West Virginia Assignment of Debt

Description

How to fill out Assignment Of Debt?

You are capable of spending hours online seeking the legal document template that satisfies the state and federal regulations you need.

US Legal Forms offers thousands of legal documents that are reviewed by experts.

You can easily download or print the West Virginia Assignment of Debt from their service.

If available, utilize the Preview button to look over the document template as well.

- If you already have a US Legal Forms account, you can sign in and click on the Obtain button.

- Then, you can fill out, modify, print, or sign the West Virginia Assignment of Debt.

- Every legal document template you acquire is yours permanently.

- To get another copy of the purchased document, go to the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Review the document description to confirm you have picked the correct form.

Form popularity

FAQ

A debt is generally written off after it has been delinquent for approximately 180 days, although this can vary based on the type of debt and creditor policies. This process is commonly related to the broader context of managing debts, such as in the West Virginia Assignment of Debt. Understanding how and when debts are written off can provide you with clearer insights into financial health and debt management. If you're facing challenges, consider reaching out for professional assistance.

Debt collection laws in West Virginia regulate how creditors can pursue individuals for unpaid debts. For example, collectors must adhere to guidelines that protect consumers from harassment and intimidation. Familiarizing yourself with these laws, especially regarding the West Virginia Assignment of Debt, empowers you to assert your rights. It’s wise to consult a legal professional for clarity on how these laws apply to your situation.

West Virginia's public debt is significant, with estimates indicating billions owed across various categories. Understanding the economic landscape, including the West Virginia Assignment of Debt, helps citizens grasp financial responsibilities. This awareness fosters better financial planning and supports informed decision-making. Community resources often provide insights into managing both public and personal debt more effectively.

Yes, a 10-year-old debt can still be collected as long as it falls within the statute of limitations, which may vary depending on the type of debt. However, creditors often have difficulty enforcing older debts. This is particularly relevant when discussing the West Virginia Assignment of Debt. To protect your rights, be informed about your options and consider consulting professionals if facing collection efforts on older debts.

Creditors in West Virginia have a period of 6 months from the date of notice to creditors to file claims against an estate. After the expiration of this period, unfiled claims may become invalid. Knowing the rules surrounding the West Virginia Assignment of Debt can save estate representatives from additional complications. It’s beneficial to seek guidance on how to manage these claims effectively.

In West Virginia, a debt typically becomes uncollectible after a period of 10 years, which is the statute of limitations for most consumer debts. This means that creditors cannot legally pursue collection efforts after this time. Understanding the timeline for the West Virginia Assignment of Debt can help you determine your rights and obligations. Always consult with a legal expert to navigate your situation appropriately.

In West Virginia, the statute of limitations for debt collection is generally 10 years, depending on the type of debt. This means creditors can pursue legal actions for up to a decade after the last payment or acknowledgement of the debt. After this period, the debt becomes 'time-barred,' and creditors cannot legally enforce collection. Understanding these timelines is essential when dealing with any West Virginia Assignment of Debt, as it may affect your strategy in handling collections.

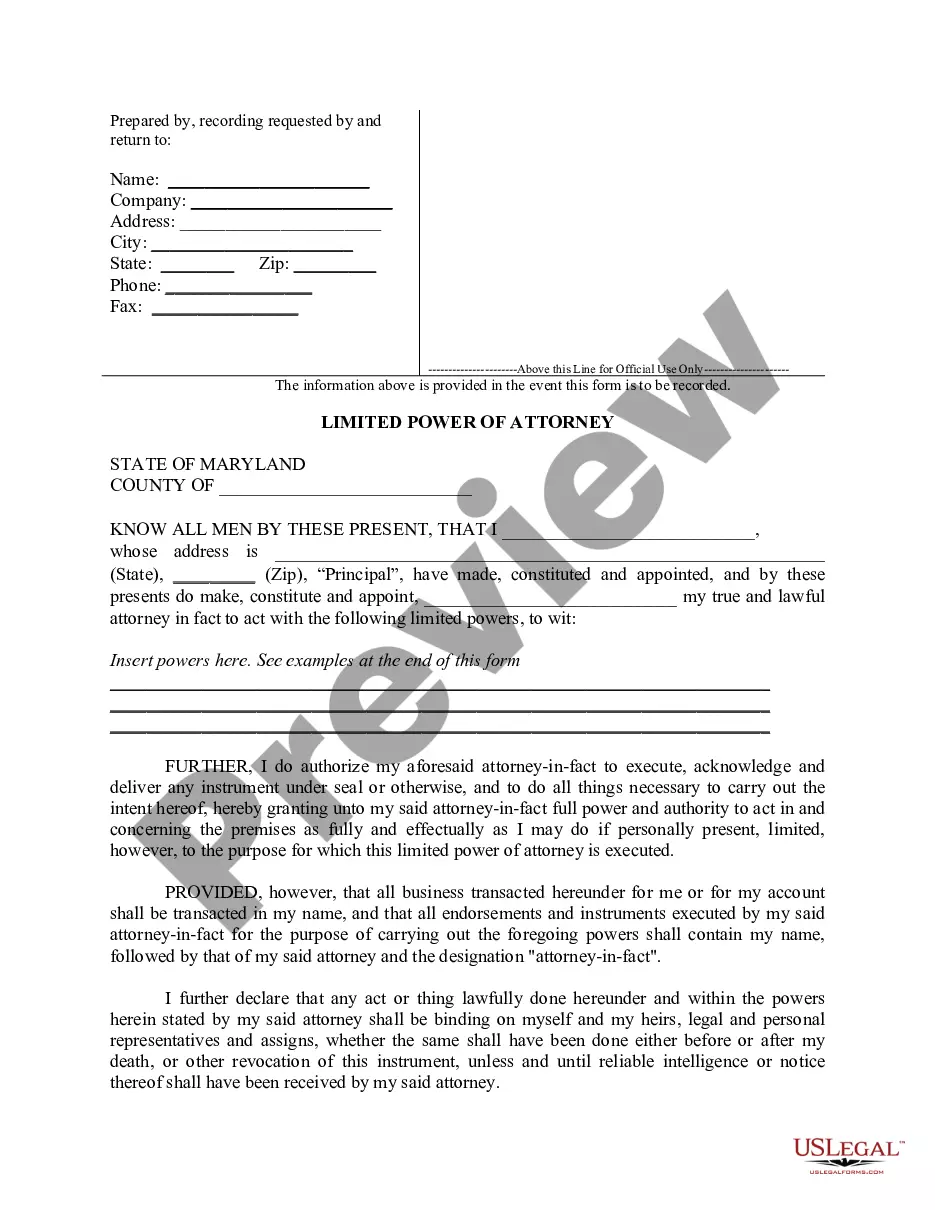

Yes, an assignment of debt must be in writing to be considered legally binding in most cases. This written form captures the essential details and mitigates potential disputes between the parties involved. While verbal agreements may occur, they often lead to misunderstandings. For clarity and protection, utilize platforms like US Legal Forms to create your assignment documents.

Debt assignment is the process where a creditor transfers the rights to collect a debt to another party. This legal action allows the new creditor, or assignee, to pursue the debtor for payment. Debt assignment can occur for various reasons, such as consolidating debt or selling debts to a collection agency. Understanding your rights in relation to West Virginia Assignment of Debt is crucial to managing your financial obligations.

For an assignment of debt to be valid in West Virginia, it must usually involve a competent assignor, a clear description of the debt being assigned, and acceptance by the assignee. Additionally, a written document detailing these factors strengthens the enforceability. Always ensure all parties understand their rights and obligations. US Legal Forms can help guide you through the proper requirements and documentation.