West Virginia Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Summary Of Terms Of Proposed Private Placement Offering?

US Legal Forms - one of the biggest libraries of legitimate forms in the States - offers a wide range of legitimate document layouts you can obtain or print out. Using the internet site, you may get 1000s of forms for business and individual purposes, sorted by classes, states, or keywords and phrases.You will discover the most up-to-date models of forms much like the West Virginia Summary of Terms of Proposed Private Placement Offering in seconds.

If you have a membership, log in and obtain West Virginia Summary of Terms of Proposed Private Placement Offering from the US Legal Forms catalogue. The Download option can look on every develop you look at. You get access to all formerly delivered electronically forms in the My Forms tab of your accounts.

If you would like use US Legal Forms the very first time, allow me to share straightforward recommendations to get you started:

- Make sure you have selected the right develop for your city/area. Go through the Preview option to review the form`s content. Browse the develop description to actually have selected the right develop.

- In the event the develop does not suit your specifications, use the Look for discipline on top of the screen to get the one that does.

- Should you be content with the form, verify your decision by visiting the Acquire now option. Then, pick the rates prepare you favor and give your credentials to sign up to have an accounts.

- Procedure the transaction. Make use of bank card or PayPal accounts to perform the transaction.

- Find the structure and obtain the form on the gadget.

- Make modifications. Fill up, edit and print out and indicator the delivered electronically West Virginia Summary of Terms of Proposed Private Placement Offering.

Every design you put into your bank account does not have an expiry day and is your own eternally. So, if you would like obtain or print out one more duplicate, just go to the My Forms area and then click on the develop you require.

Obtain access to the West Virginia Summary of Terms of Proposed Private Placement Offering with US Legal Forms, one of the most substantial catalogue of legitimate document layouts. Use 1000s of expert and express-certain layouts that meet your company or individual needs and specifications.

Form popularity

FAQ

A private placement is a security that's sold to an investor. Some common examples of private placements include: Real Estate Investment Trusts (REITs) Non-Traded REITs.

Executive Summary An overarching goal in this section of the private placement is to give investors an overview of the transaction, the high level structure of the investment and details on the market and opportunities.

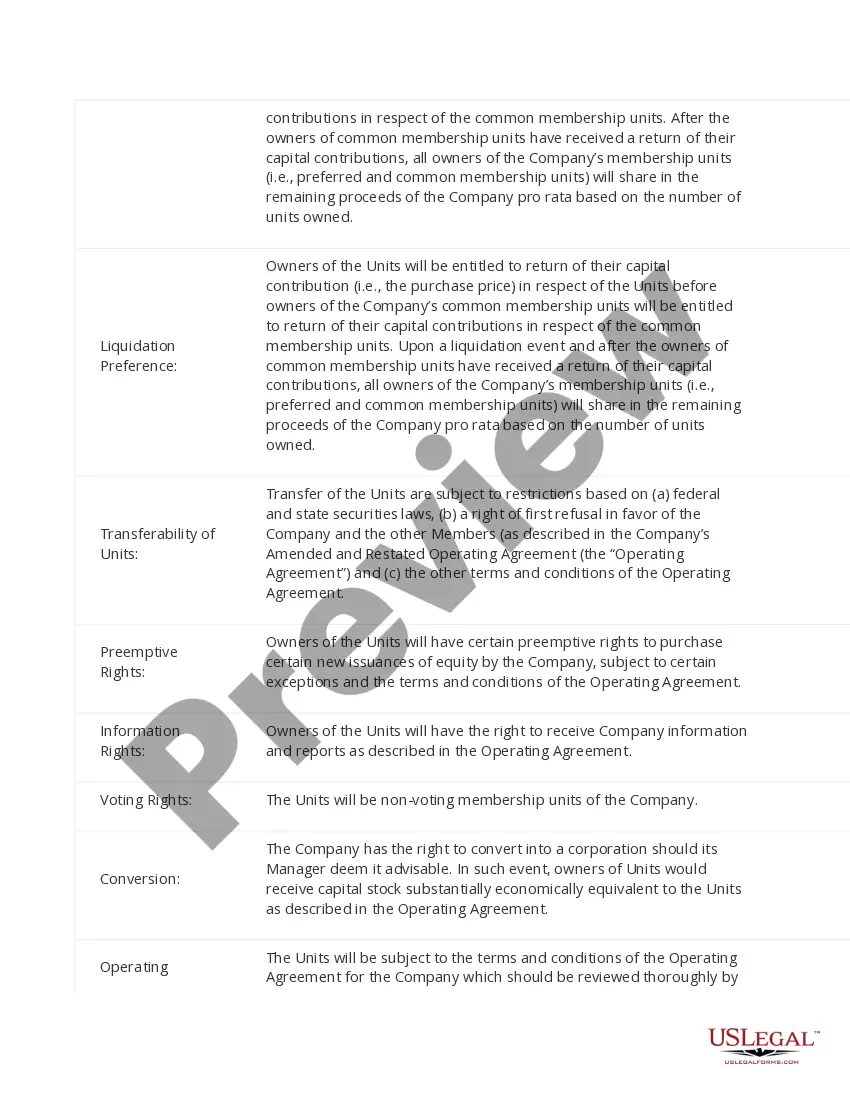

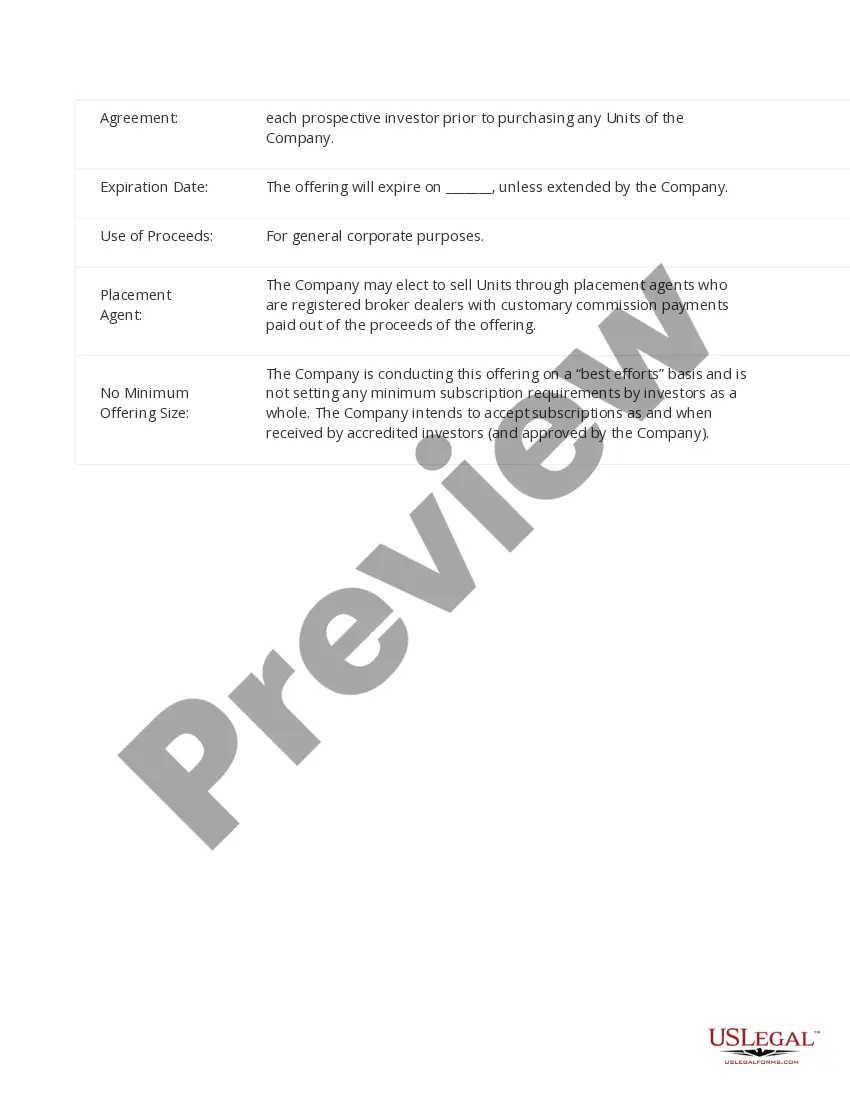

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

A Private Placement Memorandum (PPM) is a securities disclosure document used by a company (issuer) that is engaged in a private offering of securities. A PPM serves as a single, comprehensive document outlining the material details about the offering.

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than publicly on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.

A Private Placement Memorandum (PPM) is a securities disclosure document used by a company (issuer) that is engaged in a private offering of securities. A PPM serves as a single, comprehensive document outlining the material details about the offering.

??? ????????? ??????? ?? ? ?????? ?? ??? ????????? ???? ?????????? ??? ??? ??? ?????? ??? ????? ???????? ???????. ??? ????????? ??????? ?????? ?? ??????? ?? ?????? ?????????.

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than publicly on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.