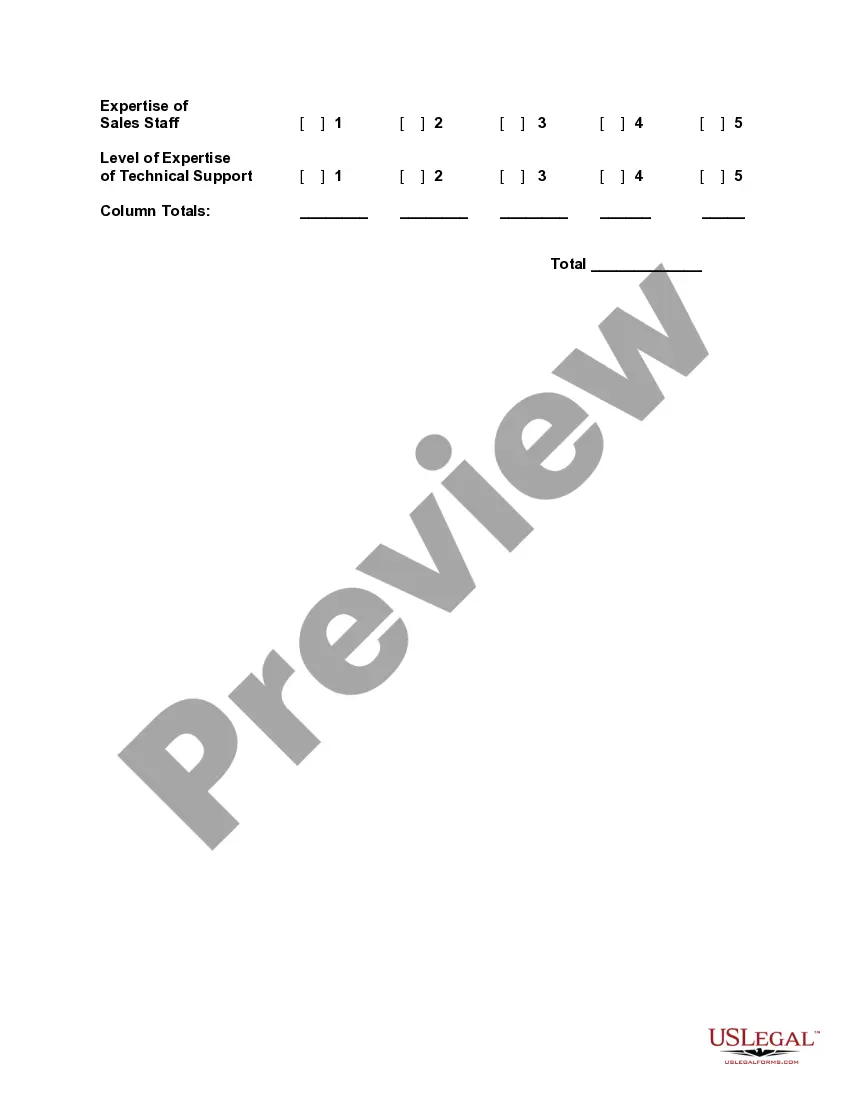

West Virginia Vendor Evaluation

Description

How to fill out Vendor Evaluation?

Selecting the optimal legitimate document design can be challenging.

Clearly, there are numerous templates accessible online, but how can you locate the correct form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the West Virginia Vendor Evaluation, which you can employ for business and personal needs.

You can preview the form by using the Preview button and read the form description to confirm that this is the right one for you.

- All forms are reviewed by professionals and comply with state and federal requirements.

- If you are already registered, Log In to your account and click on the Download button to access the West Virginia Vendor Evaluation.

- Use your account to search for the legal forms you have previously ordered.

- Visit the My documents tab in your account to obtain another copy of the document you need.

- For new users of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

The top five commodities in West Virginia include coal, natural gas, timber, agriculture products, and chemical manufacturing. Each commodity plays a unique role in the state’s economy and job market. When performing a West Virginia Vendor Evaluation, it’s crucial to consider how these commodities influence supplier options and market demands.

West Virginia's largest industry is the energy sector, primarily driven by coal, natural gas, and renewable sources. This industry provides vital employment and revenue, making it a focal point for economic growth. For those conducting a West Virginia Vendor Evaluation, recognizing the significance of the energy sector can lead to strategic supplier contracts and partnerships.

The main food in West Virginia features hearty meals that reflect the state's rich culinary heritage. Staple dishes often include pepperoni rolls, biscuits, and various regional comfort foods. In a West Virginia Vendor Evaluation, analyzing local cuisine can enhance partnerships with food suppliers, ensuring authenticity and quality.

The top commodity in West Virginia is coal, which plays a significant role in the state's economy. This resource not only fuels energy production but also supports numerous jobs across various sectors. When considering a West Virginia Vendor Evaluation, it’s essential to understand how coal impacts local markets and supplier capabilities.

Yes, West Virginia requires a seller's permit for businesses engaging in retail sales within the state. This permit allows you to collect sales tax from customers. Having a seller's permit also demonstrates your business's compliance with state regulations, which is beneficial for long-term success.

Registering a remote vendor in West Virginia involves submitting your business information to the West Virginia State Tax Department. This registration is crucial because it ensures your business can operate legally while collecting and remitting sales tax. Knowing the steps can simplify your entry into the market.

To register a remote seller in West Virginia, you must complete the state's online registration process through the West Virginia State Tax Department. This process involves providing necessary business information and understanding tax obligations. Proper registration is vital for compliance in the evolving landscape of online sales.

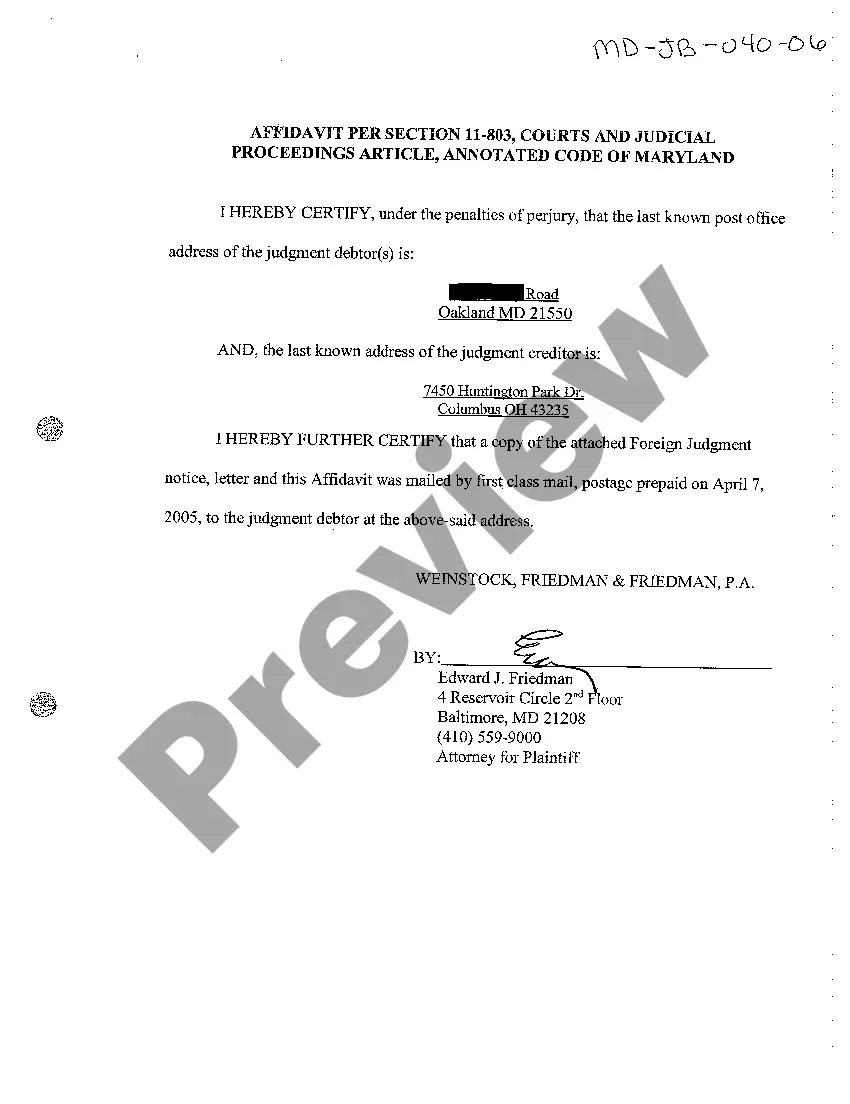

West Virginia Code 5A 3 12 outlines the procedures and requirements for vendor evaluations in the state. This law helps ensure that all vendors participating in government contracts meet specific standards of quality and compliance. Familiarity with this code is vital for vendors looking to engage with state procurement processes.

A transient vendor in West Virginia refers to a seller who temporarily conducts business in the state, typically at fairs, festivals, or similar events. These vendors may sell goods or services without establishing a permanent business location. Understanding the regulations surrounding transient vendors is crucial for compliance and successful operations.

Yes, if you plan to sell online in West Virginia, obtaining a business license is essential. This requirement helps ensure that your business complies with state laws. Additionally, a proper license can enhance your credibility and establish trust with potential customers.