A debt collector may not use unfair or unconscionable means to collect a debt. This includes depositing a postdated check prior to the date on the check.

West Virginia Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check

Description

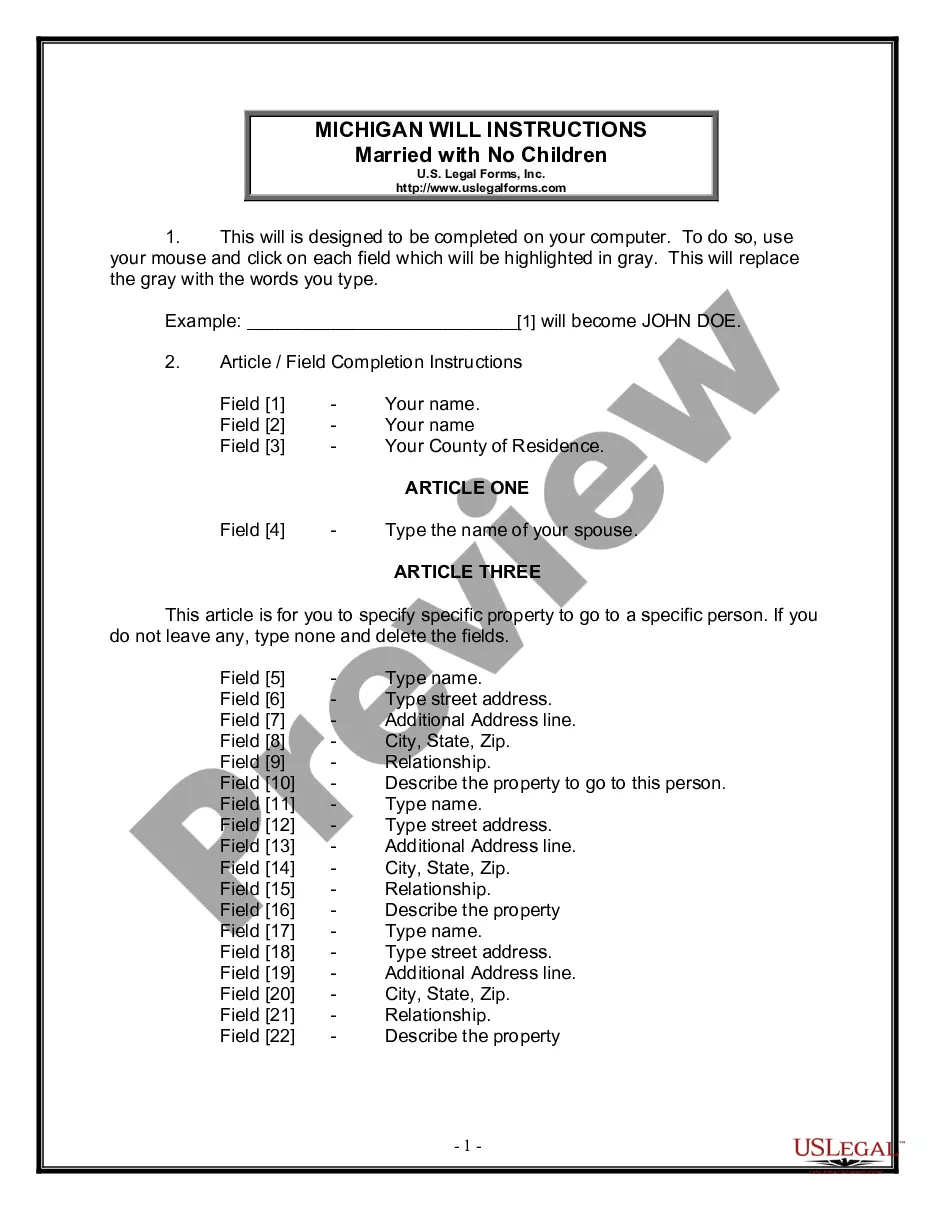

How to fill out Notice To Debt Collector - Depositing A Postdated Check Prior To The Date On The Check?

If you want to aggregate, download, or print authorized document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal uses are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for the account.

Step 5. Process the purchase. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to locate the West Virginia Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check in a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the West Virginia Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct area/state.

- Step 2. Use the Preview feature to review the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to discover other versions of the legal form template.

Form popularity

FAQ

The primary difference between dated and post-dated checks lies in the dates written on them. A dated check has a current or past date that can be cashed immediately, while a post-dated check features a future date, preventing it from being cashed until then. Understanding this difference is crucial, particularly when dealing with the West Virginia Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check.

Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice. Contact your bank or credit union to learn what its policies are.

Depositing a postdated check a day early may cause the check writer's bank to attempt to pay the check immediately. If the check writer does not yet have the funds in his bank account, this will cause the check to "bounce," or be returned for nonsufficient funds.

Depositing a postdated check a day early may cause the check writer's bank to attempt to pay the check immediately. If the check writer does not yet have the funds in his bank account, this will cause the check to "bounce," or be returned for nonsufficient funds.

According to UCC § 3-113, if a financial instrument, such as a check, is undated, its official date is the date on which it first came into the possession of the person or business listed on it. Since banks follow the UCC, your undated check will be deposited.

A signed check immediately becomes legal tender that a bank can deposit or cash before the indicated date on the check. Therefore, a bank will be able to accept a check if it is dated and signed. Ask your bank or credit union for their specific policy for postdated checks in their account disclosures.

Can a bank or credit union cash a post-dated check before the date on the check? Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice.

In most cases, when you receive a postdated check, you can deposit or cash a postdated check at any time. Debt collectors may be prohibited from processing a check before the date on the check, but most individuals are free to take postdated checks to the bank immediately.

Several banks now offer a service where your paycheck is available one or two days before the regular payday if your employer uses direct deposit. This early direct deposit of your paycheck could help you keep up with bills and avoid late fees, especially on bills due around the time you receive your salary.

Federal law restricts what a debt collector can and cannot do with your postdated check. Specifically, under the Fair Debt Collection Practices Act (FDCPA), a debt collector cannot: coerce you into making a postdated payment by threatening or instituting criminal prosecution.