West Virginia Agreement of Vendor to Perform Services

Description

How to fill out Agreement Of Vendor To Perform Services?

Locating the appropriate valid documents template can be quite a challenge.

Of course, there are numerous templates accessible on the internet, but how do you find the authentic one you need.

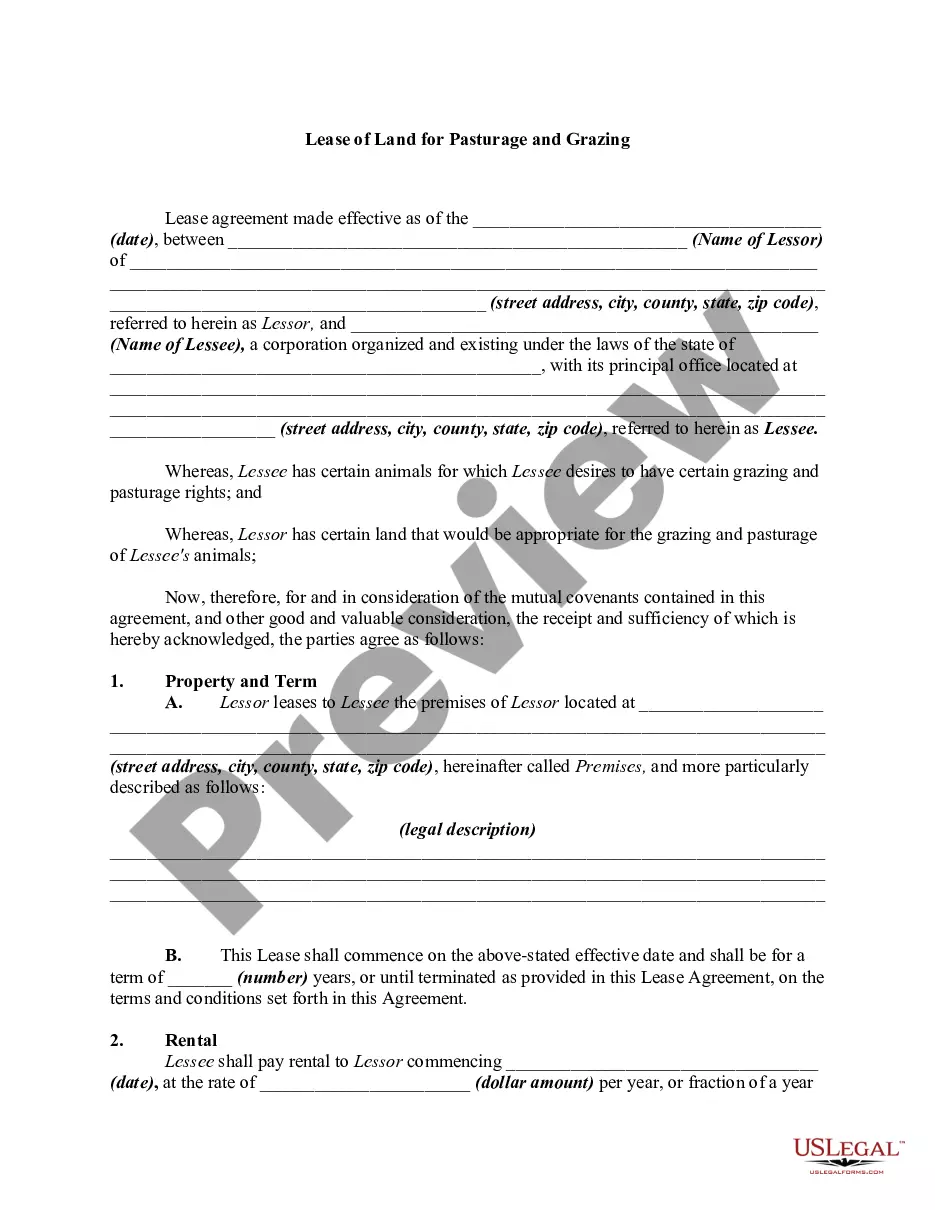

Utilize the US Legal Forms website. This service offers a multitude of templates, including the West Virginia Agreement of Vendor to Perform Services, which can serve both business and personal purposes.

If the form does not suit your requirements, use the Search field to find the appropriate document. Once you are confident that the form is correct, click the Purchase now button to obtain it. Select the payment plan you want and enter the necessary details. Create your account and finalize the purchase using your PayPal account or credit card. Choose the document format and download the legal documents template to your device. Complete, modify, print, and sign the received West Virginia Agreement of Vendor to Perform Services. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to download professionally crafted documents that adhere to state regulations.

- All of the forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Acquire button to obtain the West Virginia Agreement of Vendor to Perform Services.

- Use your account to search through the legal forms you have previously purchased.

- Navigate to the My documents section of your account and download an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

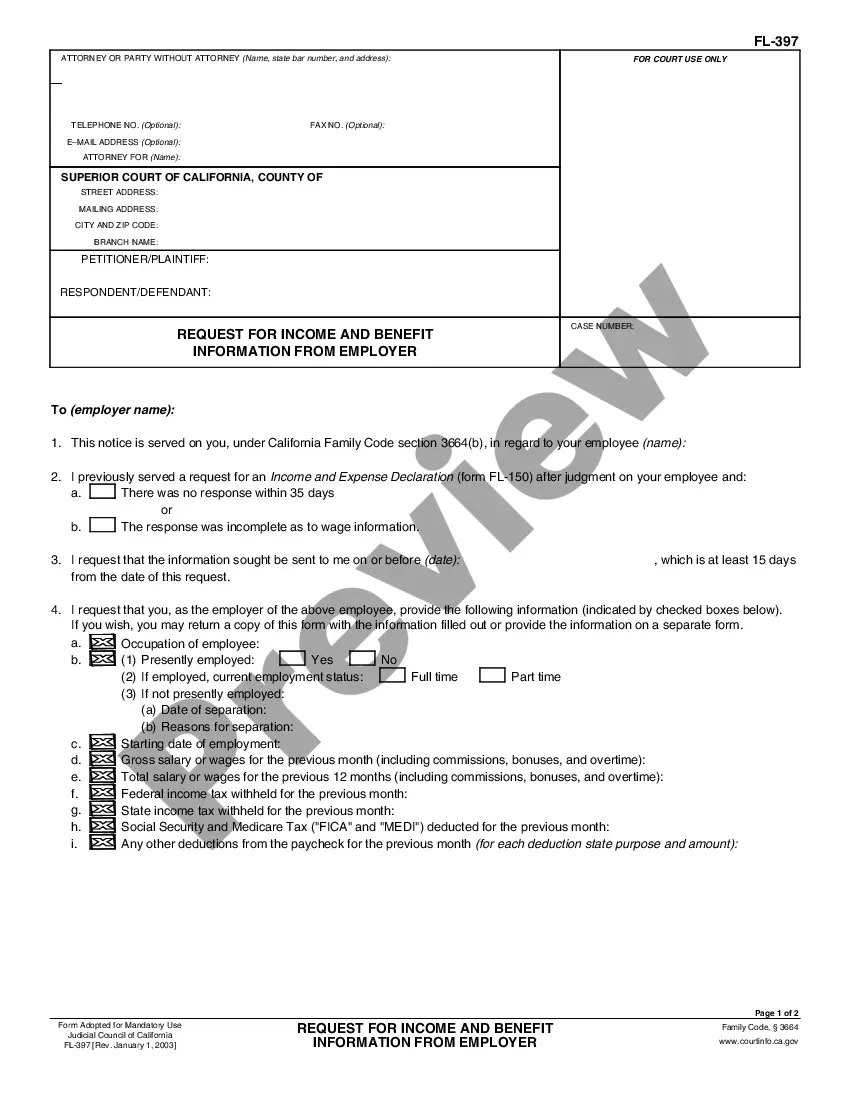

- First, ensure you have selected the correct form for your city/state. You can preview the form using the Review button and read the form description to confirm this is the right one for your needs.

Form popularity

FAQ

To request the SS-4 forms to obtain a taxpayer identification number from the Internal Revenue Service, call 1-800-829-4933. You may apply for your FEIN by mail or by calling the 800 number above or by visiting the website .

The West Virginia Tax Identification Number is your nine character ID number plus a three digit adjustment code. Personal Income Tax filers should enter '000' in this field. Business filers are defaulted to '001'.

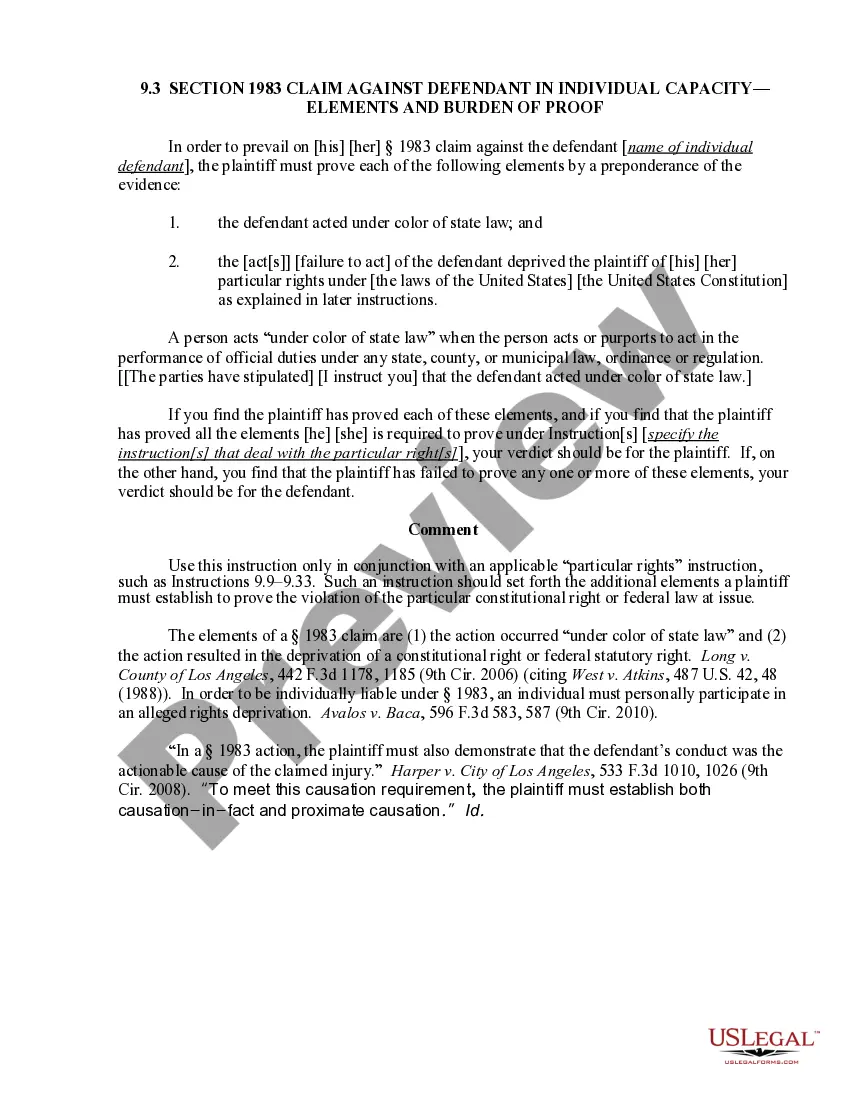

The WV-96 was developed by the Attorney General's Office to eliminate the most common conflicts with State law that are found in contract documents submitted for review.

1. The vendor should have valid VAT / CST Registration. 2. The vendor should have a valid PAN Card.

WvOASIS is the state's Enterprise Resource Planning (ERP) system. It has modernized the state's business processes through automation, fully or partially replacing approximately 100 of the state's former business applications.

The vending license required by Florida allows you to operate a business within the state. However, if you want to do business with the state directly, you need to register for a vendor account. To register your account to do business with the state, go to the Florida Department of Management Services website.

A transient vendor must properly complete a TVL-1 Application for Transient Vendor License along with payment of the $30 business registration tax and the posting of security (either through surety bond, cash, certified check, or an irrevocable letter of credit) in the amount of $500 before commencing operations within

To register as a transient vendor, you must obtain a business registration certificate, a transient vendor license and post $500 bond with the State Tax Commissioner. All three must be completed to meet the registration requirements. registration fee.

Most businesses operating in or selling in the state of West Virginia are required to purchase a resale certificate annually. Even online based businesses shipping products to West Virginia residents must collect sales tax. Obtaining your sales tax certificate allows you to do so.

Vendors may also register by completing a WV-1 or WV-1A Vendor Registration & Disclosure Statement and Small, Women, & Minority-Owned Business Certification form, available online at .