West Virginia Database Distribution and Licensing Agreement

Description

How to fill out Database Distribution And Licensing Agreement?

Are you in a situation where you often need documents for various company or personal activities.

There are numerous authentic document templates accessible online, but locating ones that you can trust is challenging.

US Legal Forms provides thousands of form templates, including the West Virginia Database Distribution and Licensing Agreement, which are designed to fulfill federal and state requirements.

Once you obtain the correct form, simply click Buy now.

Select the pricing plan you prefer, fill in the required details to create your account, and complete the transaction using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the West Virginia Database Distribution and Licensing Agreement template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct jurisdiction/region.

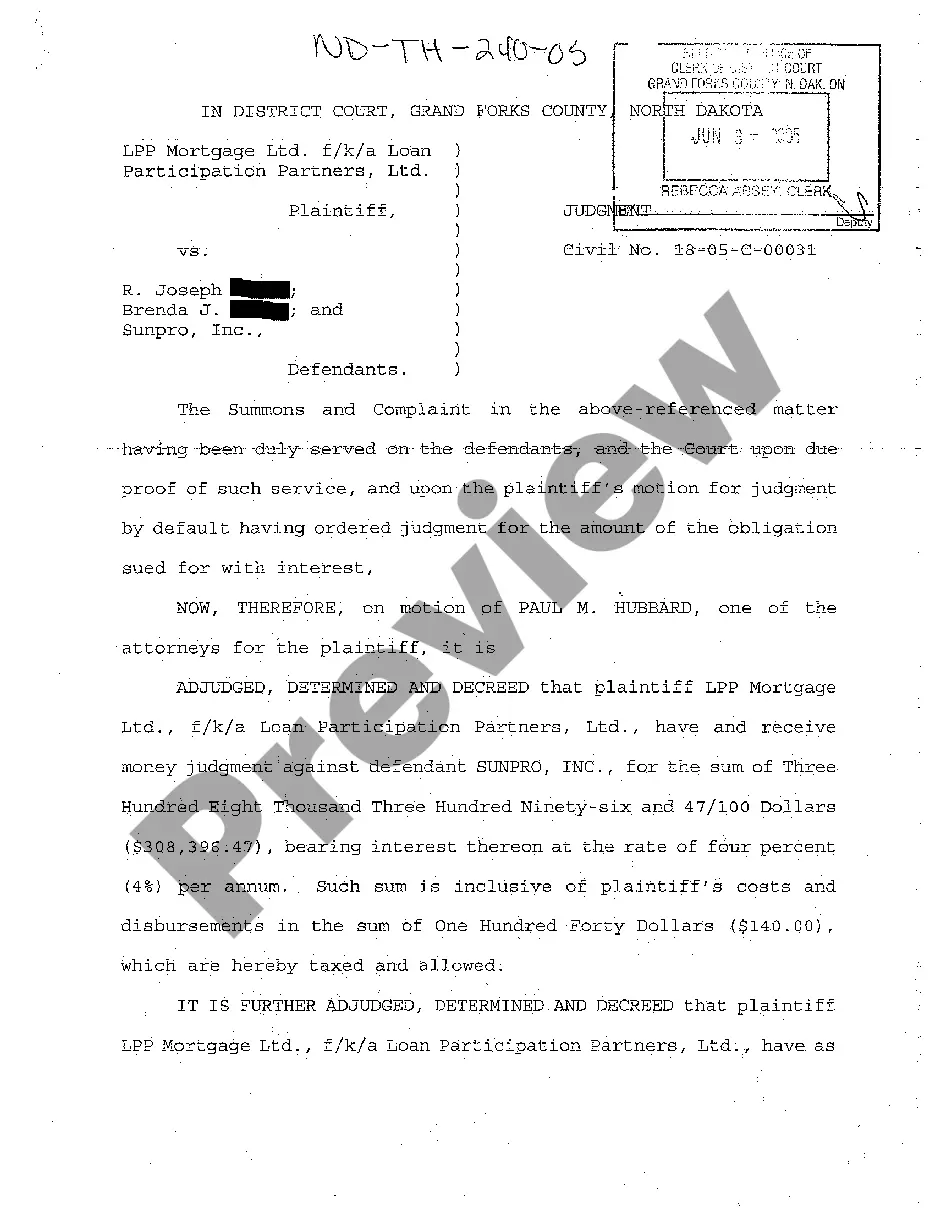

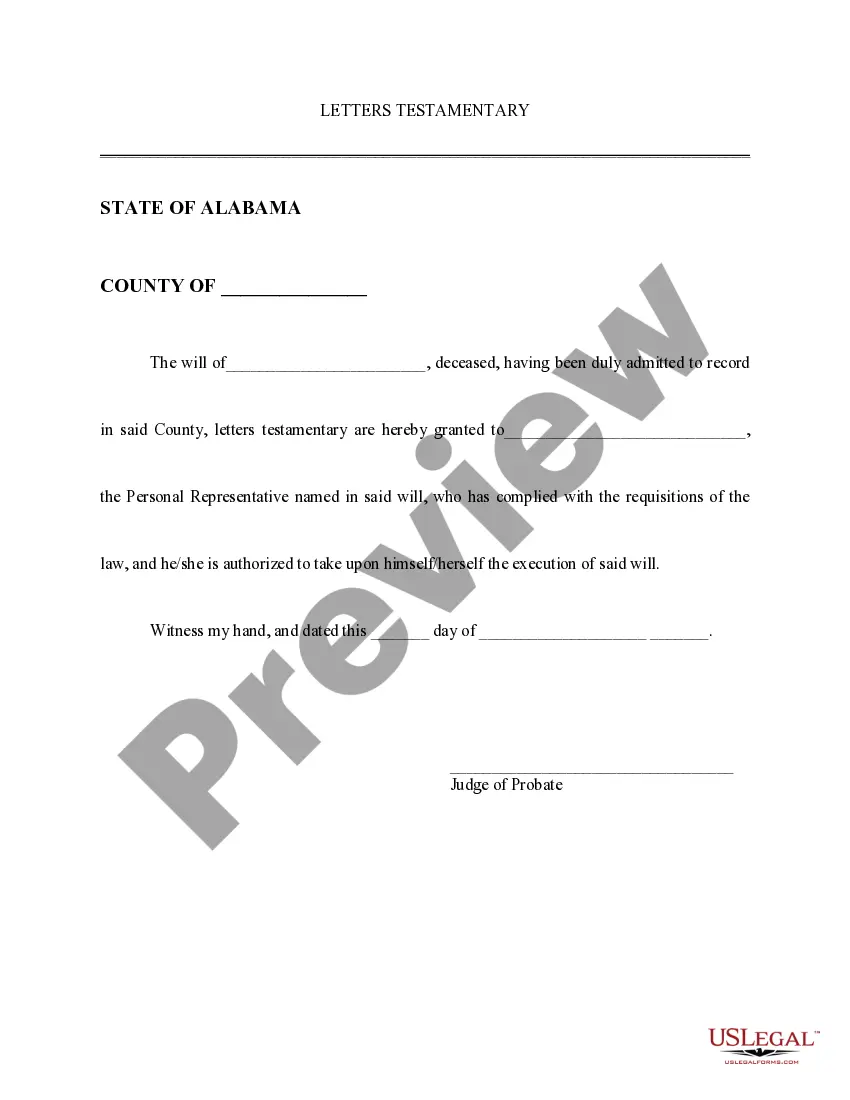

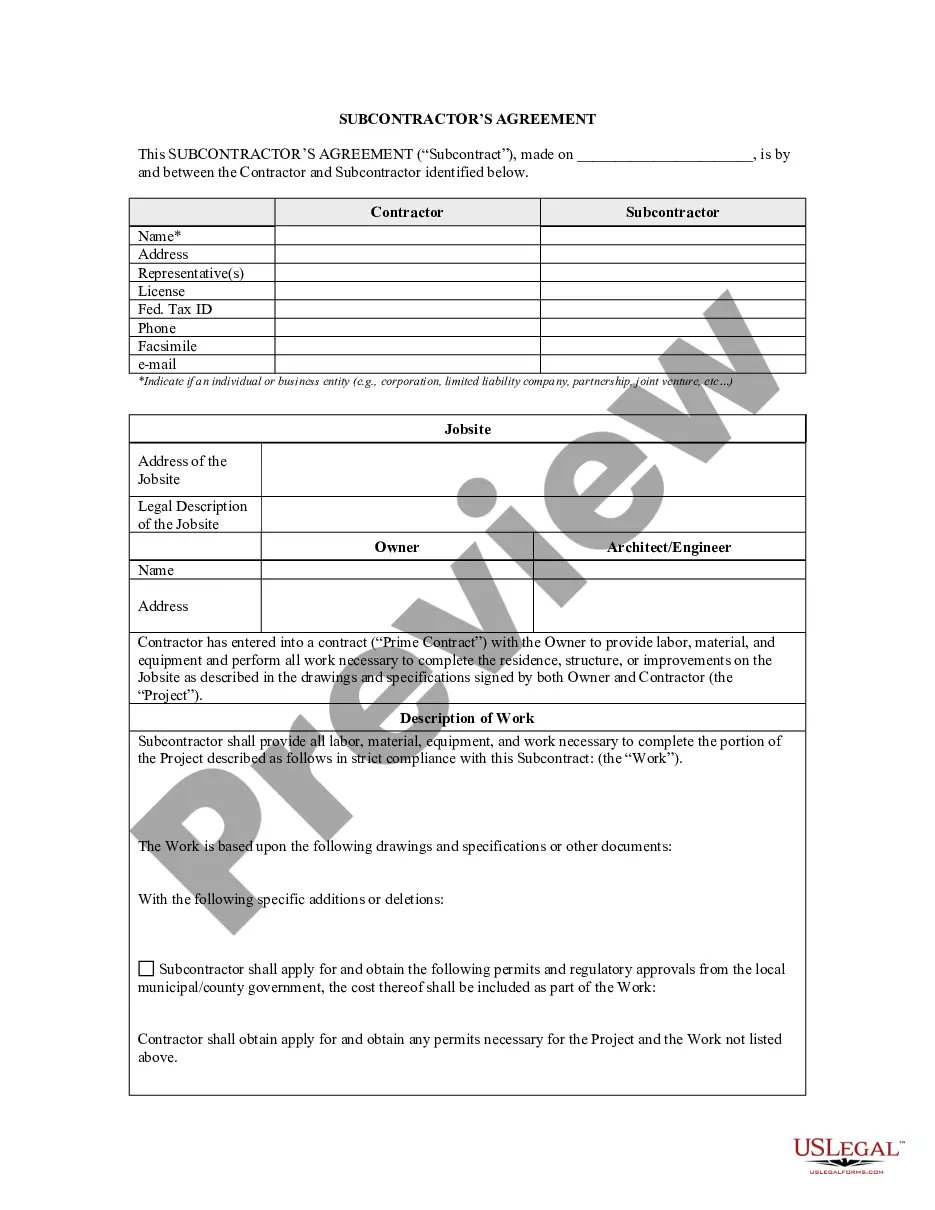

- Use the Review button to examine the form.

- Check the description to verify that you have selected the correct document.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

West Virginia Withholding Tax Account Number If you already have a WV Withholding Tax Account Number, you can find this on previous tax filings or correspondence from the WV State Tax Department. If you're unsure, contact the agency at 1-304-558-3333.

West Virginia has a 6.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 6.52 percent. West Virginia's tax system ranks 21st overall on our 2022 State Business Tax Climate Index.

Goods that are subject to sales tax in West Virginia include physical property, like furniture, home appliances, and motor vehicles. The purchase of prescription medicine, groceries and gasoline are tax-exempt.

Most businesses operating in or selling in the state of West Virginia are required to purchase a resale certificate annually. Even online based businesses shipping products to West Virginia residents must collect sales tax. Obtaining your sales tax certificate allows you to do so.

MUST EVERYONE PAY THE $30.00 BUSINESS REGISTRATION FEE? No. Any person who is engaging in any business activity in this state is required to obtain a Business Registration Certificate, but is not required to pay the $30.00 Business Registration Fee if they meet one of the following conditions. 1.

The business law exam is an open book timed test with 50 questions and a 3-hour time limit. A score of 70% is required to pass the exam.

To request the SS-4 forms to obtain a taxpayer identification number from the Internal Revenue Service, call 1-800-829-4933. You may apply for your FEIN by mail or by calling the 800 number above or by visiting the website .

The fee for obtaining a Business Registration Certificate is $30.00. A separate certificate is required for each fixed business location from which property or services are offered for sale or lease or at which customer accounts may be opened, closed, or serviced. The Business Registration fee cannot be prorated.

A sales tax certificate can be obtained by registering online through the Virginia Division of Taxation's site VATAX or by mailing in Form R-1. Information needed to register includes: Business Name. Federal Employer Identification Number (FEIN), or SSN if a sole proprietorship with no employees.

How to get a sales tax permit in West Virginia. You can complete the form WV/BUS-APP found in this booklet or register online at Business for West Virginia. You need this information to register for a sales tax permit in West Virginia: Personal identification info (SSN, address, etc.)