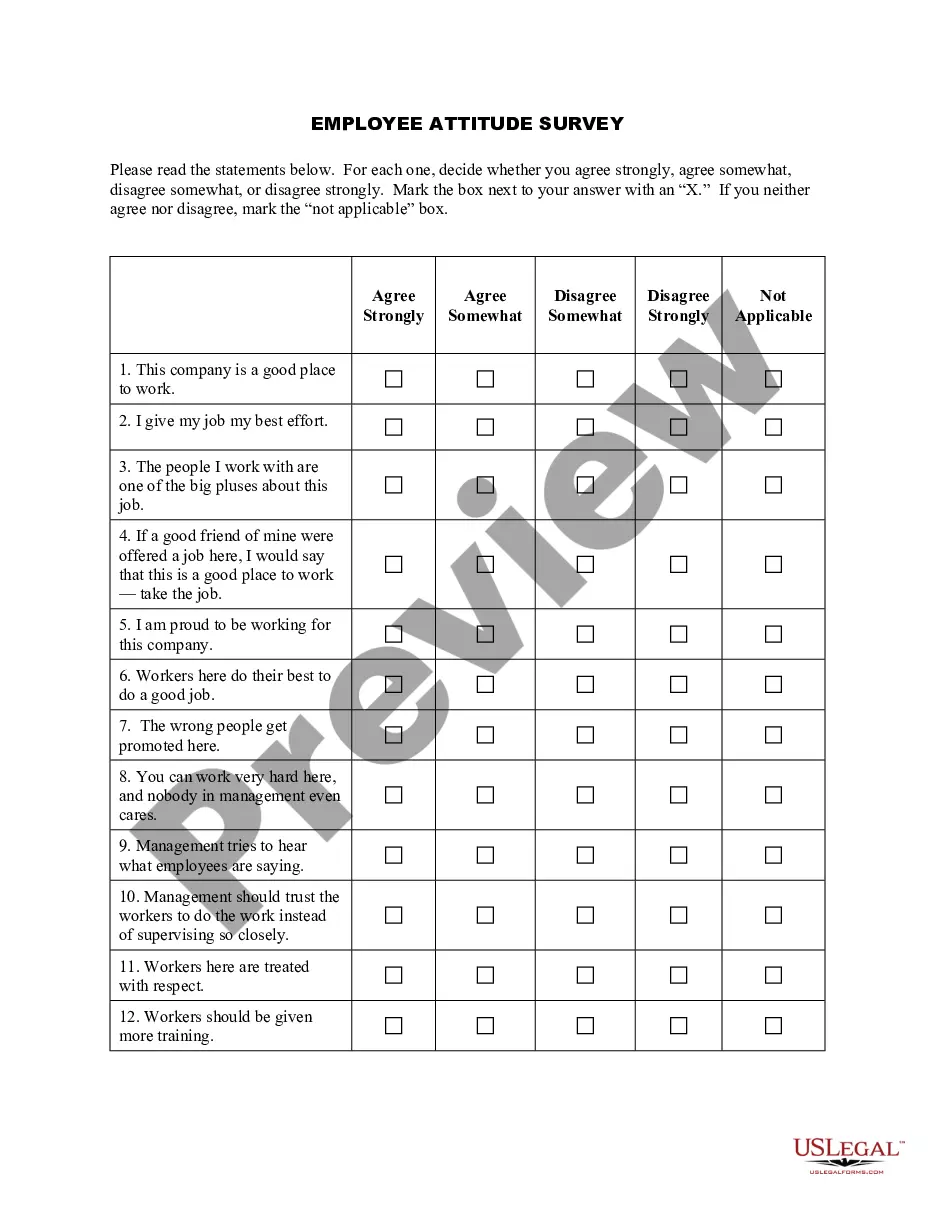

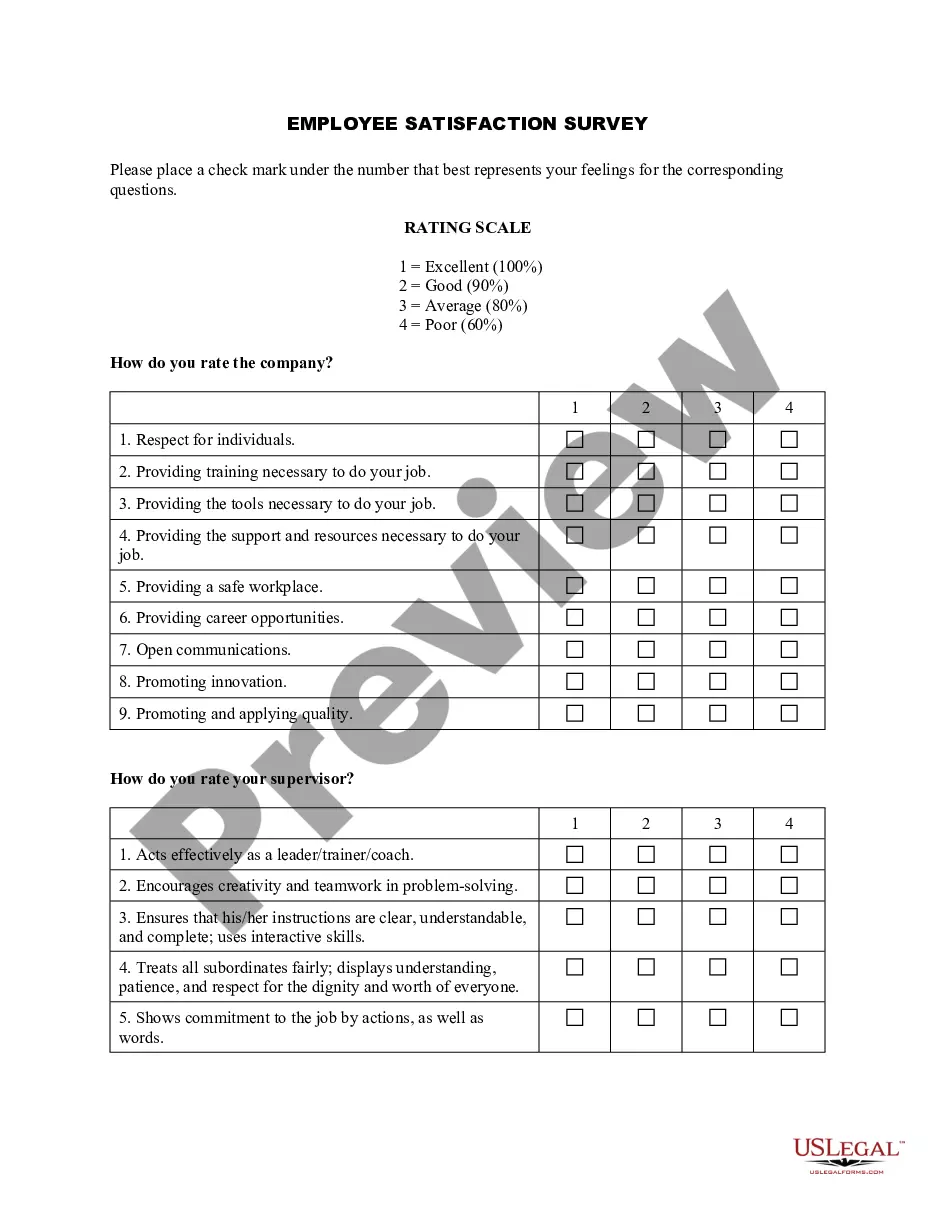

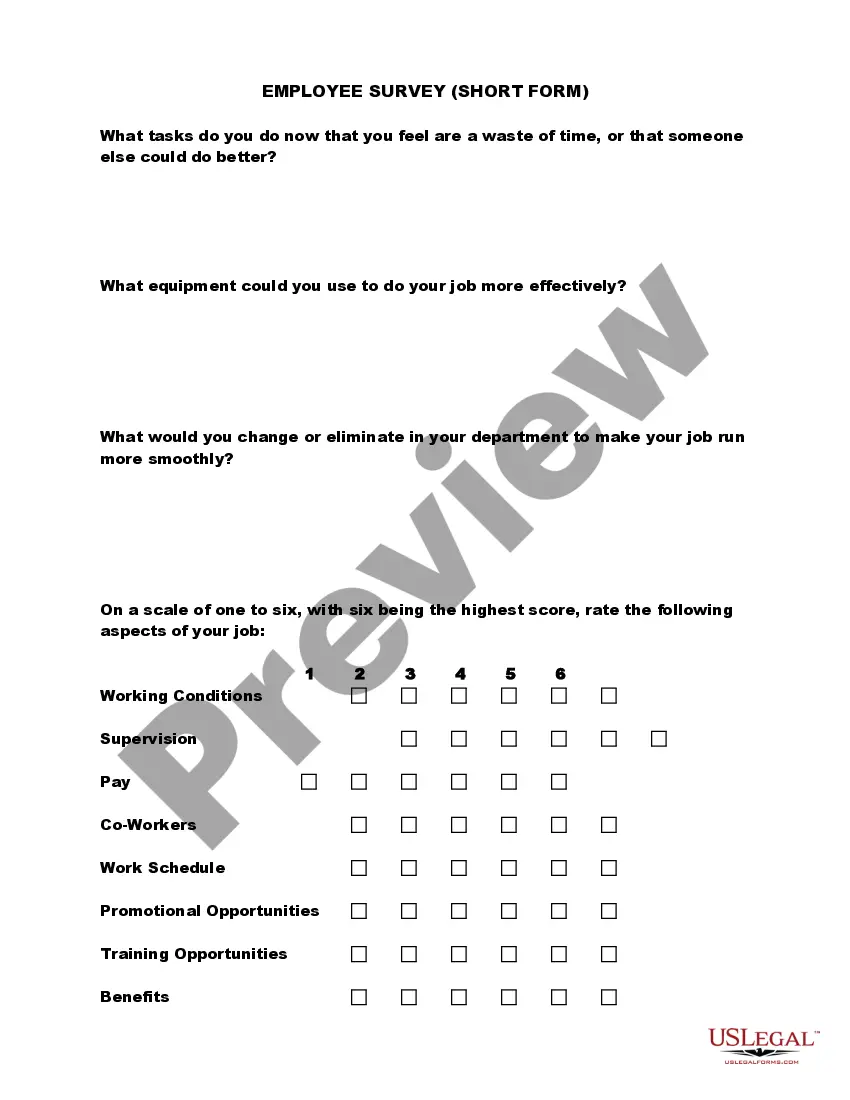

West Virginia Employee Survey (Short Form)

Description

How to fill out Employee Survey (Short Form)?

Selecting the appropriate legitimate document template can be somewhat of a challenge.

Naturally, there are numerous templates available online, but how do you find the exact legal document you need? Utilize the US Legal Forms website.

The platform provides thousands of templates, including the West Virginia Employee Survey (Short Form), which can be utilized for both business and personal purposes.

You can view the form using the Review option and examine the form details to ensure it is right for you.

- All templates are reviewed by professionals and meet federal and state regulations.

- If you are already registered, Log In to your account and select the Download option to retrieve the West Virginia Employee Survey (Short Form).

- Use your account to browse the legal documents you have obtained previously.

- Go to the My documents section of your account to download a duplicate of the document you require.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure you have chosen the correct form for your locality/state.

Form popularity

FAQ

2022 SUI tax ratesThe West Virginia SUI tax rates for 2022 will continue to range from 1.5% to 8.5% based on the highest UI rate schedule per law.

Withholding Requirements3% if annual income < $10,000. 4% if annual income > $10,000 and < $25,000. 4.5% if annual income > $25,000 and < $40,000. 6% if annual income > $40,000 and < $60,000.

The State Unemployment Insurance or SUI tax is funded by employers and offers short-term benefits to employees who have lost or left a job for various reasons.

WV/NRW-4. NOTICE OF REVOCATION OF NONRESIDENT INCOME TAX AGREEMENT.

Page 1. FORM WV IT-104. WEST VIRGINIA EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE. Complete this form and present it to your employer to avoid any delay in adjusting the amount of state income tax to be withheld from your wages.

Federal Form W-4 is normally used to determine West Virginia personal income tax withholding, but the state Form WV/IT-104 is used in certain circumstances. Certain nonresident employees must submit Form WV/IT-104NR to claim an exemption from withholding. See Employee Withholding Forms.

Once implemented, the $600 Federal Pandemic Employment Compensation payments will be backdated to all eligible weeks for which individuals claim unemployment compensation or Pandemic Unemployment Assistance beginning the week ending April 4, 2020 and will be paid for all eligible weeks claimed through July 25, 2020.

Unemployment insurance benefits provide temporary financial assistance to workers unemployed through no fault of their own that meet West Virginia's eligibility requirements. See more.

The WV/NRW-2 form is a statement of West Virginia Income Tax Withheld for Nonresident Individual or Organization. This form will produce automatically if any partner listed as a nonresident of West Virginia.