West Virginia Authorization for Release of Personal Information

Description

How to fill out Authorization For Release Of Personal Information?

If you need to thoroughly obtain, download, or print official document templates, utilize US Legal Forms, the most extensive collection of official forms available online.

Employ the site’s straightforward and user-friendly search function to locate the documents you require. Numerous templates for business and personal purposes are classified by categories and states, or keywords.

Use US Legal Forms to easily locate the West Virginia Authorization for Release of Personal Information in just a few clicks.

Every official document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Click the My documents section and choose a form to print or download again.

Stay competitive and download, and print the West Virginia Authorization for Release of Personal Information with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to locate the West Virginia Authorization for Release of Personal Information.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

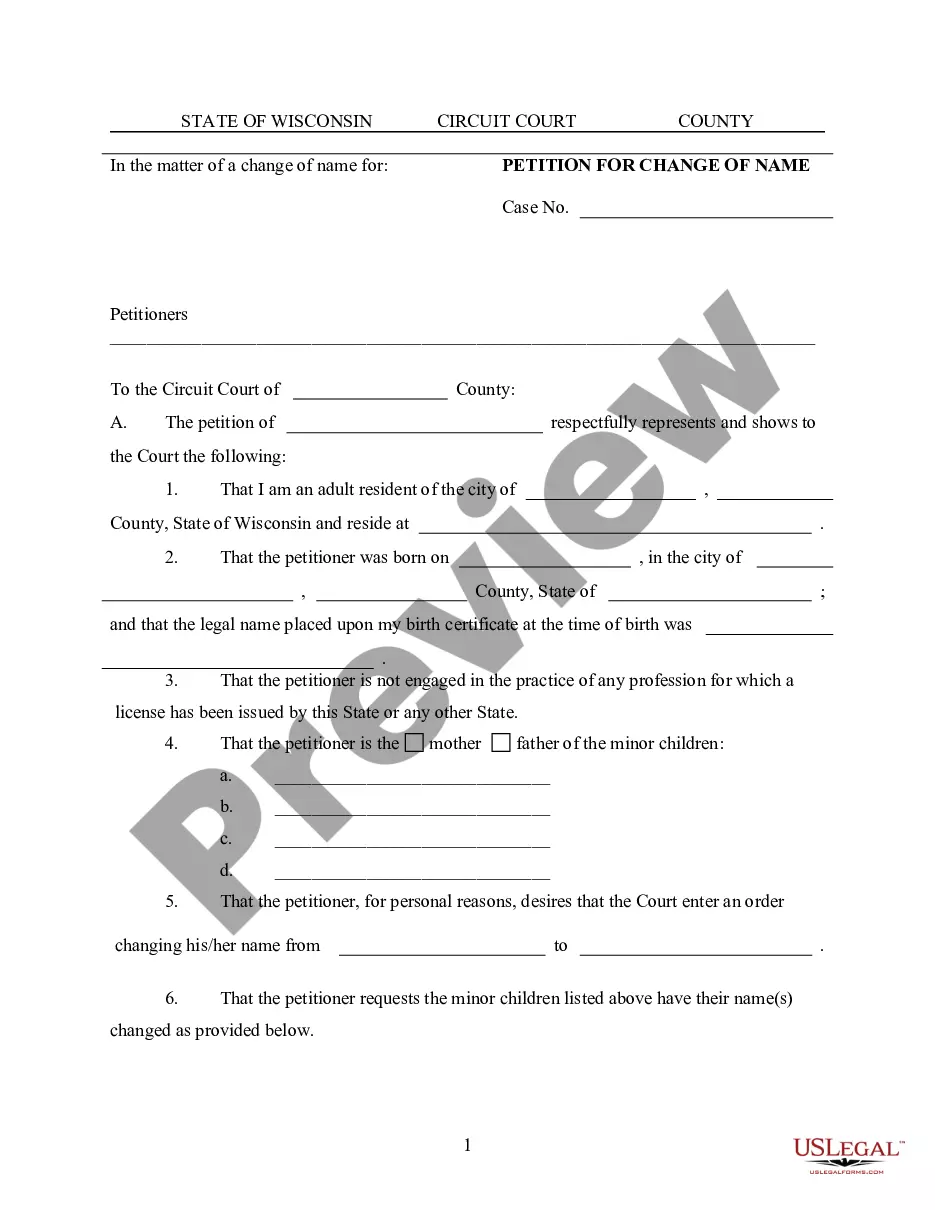

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the official form template.

- Step 4. Once you have found the form you need, click the Download now button. Select your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the official form and download it to your device.

- Step 7. Complete, modify, and print or sign the West Virginia Authorization for Release of Personal Information.

Form popularity

FAQ

Medical Records and PHI should be stored out of sight of unauthorized individuals, and should be locked in a cabinet, room or building when not supervised or in use. Provide physical access control for offices/labs/classrooms through the following: Locked file cabinets, desks, closets or offices.

Use the IT-140 form if you are: A full-year resident of West Virginia. A full-year non-resident of West Virginia and have source income (mark IT-140 as Nonresident and complete Column C of Schedule A)

The average minimum requirement is five years; however, some Medicare/Medicaid audits and/or actions can occur up to ten years after treatment and/or billing has occurred. Statutory or Regulatory Requirements: Several state and federal regulations and rules may affect medical record retention periods.

The average minimum requirement is five years; however, some Medicare/Medicaid audits and/or actions can occur up to ten years after treatment and/or billing has occurred. Statutory or Regulatory Requirements: Several state and federal regulations and rules may affect medical record retention periods.

The State of West Virginia recognizes the Federal tax extension (IRS Form 4868). Therefore, if you have a valid Federal extension, you will automatically be granted a corresponding West Virginia tax extension for the same amount of time.

To obtain records, a patient, his or her personal representative as defined by HIPAA, or his or her authorized agent or authorized representative must submit a written request with the health care provider. The provider must furnish a copy of the records within 30 days of receiving the request.

State law requires many health care providers to keep your medical record for a specific period of time. For example, West Virginia hospitals must keep your medical records for at least five years after your last treatment. In practice, many health care providers keep their medical records longer.

State law requires many health care providers to keep your medical record for a specific period of time. For example, West Virginia hospitals must keep your medical records for at least five years after your last treatment. In practice, many health care providers keep their medical records longer.

A Mandate Opt Out Form is available for taxpayers who choose not to have their income tax returns filed electronically. This form must be signed and retained by the tax preparer. E-File Registration Requirements - Acceptance in the West Virginia e-file program is automatic with acceptance in the federal e-file program.

Online Access to Your Health InformationCheck with your health care providers or doctors to see if they offer online access to your medical records. Terms sometimes used to describe electronic access to these data include personal health record, or PHR, or patient portal.