West Virginia Electrologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Electrologist Agreement - Self-Employed Independent Contractor?

Are you currently in a location where you need to possess documents for either professional or personal purposes almost all the time.

There are numerous valid document templates available online, but finding versions you can trust is challenging.

US Legal Forms offers a vast array of form templates, such as the West Virginia Electrologist Agreement - Self-Employed Independent Contractor, which can be filled out to meet federal and state requirements.

Once you obtain the correct form, click Get now.

Select the payment plan you wish, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card. Choose a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the West Virginia Electrologist Agreement - Self-Employed Independent Contractor anytime, if needed. Just select the desired form to download or print the document template. Utilize US Legal Forms, the largest selection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life simpler.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the West Virginia Electrologist Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

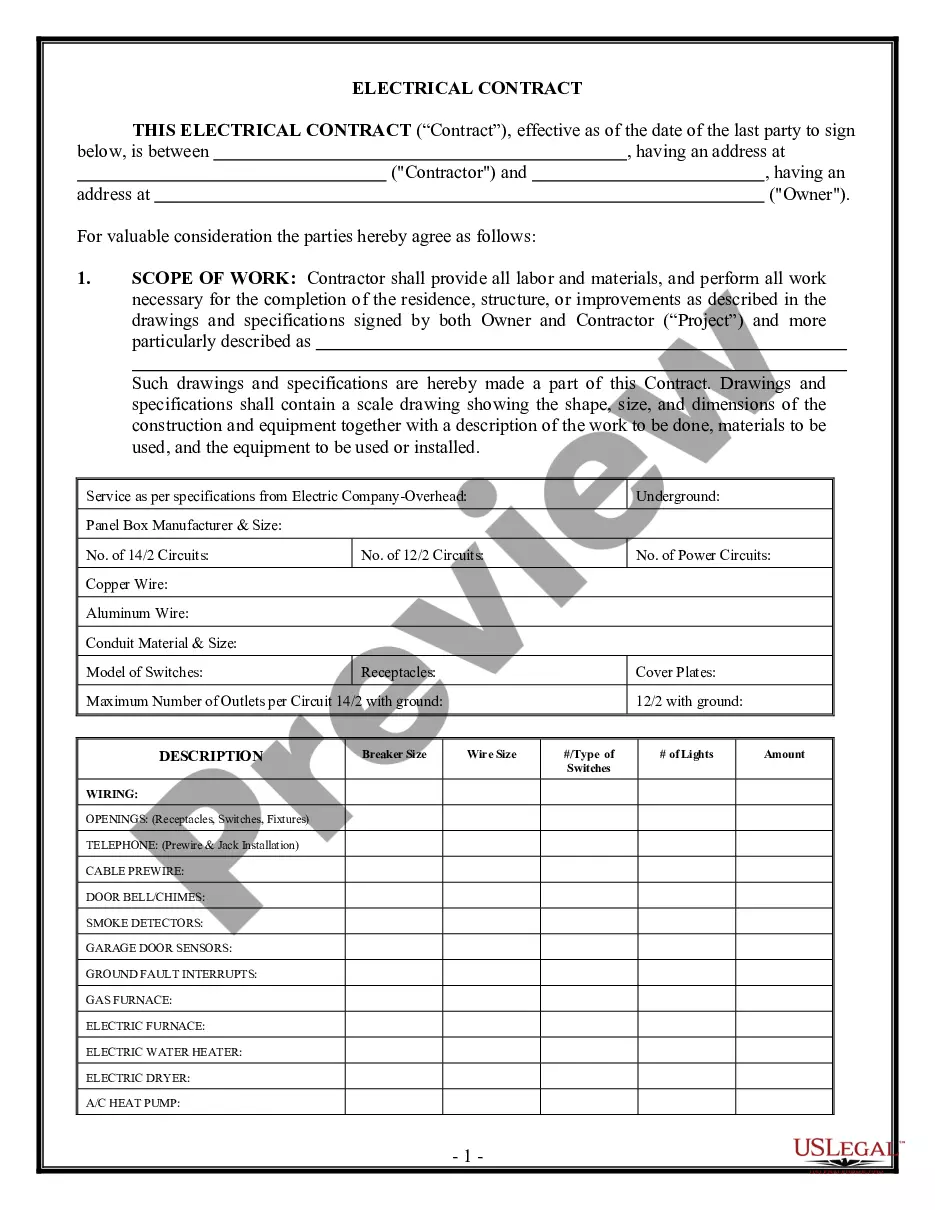

- Use the Preview option to review the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you’re looking for, utilize the Search field to find the form that meets your requirements.

Form popularity

FAQ

To fill out an independent contractor form effectively, start by entering your basic information, such as your name, contact details, and tax identification number. Be specific about the type of work you will perform and the compensation structure. Additionally, include any relevant clauses regarding confidentiality and liability. A well-completed form reflects professionalism and helps clarify expectations with the client.

Filling out a West Virginia Electrologist Agreement - Self-Employed Independent Contractor involves several important steps. Begin by including your personal information, such as your name and address, along with the client's details. Clearly outline the services to be provided, payment terms, and the duration of the agreement. Ensuring all necessary details are accurate will help protect both you and the client.

To prove you are an independent contractor, you need to demonstrate control over your work and establish a separate business identity. This can include providing various documents, such as contracts, invoices, and tax forms that outline your role. Using a West Virginia Electrologist Agreement - Self-Employed Independent Contractor can help you formalize your status. By having a clear agreement, you clarify your responsibilities and rights, allowing you to confidently showcase your independent contractor status.

To create a West Virginia Electrologist Agreement - Self-Employed Independent Contractor, start by clearly outlining the scope of work and responsibilities for both parties. Include details on payment terms, work hours, and the duration of the agreement. It is also important to define confidentiality and non-compete clauses to protect your business interests. Consider using a reliable platform like US Legal Forms to ensure that your agreement complies with legal requirements and addresses key concerns.

Yes, West Virginia allows independent contractors, giving you the flexibility to work on your terms. Independent contractor status comes with specific obligations, such as tax responsibilities and compliance with labor laws. By drafting a solid West Virginia Electrologist Agreement - Self-Employed Independent Contractor, you can clarify your working conditions and protect your interests. Platforms like US Legal Forms can assist you in creating a compliant and personalized agreement.

Legal requirements for independent contractors often depend on state laws and the nature of the work. Generally, the agreement should outline the scope of work, payment details, and liability clauses. In West Virginia, it is crucial to establish clear terms in your West Virginia Electrologist Agreement - Self-Employed Independent Contractor to comply with local regulations. Consulting legal resources or platforms like US Legal Forms can help ensure your agreement fulfills all legal requirements.

To write an independent contractor agreement, start by clearly stating the roles and responsibilities of both parties. Include important details such as payment terms, project milestones, and the duration of the agreement. You can streamline this process by using platforms like US Legal Forms, which offer templates specifically for a West Virginia Electrologist Agreement - Self-Employed Independent Contractor. This ensures your agreement meets local legal standards and covers all necessary aspects.