West Virginia Farm Hand Services Contract - Self-Employed

Description

How to fill out Farm Hand Services Contract - Self-Employed?

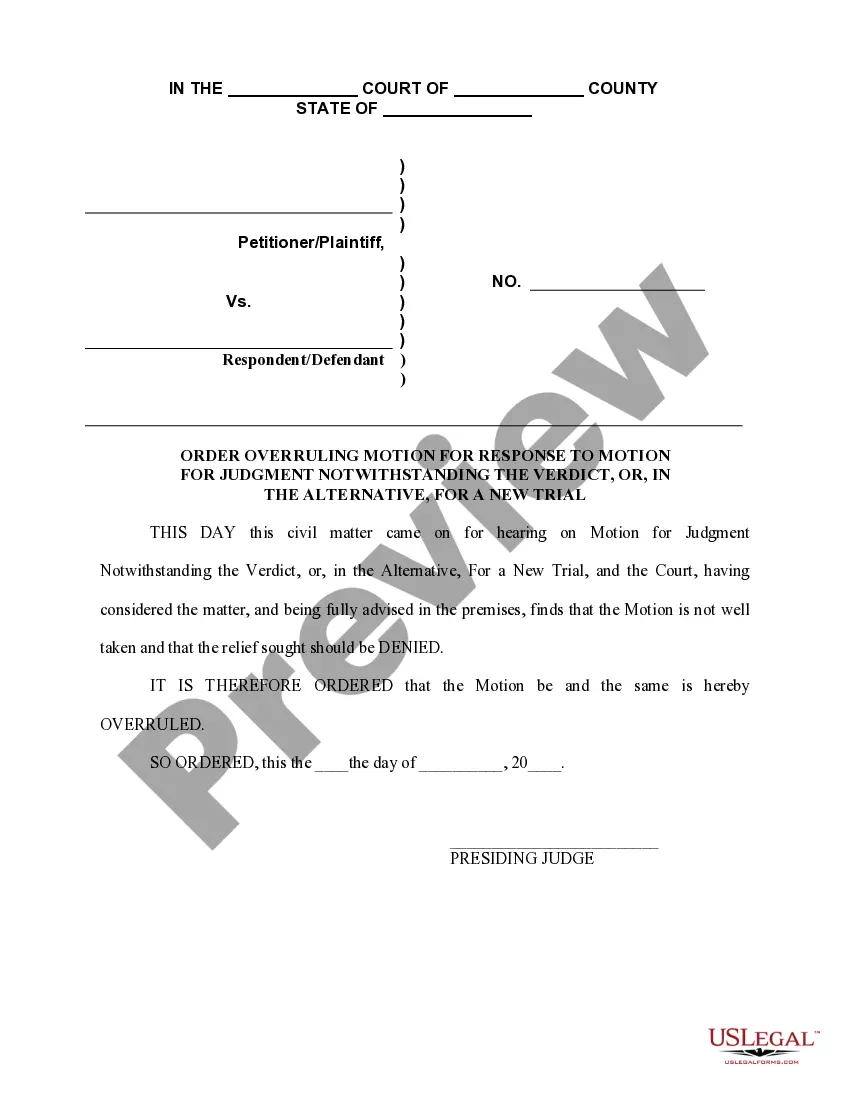

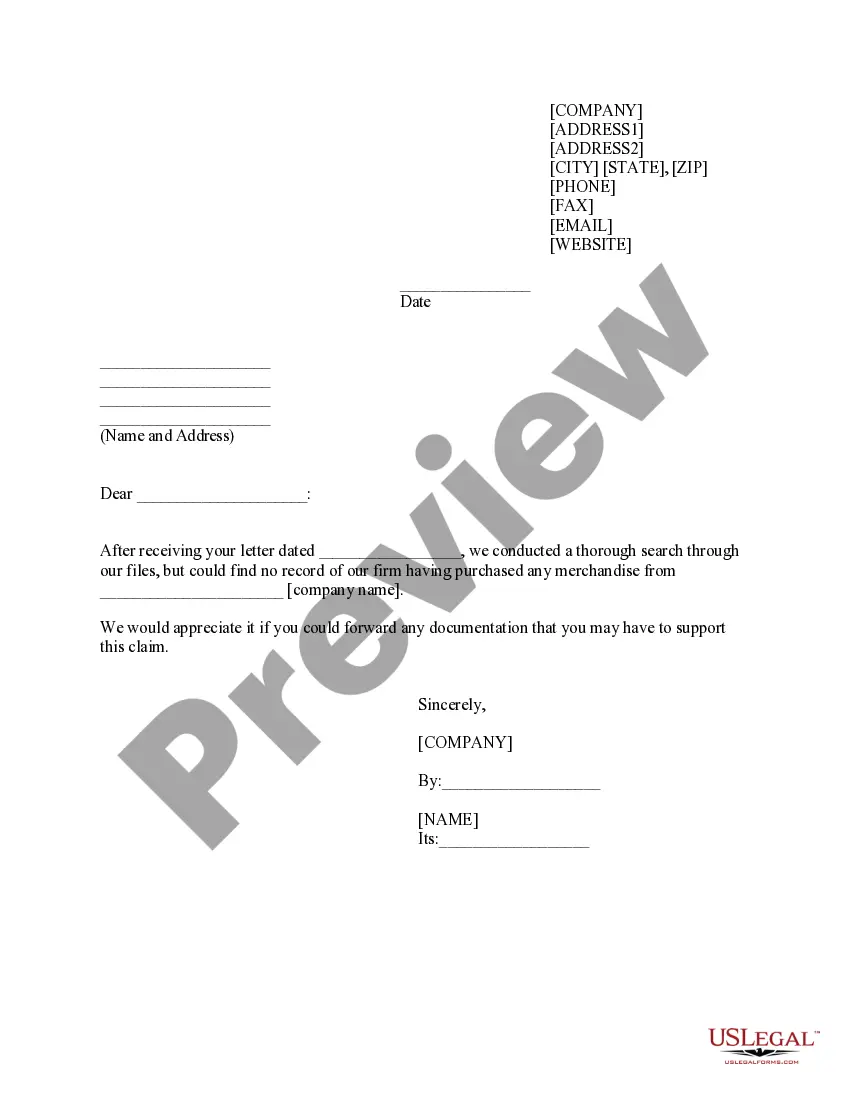

Have you found yourself in a scenario where you frequently need to have documents for potential organization or particular purposes? There are numerous authentic document templates available online, but locating ones you can trust isn't easy. US Legal Forms provides thousands of form templates, such as the West Virginia Farm Hand Services Agreement - Self-Employed, designed to meet state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the West Virginia Farm Hand Services Agreement - Self-Employed template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Obtain the form you need and ensure it is for the correct region/county. Use the Review button to examine the form. Check the summary to ensure you have selected the appropriate document. If the form isn’t what you are looking for, use the Search feature to find the form that meets your needs. If you have found the correct form, click Purchase now. Choose the payment plan you prefer, fill in the necessary details to create your account, and complete the order using your PayPal or credit card. Select a suitable file format and download your copy.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- Locate all the document templates you have purchased in the My documents section.

- You can obtain an additional copy of the West Virginia Farm Hand Services Agreement - Self-Employed at any time if needed.

- Click on the desired form to download or print the document template.

- Utilize US Legal Forms, the largest selection of legal documents, to save time and prevent errors.

- The service offers professionally crafted legal document templates that can be used for a variety of purposes.

- Create an account on US Legal Forms and start simplifying your life.

Form popularity

FAQ

Yes, if you plan to operate as an independent contractor in West Virginia, you should register your business. This step ensures compliance with state regulations and allows you to protect your brand. Use the West Virginia Farm Hand Services Contract - Self-Employed to demonstrate your legitimacy, especially if you plan to work with farms and landowners. Being properly registered builds trust and credibility in your professional relationships.

To establish yourself as an independent contractor in West Virginia, start by understanding your business model and defining your services. Create a clear contract that outlines your terms of work, which is crucial when dealing with clients. Utilize the West Virginia Farm Hand Services Contract - Self-Employed to formalize your arrangements. This contract will help protect your rights and set clear expectations with your clients.

To fill out a W9 as a freelancer, start by writing your legal name and any business name you operate under. Then, provide your complete address and relevant taxpayer identification number. This process is crucial for anyone looking to establish a clear professional relationship while entering a West Virginia Farm Hand Services Contract - Self-Employed.

As a freelancer, filling out a W-9 form involves entering your name, business name, and contact information accurately. Choose the correct tax classification, ensuring it reflects your freelance status. By doing this correctly, you protect yourself while engaging in a West Virginia Farm Hand Services Contract - Self-Employed, as it allows clients to report payments properly.

When filling out a W9 as an independent contractor, enter your name and business name if applicable, followed by your address. It’s important to select the right tax classification that reflects your business structure. Be sure to provide your taxpayer identification number precisely, as this information will be used for tax reporting related to any West Virginia Farm Hand Services Contract - Self-Employed.

As an independent contractor, you fill out a 1099 form by providing your taxpayer identification number and the amount earned during the tax year. Ensure to report the correct income under the appropriate boxes. This form is vital for anyone engaged in a West Virginia Farm Hand Services Contract - Self-Employed, as it helps to track your earnings accurately.

To properly fill out a W9 form, start by providing your name and business name if applicable. Next, select your business type, and include your address, city, state, and zip code. For independent contractors, make sure to enter your taxpayer identification number. Completing the W9 accurately is essential for any West Virginia Farm Hand Services Contract - Self-Employed.

The farm use exemption in West Virginia allows certain property used for agricultural purposes to be exempt from property taxes. This exemption typically applies to land, equipment, and supplies directly related to farming activities. If you are considering a West Virginia Farm Hand Services Contract - Self-Employed, understanding this exemption can benefit your financial planning.

Yes, contract workers are generally considered self-employed since they provide services on a contractual basis rather than as traditional employees. This status allows them flexibility and autonomy in managing their work. When drafting a West Virginia Farm Hand Services Contract - Self-Employed, it is important to outline the terms clearly, ensuring that both parties understand their rights and obligations within this framework.

West Virginia has specific laws governing farm use, which provide guidelines and protections for agricultural activities. These laws include provisions related to land use, property taxes, and zoning regulations. When creating a West Virginia Farm Hand Services Contract - Self-Employed, it is crucial to be aware of these laws to ensure compliance and protect your rights as a service provider.