West Virginia Sample Identity Theft Policy for FCRA and FACTA Compliance

Description

How to fill out Sample Identity Theft Policy For FCRA And FACTA Compliance?

It is possible to invest hours on the web searching for the legitimate papers web template that meets the federal and state requirements you require. US Legal Forms supplies a large number of legitimate forms that are analyzed by pros. You can actually acquire or produce the West Virginia Sample Identity Theft Policy for FCRA and FACTA Compliance from the support.

If you have a US Legal Forms account, you can log in and click the Obtain switch. After that, you can complete, edit, produce, or sign the West Virginia Sample Identity Theft Policy for FCRA and FACTA Compliance. Every single legitimate papers web template you acquire is yours forever. To have another backup of the obtained develop, check out the My Forms tab and click the related switch.

If you are using the US Legal Forms web site initially, adhere to the straightforward recommendations below:

- First, make sure that you have chosen the right papers web template to the state/town of your liking. See the develop information to ensure you have picked out the appropriate develop. If available, use the Preview switch to search throughout the papers web template also.

- If you would like locate another model in the develop, use the Lookup discipline to obtain the web template that fits your needs and requirements.

- Once you have identified the web template you would like, click Purchase now to carry on.

- Select the pricing strategy you would like, key in your credentials, and register for a merchant account on US Legal Forms.

- Comprehensive the transaction. You may use your bank card or PayPal account to pay for the legitimate develop.

- Select the file format in the papers and acquire it to the device.

- Make modifications to the papers if required. It is possible to complete, edit and sign and produce West Virginia Sample Identity Theft Policy for FCRA and FACTA Compliance.

Obtain and produce a large number of papers themes making use of the US Legal Forms website, that provides the most important variety of legitimate forms. Use specialist and state-particular themes to handle your small business or specific requirements.

Form popularity

FAQ

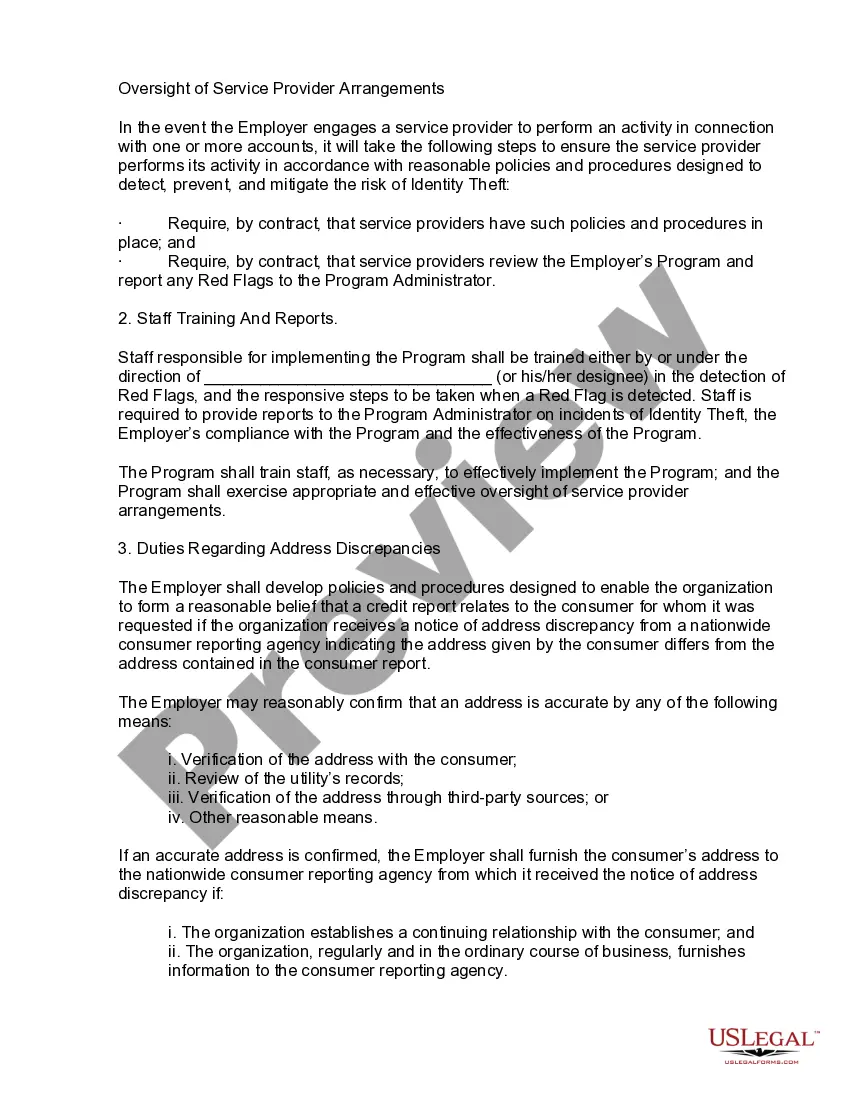

The Red Flags Rule calls for financial institutions and creditors to implement red flags to detect and prevent against identity theft. Institutions are required to have a written identity theft prevention program (ITPP) to govern their organization and protect their consumers.

Any person who knowingly takes the name, birth date, social security number, or other identifying information of another person, without the consent of that other person, with the intent to fraudulently represent that he or she is the other person for the purpose of making financial or credit transactions in the other ...

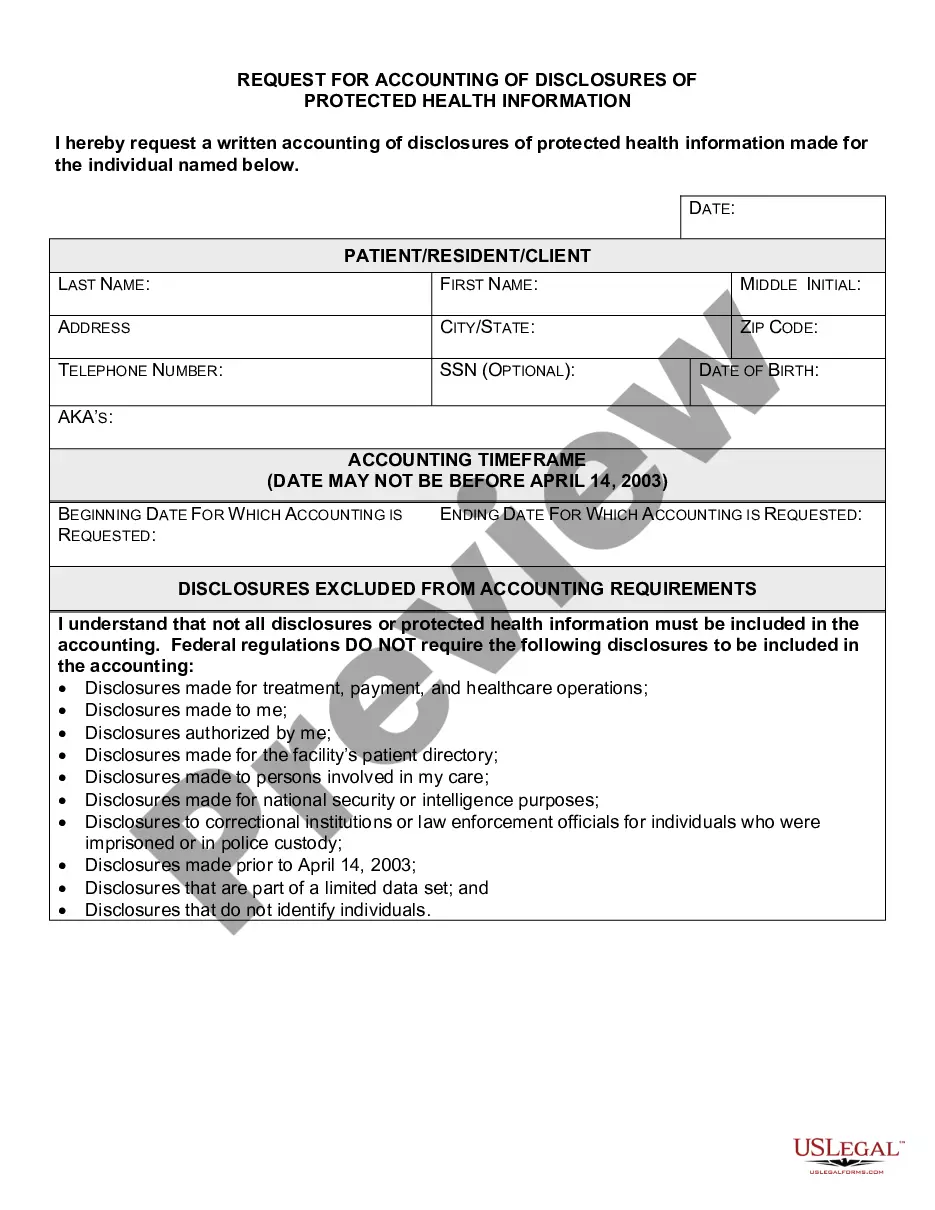

The Fair Credit Reporting Act (FCRA) spells out rights for victims of identity theft, as well as responsibilities for businesses. Identity theft victims are entitled to ask businesses for a copy of transaction records ? such as applications for credit ? relating to the theft of their identity.

The identity theft red flags rule requires a financial institution to periodically determine whether it offers or maintains accounts covered by the regulation. A covered account generally is a consumer account or any other account the institution determines carries a foreseeable risk of identity theft.

Most Frequent Violations of the Fair Credit Reporting Act Reporting outdated information. Reporting false information. Accidentally mixing your files with another consumer. Failure to notify a creditor about a debt dispute. Failure to correct false information.

To file an identity theft report with the FTC: Step 1: Visit the FTC's Identity Theft Portal. Step 2: Complete the FTC Identity Theft Report. Step 3: Access a Recovery Plan. Step 4: Call the FTC to File a Report. Step 1: Obtain a Copy of Your FTC Identity Theft Report. Step 2: Provide a Photo ID. Step 3: Provide Your Address.

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

Proof of your address (mortgage statement, rental agreement, or utilities bill) Any other proof you have of the theft?bills, Internal Revenue Service (IRS) notices, etc.