West Virginia Auctioneer Services Contract - Self-Employed Independent Contractor

Description

How to fill out Auctioneer Services Contract - Self-Employed Independent Contractor?

You might dedicate numerous hours online trying to locate the legal documents template that aligns with the state and federal requirements you have.

US Legal Forms offers a vast selection of legal documents that are evaluated by professionals.

You can download or print the West Virginia Auctioneer Services Contract - Self-Employed Independent Contractor from the service.

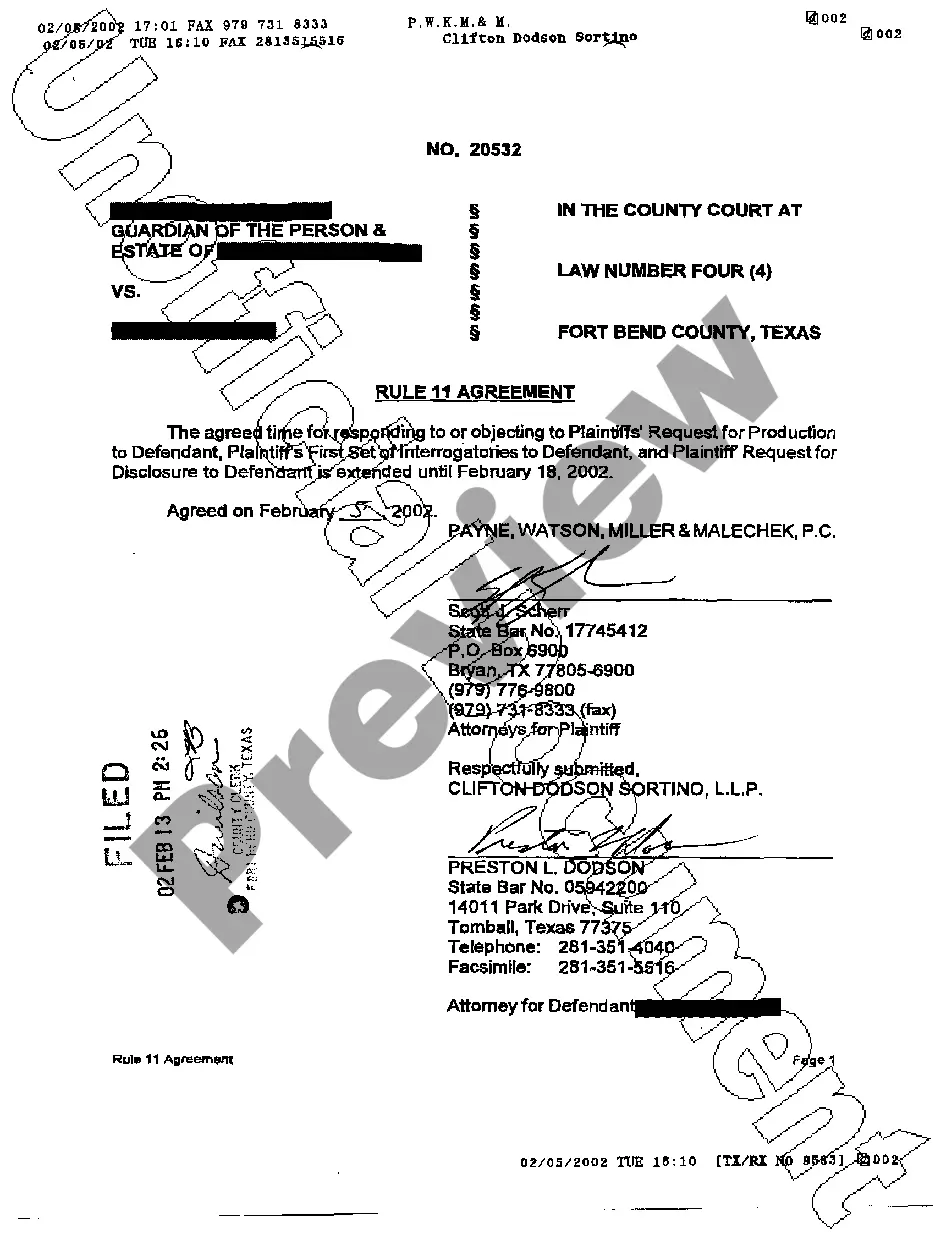

If available, utilize the Preview option to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download option.

- After that, you may complete, edit, print, or sign the West Virginia Auctioneer Services Contract - Self-Employed Independent Contractor.

- Every legal document template you acquire is your property indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and click the appropriate option.

- If you are using the US Legal Forms website for the first time, adhere to the straightforward instructions below.

- Initially, ensure that you have selected the correct document template for the region/town of your choice.

- Review the document description to verify you have selected the proper form.

Form popularity

FAQ

Writing an independent contractor agreement for the West Virginia Auctioneer Services Contract - Self-Employed Independent Contractor involves several key steps. Start by outlining the scope of work, payment terms, and duration of the contract. Additionally, ensure to include clauses that cover confidentiality, termination, and any required compliance with local regulations. Platforms like UsLegalForms can provide templates and guidance to streamline the process and help you create a solid, legally-binding agreement.

When discussing the West Virginia Auctioneer Services Contract - Self-Employed Independent Contractor, it's essential to understand that both terms are often used interchangeably. However, 'independent contractor' typically reflects a specific legal distinction, especially in contracts and tax matters. In this context, using 'independent contractor' may provide clearer legal meaning in agreements. Consider the implications in your West Virginia Auctioneer Services Contract to ensure accuracy and compliance.

Creating an independent contractor contract involves outlining key elements such as the scope of work, payment terms, and deadlines. It’s important to include clauses that protect both parties, such as confidentiality and termination conditions. A West Virginia Auctioneer Services Contract - Self-Employed Independent Contractor can be a useful resource, offering templates that guide you in structuring your agreement professionally, ensuring all legal aspects are covered.

To become an independent contractor, you typically need to register your business and acquire any necessary licenses specific to your field. In West Virginia, auctioneer services require a state license, which ensures that you meet regulations. Using a West Virginia Auctioneer Services Contract - Self-Employed Independent Contractor can standardize this process by detailing the requirements and responsibilities, giving you a clear pathway to start your business.

When an agent works as an independent contractor, it signifies that they operate under their own business authority rather than as an employee of a company. This independence allows them to control their work schedule and methods, which can be beneficial for someone looking for flexibility. In terms of agreements, a West Virginia Auctioneer Services Contract - Self-Employed Independent Contractor outlines the terms of engagement between the agent and the client, ensuring clarity in the relationship.

Filling out the West Virginia Auctioneer Services Contract - Self-Employed Independent Contractor involves several key steps. First, ensure you provide accurate personal information, including your business name and contact details. Next, specify the services offered, payment terms, and any other conditions pertinent to your role. If you find this process overwhelming, US Legal Forms offers guidance and templates that can help simplify the procedure.

For self-employed individuals in West Virginia, the primary form needed is the West Virginia Auctioneer Services Contract - Self-Employed Independent Contractor. This contract outlines the terms of the service agreement, ensuring clarity between the contractor and the client. Filling out this form correctly protects both parties and establishes a clear working relationship. You can find this form through various legal platforms, including US Legal Forms, which provide easy access to necessary documents.

In West Virginia, the amount of work you can perform without a contractor's license varies based on the type of services provided. For most independent contracting roles, such as those covered under a West Virginia Auctioneer Services Contract - Self-Employed Independent Contractor, there may be limits on the project size or total compensation before licensing becomes necessary. It is advisable to check local laws or consult with legal services to ensure compliance.

To be authorized as an independent contractor in the U.S., you typically need to register your business and obtain any necessary licenses specific to your profession. For those focusing on West Virginia Auctioneer Services Contract - Self-Employed Independent Contractor roles, familiarize yourself with state regulations and ensure you meet all requirements. This may include tax registrations and insurance to protect both you and your clients.

Yes, businesses and individuals can hire independent contractors in West Virginia. This practice allows for flexibility and often helps in completing specific projects without the commitment of full-time employment. If you're considering entering into a West Virginia Auctioneer Services Contract - Self-Employed Independent Contractor, there are many qualified professionals ready to assist you.