West Virginia Revocable Trust Agreement - Grantor as Beneficiary

Description

How to fill out Revocable Trust Agreement - Grantor As Beneficiary?

If you require thorough, acquire, or print lawful document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Utilize the site’s straightforward and convenient search to find the documents you need.

A range of templates for business and individual purposes are categorized by types and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, amend, and print or sign the West Virginia Revocable Trust Agreement - Grantor as Beneficiary.

Every legal document template you purchase is yours indefinitely. You have access to all forms you downloaded with your account. Click on the My documents section and select a form to print or download again.

Be proactive and obtain, and print the West Virginia Revocable Trust Agreement - Grantor as Beneficiary with US Legal Forms. There are numerous professional and state-specific forms available for your personal or business needs.

- Utilize US Legal Forms to acquire the West Virginia Revocable Trust Agreement - Grantor as Beneficiary with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to download the West Virginia Revocable Trust Agreement - Grantor as Beneficiary.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, review the following steps.

- Step 1. Ensure you have selected the form for your specific town/county.

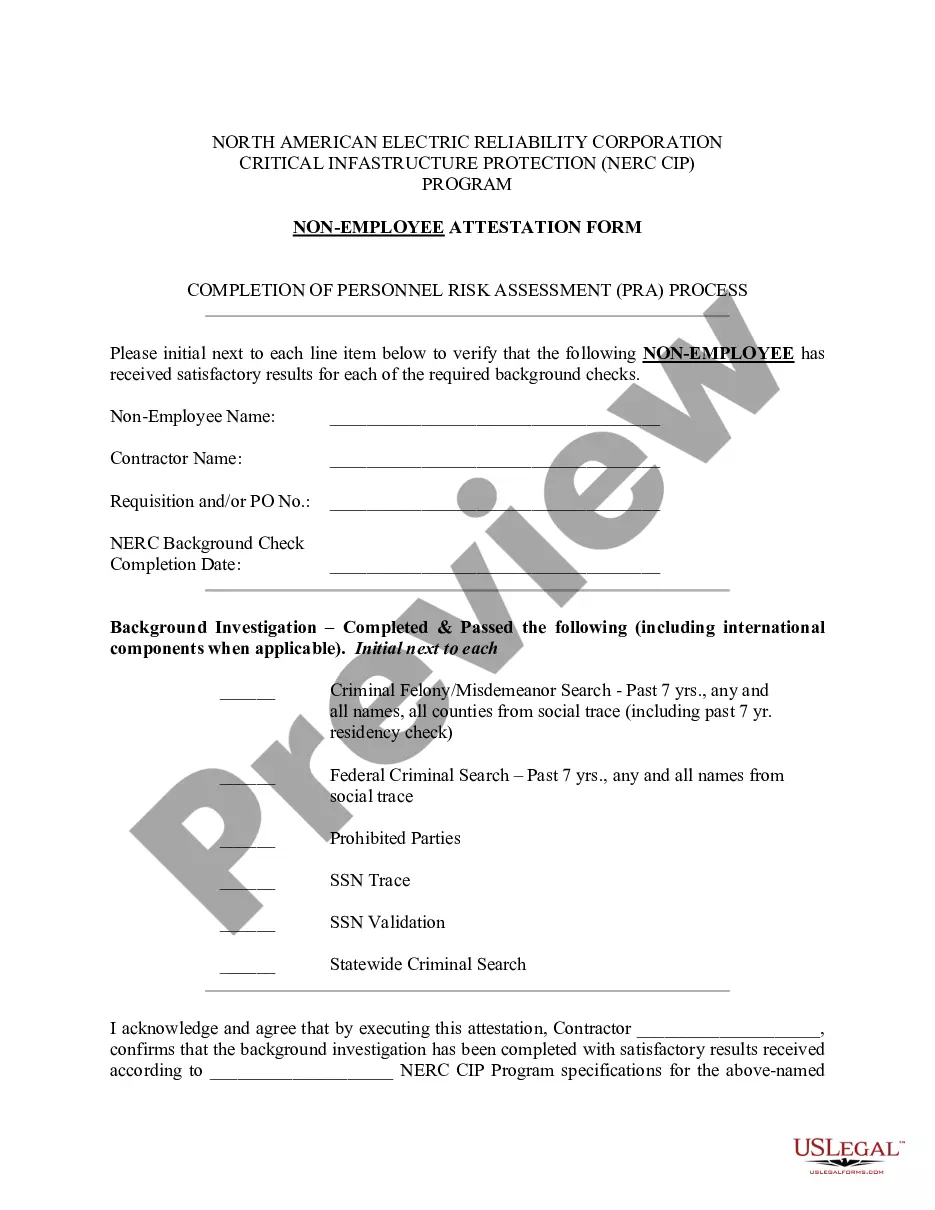

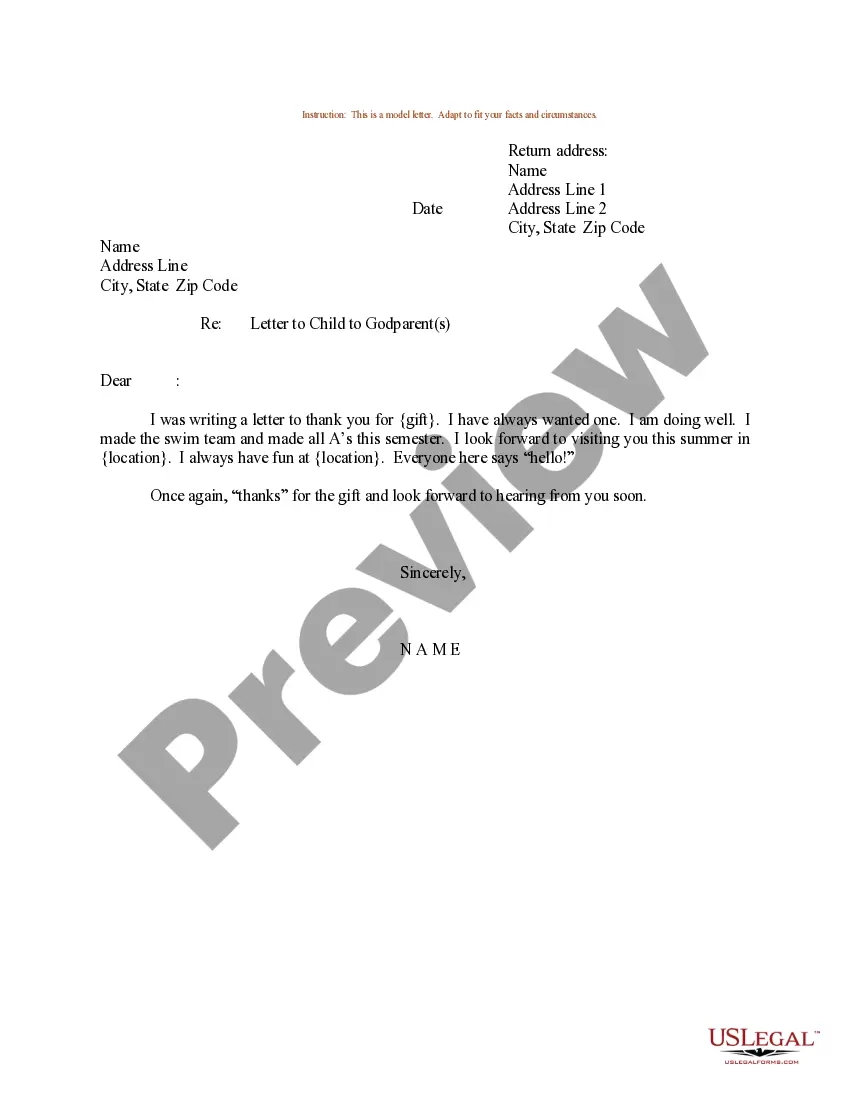

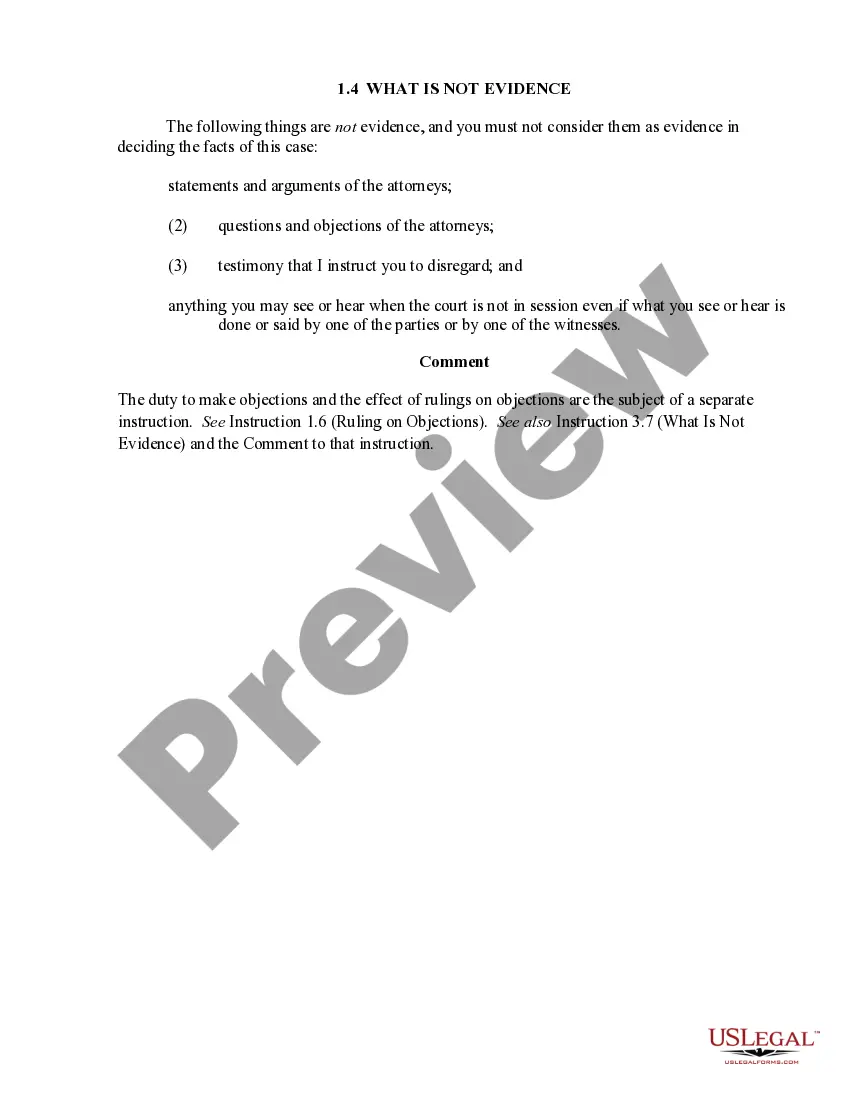

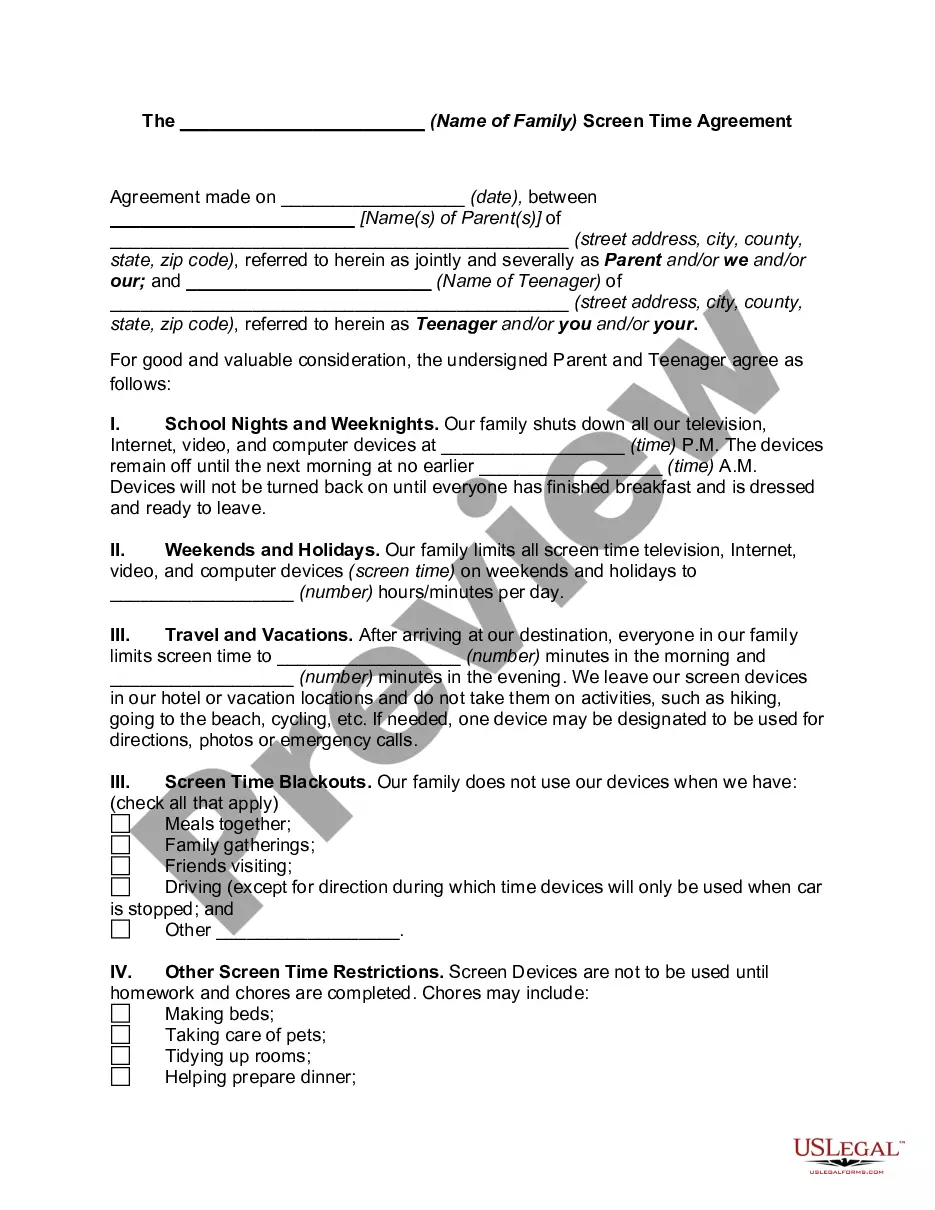

- Step 2. Use the Preview option to examine the content of the form. Don't forget to check the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other templates from the legal document library.

- Step 4. Once you have located the form you need, click the Acquire now button. Choose your preferred pricing plan and enter your details to register for an account.

Form popularity

FAQ

Yes, the grantor can indeed be the beneficiary of their own trust. In the context of a West Virginia Revocable Trust Agreement, this often allows the grantor to maintain control over the trust assets while enjoying the benefits. However, it’s important to structure the trust appropriately to ensure it meets your financial and estate planning objectives.

A significant mistake parents often make when establishing a trust fund is failing to update the trust documents after major life events, such as births, deaths, or changes in financial status. It’s essential to keep your West Virginia Revocable Trust Agreement current to reflect your wishes accurately. Regularly review and adjust the trust to ensure it still aligns with your family's needs and goals.

One disadvantage of naming a trust as a beneficiary is the potential for complex tax implications and administrative costs. Trusts, particularly those in a West Virginia Revocable Trust Agreement, often require ongoing management that can lead to fees and oversight responsibilities. Additionally, if the trust is not structured properly, it may not provide the intended benefits to the grantor or other beneficiaries.

Yes, a trust can be an eligible designated beneficiary, but it must meet specific criteria under IRS regulations. Typically, the trust needs to be a valid trust under West Virginia law and should comply with the requirements of a 'see-through trust' so that individual beneficiaries can be identified. This allows the assets within the trust to retain favorable tax treatment, benefiting the grantor as the beneficiary.

Designating a trust as a beneficiary requires you to fill out the relevant forms for your assets, such as a life insurance policy or retirement account. In the section for beneficiaries, specify the name of your trust clearly, along with its date of establishment and the trustee's name for clarity. This step is crucial for ensuring that the intended assets transfer seamlessly according to the West Virginia Revocable Trust Agreement - Grantor as Beneficiary.

To list a trust as a beneficiary, first ensure that the trust is properly established under a West Virginia Revocable Trust Agreement. Then, on the beneficiary designation form for your financial accounts or insurance policies, simply enter the name of the trust along with the appropriate identifying information. Always ensure that the details match the trust document to avoid any confusion in the future.

To set up a trust in West Virginia, you begin by drafting a trust document that outlines the terms and conditions of the trust, specifying the grantor, beneficiaries, and assets involved. Utilizing a West Virginia Revocable Trust Agreement - Grantor as Beneficiary, you have the opportunity to maintain flexibility in managing the trust. It's also wise to consult with legal professionals or platforms like uslegalforms, which can guide you through the process and ensure compliance with state regulations.

While trusts offer numerous benefits, they do come with some disadvantages, including initial setup costs and ongoing maintenance fees. In a West Virginia Revocable Trust Agreement - Grantor as Beneficiary, the grantor may lose some personal control over assets once they are placed in the trust. It is essential to weigh these factors carefully as you consider whether a trust aligns with your financial and estate planning goals.

Yes, a beneficiary can also serve as a grantor in a West Virginia Revocable Trust Agreement - Grantor as Beneficiary. This arrangement allows the individual who creates the trust to benefit from the trust assets while retaining control over them during their lifetime. It adds flexibility and personal touch to your estate plan, enabling you to balance your wishes with your beneficiaries' needs.

The minimum amount required to set up a trust can vary based on specific state laws and the type of trust you choose. In the case of a West Virginia Revocable Trust Agreement - Grantor as Beneficiary, there is no set minimum amount, but it is advisable to fund the trust adequately to meet your estate planning goals. Establishing a trust with a reasonable amount can ensure that it serves its intended purpose effectively.