West Virginia Authorization to Release Wage and Employment Information

Description

How to fill out Authorization To Release Wage And Employment Information?

You are able to invest hrs on the web trying to find the legal file design that suits the federal and state demands you need. US Legal Forms supplies a large number of legal varieties which can be reviewed by specialists. It is simple to download or print the West Virginia Authorization to Release Wage and Employment Information from your support.

If you currently have a US Legal Forms accounts, you can log in and click on the Down load button. Afterward, you can total, change, print, or indication the West Virginia Authorization to Release Wage and Employment Information. Each and every legal file design you buy is yours eternally. To obtain one more copy for any bought develop, check out the My Forms tab and click on the related button.

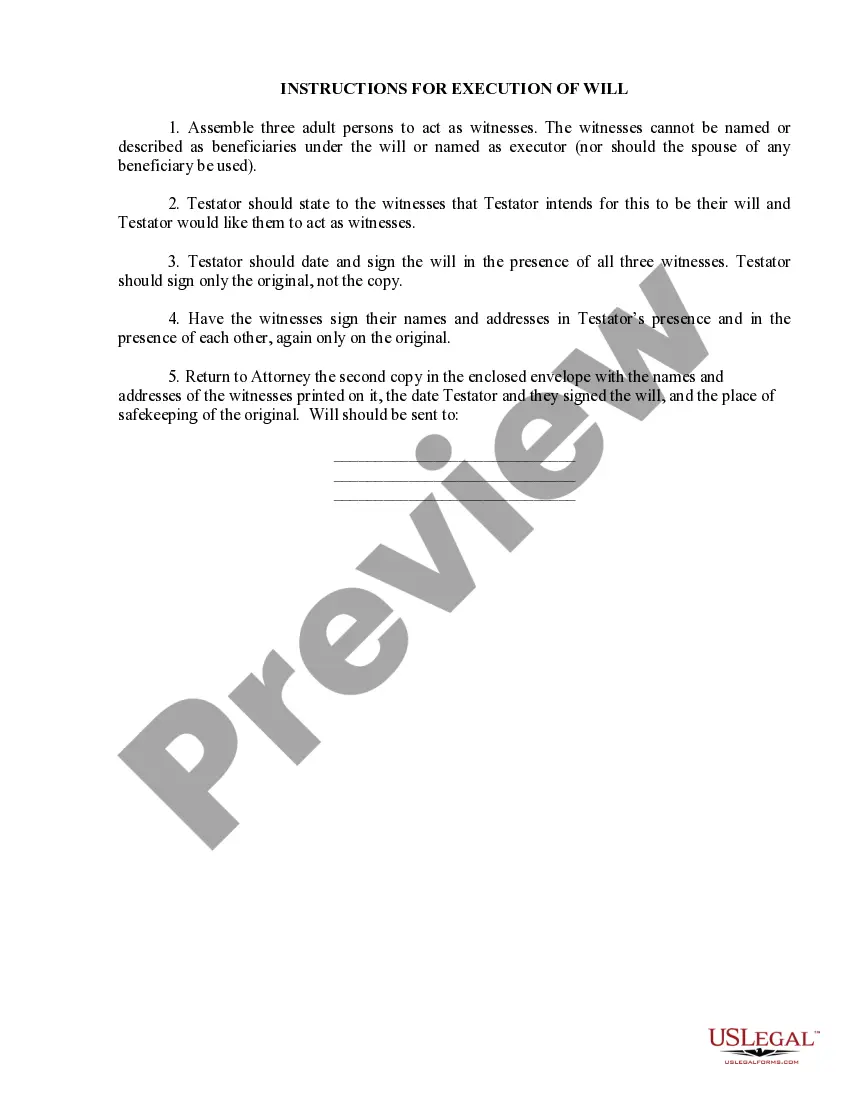

Should you use the US Legal Forms web site the first time, stick to the simple instructions listed below:

- Initially, make sure that you have chosen the right file design for that region/metropolis of your choosing. Read the develop information to make sure you have chosen the correct develop. If accessible, use the Preview button to check from the file design too.

- If you would like get one more model of the develop, use the Search discipline to obtain the design that suits you and demands.

- Upon having discovered the design you desire, simply click Buy now to carry on.

- Select the costs plan you desire, type in your references, and register for your account on US Legal Forms.

- Full the purchase. You can use your Visa or Mastercard or PayPal accounts to purchase the legal develop.

- Select the formatting of the file and download it to the system.

- Make modifications to the file if required. You are able to total, change and indication and print West Virginia Authorization to Release Wage and Employment Information.

Down load and print a large number of file themes utilizing the US Legal Forms website, which provides the largest selection of legal varieties. Use specialist and status-particular themes to take on your company or specific requires.

Form popularity

FAQ

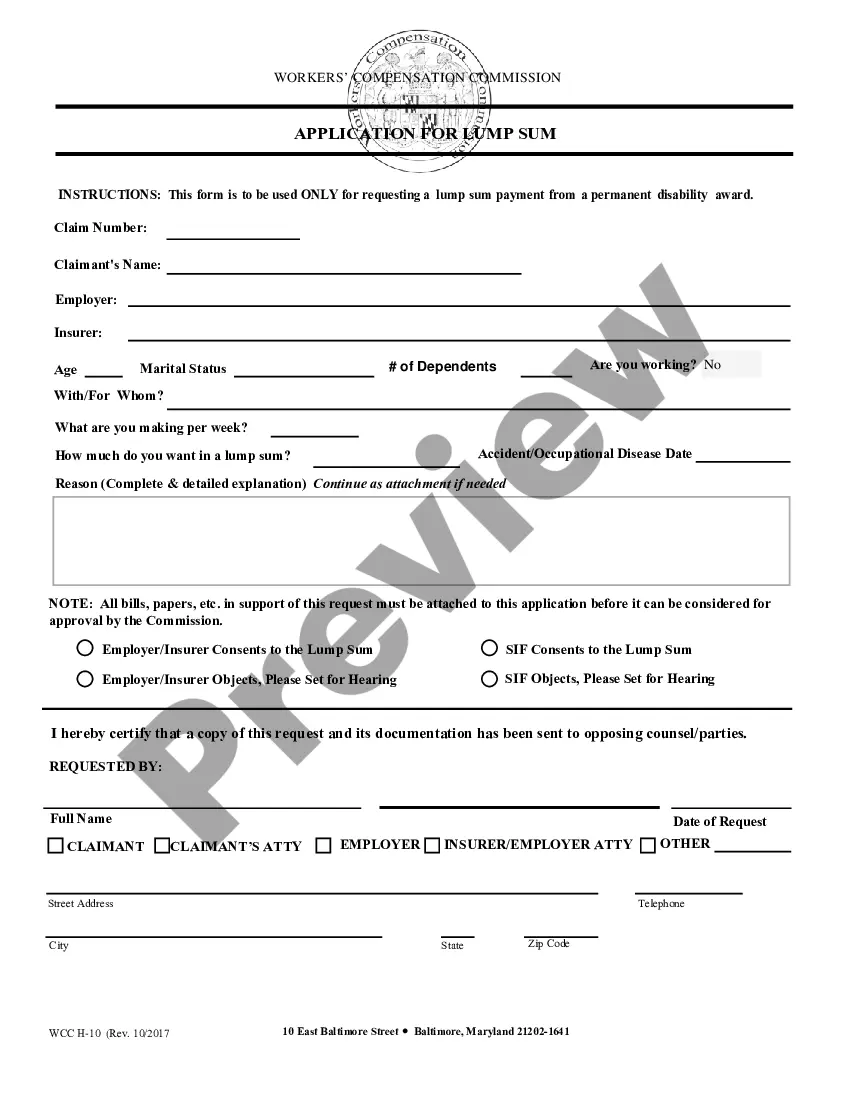

The FLSA requires employers to pay nonexempt employees a rate at least equal to the federal minimum wage and an overtime rate of one and-one-half times the employees' regular rates for time worked in excess of forty (40) hours in a workweek or work period (when designated by fire protection or law enforcement agencies) ...

In order for the Wage Payment & Collection Act to apply, an employment relationship must exist between the employer and the worker. Any individual working outside of an employer/employee relationship that is not paid for his or her work must address such unpaid funds by filing a claim in magistrate or circuit court.

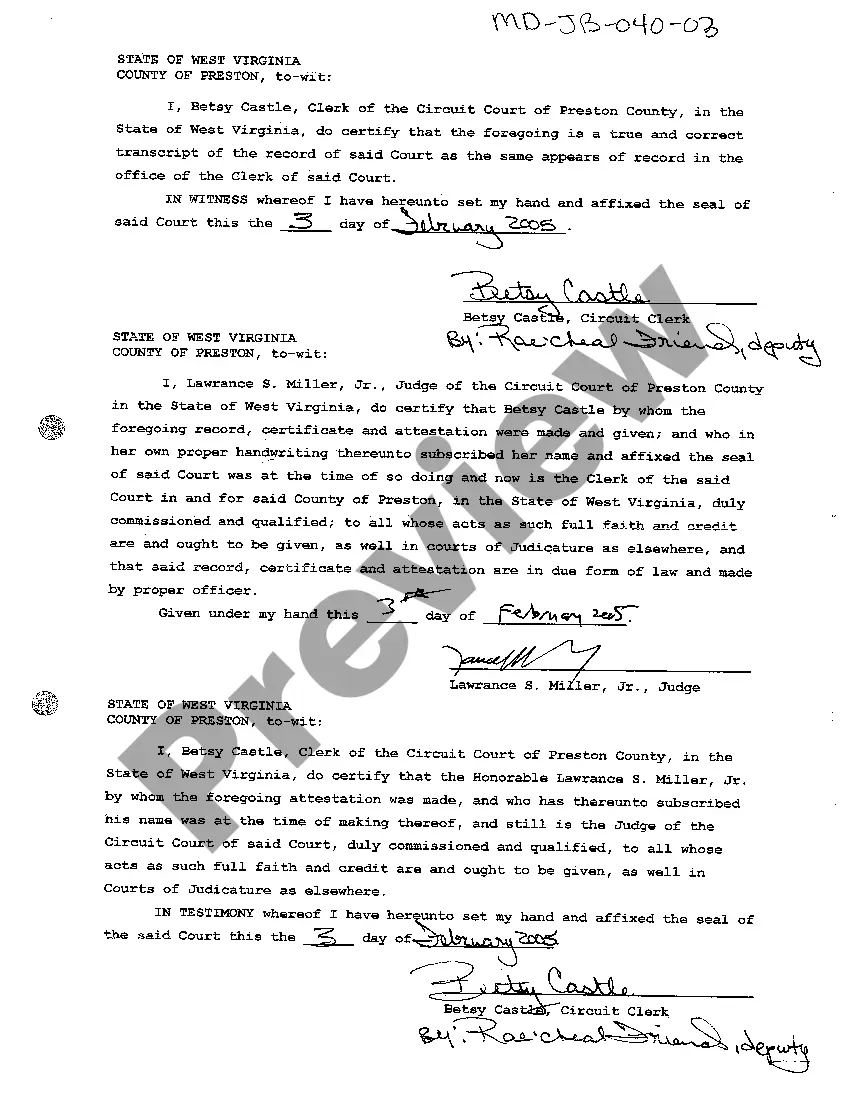

The employer can provide information on professional conduct, the reasons for separation, and job performance (including any written performance evaluations), provided that, when giving the information, the employer is not acting in bad faith.

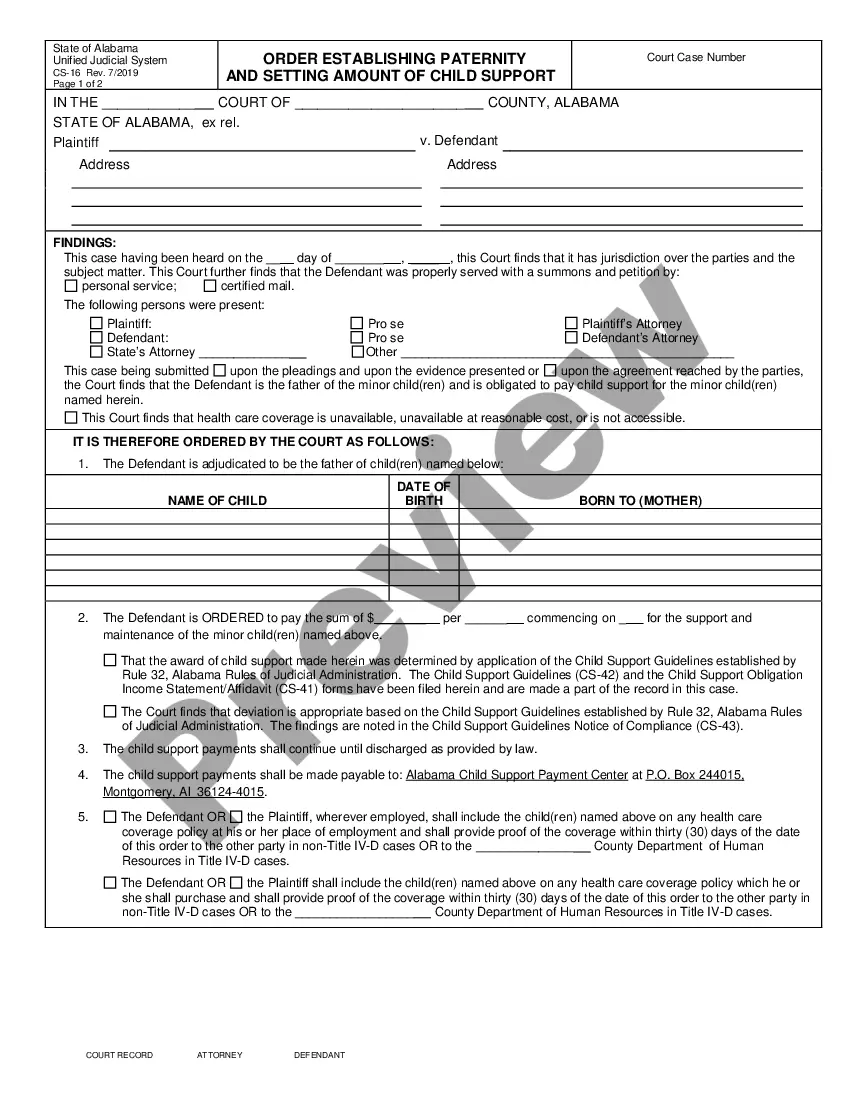

On January 17, 2023, HB 2626, also known as the ?Katherine Johnson and Dorothy Vaughan Fair Pay Act,? was proposed in the West Virginia House of Delegates. If passed, this bill would require employers to provide information about pay, benefits, and other compensation to candidates who ask for it.

The West Virginia Wage Payment & Collection Act provides for the assessment of liquidated damages as a monetary penalty to employers that fail to pay final wages in a timely manner. Such damages are calculated at two (2) times the total amount of unpaid wages or fringe benefits owed.

In order for the Wage Payment & Collection Act to apply, an employment relationship must exist between the employer and the worker. Any individual working outside of an employer/employee relationship that is not paid for his or her work must address such unpaid funds by filing a claim in magistrate or circuit court.

An employer generally may disclose, both to an employee's co-workers and to potential employers, the true reason why an employee left or was fired.

Requirements newly added for 2023 include showing the median and mean hourly rate broken out by job category, race, ethnicity and gender. Employers with 100 or more labor contractors must file a separate report with pay data on their labor contractors, which they should work with their staffing companies to prepare.

A written request to check files is required. Employers must keep files of former employees for at least one year after termination. Employees may view records during regular business hours in a location at or near the worksite.