West Virginia Guaranty of Payment of Open Account

Description

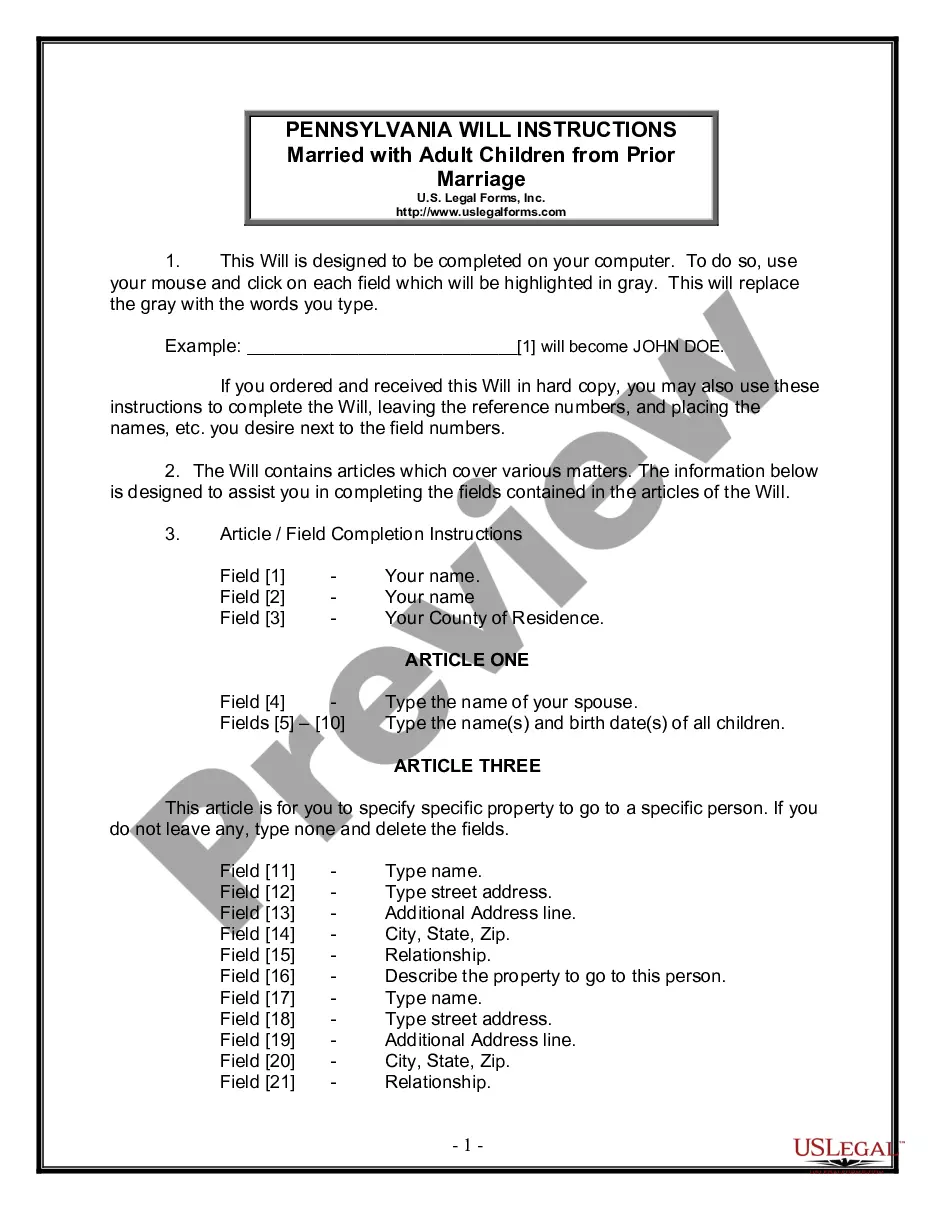

How to fill out Guaranty Of Payment Of Open Account?

Are you in a situation where you frequently require documents for various business or specific purposes? There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, such as the West Virginia Guaranty of Payment of Open Account, that are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Afterward, you can download the West Virginia Guaranty of Payment of Open Account template.

Find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the West Virginia Guaranty of Payment of Open Account at any time if needed. Just click on the relevant form to download or print the document format.

Use US Legal Forms, which has one of the largest selections of legal documents, to save time and avoid errors. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- Obtain the form you need and ensure it is for the correct area/region.

- Utilize the Review button to inspect the form.

- Read the description to confirm that you have selected the appropriate form.

- If the form is not what you're looking for, make use of the Search area to find the form that meets your requirements.

- Once you find the correct form, click on Get now.

- Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- Choose a convenient document format and download your version.

Form popularity

FAQ

The Guaranty Association in West Virginia receives its funds primarily through the contributions of member insurance companies. These companies contribute to a collective fund that supports policyholders with guaranteed benefits. This funding can also help with claims related to the West Virginia Guaranty of Payment of Open Account, ensuring that consumers are protected. By understanding how these funds work, you can better navigate your rights and protections.

In West Virginia, the dormancy period for unclaimed property is typically five years. This means if you have not made a transaction or shown any interest in your property, it may be considered unclaimed after this time. It is important to keep track of your accounts, as the West Virginia Guaranty of Payment of Open Account may apply to facilitate claims on unclaimed funds. By staying informed about your properties, you can avoid unexpected complications.

The West Virginia insurance guaranty act establishes a framework for protecting policyholders in situations where an insurance company fails. It ensures that claims are honored, maintaining confidence in the insurance sector. This act is particularly significant for the West Virginia Guaranty of Payment of Open Account, as it reinforces the reliability of insurance dealings. Understanding this act allows businesses to navigate financial uncertainties more effectively.

Guarantee insurance functions by providing a safety net for parties involved in a financial agreement, such as open accounts. When a debtor defaults, the guaranty insurance steps in to cover the unpaid amounts, relieving financial burdens. In the context of the West Virginia Guaranty of Payment of Open Account, it effectively eliminates risks that could hinder business operations. This not only protects individual stakeholders but also fosters stronger relationships between businesses.

To obtain a financial power of attorney in West Virginia, you need to draft a document that grants authority to someone to manage your financial matters. It's essential to clearly outline the powers you wish to grant, ensuring they align with the West Virginia Guaranty of Payment of Open Account to protect your financial interests. Once drafted, both you and the chosen agent must sign the document, usually in front of a notary. For convenience and accuracy, you may consider using a reliable platform like USLegalForms to assist with this process.

Guaranty insurance serves to protect creditors against losses that may arise from a debtor's failure to settle open accounts. Essentially, it builds financial security for businesses, ensuring they can recover outstanding debts. When it comes to the West Virginia Guaranty of Payment of Open Account, this type of insurance is especially crucial for fostering economic growth by minimizing risks. It creates an environment where businesses can operate confidently.

The West Virginia insurance guaranty association protects policyholders by ensuring that they receive benefits if an insurance company becomes insolvent. This association works to uphold the financial stability of the insurance market. By safeguarding open accounts, the West Virginia Guaranty of Payment of Open Account provides peace of mind to businesses and individuals alike. Ultimately, it plays a vital role in maintaining trust within the insurance industry.

To enforce a guaranty effectively, one should follow specific legal steps, starting with reviewing the terms outlined in the agreement. In the context of the West Virginia Guaranty of Payment of Open Account, it is essential to document all interactions and payments meticulously. Depending on the circumstances, you may need to involve a legal professional to represent your interests. Utilizing platforms like USLegalForms can help simplify the enforcement process by providing necessary legal documents and guidance tailored to your situation.

The West Virginia Life and Health Insurance Guaranty Association offers crucial protection to policyholders in the event of an insurance company’s failure. This organization ensures that individuals continue to receive benefits, covering various types of policies, including life and health insurance. When it comes to the West Virginia Guaranty of Payment of Open Account, this association plays a vital role in maintaining financial stability for consumers. By providing this support, they help assure policyholders that their claims will be honored even during troubling times.