Many so-called nonprofits are simply groups of people who come together to perform some social good. These informal groups are called unincorporated nonprofit associations. An unincorporated nonprofit association may be subject to certain legal requirements, even though it hasn't filed for incorporation under its state's incorporation laws. For example, an unincorporated association will generally need to file tax returns, whether as a taxable or tax-exempt entity. Additionally, there may be state registration requirements.

West Virginia Articles of Association of Unincorporated Church Association

Description

How to fill out Articles Of Association Of Unincorporated Church Association?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are many trustworthy document templates available online, yet finding reliable ones is not straightforward.

US Legal Forms provides a vast array of form templates, including the West Virginia Articles of Association of Unincorporated Church Association, which can be completed to satisfy state and federal requirements.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the West Virginia Articles of Association of Unincorporated Church Association anytime if needed. Just select the necessary form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the West Virginia Articles of Association of Unincorporated Church Association template.

- If you lack an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

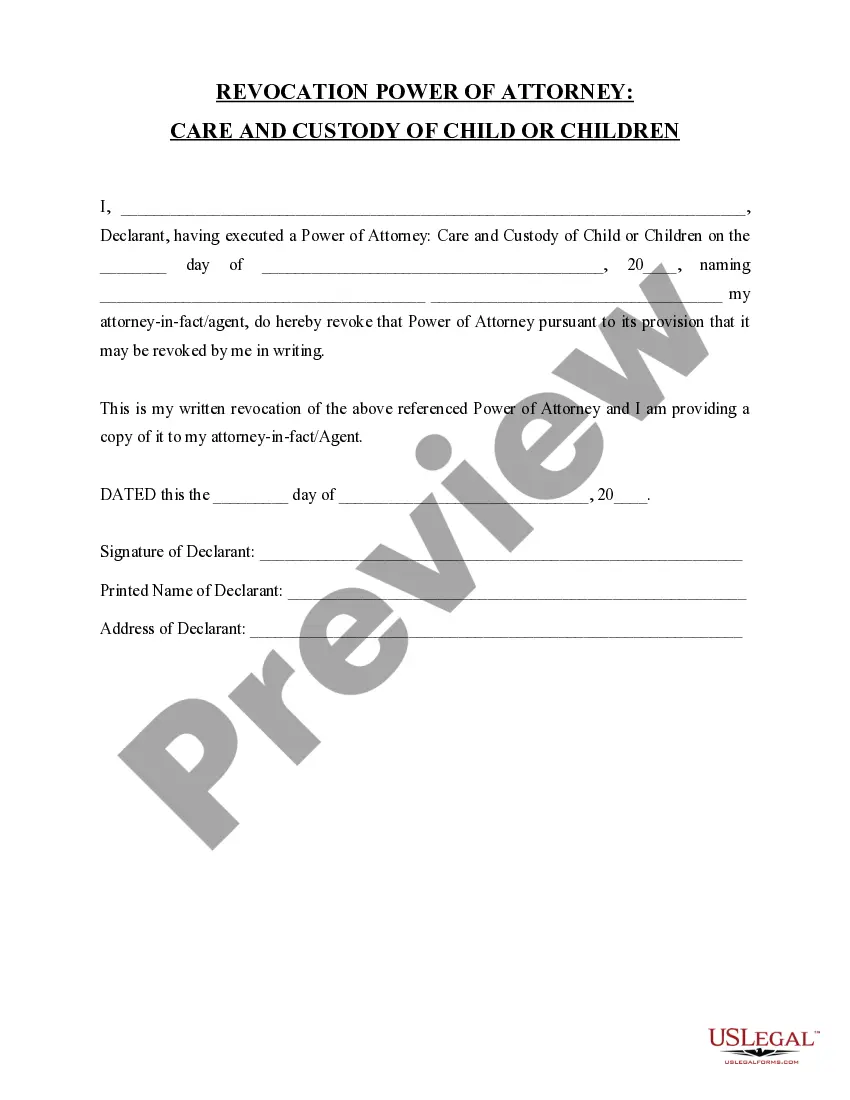

- Utilize the Preview option to review the form.

- Examine the description to confirm you have chosen the correct document.

- If the form isn’t what you're seeking, use the Lookup field to find a form that fulfills your needs and requirements.

- When you locate the appropriate form, click Acquire now.

- Select the pricing plan you desire, complete the required information to create your account, and pay for your order using your PayPal or credit card.

Form popularity

FAQ

Yes, churches can incorporate in West Virginia. Incorporation provides legal advantages, such as limited liability and eligibility for tax-exempt status. For those considering this option, it's vital to draft the appropriate documents, including the West Virginia Articles of Association of Unincorporated Church Association, to ensure compliance and protection.

The Flick Amendment addressed and modernized certain provisions in the West Virginia Constitution. It primarily aimed to bring clarity and efficiency to various legal processes. Changes like these can influence churches' operational procedures, particularly for those interested in the West Virginia Articles of Association of Unincorporated Church Association.

Yes, West Virginia has enacted constitutional carry laws, allowing individuals to carry firearms without a permit. This change reflects a broader trend towards gun rights within the state. The implications of these laws can impact various organizations, including those drafting West Virginia Articles of Association of Unincorporated Church Association, especially related to safety and community policies.

A church can exist as either a corporation or an unincorporated association, depending on its legal structure. While many churches choose to incorporate for liability protection, others may remain unincorporated. Understanding the distinctions is crucial, especially when preparing West Virginia Articles of Association of Unincorporated Church Association.

Yes, West Virginia is a legally created state. It was formed through an act of separation from Virginia, which occurred with approval from Congress. This incorporation is important for organizations like unincorporated church associations, especially relating to the West Virginia Articles of Association of Unincorporated Church Association.

No, West Virginia's statehood is not unconstitutional. The creation of West Virginia followed a lawful process during the Civil War. As a result, the legislature and Congress both recognized West Virginia's status as a state. Understanding the legal foundations can help you navigate matters like the West Virginia Articles of Association of Unincorporated Church Association.

Unincorporated associations are not recognized as separate legal entities, which means their members may face potential liabilities. This status can influence various operational aspects, including taxation and legal protections. Therefore, when drafting and examining the West Virginia Articles of Association of Unincorporated Church Association, always consider the implications for personal liability and organization structure.

Generally, an association is not considered a legal entity unless it is formally incorporated. This means the group does not have the legal standing to enter contracts or own property independently. When referencing the West Virginia Articles of Association of Unincorporated Church Association, it's important for church groups to understand these legal challenges they may face.

An example of an unincorporated association could include a social club or a community group that operates under shared goals without formal registration. Many churches operate as unincorporated associations, especially before they file the West Virginia Articles of Association of Unincorporated Church Association. Such groups often serve their areas while enjoying flexibility in their operations.

An unincorporated association itself does not qualify as a separate legal entity, which means members can be personally liable for the organization's debts. This contrasts with incorporated entities, which provide protection to their members. If you're using the West Virginia Articles of Association of Unincorporated Church Association, be aware of these legal implications when managing liability.