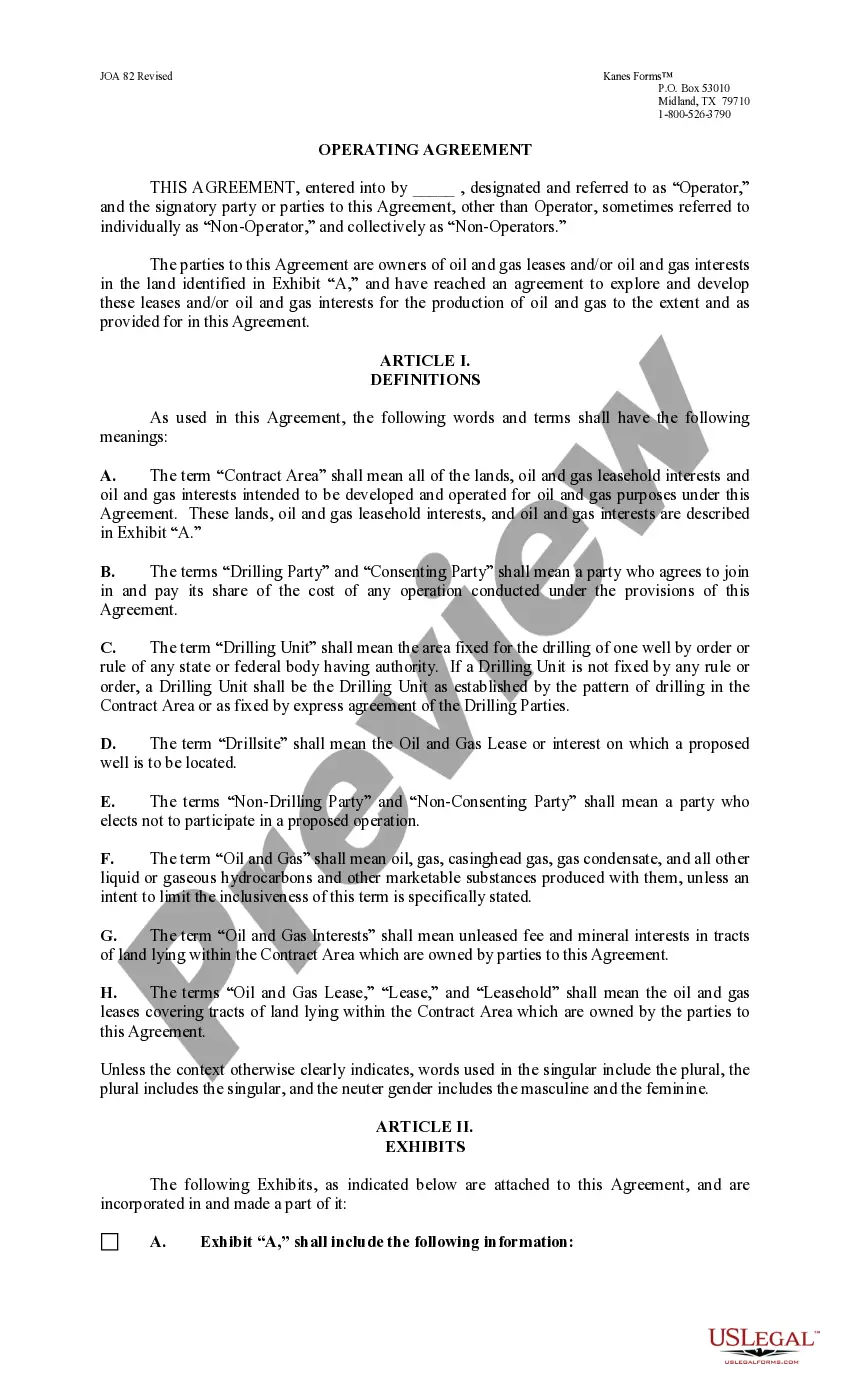

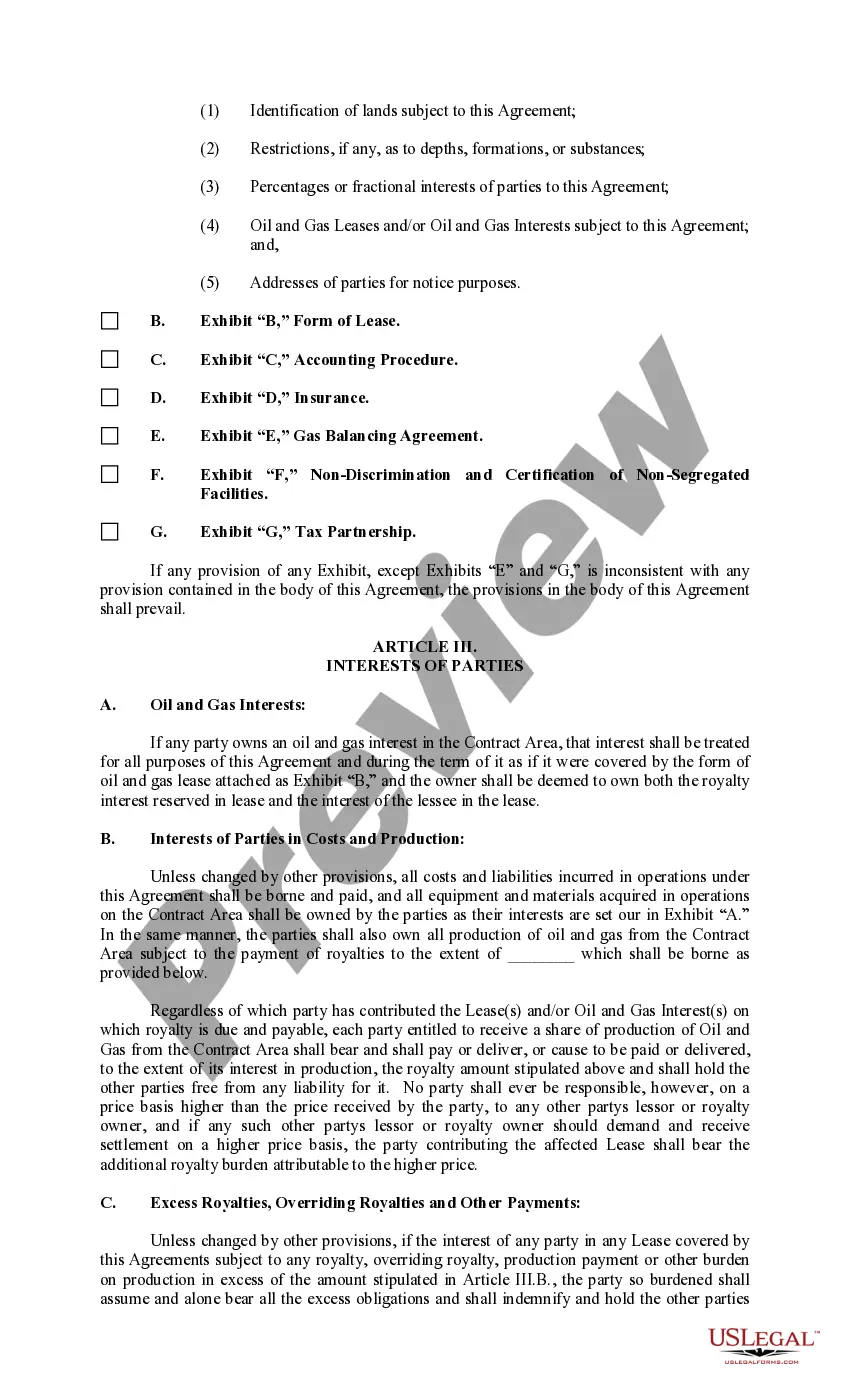

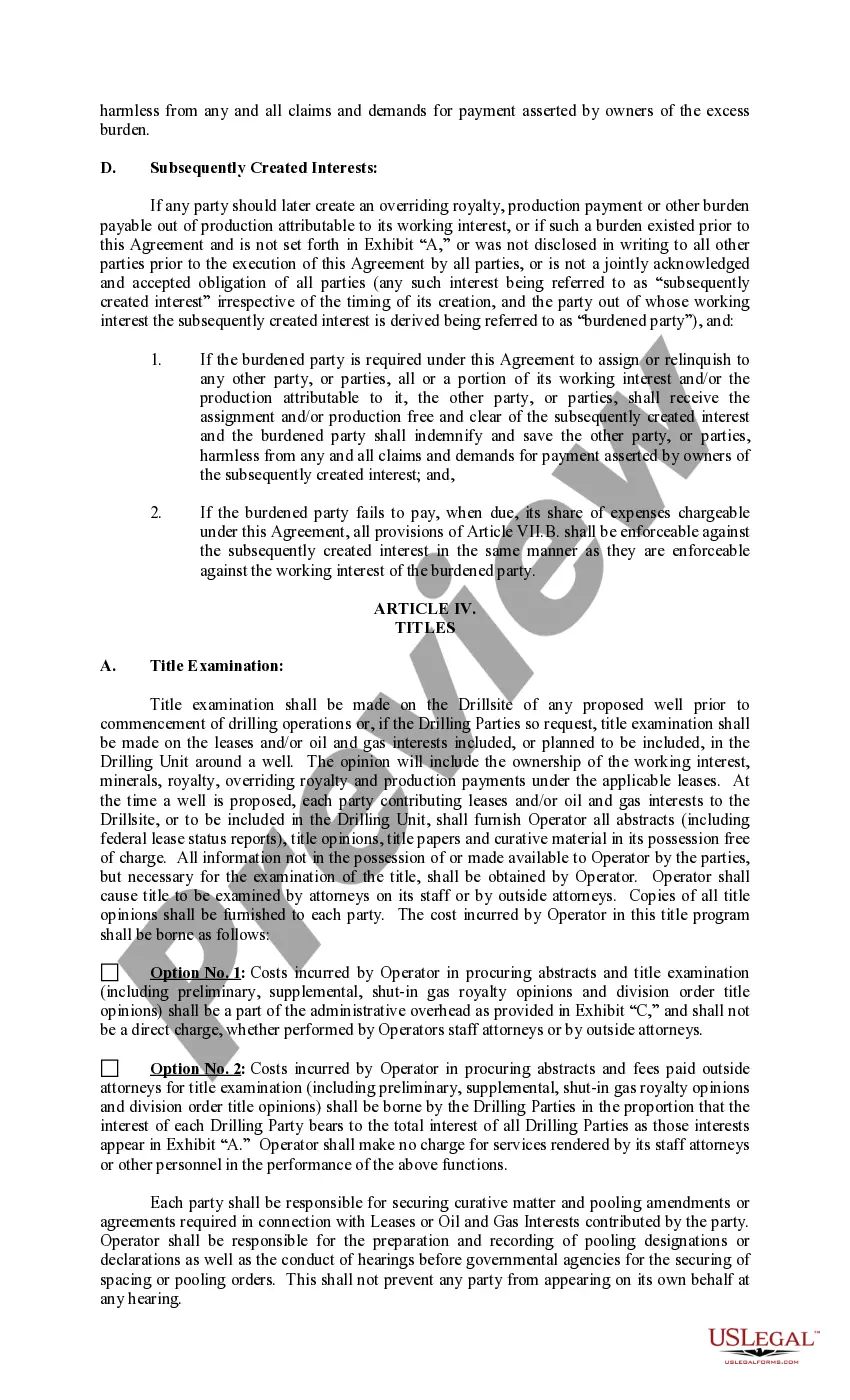

This operating agreement is used when the parties to the Agreement are owners of oil and gas leases and/or oil and gas interests in the land identified in Exhibit A to the agreement, and have reached an agreement to explore and develop these leases and/or oil and gas interests for the production of oil and gas to the extent and as provided for in this Agreement.

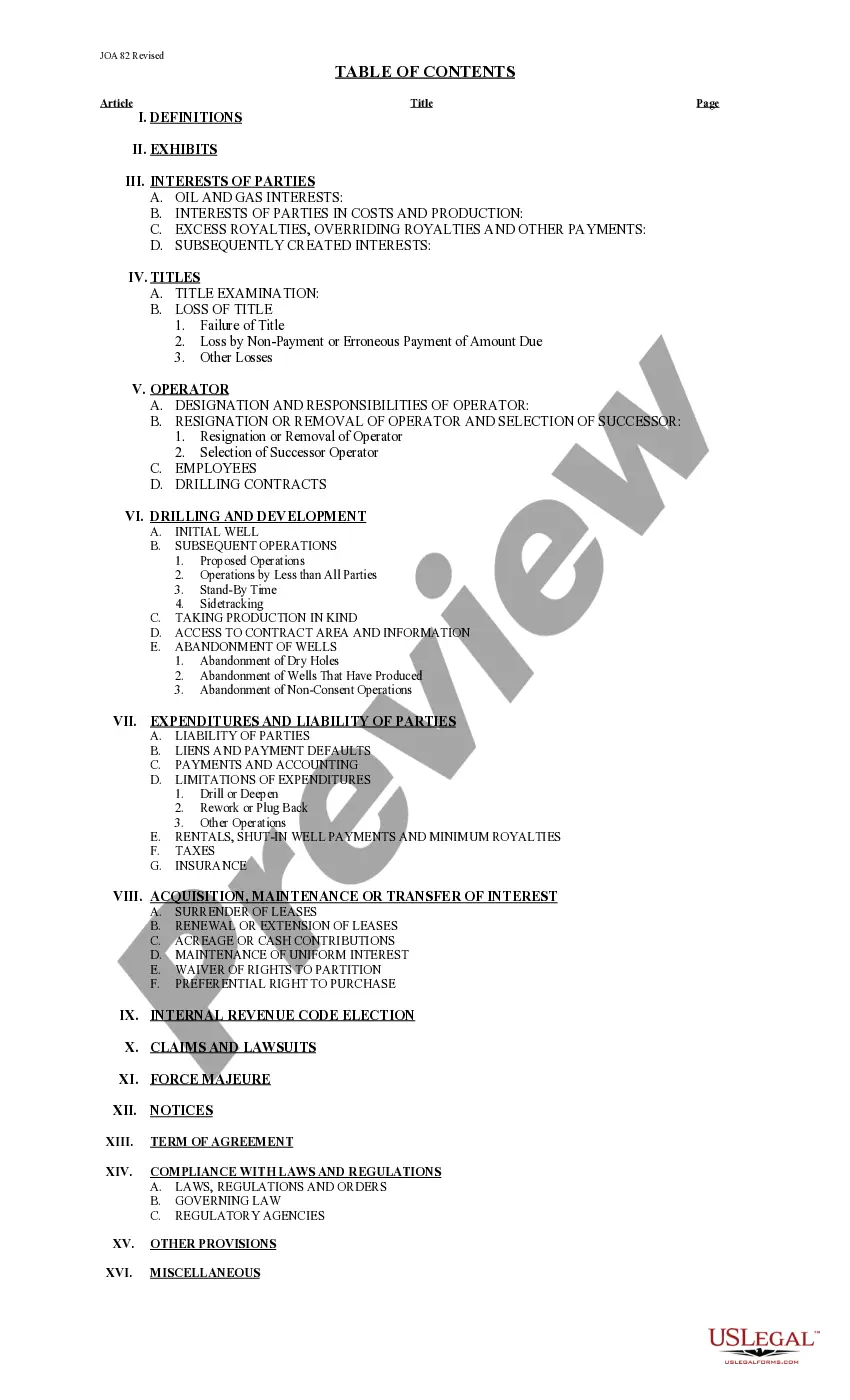

West Virginia Joint Operating Agreement 82 Revised

Description

How to fill out Joint Operating Agreement 82 Revised?

US Legal Forms - one of many biggest libraries of authorized types in America - delivers a wide array of authorized file layouts you are able to obtain or print out. Making use of the site, you will get 1000s of types for company and person functions, sorted by groups, states, or keywords.You can get the newest types of types just like the West Virginia Joint Operating Agreement 82 Revised within minutes.

If you currently have a monthly subscription, log in and obtain West Virginia Joint Operating Agreement 82 Revised in the US Legal Forms collection. The Acquire option can look on each and every develop you view. You have accessibility to all earlier acquired types within the My Forms tab of your respective account.

In order to use US Legal Forms the first time, listed here are simple directions to help you started out:

- Be sure you have chosen the proper develop for your town/state. Go through the Review option to review the form`s content. Look at the develop outline to ensure that you have chosen the proper develop.

- In the event the develop doesn`t satisfy your demands, make use of the Search field towards the top of the screen to find the the one that does.

- Should you be happy with the shape, validate your selection by clicking the Buy now option. Then, choose the rates plan you favor and give your accreditations to register on an account.

- Method the transaction. Use your credit card or PayPal account to perform the transaction.

- Select the structure and obtain the shape on your own product.

- Make modifications. Fill up, change and print out and signal the acquired West Virginia Joint Operating Agreement 82 Revised.

Every web template you added to your money lacks an expiry particular date and is your own property permanently. So, if you wish to obtain or print out one more duplicate, just proceed to the My Forms section and click on on the develop you want.

Get access to the West Virginia Joint Operating Agreement 82 Revised with US Legal Forms, one of the most extensive collection of authorized file layouts. Use 1000s of professional and state-certain layouts that meet up with your small business or person requirements and demands.

Form popularity

FAQ

Whether you have an offer on the table or not, you may have good reasons to sell your mineral rights: To pursue other opportunities. If you have a nonproducing property, you might have to wait years for anything to happen ? and nothing may ever happen, even after multiple leases.

Mineral interests in WV are taxed the same as your home. You will pay 60% of the appraised value on the minerals at the levy rate for your county.

Cons of Selling Your Mineral Rights Loss of Potential Future Income: When you sell your mineral rights, you also give up any potential future income from those rights. This can be a significant loss if the mineral rights end up producing more than expected or if there are new discoveries in the future.

For a mineral rights sale, the capital gain would be determined based on the proceeds from the sale minus the basis assigned to the mineral rights when you purchased the land or inherited the minerals. If the value was ?0?, then the entire sales proceeds would be taxed as capital gains income.

Are Mineral Rights and Royalties Taxable? Any income you earn from the sale or lease of your land's mineral rights is taxable. Income, severance and ad valorem taxes are some of the taxes you might need to pay. Each type comes from a different entity.

(b) Any person who unlawfully, willfully and intentionally destroys, injures or defaces the real or personal property of one or more other persons or entities during the same act, series of acts or course of conduct causing a loss in the value of the property in an amount of $2,500 or more, is guilty of the felony ...

In West Virginia, the governor can be elected for two consecutive four-year terms. The West Virginia governor has no term limits.

In many families, there's debate over the owners of mineral rights or surface rights. You can use the local authority website to find the general information in the state and county records.