West Virginia Withdrawal of Assumed Name for Corporation

Description

How to fill out Withdrawal Of Assumed Name For Corporation?

Are you presently in the placement where you need files for sometimes company or specific uses just about every working day? There are a lot of legitimate file themes available on the net, but locating ones you can rely isn`t effortless. US Legal Forms gives a large number of develop themes, like the West Virginia Withdrawal of Assumed Name for Corporation, that are created to fulfill federal and state requirements.

Should you be already informed about US Legal Forms internet site and get a merchant account, just log in. Next, you can obtain the West Virginia Withdrawal of Assumed Name for Corporation web template.

If you do not offer an bank account and would like to start using US Legal Forms, follow these steps:

- Find the develop you require and ensure it is for that proper metropolis/area.

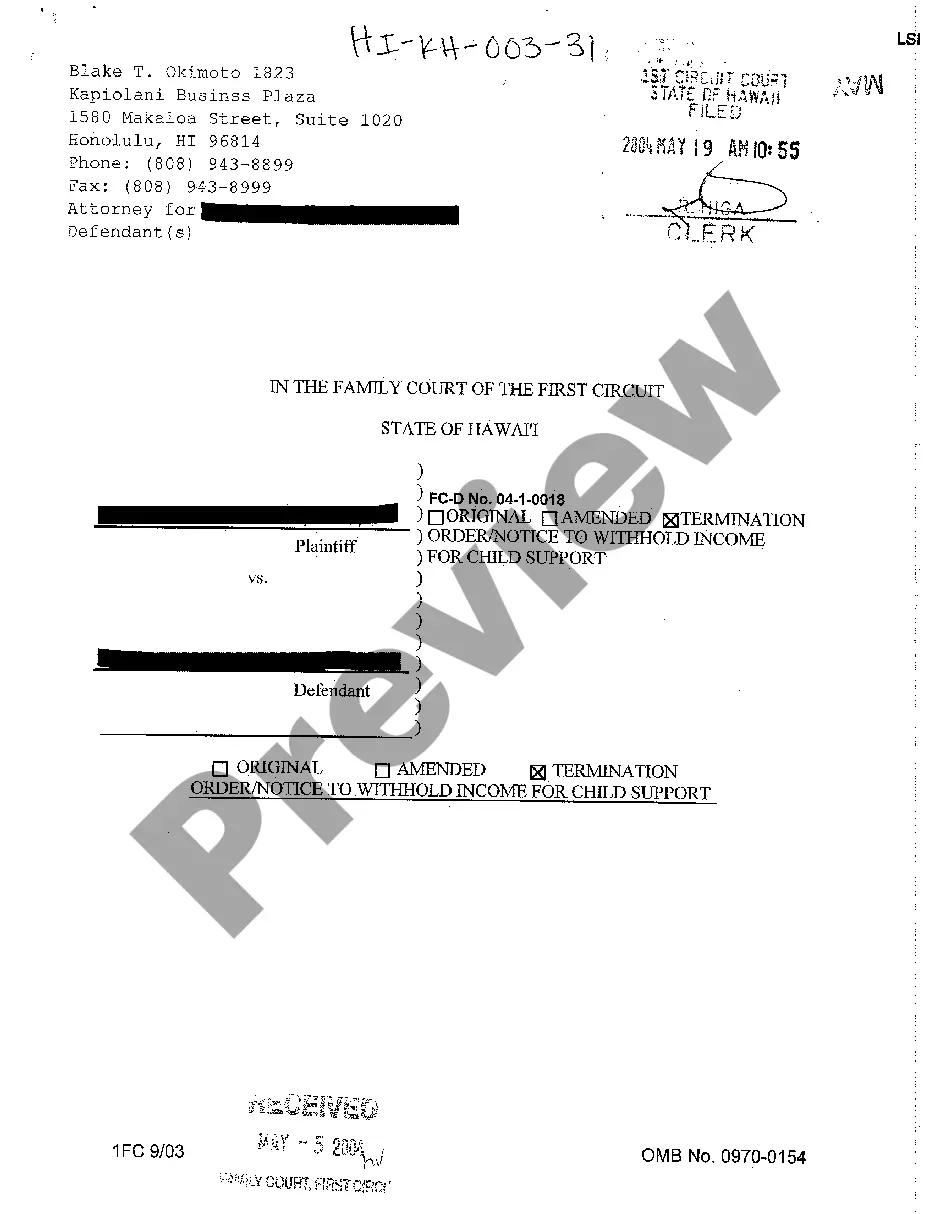

- Make use of the Preview option to examine the form.

- See the explanation to ensure that you have selected the right develop.

- In case the develop isn`t what you`re seeking, make use of the Research discipline to get the develop that suits you and requirements.

- Once you discover the proper develop, click Get now.

- Select the costs prepare you would like, complete the desired information to produce your money, and pay money for your order using your PayPal or charge card.

- Select a practical document file format and obtain your copy.

Discover every one of the file themes you may have purchased in the My Forms menus. You may get a extra copy of West Virginia Withdrawal of Assumed Name for Corporation anytime, if needed. Just click the needed develop to obtain or print out the file web template.

Use US Legal Forms, the most considerable assortment of legitimate forms, to save efforts and steer clear of faults. The service gives expertly created legitimate file themes which can be used for a selection of uses. Make a merchant account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

File a dissolution, termination, withdrawal, or cancellation online quickly and conveniently through the One Stop Business Portal. The Secretary of State's Office also provides forms that meet minimum state law requirements available online through the Secretary of State Form Search.

Name your West Virginia LLC. ... Choose your registered agent. ... Prepare and file articles of organization. ... Receive a certificate from the state. ... Create an operating agreement. ... Obtain a West Virginia business registration certificate. ... Get an Employer Identification Number.

To withdraw your foreign corporation from West Virginia, file an Application for Certificate of Withdrawal from Certificate of Authority. You can file the withdrawal by fax, mail, or in person. Pay your filing fees by check, money order, or credit card. If you file in person, you can pay in cash.

West Virginia requires all business entities and individuals to obtain a business registration certificate from the State Tax Department before doing business in the state. This certificate (sometimes referred to as a ?business license?) is needed for each business location.

Yes. If your business plans to operate in West Virginia under a name other than its legal business name, you're required to register a DBA with the Secretary of State.

Virginia does not require businesses to obtain or use a DBA. It is completely optional. Whether you should get a DBA depends on your business strategy. As discussed above, a DBA can benefit a sole proprietor by providing privacy and making it easier to avoid commingling personal and business assets.

When you are ready to dissolve your West Virginia corporation, you file original Articles of Dissolution with the West Virginia Secretary of State, Business Division (SOS). West Virginia SOS does not require the use of their forms. They do not require original signatures.

The WV State Tax Department is located at 1001 Lee Street East, Charleston, WV 25301. Contact: 304.558. 3333 or online at WV One Stop Business Portal. For more information about West Virginia Business Registration, visit West Virginia State Tax Department.