West Virginia Equity Share Agreement

Description

How to fill out Equity Share Agreement?

You can spend time on the internet trying to find the legal document template that meets the federal and state standards you require.

US Legal Forms offers thousands of legal documents that have been evaluated by experts.

You can easily download or print the West Virginia Equity Share Agreement from the service.

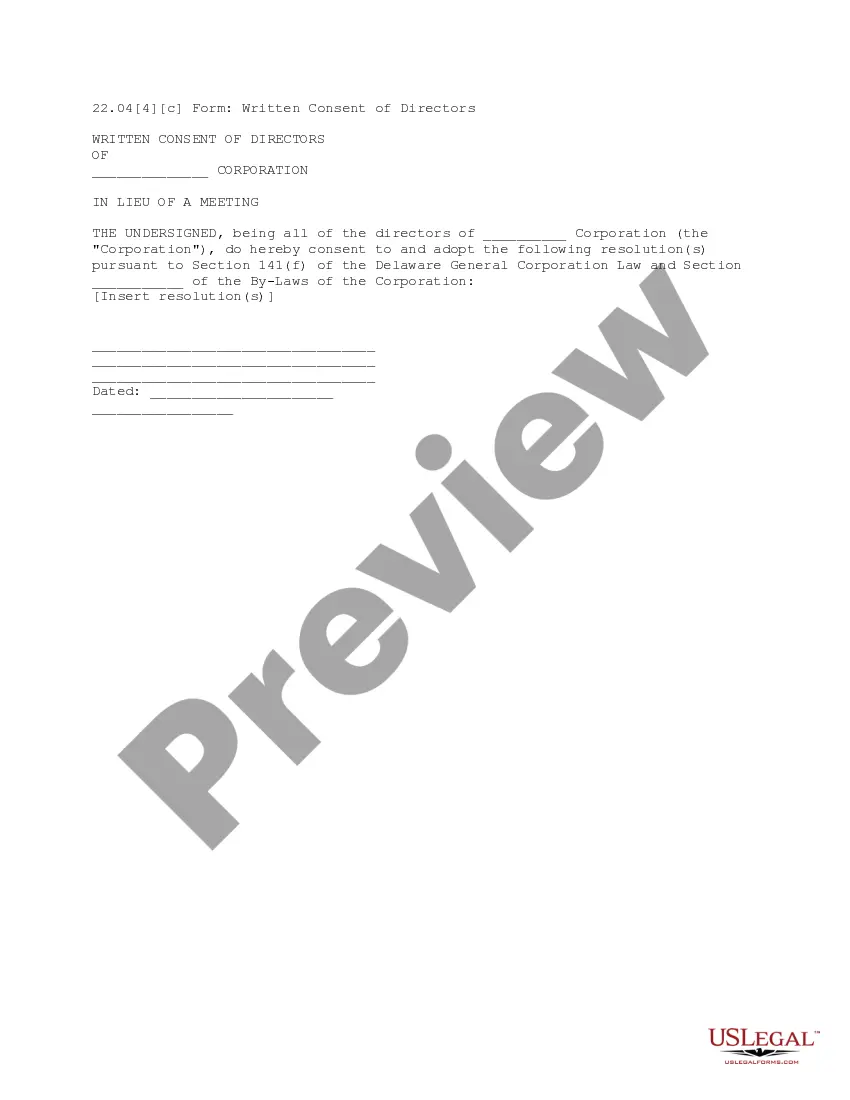

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, edit, print, or sign the West Virginia Equity Share Agreement.

- Every legal document template you purchase is your property for a long time.

- To obtain another copy of the purchased document, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure you have selected the correct document template for your chosen state/city.

- Review the document description to confirm you have selected the right document.

Form popularity

FAQ

Home equity agreements can be a smart choice for homeowners in West Virginia. With a West Virginia Equity Share Agreement, you can access a portion of your home's equity without incurring additional debt. This agreement allows you to receive funds for various needs, such as home improvements or debt consolidation, while still maintaining ownership of your property. Evaluating your unique financial situation will help you determine if this option aligns with your long-term goals.

To secure a home equity agreement, start by assessing your home’s value and equity. Next, look for reputable services, such as US Legal Forms, that specialize in West Virginia Equity Share Agreements. They provide necessary documents and guidance throughout the process to ensure all legal requirements are met. Finally, review your options and select a plan that best fits your financial needs and long-term goals.

Investing in a home equity agreement can be a beneficial option for many homeowners seeking additional funds. It allows you to leverage your home's value without taking on additional monthly debt payments, making it an appealing choice. Specifically, with a West Virginia Equity Share Agreement, you can access funds while enjoying the financial flexibility that comes with sharing future appreciation or equity with investors. Always evaluate your financial situation to see if this aligns with your goals.

Choosing the right lender for a West Virginia Equity Share Agreement can significantly impact your financial journey. Consider lenders that offer competitive rates, transparent terms, and excellent customer service. It’s essential to research and compare options to find a lender that suits your needs. Tools like the US Legal Forms platform can help you navigate through various lenders and their offerings.

Dave Ramsey often advises caution regarding a West Virginia Equity Share Agreement. He emphasizes the importance of understanding the long-term implications of sharing your home's equity. An informed approach and thorough consideration of alternatives can guide you in making a wise financial decision, ultimately leading to greater stability.

The negatives of a West Virginia Equity Share Agreement include possible complications during resale and losing some equity growth. Additionally, agreements may come with upfront fees and other costs that could outweigh the initial benefits. Understanding these aspects ensures that you make an informed decision.

Typically, a West Virginia Equity Share Agreement can take around 20% to 30% of the home's future appreciation at the time of sale. This percentage can vary based on the specific terms outlined in the agreement. Therefore, before committing, it's wise to read the contract carefully and consult a legal expert if needed.

One disadvantage of a West Virginia Equity Share Agreement is the potential loss of a portion of your home's future appreciation. Additionally, you must share the profits when you sell your home, which may be less appealing than keeping all the equity. It's essential to consider these factors alongside potential financial gains to understand the full impact.

A West Virginia Equity Share Agreement can be beneficial depending on your financial situation. It allows homeowners to access funds without taking on additional debt. However, you should assess your current needs and long-term goals before deciding. Consulting with a financial advisor can provide clarity on whether this type of agreement aligns with your plans.