West Virginia Specialty Services Contact - Self-Employed

Description

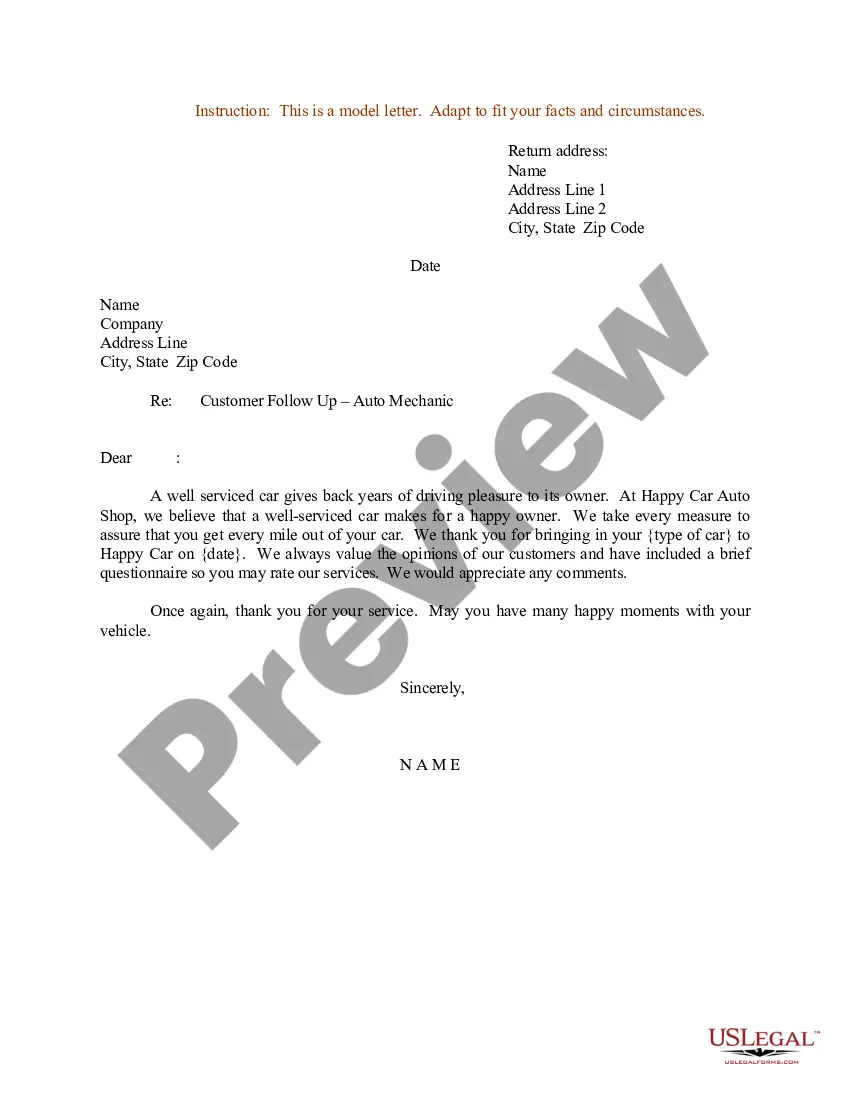

How to fill out Specialty Services Contact - Self-Employed?

You can spend hours online searching for the legal document template that meets the federal and state requirements you desire. US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can easily obtain or print the West Virginia Specialty Services Contact - Self-Employed from their service. If you already have a US Legal Forms account, you can Log In and click the Download button. After that, you can complete, modify, print, or sign the West Virginia Specialty Services Contact - Self-Employed.

Every legal document template you download is yours permanently. To acquire another copy of the downloaded form, navigate to the My documents tab and click the corresponding button.

Choose the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, modify, sign, and print the West Virginia Specialty Services Contact - Self-Employed. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/state of your choice. Review the form outline to confirm you have chosen the right template.

- If available, utilize the Preview button to view the document template as well.

- If you want to find another version of the form, use the Lookup field to find the template that matches your needs and criteria.

- Once you have found the template you want, click Purchase now to proceed.

- Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal document.

Form popularity

FAQ

Yes, West Virginia does require a business license for most self-employed individuals operating within the state. Obtaining a business license helps ensure compliance with local regulations and can protect your business interests. It is essential to check with your local government for specific requirements regarding licensing. For further assistance, consider using the US Legal Forms platform, which can guide you through the licensing process for your West Virginia Specialty Services Contact – Self-Employed.

A specialty contractor in West Virginia is an individual or business that specializes in a particular area of construction or trade. This can include electrical work, plumbing, roofing, and more. Understanding this classification is important for those interested in West Virginia Specialty Services Contact - Self-Employed, as it affects licensing and regulatory requirements. If you need more assistance or documentation, consider using uslegalforms to streamline your process.

To contact the West Virginia Secretary of State (WV SOS), visit their official website. You can find phone numbers and email addresses for various departments, making it easier to reach the right contact for your needs. They offer resources specifically for individuals seeking information on West Virginia Specialty Services Contact - Self-Employed. Alternatively, you can visit their office in person for direct assistance.

In West Virginia, you can usually perform minor projects without a contractor license, but there are specific limits based on the type of work. If your work exceeds certain financial thresholds or involves significant construction projects, licensing becomes necessary. Understanding these regulations can save you from potential legal issues. For expert assistance, getting in touch with our West Virginia Specialty Services Contact - Self-Employed can provide you with the clarity you need.

In West Virginia, many professional services are indeed subject to sales tax. This includes services provided by professionals in sectors like legal, accounting, and consulting. However, some specific exemptions may apply, making it crucial to understand the rules. By contacting our West Virginia Specialty Services Contact - Self-Employed, you can clarify your tax responsibilities and ensure you stay compliant.

Yes, West Virginia permits individuals to work as independent contractors. This arrangement provides flexibility in your work schedule and encourages entrepreneurship. However, it is essential to understand your responsibilities, such as tax obligations and contract management. For comprehensive guidance, remember to utilize our West Virginia Specialty Services Contact - Self-Employed.

The self-employment tax in West Virginia encompasses both Social Security and Medicare taxes, amounting to a total of 15.3%. This tax applies to your net earnings from self-employment. Keep in mind that estimating your taxes accurately can help you avoid surprise payments later. For personalized assistance, consider reaching out through our West Virginia Specialty Services Contact - Self-Employed to ensure compliance.