West Virginia Stock Option Agreement

Description

How to fill out Stock Option Agreement?

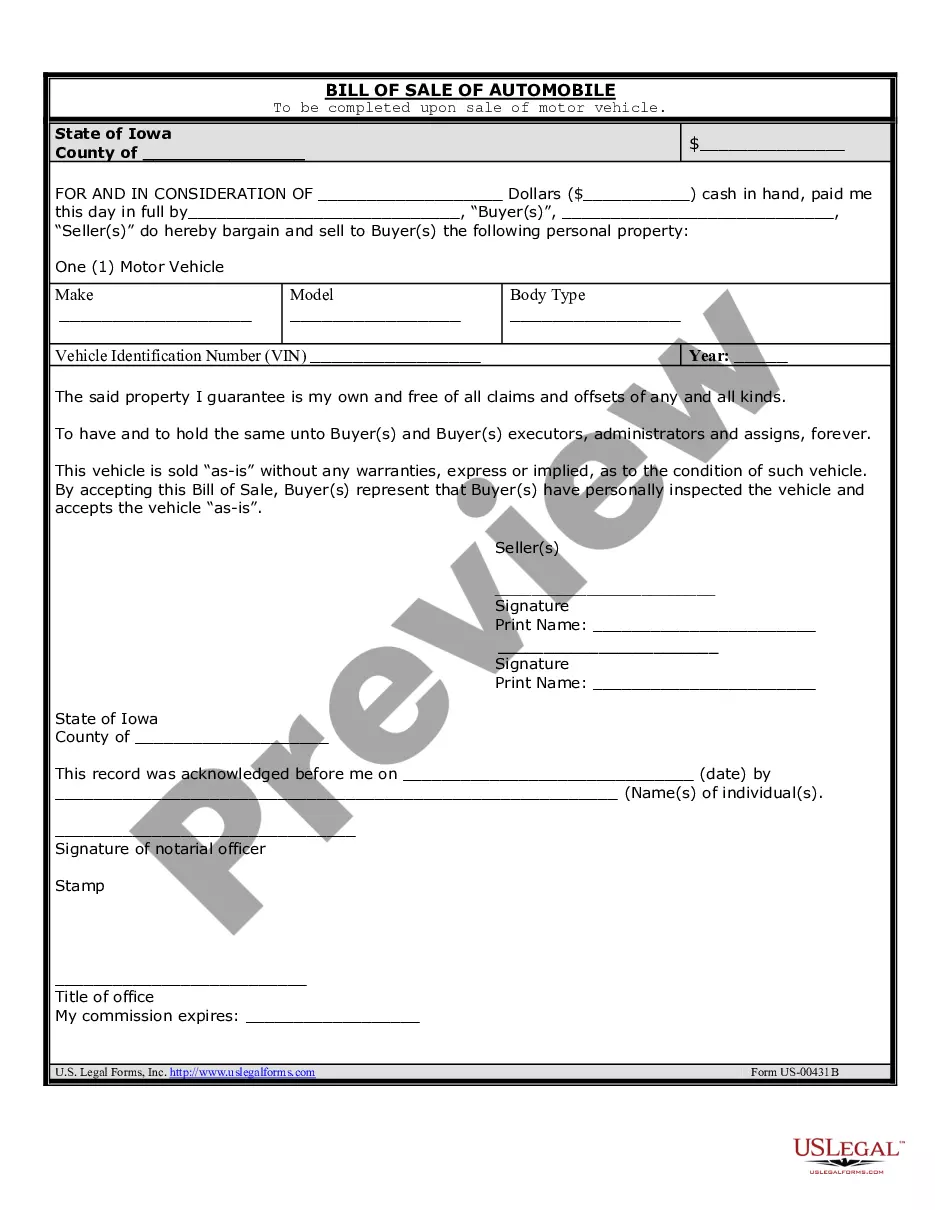

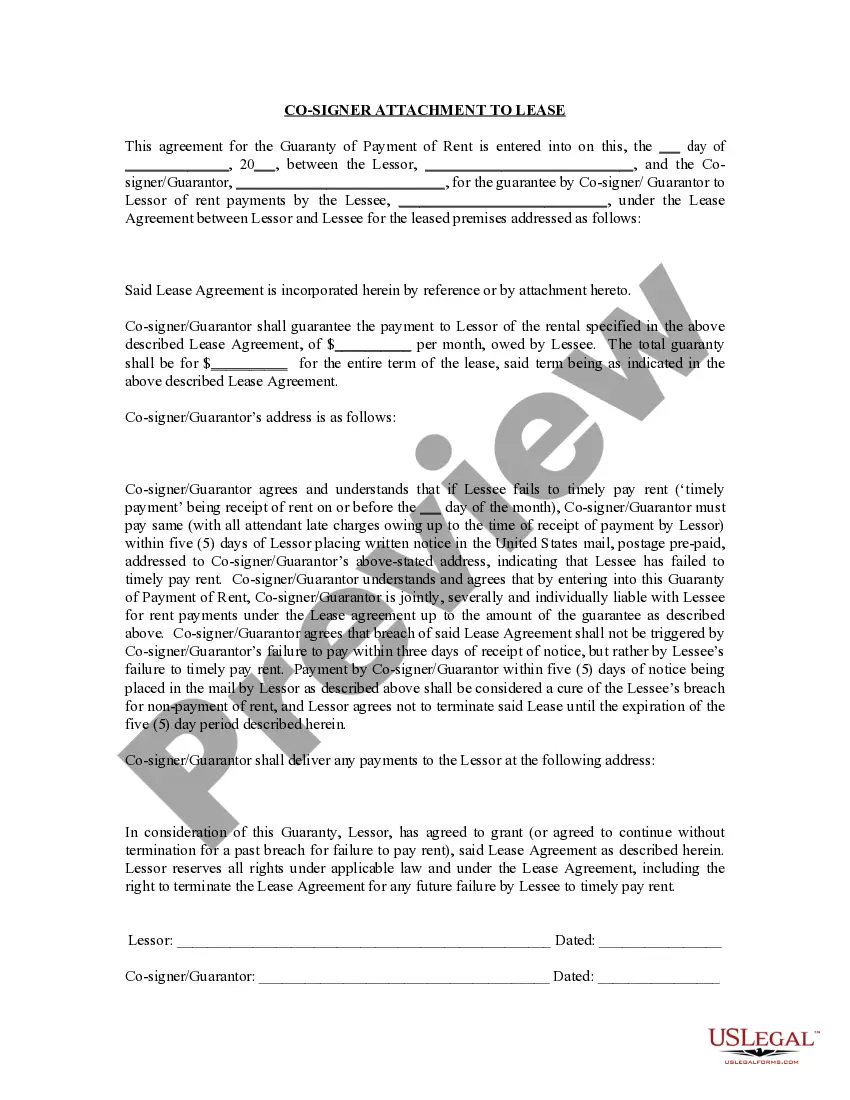

Discovering the right legal record web template might be a battle. Of course, there are a lot of themes available on the Internet, but how would you find the legal type you will need? Utilize the US Legal Forms site. The services delivers a large number of themes, like the West Virginia Stock Option Agreement, that can be used for organization and private requires. Each of the forms are inspected by professionals and meet state and federal needs.

In case you are presently listed, log in for your bank account and then click the Down load button to have the West Virginia Stock Option Agreement. Make use of bank account to appear from the legal forms you might have purchased formerly. Go to the My Forms tab of your respective bank account and obtain yet another backup of the record you will need.

In case you are a whole new customer of US Legal Forms, allow me to share simple instructions so that you can stick to:

- First, make certain you have chosen the appropriate type for the town/area. You are able to check out the shape utilizing the Review button and study the shape explanation to make sure it will be the right one for you.

- When the type fails to meet your requirements, make use of the Seach discipline to find the appropriate type.

- Once you are sure that the shape would work, go through the Buy now button to have the type.

- Select the pricing plan you would like and enter in the needed details. Build your bank account and purchase the order utilizing your PayPal bank account or credit card.

- Select the file format and down load the legal record web template for your gadget.

- Total, edit and printing and signal the obtained West Virginia Stock Option Agreement.

US Legal Forms is the most significant local library of legal forms where you will find different record themes. Utilize the company to down load skillfully-created papers that stick to condition needs.

Form popularity

FAQ

The standard stock option plan grants your employee a stock option that invests over four years. After the first year, there's a cliff?they don't own anything for their first 12 months, but after their first year, they invest in 25% of all the options you give them.

Holders of share purchase rights may or may not buy an agreed number of shares of stock at a pre-determined price, but only if they are an existing stockholder. Options, on the other hand, are the right to buy or sell stocks at a pre-set price called the strike price.

Your ESPP will have set offering and purchase periods, while a stock option grant has a set term in which you can exercise the options after they vest. The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase.

A Stock Purchase Agreement is used for the purchase and sale of outstanding stock of a business. The agreement typically includes purchase and sale terms, representations and warranties, covenants, conditions precedent, termination, and indemnification provisions.

The biggest difference between options and stocks is that stocks represent shares of ownership in individual companies, while options are contracts with other investors that let you bet on which direction you think a stock price is headed.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.

West Virginia is an at-will jurisdiction, which means that either the employer or the employee, absent contractual or statutory (e.g., anti-discrimination, anti-retaliation) provisions, may end the employment relationship without cause and for any or no reason. Cook v. Heck's, Inc., 342 S.E.2d 453, 457 (W. Va.