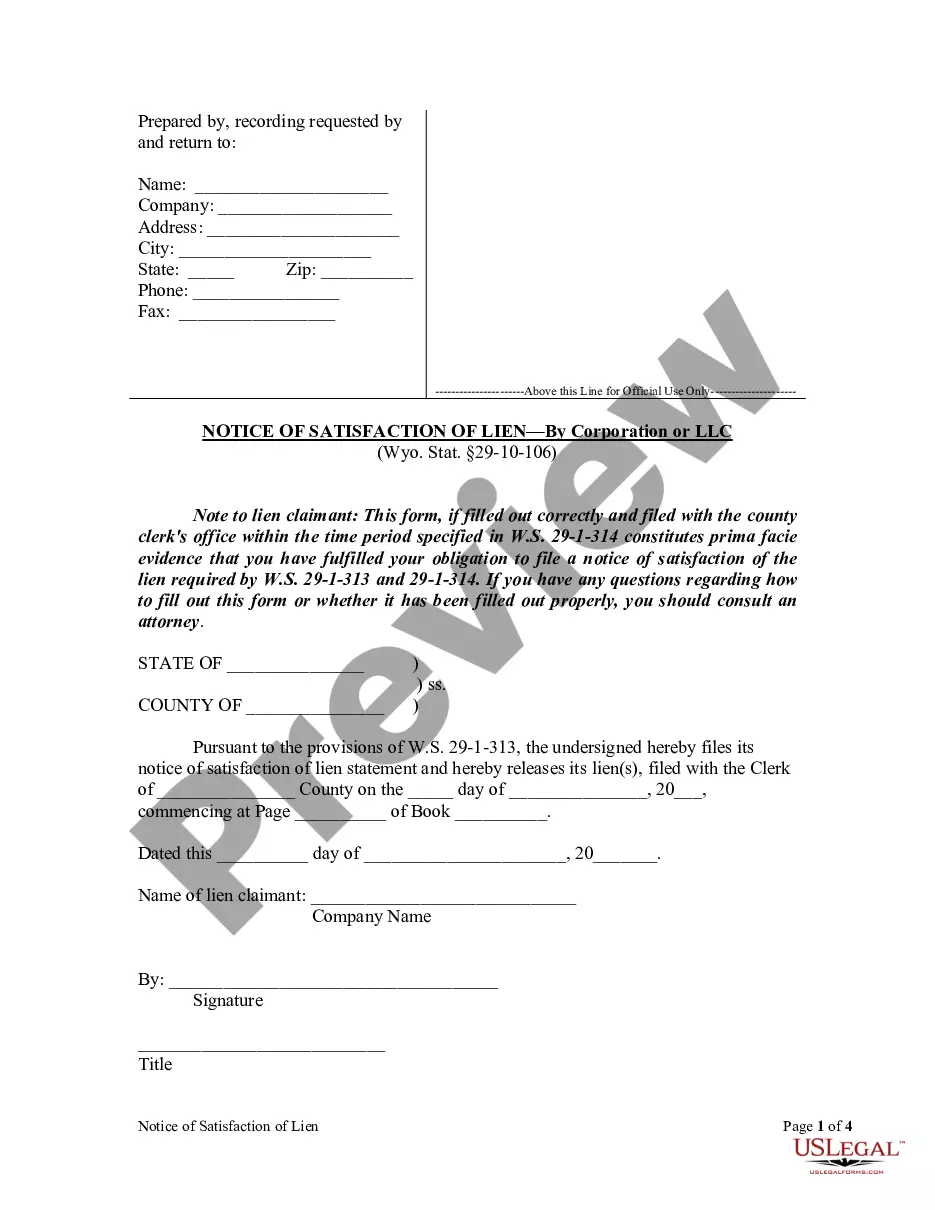

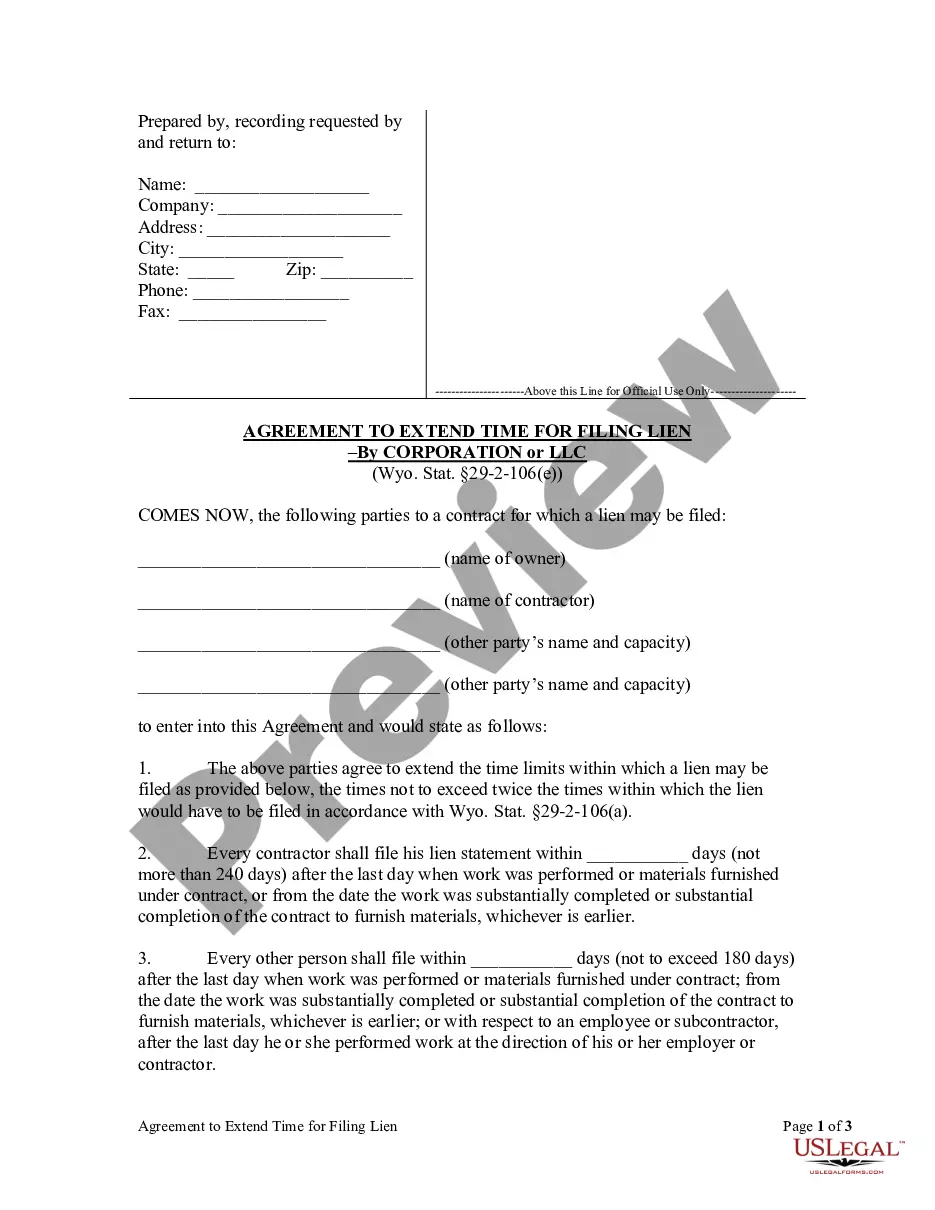

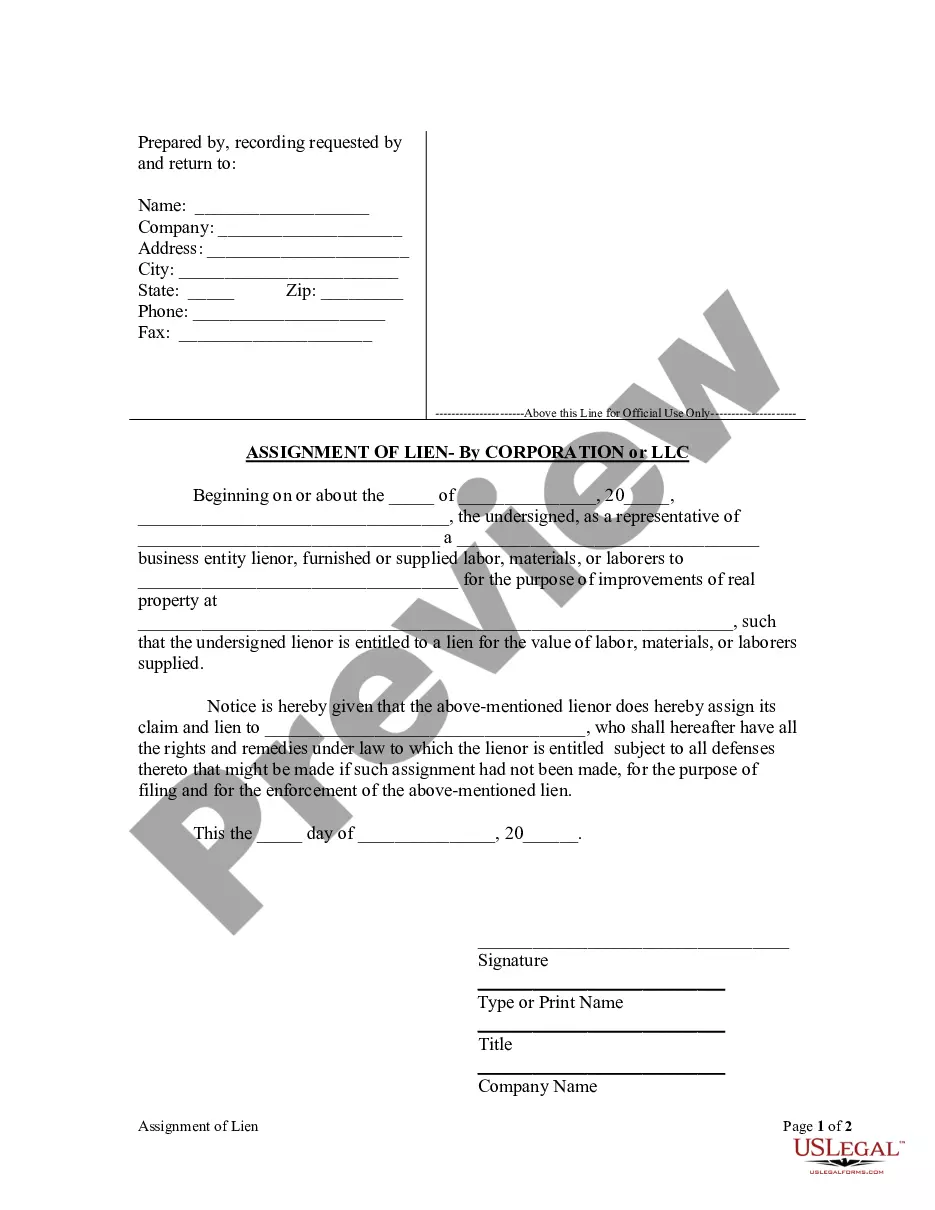

This is a Lien Statement notice pursuant to state statute from a coporation who has provided labor or materials under contract that a lien is being placed on the property as specified for the amount owed.

Wyoming Lien Statement by Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Wyoming Lien Statement By Corporation?

Out of the multitude of services that offer legal samples, US Legal Forms offers the most user-friendly experience and customer journey when previewing forms before buying them. Its complete catalogue of 85,000 templates is categorized by state and use for efficiency. All of the documents on the service have been drafted to meet individual state requirements by qualified legal professionals.

If you already have a US Legal Forms subscription, just log in, look for the form, hit Download and get access to your Form name from the My Forms; the My Forms tab holds all of your downloaded documents.

Follow the guidelines listed below to obtain the form:

- Once you find a Form name, make sure it is the one for the state you need it to file in.

- Preview the template and read the document description before downloading the template.

- Look for a new sample via the Search engine if the one you have already found is not proper.

- Just click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the template.

Once you have downloaded your Form name, you can edit it, fill it out and sign it with an online editor that you pick. Any form you add to your My Forms tab might be reused multiple times, or for as long as it remains the most up-to-date version in your state. Our service provides fast and easy access to samples that fit both legal professionals as well as their clients.

Form popularity

FAQ

There are significant benefits to forming an LLC in Wyoming such as unparalleled limited liability protection, fewer corporate formalities, no state taxes, and privacy. Member and/or Manager names are never required on public record for an LLC in Wyoming.

First, the tax climate in the state is incredibly business-friendly. Wyoming does not have a corporate income tax, nor does it have an individual income tax or gross receipts tax.Of all fifty States, Wyoming has one of the best records of business survival.

Delaware. Delaware takes one of the top spots as the best state to form LLC. More than 50% of all U.S. publicly-traded companies and roughly 63% of Fortune 500 companies are incorporated in Delaware.

Someone who is owed money is generally not able to just put a lien on property without first securing a judgment. Securing a judgment requires the creditor to sue the debtor. This may be through circuit court in many jurisdictions. If under a certain dollar amount, this suit may be through the small claims court.

Answer. A business is pretty much free to form a limited liability company (LLC) in any old state. But you may still need to qualify your LLC to do business in your home state -- and this means you'll have to file additional paperwork and pay additional fees.

Has 2 LLC filings to maintain (a Domestic Wyoming LLC and a Foreign California LLC) has 2 state filing fees. has to meet annual requirements and fees in both states. may have increased Registered Agent fees.

Someone can setup a Wyoming business entity through a registered agent and hide the true owner of the entity from both the public and State government.This unique privacy function has contributed to Wyoming being known as a haven for corporate secrecy.

Preliminary notice is mandatory All project participants wishing to file a mechanics lien in Wyoming must first file a Preliminary Notice of Right to Lien with the property owner. Also, every project participant is required to send a notice of intent to lien 20 days prior to filing a mechanics lien on the property.

Many companies incorporate in Wyoming because the administrative costs are generally lower than in Delaware or Nevada.Wyoming also has personal asset protection laws in place to protect business owners and company officers from losing assets like cars and houses in the event of litigation.