West Virginia Franchise Registration Renewal Questionnaire

Description

How to fill out Franchise Registration Renewal Questionnaire?

If you wish to full, obtain, or print out lawful papers templates, use US Legal Forms, the largest assortment of lawful varieties, which can be found online. Make use of the site`s simple and handy search to find the papers you will need. Numerous templates for organization and specific reasons are categorized by groups and says, or search phrases. Use US Legal Forms to find the West Virginia Franchise Registration Renewal Questionnaire in a number of clicks.

In case you are already a US Legal Forms consumer, log in to the account and then click the Obtain button to obtain the West Virginia Franchise Registration Renewal Questionnaire. You can also access varieties you formerly acquired inside the My Forms tab of the account.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for the right town/land.

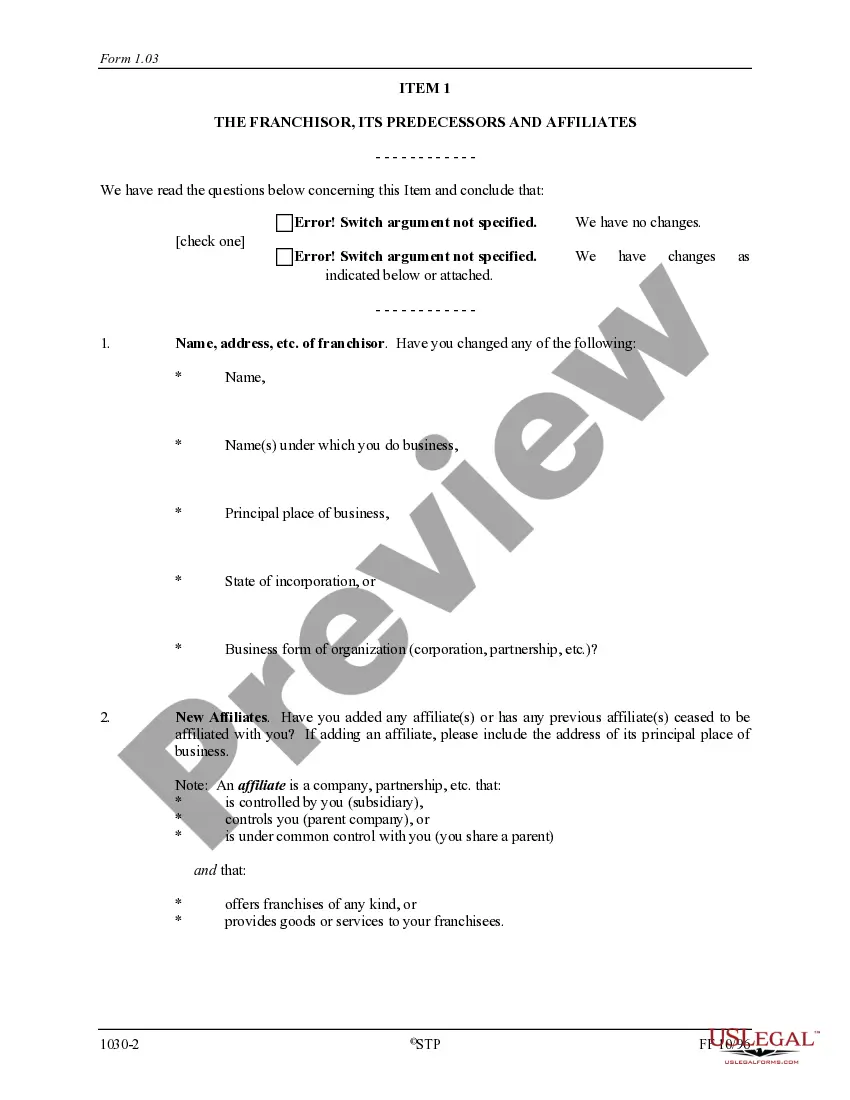

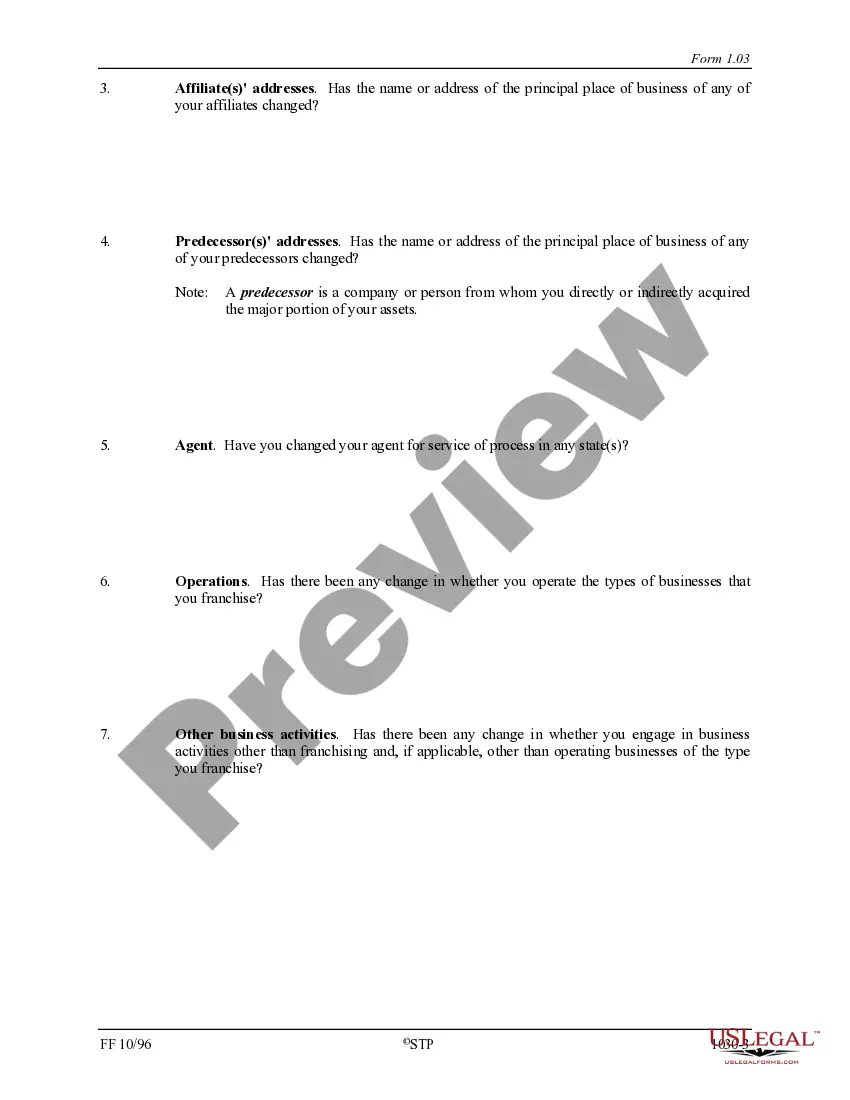

- Step 2. Use the Preview method to look over the form`s articles. Do not overlook to read through the description.

- Step 3. In case you are not happy together with the develop, make use of the Look for discipline at the top of the monitor to find other models of the lawful develop template.

- Step 4. Once you have located the shape you will need, go through the Purchase now button. Pick the prices prepare you choose and add your references to sign up to have an account.

- Step 5. Method the purchase. You may use your charge card or PayPal account to complete the purchase.

- Step 6. Pick the structure of the lawful develop and obtain it on your system.

- Step 7. Complete, modify and print out or indicator the West Virginia Franchise Registration Renewal Questionnaire.

Every single lawful papers template you purchase is the one you have eternally. You have acces to every single develop you acquired within your acccount. Click the My Forms section and choose a develop to print out or obtain yet again.

Remain competitive and obtain, and print out the West Virginia Franchise Registration Renewal Questionnaire with US Legal Forms. There are millions of specialist and express-certain varieties you may use for your organization or specific requirements.

Form popularity

FAQ

To protect taxpayer confidential identification number(s), an account number has been assigned to each tax type that the taxpayer is responsible for filing. The new WV tax account number is eight digits, specific to each individual tax type (account) and is on all documentation issued from the department.

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). You are limited to one EIN per responsible party per day.

If you are engaged in business activity, a business registration certificate can be obtained by filing an application, either through the Business for West Virginia Website or by filing a BUS-APP with the Tax Commissioner.

A business license is valid for one year starting on July 1 and ending on June 30. A business license renewal will be sent out around the first of June each year. All business licenses expire on June 30 of each year. Business license fees are not prorated.

To request the SS-4 forms to obtain a taxpayer identification number from the Internal Revenue Service, call 1-800-829-4933. You may apply for your FEIN by mail or by calling the 800 number above or by visiting the website .irs.gov.

All inquiries about tax returns should be directed to one of the Regional Office Locations listed below or by calling 304-558-3333 or 800-982-8297 during regular business hours.

West Virginia requires all business entities and individuals to obtain a business registration certificate from the State Tax Department before doing business in the state. This certificate (sometimes referred to as a ?business license?) is needed for each business location.