West Virginia Software Installation Agreement between Seller and Independent Contractor

Description

An independent contractor is a person or business who performs services for another person pursuant to an agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The exact nature of the independent contractor's relationship with the hiring party is important since an independent contractor pays his/her own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

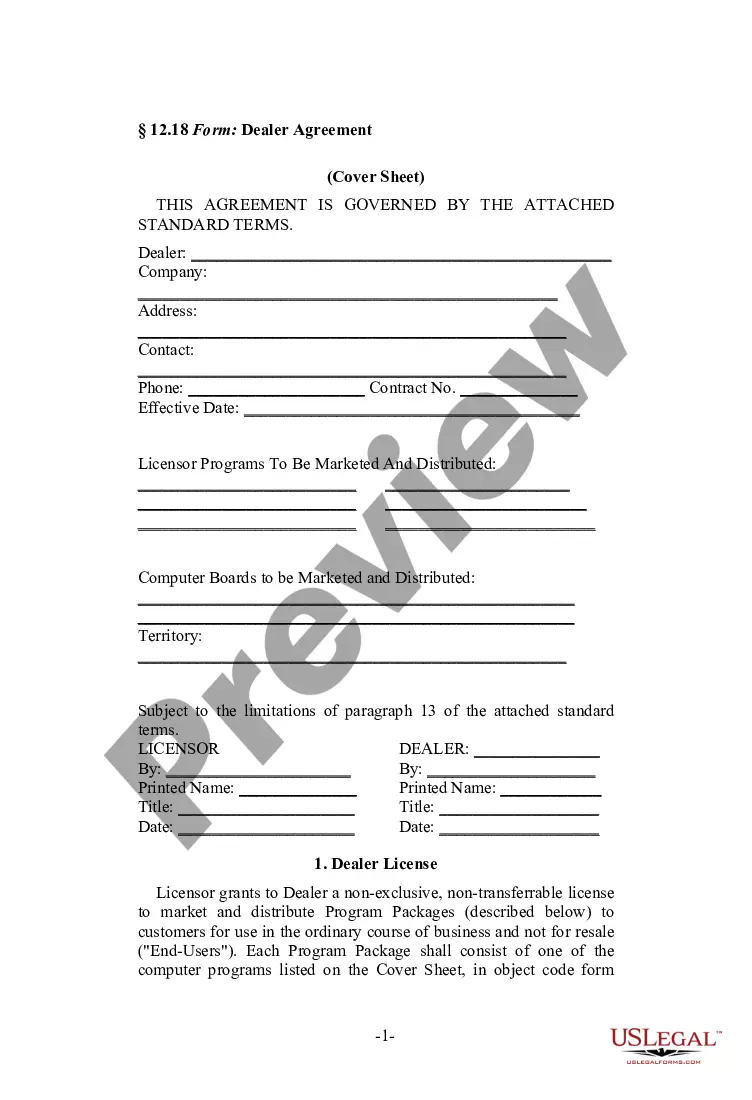

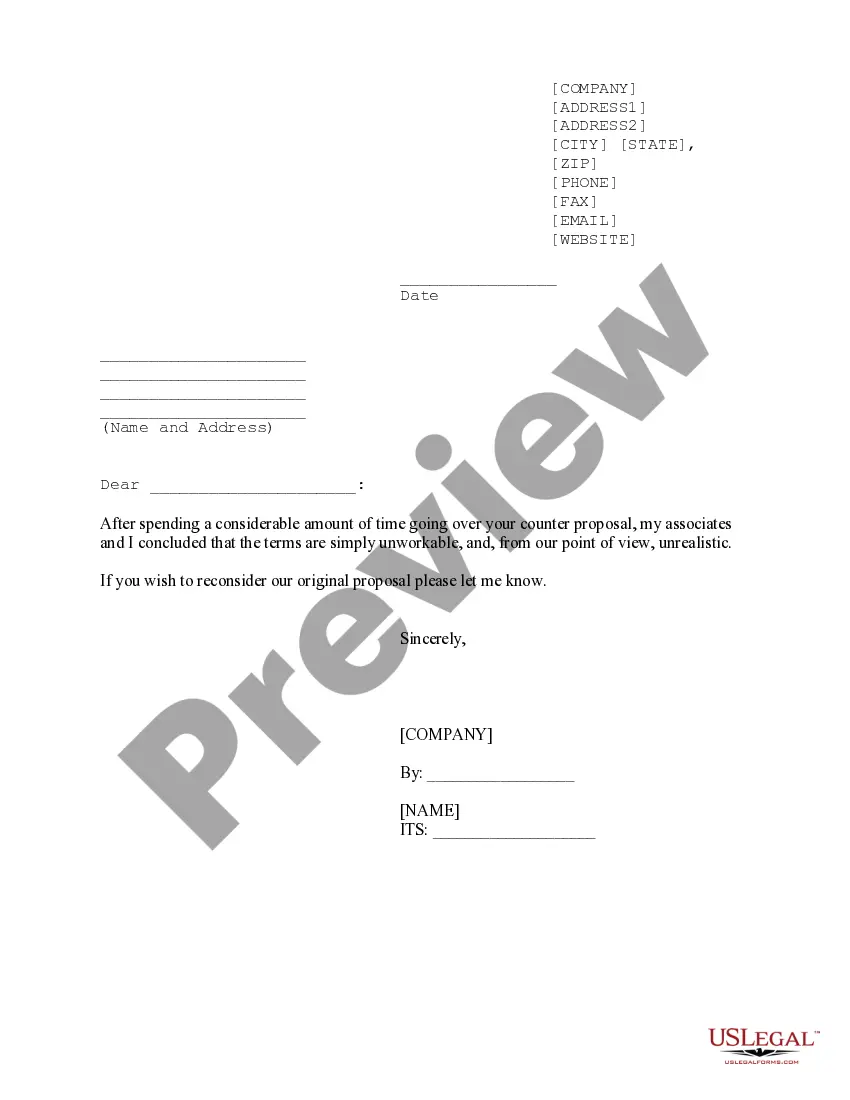

How to fill out Software Installation Agreement Between Seller And Independent Contractor?

You might spend hours online searching for the sanctioned document template that meets the local and national requirements you need.

US Legal Forms provides a vast array of legal forms that have been reviewed by professionals.

It’s easy to download or print the West Virginia Software Installation Agreement between Seller and Independent Contractor from our service.

If you wish to find another version of the form, use the Search field to locate the template that suits your needs.

- If you have a US Legal Forms account, you can Log In and click on the Download button.

- Next, you can complete, modify, print, or sign the West Virginia Software Installation Agreement between Seller and Independent Contractor.

- Every legal document template you purchase is yours permanently.

- To access another copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the appropriate document template for the area/town of your choice.

- Review the form details to confirm you have chosen the correct document. If available, use the Review button to view the document template as well.

Form popularity

FAQ

The 2 year contractor rule refers to a guideline for independent contractors related to their business activities and how they must operate in compliance with tax laws. For contracts like the West Virginia Software Installation Agreement between Seller and Independent Contractor, it highlights how contractors should manage their status over a two-year period. Understanding this rule helps prevent misclassification issues with tax authorities.

Independent contractors need to fill out several forms, the most critical of which is the W-9 for tax purposes. For work relationships, having a West Virginia Software Installation Agreement between Seller and Independent Contractor is essential to define the responsibilities and expectations. Additionally, contractors should maintain proper invoicing records to simplify payment processes.

To create a simple contract agreement, start by clearly stating the names of the parties involved, the scope of the work, and payment terms. Ensure you incorporate a West Virginia Software Installation Agreement between Seller and Independent Contractor that specifies timelines, deliverables, and any confidentiality clauses. Always end the agreement with signatures from both parties to signify agreement.

Independent contractors typically need to complete a W-9 form to provide their taxpayer information. It's also essential to have a signed West Virginia Software Installation Agreement between Seller and Independent Contractor to outline the terms of the engagement. In addition, depending on the nature of the work, other documents like invoices may be necessary to keep records of payments.

To set up an independent contractor agreement, you first need to outline the scope of work. Clearly define the roles and responsibilities of both the seller and the independent contractor. It’s essential to include payment terms, deadlines, and any applicable legal considerations. Utilizing a West Virginia Software Installation Agreement between Seller and Independent Contractor can simplify this process, ensuring that all parties are protected and the terms are clearly stated.

Several items and services are exempt from sales tax in West Virginia, including certain educational materials, agricultural supplies, and specific manufacturing inputs. Services provided under a West Virginia Software Installation Agreement between Seller and Independent Contractor may also be exempt under certain conditions. It is important to consult with a tax professional to navigate these exemptions effectively and ensure your business transactions align with existing tax laws.

Software is generally taxable in West Virginia, unless it qualifies for specific exemptions. This can include cases where software is customized or installed as part of a service agreement. If you engage in a West Virginia Software Installation Agreement between Seller and Independent Contractor, be aware of the tax implications that may apply to your software products. Staying informed about tax regulations can help you remain compliant and avoid unexpected costs.

Yes, software sales are typically subject to sales tax in West Virginia. This includes both tangible software and digital downloads. When executing a West Virginia Software Installation Agreement between Seller and Independent Contractor, it is crucial to understand if the transaction involves taxable software sales. Proper documentation and adherence to tax laws can help avoid complications.

Software as a Service (SaaS) is generally considered taxable in West Virginia. However, the tax implications can depend on the specifics of the service and how it's delivered. If you enter into a West Virginia Software Installation Agreement between Seller and Independent Contractor, it is essential to clarify these details to ensure compliance. Consulting with legal and tax professionals can provide better insights into your specific situation.

In West Virginia, certain items are not subject to sales tax. These include groceries, prescription drugs, and some medical equipment. Additionally, services like the installation of software under a West Virginia Software Installation Agreement between Seller and Independent Contractor may fall into non-taxable categories, depending on specific conditions. Understanding these exemptions helps businesses comply with tax regulations.