West Virginia Marketing and Participating Internet Agreement

Description

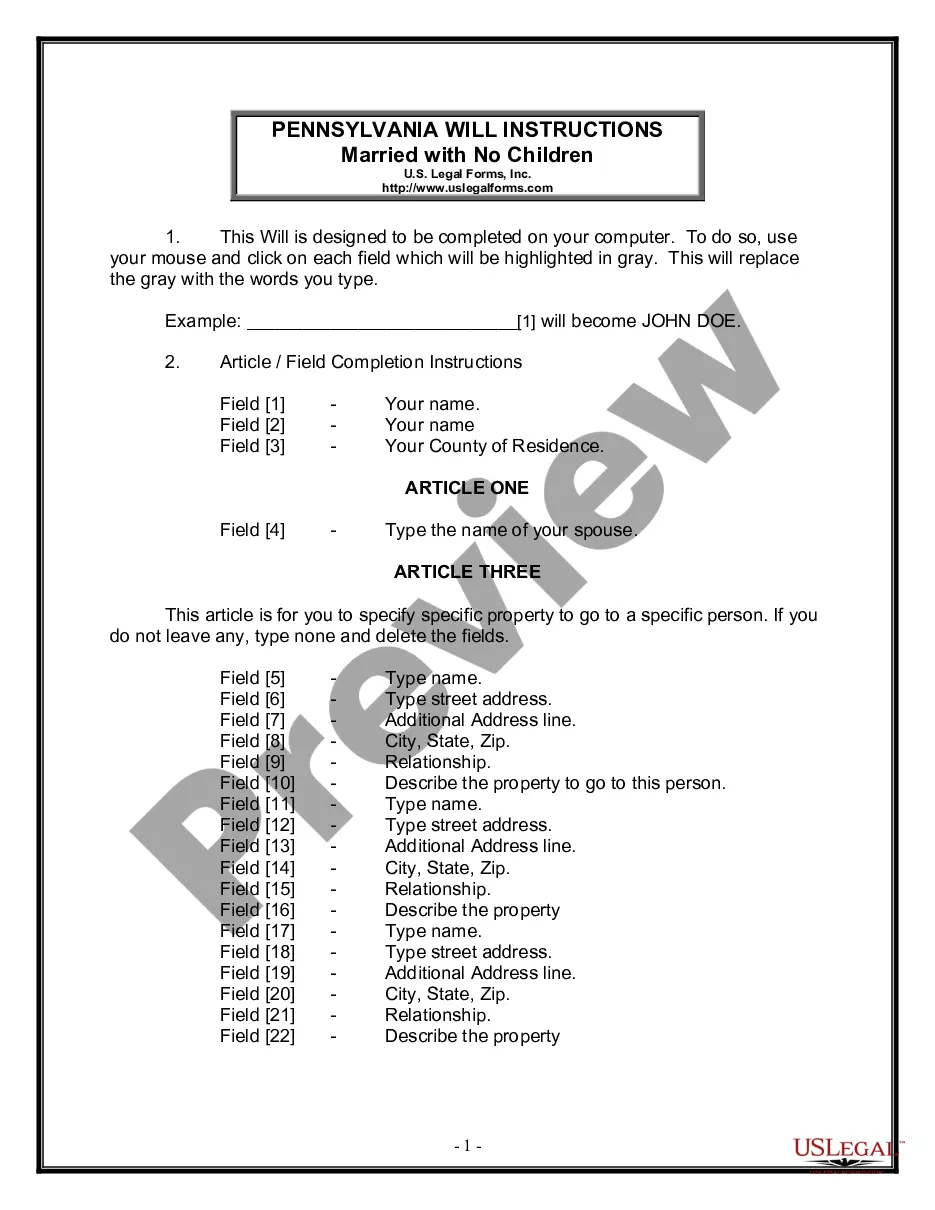

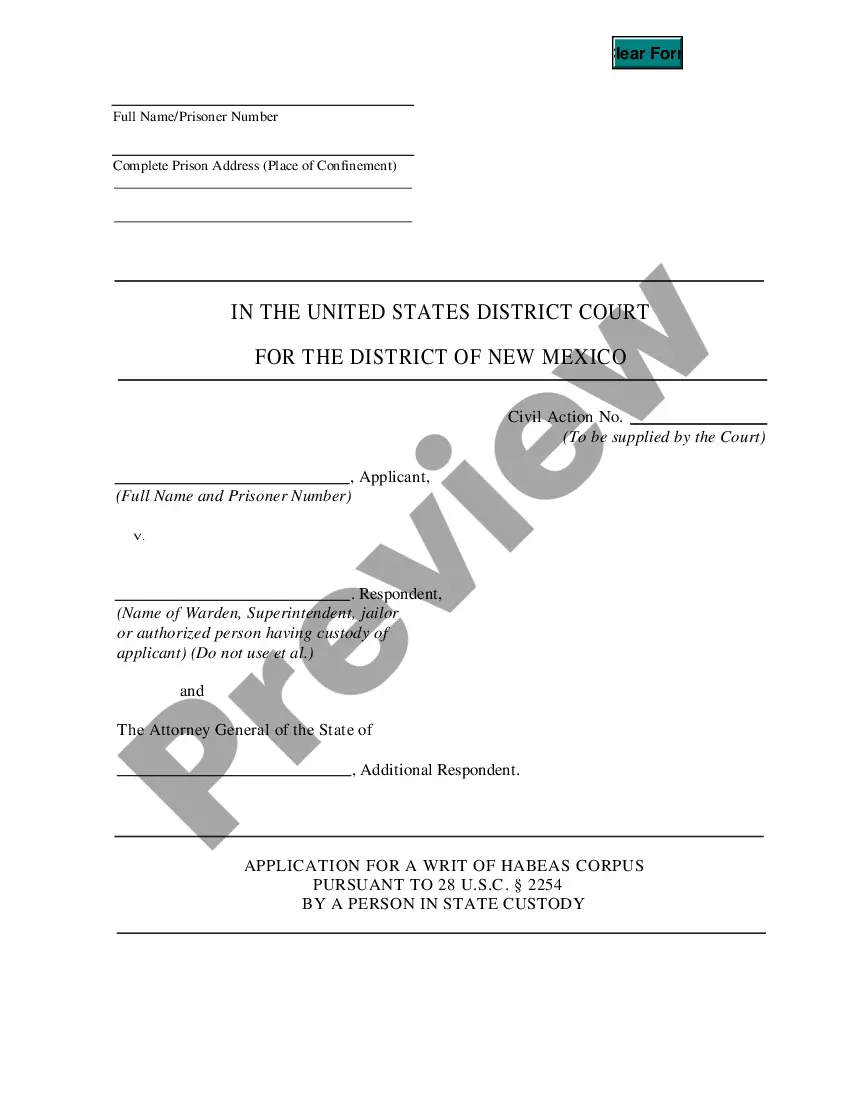

How to fill out Marketing And Participating Internet Agreement?

If you desire to complete, acquire, or create legal document formats, utilize US Legal Forms, the largest collection of legal documents, which can be accessed online.

Employ the site`s user-friendly and convenient search feature to find the documents you require.

Various templates for business and personal uses are organized by categories and states, or keywords.

Step 4. Once you have located the form you want, click the Purchase now button. Choose the pricing plan you prefer and enter your information to register for the account.

Step 5. Complete the purchase. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Use US Legal Forms to locate the West Virginia Marketing and Participating Internet Agreement with a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to receive the West Virginia Marketing and Participating Internet Agreement.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Review function to browse the form`s content. Don`t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search section at the top of the screen to find alternative types of the legal form format.

Form popularity

FAQ

The WV IT 104 is the specific form used by residents of West Virginia to file state income taxes. This form is crucial for reporting your income and calculating the taxes owed. Utilizing resources like uslegalforms can help simplify the process, ensuring you're in compliance with the West Virginia Marketing and Participating Internet Agreement.

If you earn income in West Virginia, you are required to file a WV state tax return. This requirement applies to residents and non-residents with income sourced from West Virginia. Filing your return correctly ensures adherence to the West Virginia Marketing and Participating Internet Agreement, providing peace of mind in your financial activities.

Yes, if you plan to sell online in West Virginia, you will typically need a business license. E-commerce businesses must adhere to state regulations concerning commerce and taxation. Acquiring the correct licenses ensures your business operates legally under the West Virginia Marketing and Participating Internet Agreement.

Form 104 refers to the primary tax form used to file personal income taxes in the United States, while WV IT 104 is the state-specific version for West Virginia. This form breaks down your income, allowing you to determine your tax obligations efficiently. Understanding the intricacies of these forms is vital for anyone engaging in activities linked to the West Virginia Marketing and Participating Internet Agreement.

The personal exemption in West Virginia allows taxpayers to reduce their taxable income by a specified amount for themselves and their dependents. This reduction helps lower your overall tax liability, making it easier to comply with regulations. Staying informed about personal exemptions is essential when navigating the West Virginia Marketing and Participating Internet Agreement.

To obtain a WV business license, start by visiting the West Virginia Secretary of State's website, where you'll find resources tailored for business owners. You may need to register your business entity and apply for a license specific to your industry. Understanding the licensing requirements will help you stay compliant and tap into opportunities under the West Virginia Marketing and Participating Internet Agreement.

The WV IT 104 form is used by West Virginia residents to file their personal income taxes. It allows you to report your income, calculate your tax liability, and claim any applicable credits or deductions. By using this form, you can ensure compliance with the tax requirements under the West Virginia Marketing and Participating Internet Agreement.

To register a foreign LLC in West Virginia, you must file an application with the Secretary of State along with a Certificate of Existence from your home state. This process ensures that your business complies with local laws. Utilizing resources like uslegalforms can simplify the registration process, making it easier to integrate your foreign LLC into the West Virginia Marketing and Participating Internet Agreement landscape.

The lookback period for the Voluntary Disclosure Agreement (VDA) sales tax in West Virginia is typically three years. This means that businesses can request waivers for penalties and interest for sales taxes owed in that timeframe. Understanding this period is important for compliance and financial planning, especially if your business strategy involves the West Virginia Marketing and Participating Internet Agreement.

Yes, most businesses in West Virginia require a business license to operate legally. This license ensures that your business adheres to local regulations and standards. If you're considering launching a business that relates to the West Virginia Marketing and Participating Internet Agreement, obtaining this license is a crucial first step.