The "look through" trust can affords long term IRA deferrals and special protection or tax benefits for the family. But, as with all specialized tools, you must use it only in the right situation. If the IRA participant names a trust as beneficiary, and the trust meets certain requirements, for purposes of calculating minimum distributions after death, one can "look through" the trust and treat the trust beneficiary as the designated beneficiary of the IRA. You can then use the beneficiary's life expectancy to calculate minimum distributions. Were it not for this "look through" rule, the IRA or plan assets would have to be paid out over a much shorter period after the owner's death, thereby losing long term deferral.

West Virginia Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account

Description

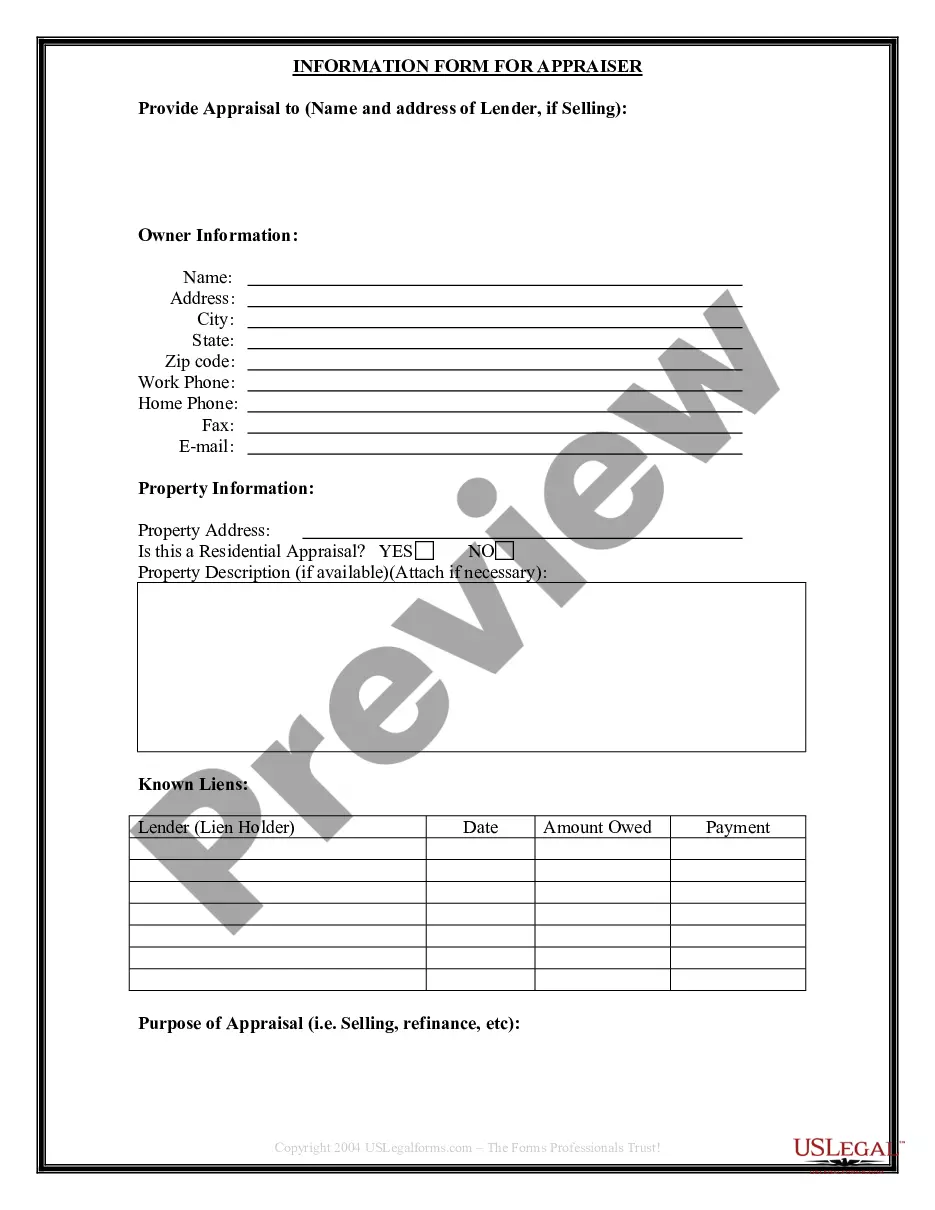

How to fill out Irrevocable Trust As Designated Beneficiary Of An Individual Retirement Account?

If you need to download, print, or access authentic document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's straightforward and convenient search feature to find the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Process the payment. You can use your Visa or Mastercard or PayPal account to complete the transaction.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the West Virginia Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. Every legal document template you purchase is yours for a lifetime. You will have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again.

- Use US Legal Forms to obtain the West Virginia Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account within just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to acquire the West Virginia Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Preview option to review the form's content. Remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other models in the legal form template.

- Step 4. After you have found the form you need, click on the Download now button. Choose the payment plan you prefer and enter your details to register for an account.

Form popularity

FAQ

One downside of naming a trust as the beneficiary of a retirement plan is the potential for increased taxes on the inherited IRA. A West Virginia Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account may not have the same tax flexibility as an individual beneficiary. Additionally, maintaining the trust requires ongoing management and possible legal fees, so consider these factors carefully when making your decision.

Generally, you cannot directly place an existing retirement account into an irrevocable trust. However, you can designate a West Virginia Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, allowing the trust to inherit the IRA upon your death. This strategy can help manage the distribution of assets according to your wishes while also offering potential tax advantages for your heirs.

Naming a trust as a beneficiary of an IRA can lead to complications, especially regarding taxation. A West Virginia Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account needs to meet specific IRS requirements to benefit from favorable tax treatment. Failure to meet these requirements might result in increased tax burdens for the heirs, so it's wise to seek professional advice to navigate these complexities.

An irrevocable trust can inherit an IRA, but there are specific conditions to consider. When a West Virginia Irrevocable Trust is named as Designated Beneficiary of an Individual Retirement Account, the trust must meet the IRS requirements to receive the funds effectively. It's crucial to consult with a legal expert, ensuring that the trust is structured properly to avoid unnecessary tax penalties.

Yes, an irrevocable trust can serve as the beneficiary of an IRA. In fact, designating a West Virginia Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account allows for greater control over the distribution of assets. However, it is essential to follow specific IRS guidelines to ensure the trust retains the tax benefits associated with the IRA.

The beneficiary of an individual retirement account (IRA) is the person, trust, or entity designated to receive the funds upon the account holder's death. This can include individuals, multiple people, or a West Virginia Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. Choosing the right beneficiary is crucial for ensuring smooth asset transfer and minimizing tax implications.

You can definitely designate a trust as a beneficiary of your retirement accounts. Choosing a West Virginia Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account allows you greater control over your assets after your passing. This can be a valuable strategy for guiding the management of your estate, particularly if you want to ensure careful administration for your beneficiaries.

Yes, a trust can serve as an eligible designated beneficiary, particularly when structured properly. By establishing a West Virginia Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, you can manage the inheritance process for your beneficiaries. This approach ensures that strings attached to the distribution meet your specific goals, providing peace of mind.

A trust can indeed be the beneficiary of a retirement account, including a West Virginia Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. This arrangement allows careful control over how the retirement funds are distributed following the account holder's death. It can provide structured support for beneficiaries, making it a smart choice for long-term financial planning.

Eligible designated beneficiaries for a special needs trust typically include individuals with disabilities who rely on specific assets for their care. By naming a West Virginia Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, you can ensure that funds are utilized to enhance their quality of life. Always consult with a financial advisor to maximize benefits while ensuring compliance with relevant laws.