West Virginia Opinion of Lehman Brothers

Description

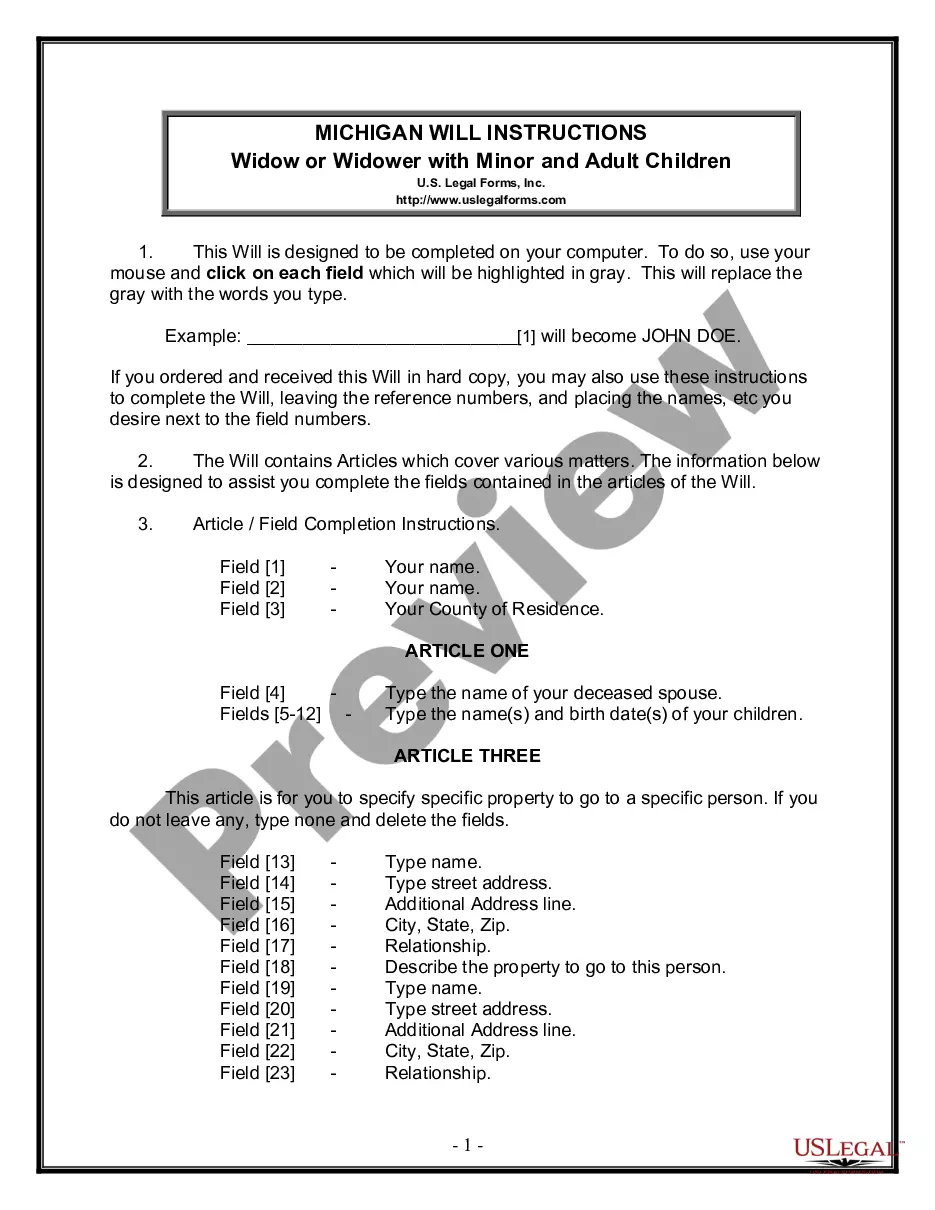

How to fill out Opinion Of Lehman Brothers?

US Legal Forms - one of many biggest libraries of authorized kinds in the USA - delivers a wide array of authorized file themes it is possible to acquire or print. Using the website, you can find a huge number of kinds for organization and person functions, categorized by types, says, or keywords and phrases.You will find the latest versions of kinds just like the West Virginia Opinion of Lehman Brothers within minutes.

If you have a registration, log in and acquire West Virginia Opinion of Lehman Brothers through the US Legal Forms catalogue. The Obtain option will appear on every single develop you see. You gain access to all earlier delivered electronically kinds from the My Forms tab of your own profile.

If you would like use US Legal Forms the very first time, listed below are basic instructions to get you started off:

- Be sure to have chosen the right develop to your area/region. Click the Review option to analyze the form`s content material. Browse the develop description to actually have selected the correct develop.

- If the develop doesn`t suit your demands, take advantage of the Search field near the top of the monitor to find the one which does.

- When you are pleased with the form, affirm your choice by clicking on the Acquire now option. Then, pick the prices program you want and provide your accreditations to sign up on an profile.

- Procedure the purchase. Make use of Visa or Mastercard or PayPal profile to accomplish the purchase.

- Find the formatting and acquire the form on the system.

- Make changes. Complete, modify and print and signal the delivered electronically West Virginia Opinion of Lehman Brothers.

Every single web template you added to your bank account lacks an expiration date and is also your own property eternally. So, if you want to acquire or print one more copy, just visit the My Forms area and then click in the develop you will need.

Get access to the West Virginia Opinion of Lehman Brothers with US Legal Forms, by far the most comprehensive catalogue of authorized file themes. Use a huge number of professional and condition-specific themes that fulfill your organization or person needs and demands.

Form popularity

FAQ

The firm survived many challenges but was eventually brought down by the collapse of the subprime mortgage market. Lehman first got into mortgage-backed securities in the early 2000s before acquiring five mortgage lenders. The firm posted multiple, consecutive losses and its share price dropped.

Lehman Brothers was acquired by Shearson/American Express in 1984 for a reported $360 million.

The Lehman Brothers bankruptcy was the largest in U.S. history. It invested heavily in risky mortgages just as housing prices started falling. The government could not bail out Lehman without a buyer. Lehman's bankruptcy kicked off the 2008 financial crisis.

Largest Bankruptcy in U.S. history Despite concerns about the consequences a Lehman Brothers collapse would bring, the federal government and representatives of the administration of President George W. Bush ultimately refused to bail out another investment bank.

Barclays and Bank of America had both looked to buy Lehman Brothers before its collapse. However, UK Chancellor of the Exchequer Alistair Darling stepped in to prevent Barclays from executing the deal and Bank of America ultimately agreed to pay $50 billion to purchase Merrill Lynch.

Lehman Brothers was regulated under a program supervised by the Securities and Exchange Commission (SEC).

The transaction collapsed, however, when the Financial Services Administration?the U.K. securities regulator?refused to waive the shareholder vote required before Barclays would be permitted to guarantee Lehman's operations during the period of the sale.

Lehman Brothers Holdings Inc.