West Virginia Debt Agreement

Description

How to fill out Debt Agreement?

If you want to finalize, acquire, or create authentic document templates, utilize US Legal Forms, the largest selection of valid forms available online.

Leverage the site's straightforward and user-friendly search to find the documents you need.

Various templates for commercial and personal purposes are categorized by types and titles, or keywords.

Each legal document template you acquire is yours indefinitely. You have access to every form you downloaded within your account. Go to the My documents section and choose a form to print or download again.

Complete and download, and print the West Virginia Debt Agreement with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

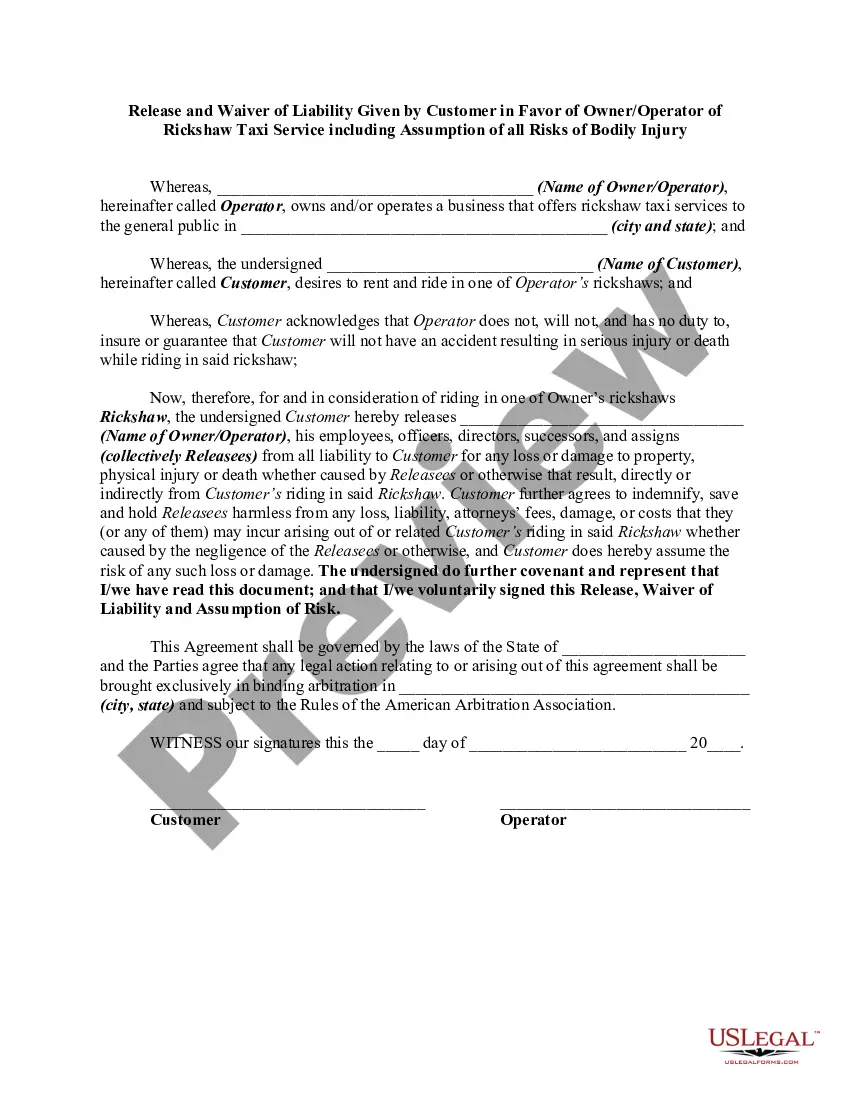

- Step 1: Ensure you have selected the form for the correct state/city.

- Step 2: Utilize the Review option to examine the form's content. Don't forget to read the summary.

- Step 3: If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4: Once you have located the form you need, click on the Acquire now option. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5: Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6: Select the format of your legal document and download it to your device.

- Step 7: Fill out, modify, and print or sign the West Virginia Debt Agreement.

Form popularity

FAQ

The relationship between Virginia and West Virginia has been complex since West Virginia's formation in 1863. Economic interests, political disagreements, and regional differences fueled the split. Understanding this history can help you appreciate contemporary issues, including those involving debts and West Virginia Debt Agreements.

The separation of West Virginia from Virginia occurred during the Civil War, driven by differing political and economic interests. Residents of the western counties sought better representation and governance, leading to the creation of a new state. This historical context remains relevant for those exploring local laws, including West Virginia Debt Agreements.

In West Virginia, a debt typically becomes uncollectible after 10 years due to the statute of limitations. After this period, creditors may find it difficult to legally enforce collection. If you're facing unmanageable debts, exploring a West Virginia Debt Agreement can provide viable options.

In West Virginia, debt collection practices are governed by specific laws to protect consumers. Creditors must follow accurate procedures when attempting to collect debts from individuals. Familiarizing yourself with these laws is crucial when engaging with a West Virginia Debt Agreement.

West Virginia currently faces significant financial challenges, with billions in state debt. This debt impacts various sectors, including education and infrastructure, making financial planning essential for residents. Understanding the West Virginia Debt Agreement can help individuals manage their debts effectively.

In West Virginia, verbal agreements can be legally binding under certain conditions. However, proving the terms of a verbal agreement may become challenging if disputes arise. It’s often recommended to formalize agreements in writing, especially when they involve significant commitments like a West Virginia Debt Agreement. For clarity and assurance, putting agreements in writing can prevent misunderstandings.

Several factors can disqualify you from filing for Chapter 7 bankruptcy in West Virginia. If you have filed for Chapter 7 in the last eight years, or if your income exceeds the state median income, you may be disqualified. Additionally, not completing mandatory credit counseling can prevent you from achieving a West Virginia Debt Agreement. Always stay informed about these requirements to ensure your eligibility.

You can generally have $25,000 of equity in your house while filing for Chapter 7 bankruptcy in West Virginia. If your equity exceeds this amount, you might face challenges during the process, potentially impacting your West Virginia Debt Agreement. Always assess your equity situation closely to ensure a smooth transition through bankruptcy. Seeking help from professionals can clarify your options.

In West Virginia, you can keep up to $25,000 of equity in your home when filing a Chapter 7 bankruptcy. This means if your home is worth $150,000 and you owe $125,000, you can still file for a Chapter 7 without losing your home. It’s an important part of the West Virginia Debt Agreement process to understand your equity limits. Always consider consulting an expert to help navigate these specifics.

West Virginia has specific laws governing debt collection practices to protect consumers. Creditor actions must comply with state regulations, including providing written notice of the debt and avoiding harassment tactics. If you face issues with debt collectors, legal recourse is available. Using a West Virginia Debt Agreement can guide you through these laws and protect your rights while managing debts.