West Virginia Contract with Independent Contractor for Systems Programming and Related Services

Description

How to fill out Contract With Independent Contractor For Systems Programming And Related Services?

It is feasible to spend hours online searching for the legal document template that meets the federal and state criteria you require.

US Legal Forms offers a vast array of legal forms that have been reviewed by experts.

You can download or print the West Virginia Contract with Independent Contractor for Systems Programming and Related Services from our service.

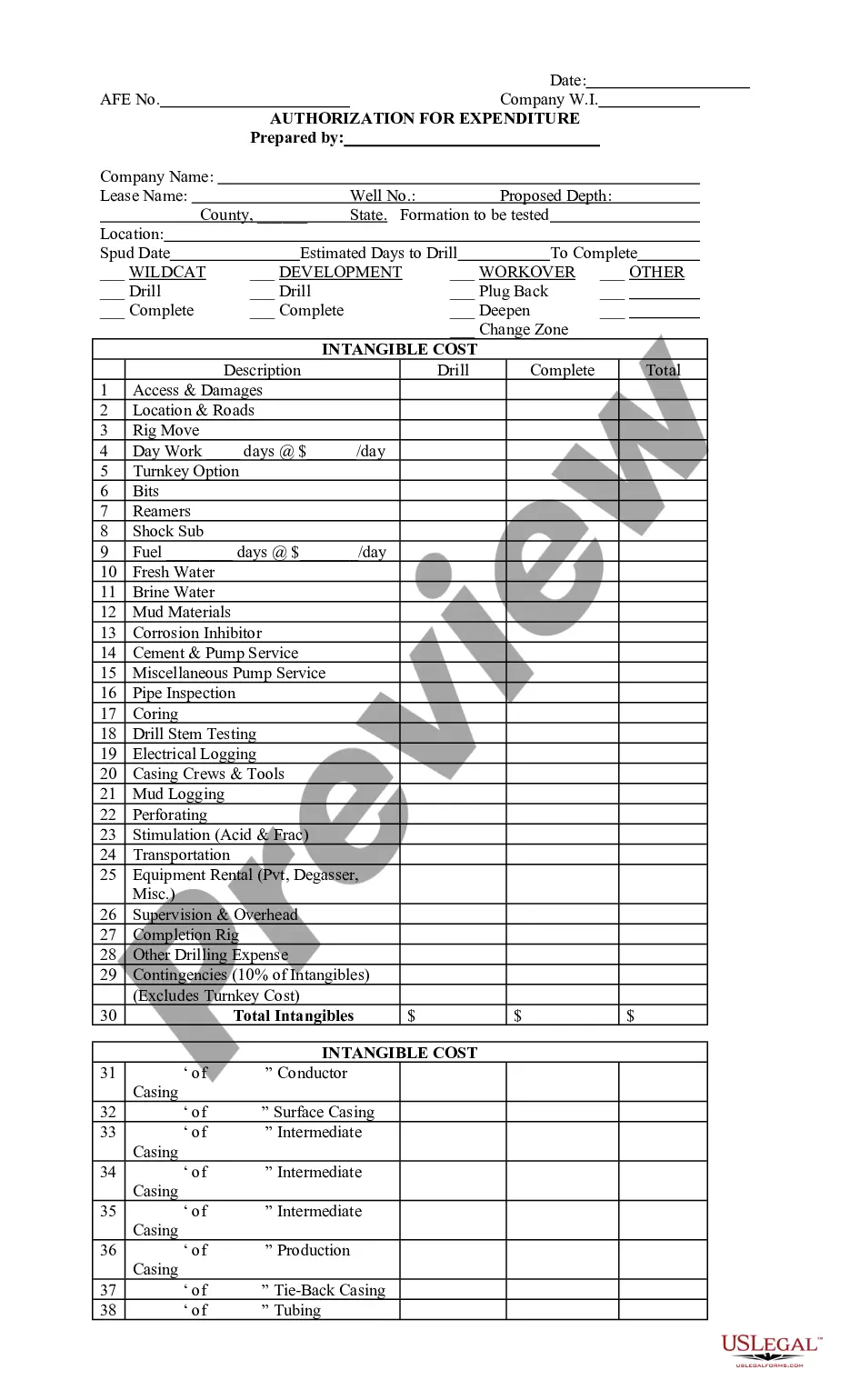

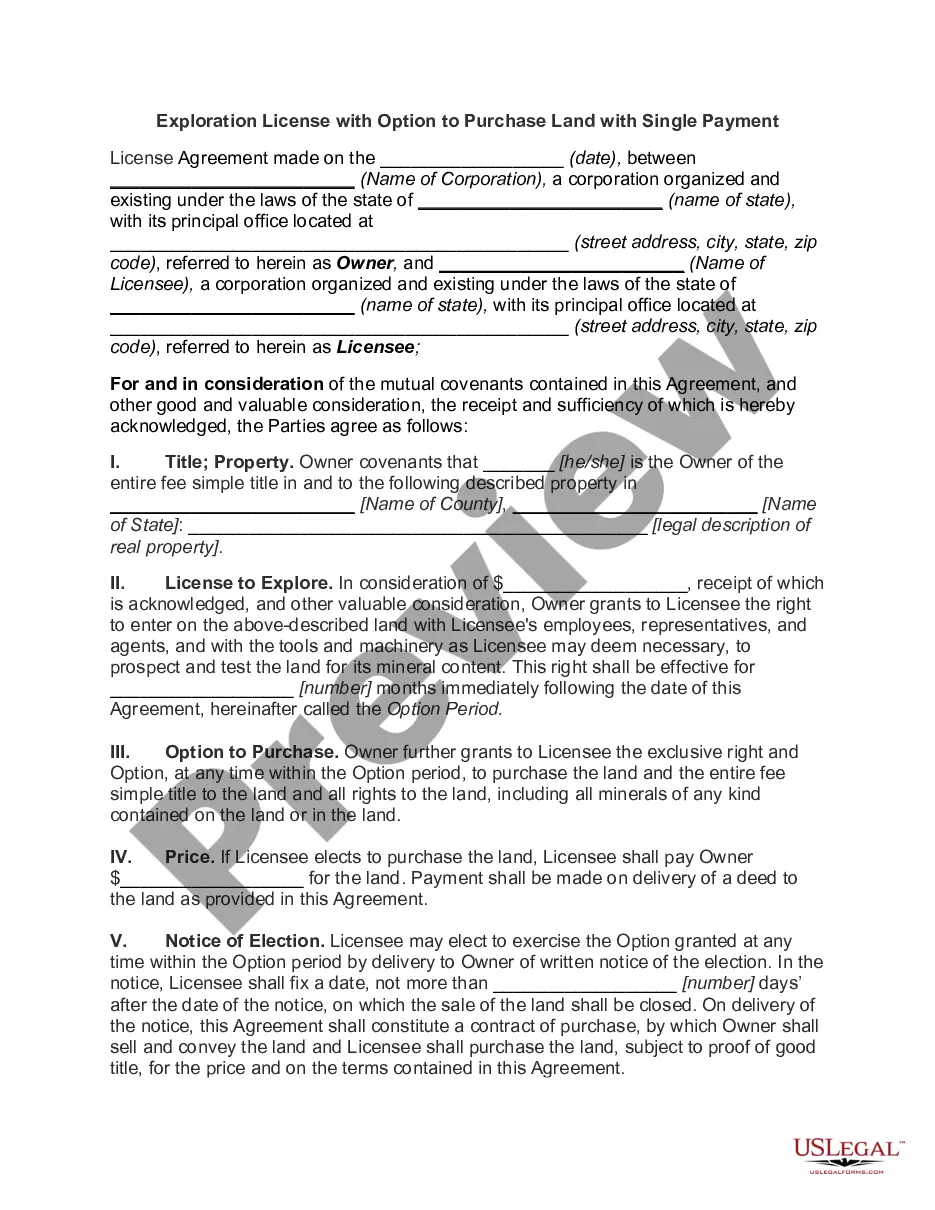

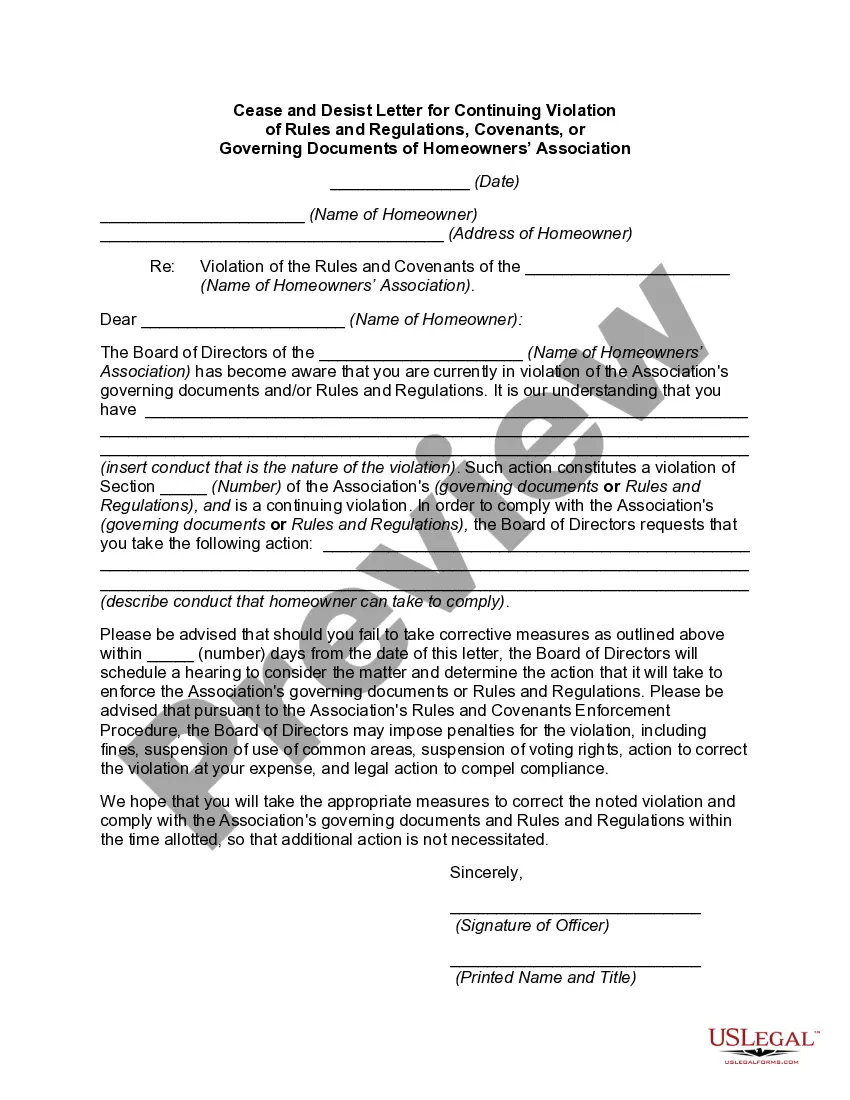

If available, utilize the Preview button to browse through the document template as well.

- If you already have a US Legal Forms account, you may Log In and click the Download button.

- Afterward, you can complete, modify, print, or sign the West Virginia Contract with Independent Contractor for Systems Programming and Related Services.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/town you choose.

- Check the form details to make sure you have selected the right form.

Form popularity

FAQ

Writing an independent contractor agreement involves outlining the specific services to be provided, payment terms, and the duration of the contract. Be sure to include clauses that address confidentiality, ownership of work, and termination conditions. This ensures clarity for both parties, especially when dealing with a West Virginia Contract with Independent Contractor for Systems Programming and Related Services. You can use USLegalForms to find suitable templates and ensure that your agreement complies with local laws.

An employee usually has no investment in the work other than his or her own time. An independent contractor often has a significant investment in the facilities he or she uses in performing services for someone else. However, a significant investment is not necessary for independent contractor status.

For purposes of determining whether a worker is an independent contractor or an employee, the most important factor to the IRS is: the degree of control the business exercises over the worker.

How to write an employment contractTitle the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.

Generally, to be legally valid, most contracts must contain two elements:All parties must agree about an offer made by one party and accepted by the other.Something of value must be exchanged for something else of value. This can include goods, cash, services, or a pledge to exchange these items.

When deciding whether you can safely treat a worker as an independent contractor, there are two separate tests you should consider: The common law test; and The reasonable basis test. The common law test: IRS examiners use the 20-factor common law test to measure how much control you have over the worker.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

Some of the common characteristics of an independent contractor include:Furnishes equipment and has control over that equipment.Submits bids for jobs, contracts, or fixes the price in advance.Has the capacity to accept or refuse an assignment or work.Pay relates more to completion of a job.More items...

A business may pay an independent contractor and an employee for the same or similar work, but there are important legal differences between the two. For the employee, the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor, the company does not withhold taxes.

Specific Contract Terms To Include Pay and benefits: Give details of pay rate, pay dates, and benefits provided by the company. Full-time employment: The employee must agree to devote their best efforts to the company's business, not doing work for anyone else during work hours without prior approval.