West Virginia Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation

Description

How to fill out Cash Award Paid To Holders Of Non-Exercisable Stock Options Upon Merger Or Consolidation?

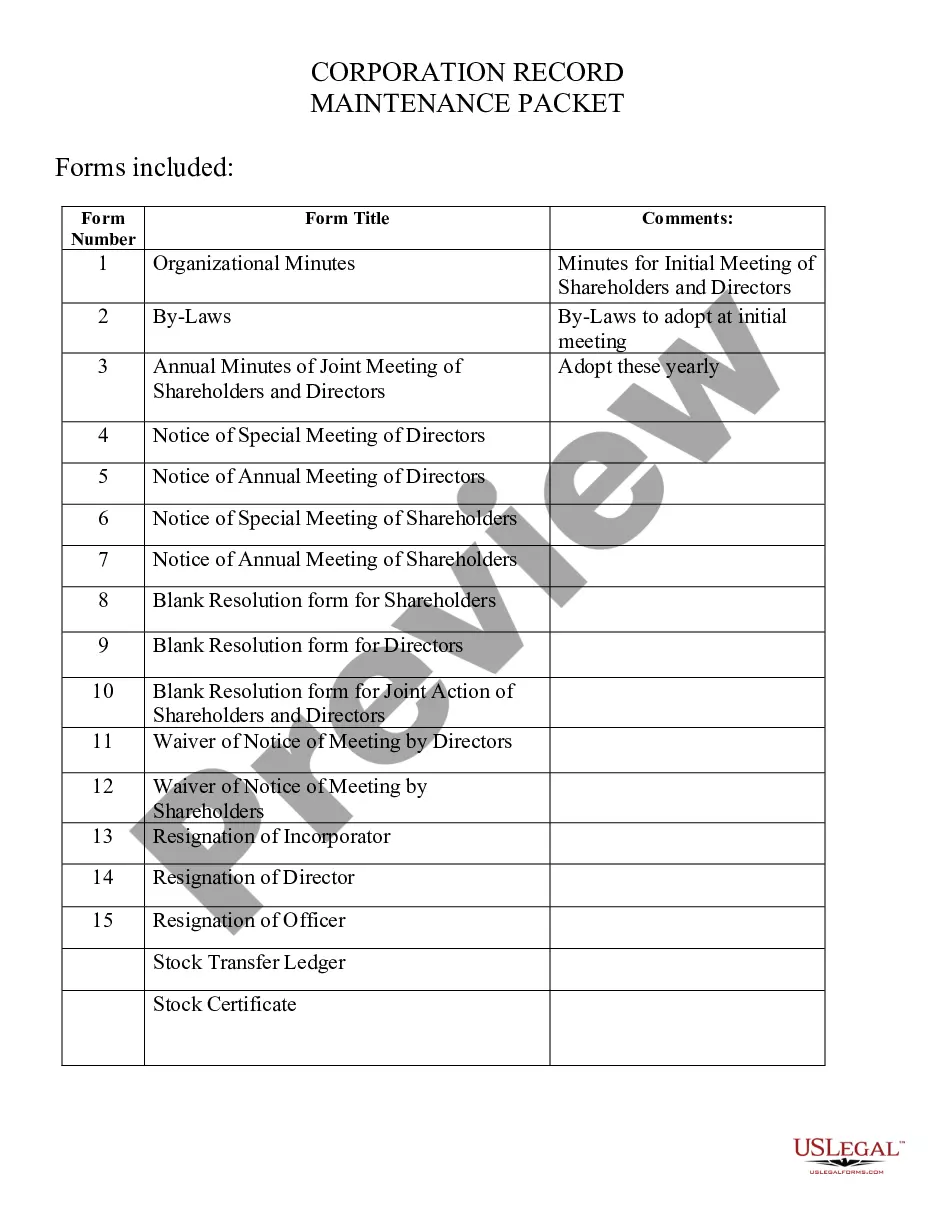

Choosing the right authorized papers design can be a struggle. Naturally, there are tons of web templates accessible on the Internet, but how would you find the authorized form you require? Take advantage of the US Legal Forms website. The services delivers a huge number of web templates, including the West Virginia Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation, that you can use for business and private needs. All the forms are checked out by experts and satisfy state and federal demands.

In case you are already listed, log in to the bank account and click on the Download option to obtain the West Virginia Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation. Make use of your bank account to search throughout the authorized forms you possess purchased previously. Check out the My Forms tab of the bank account and get one more version from the papers you require.

In case you are a brand new end user of US Legal Forms, here are easy recommendations for you to follow:

- Initially, ensure you have selected the correct form for the metropolis/region. You may examine the shape making use of the Review option and browse the shape outline to ensure this is the best for you.

- In case the form does not satisfy your expectations, take advantage of the Seach discipline to discover the appropriate form.

- When you are certain the shape is acceptable, click the Buy now option to obtain the form.

- Choose the prices plan you need and enter the essential info. Build your bank account and purchase the transaction making use of your PayPal bank account or bank card.

- Pick the data file format and down load the authorized papers design to the system.

- Total, revise and print out and signal the acquired West Virginia Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation.

US Legal Forms is the biggest catalogue of authorized forms in which you can find a variety of papers web templates. Take advantage of the service to down load appropriately-made documents that follow condition demands.

Form popularity

FAQ

If you've exercised a vested stock options (e.g. an NSO or ISO), you own shares of stock in the company. In most situations, the acquiring company will need to purchase these shares from you pursuant to the terms of the acquisition (cash, stock, or mix). Vested stock options (ISOs or NSOs).

Acquired for both stock & cash: A portion of equity stakes are cashed out, and the remainder turns into stocks or options. You and most other employees will likely get offered the same ratio of shares and cash. Depends on how much cash and what type of option grants you receive.

?ISOs and 90 days ? why so important (even if your company extended the window)? The 90-day post-termination exercise (PTE) window is the period you have to exercise (ie, pay) for your vested incentive stock options (ISOs) or else you lose them.

First is the acquiring company may buy out the options for cash. They may also offer to replace those contracts with options of the acquirer of equal or greater value. If stock options that had been granted are very far out of the money (i.e. "underwater"), however, they may be canceled.

Vested employee stock options contain guarantees, so when a company is acquired employees with vested options will have some options. First is the acquiring company may buy out the options for cash. They may also offer to replace those contracts with options of the acquirer of equal or greater value.

Regardless, if the acquisition terms provide that options will be deemed net exercised at closing and paid based on the net number of shares owned, that will cause any ISOs to be treated as NSOs and the proceeds paid will be compensation income subject to all income tax and employment tax withholding.

Vested stock options (ISOs or NSOs). Acquirers typically handle this in a couple ways: (i) Buyout your stock options (net of the strike price) (ii) Substitute or assume your stock options for equivalent value in their company.

The new company could assume your current unvested stock options or RSUs or substitute them. The same goes for vested options. You'd likely still have to wait to buy shares or receive cash, but could at least retain your unvested shares.