This office lease provision states that the parties desire to allocate certain risks of personal injury, bodily injury or property damage, and risks of loss of real or personal property by reason of fire, explosion or other casualty, and to provide for the responsibility for insuring those risks permitted by law.

West Virginia Provision Allocation Risks and Setting Forth Insurance Obligations of Both the Landlord and the Tenant

Description

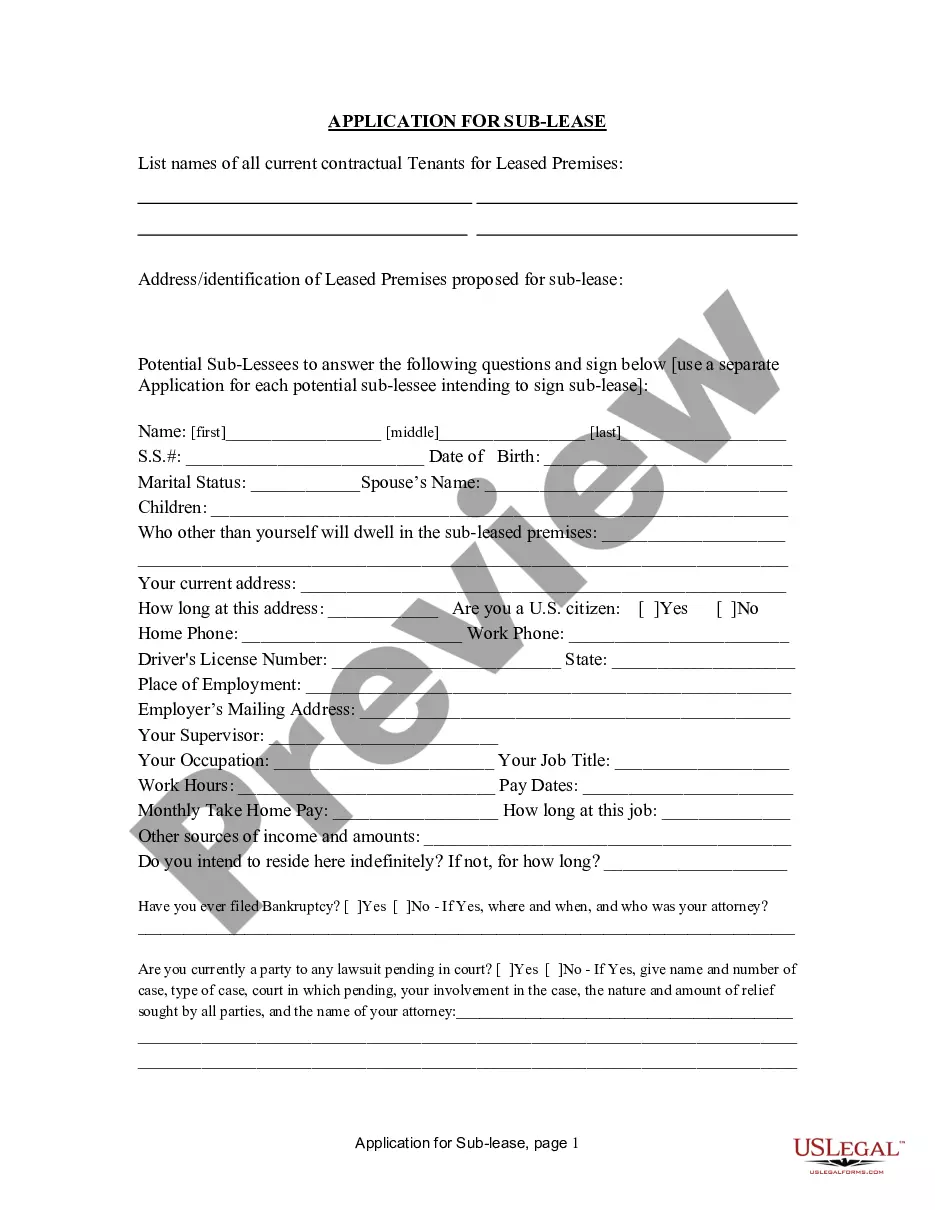

How to fill out Provision Allocation Risks And Setting Forth Insurance Obligations Of Both The Landlord And The Tenant?

Discovering the right lawful file web template could be a battle. Needless to say, there are a lot of themes available online, but how would you find the lawful type you will need? Use the US Legal Forms site. The assistance offers a large number of themes, for example the West Virginia Provision Allocation Risks and Setting Forth Insurance Obligations of Both the Landlord and the Tenant, which you can use for organization and personal requires. All the types are inspected by professionals and meet up with federal and state requirements.

When you are previously listed, log in to the accounts and click on the Download option to have the West Virginia Provision Allocation Risks and Setting Forth Insurance Obligations of Both the Landlord and the Tenant. Make use of your accounts to look throughout the lawful types you may have ordered previously. Go to the My Forms tab of your own accounts and obtain one more duplicate in the file you will need.

When you are a fresh consumer of US Legal Forms, here are straightforward recommendations that you can follow:

- Very first, ensure you have selected the right type to your metropolis/area. It is possible to check out the form utilizing the Preview option and browse the form description to guarantee it will be the right one for you.

- In case the type does not meet up with your preferences, make use of the Seach field to get the correct type.

- When you are positive that the form is acceptable, click the Buy now option to have the type.

- Pick the prices plan you desire and enter the required details. Create your accounts and pay money for your order using your PayPal accounts or credit card.

- Choose the file file format and down load the lawful file web template to the product.

- Total, change and produce and signal the received West Virginia Provision Allocation Risks and Setting Forth Insurance Obligations of Both the Landlord and the Tenant.

US Legal Forms will be the biggest local library of lawful types where you will find various file themes. Use the company to down load skillfully-created paperwork that follow condition requirements.

Form popularity

FAQ

The Virginia Residential Landlord and Tenant Act (VRLTA), Sections 55.1-1200 through 55.1-1262 of the Code of Virginia, establishes the rights and obligations of residential landlords and tenants in the Commonwealth, but only the courts can enforce those rights and obligations.

Under West Virginia law, landlords are required to maintain rental housing in a fit and habitable condition from the time of move in until the time of move out. This means a landlord must make sure that rental housing measures up to all health, safety, fire, and housing code standards at all time.

The rule of subrogation known as the ?Sutton Rule? states that a tenant and landlord are automatically considered ?co-insureds? under a fire insurance policy as a matter of law and, therefore, the insurer of the landlord who pays for the fire damage caused by the negligence of a tenant may not sue the tenant in ...

State and local laws can vary, but as a landlord, you will generally be responsible for providing your tenants with a ?habitable? dwelling, meaning that basic requirements for human occupancy such as having electricity, running water, a pest-free environment, and secure windows and doors must be met.

Make all repairs needed to keep the place fit and habitable. Keep in good and safe working order all electrical, plumbing, sanitary, heating, ventilating, air conditioning and other facilities and appliances that the landlord supplies, or must supply.

2. Timeline Lease Agreement / Type of Tenancy / Rent PaymentTermination Notice to ReceiveWeek-to-week7-Day Notice to QuitMonth-to-month30-Day Notice to QuitYear-to-year90-Day Notice to Quit

With home values less than the national average and a booming economy, West Virginia is a great option for property investors. The state also boasts a competitive cost of living and endless outdoor recreation for anyone looking to relocate to this state.

§37-6-30. Landlord to deliver premises; duty to maintain premises in fit and habitable condition.