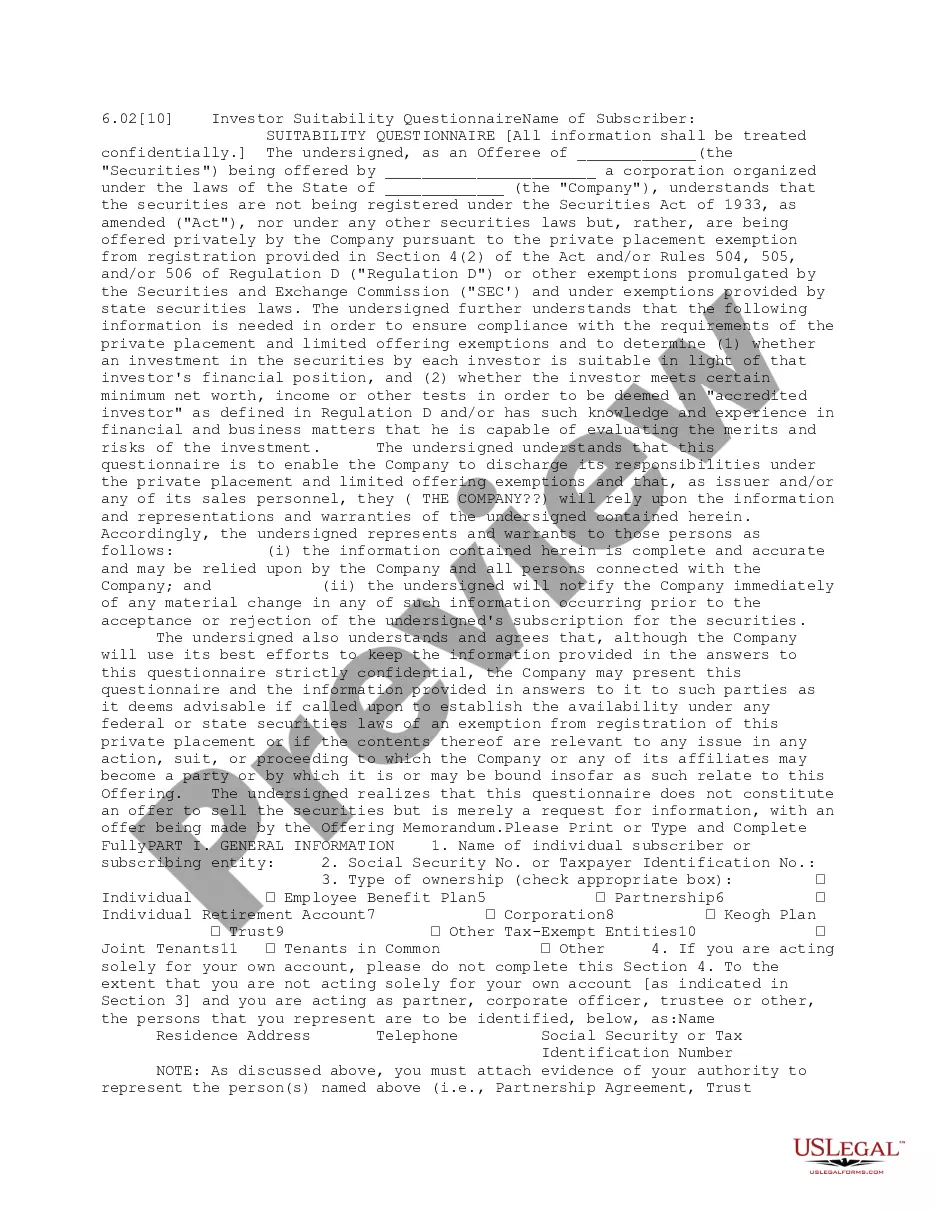

West Virginia Accredited Investor Suitability

Description

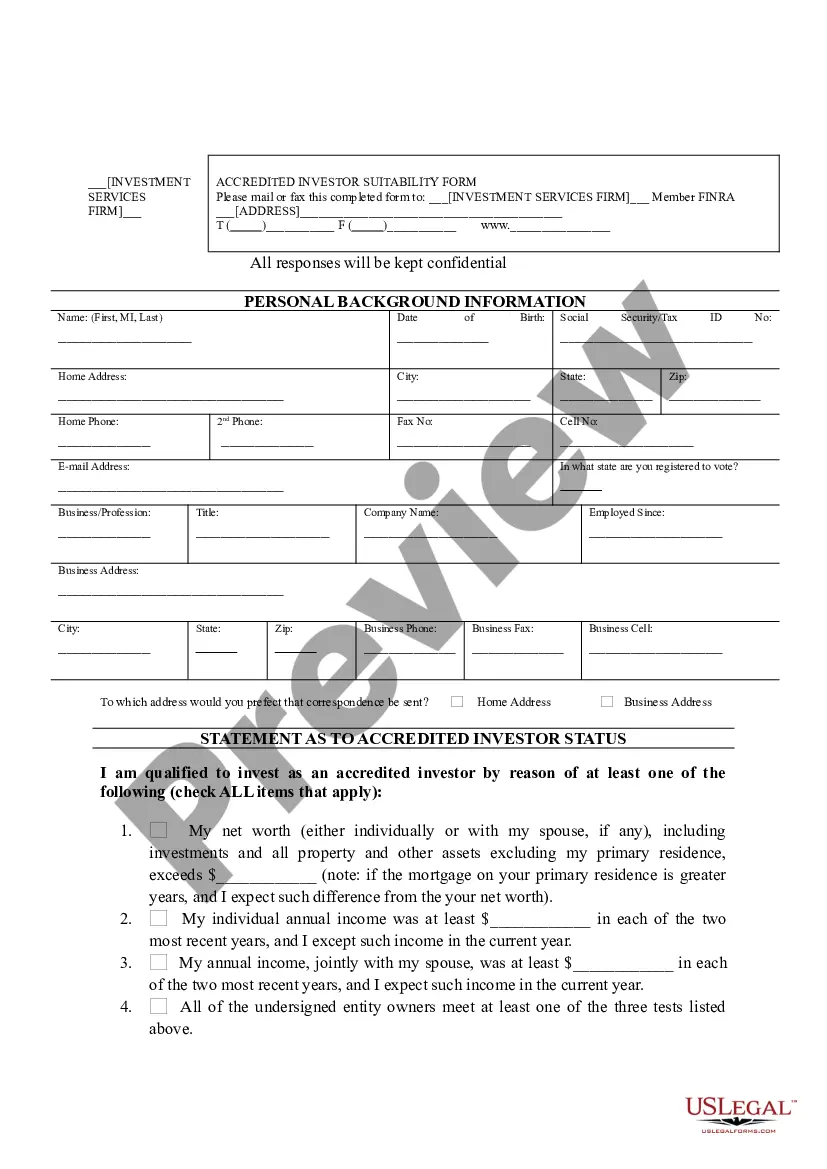

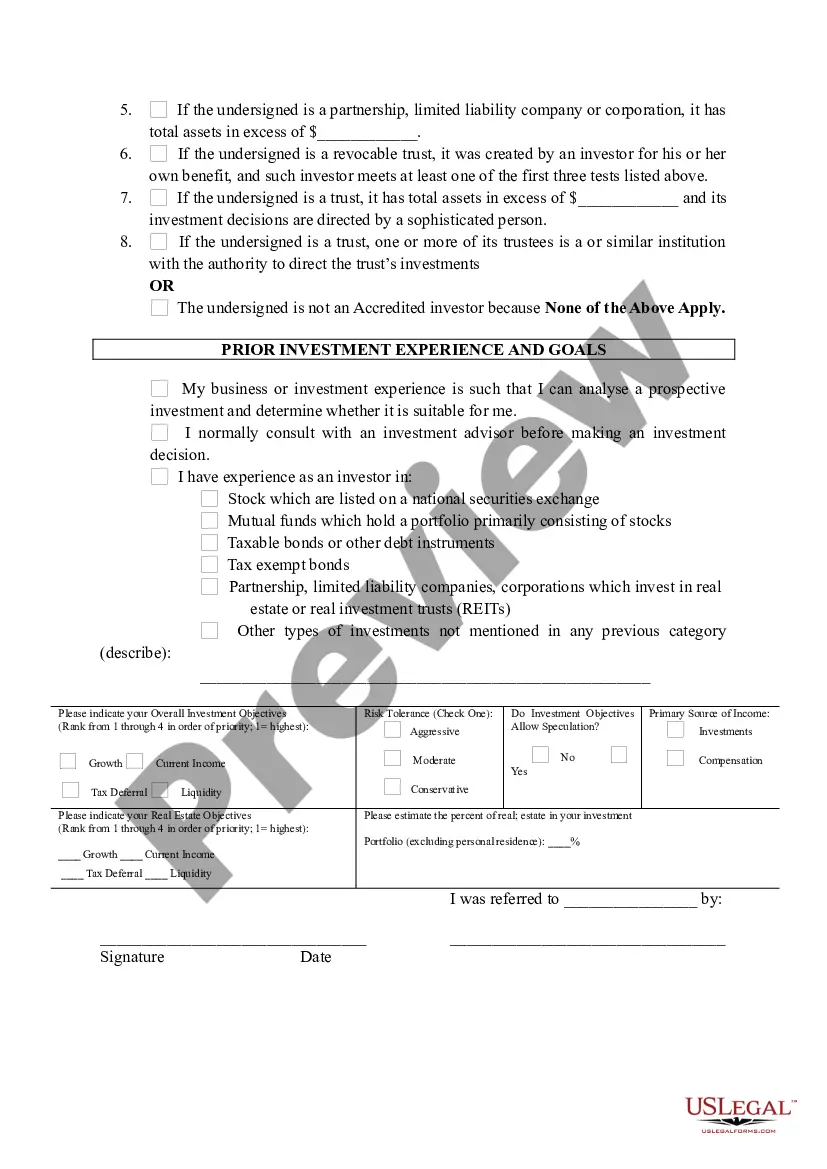

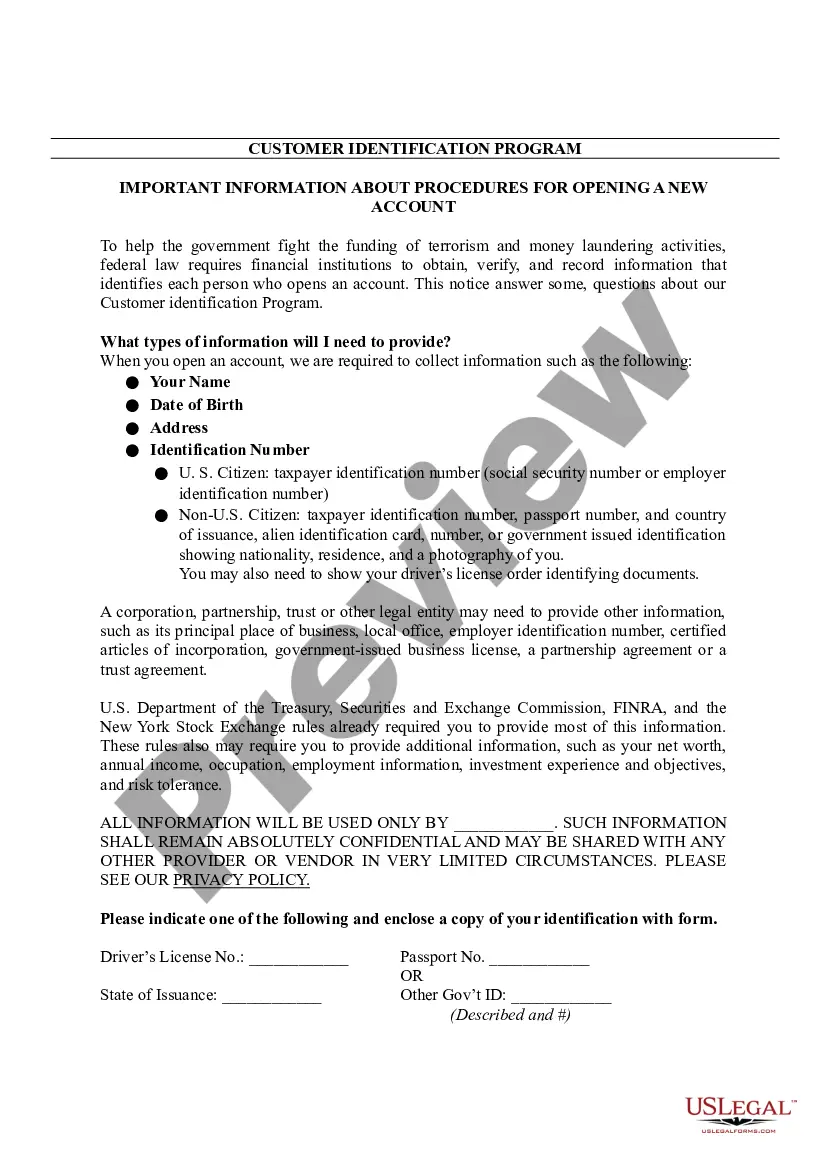

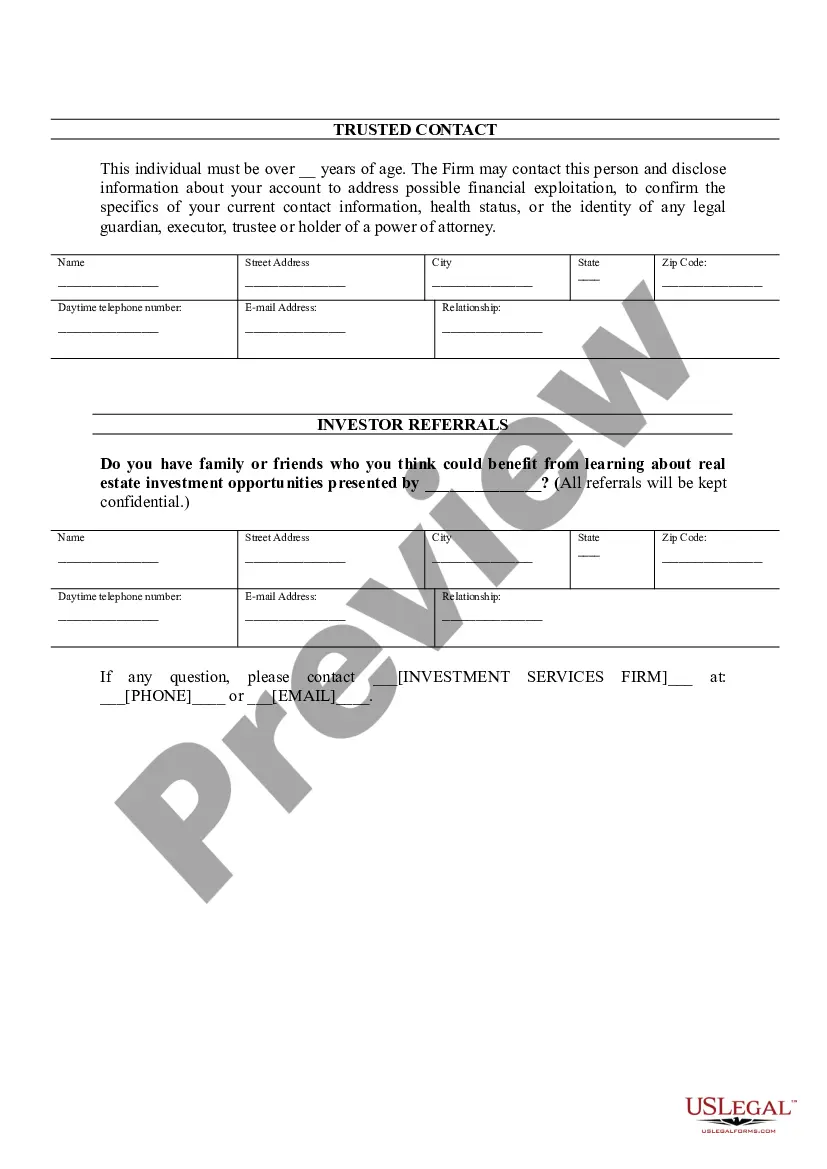

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Suitability?

Choosing the right legitimate file format can be quite a battle. Naturally, there are a variety of templates available on the net, but how can you get the legitimate develop you want? Use the US Legal Forms site. The support provides a huge number of templates, including the West Virginia Accredited Investor Suitability, which can be used for company and private demands. Every one of the types are checked by professionals and satisfy federal and state specifications.

In case you are previously listed, log in to your profile and then click the Down load button to find the West Virginia Accredited Investor Suitability. Make use of your profile to check with the legitimate types you might have acquired in the past. Visit the My Forms tab of your respective profile and obtain yet another copy from the file you want.

In case you are a whole new customer of US Legal Forms, listed here are straightforward directions for you to comply with:

- Initial, be sure you have chosen the proper develop for your personal metropolis/county. You can look over the form making use of the Preview button and read the form information to make certain this is basically the best for you.

- In case the develop is not going to satisfy your requirements, make use of the Seach industry to discover the right develop.

- When you are certain that the form would work, select the Get now button to find the develop.

- Choose the costs program you desire and type in the required information and facts. Create your profile and pay for your order making use of your PayPal profile or bank card.

- Choose the submit file format and acquire the legitimate file format to your device.

- Complete, edit and print and signal the acquired West Virginia Accredited Investor Suitability.

US Legal Forms is the most significant library of legitimate types where you can see different file templates. Use the company to acquire appropriately-manufactured papers that comply with state specifications.

Form popularity

FAQ

Requirements to Be an Accredited Investor A natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

The first way an individual can become an accredited investor is with a pre-tax income exceeding $200,000 in each of the two most recent tax return years. There must also be a reasonable expectation that they will earn the same or more in the current calendar year and the coming year.

Requirements for Accredited Investors An entity is considered an accredited investor if it is a private business development company or an organization with assets exceeding $5 million. Also, if an entity consists of equity owners who are accredited investors, the entity itself is an accredited investor.

How to invest without being an accredited investor requires only that the investor has a net worth of less than $1 million. This includes the net worth of his or her spouse. The investor must also have earned $200,000 or more annually for the last two years.

Accredited investor questionnaires are used to determine whether potential investors meet the suitability requirements of Regulation D of the Securities Act of 1933, which may eliminate the need for the offering or issuance of such securities to be registered with the Securities and Exchange Commission.