A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

West Virginia Continuing Guaranty of Business Indebtedness By Corporate Stockholders

Description

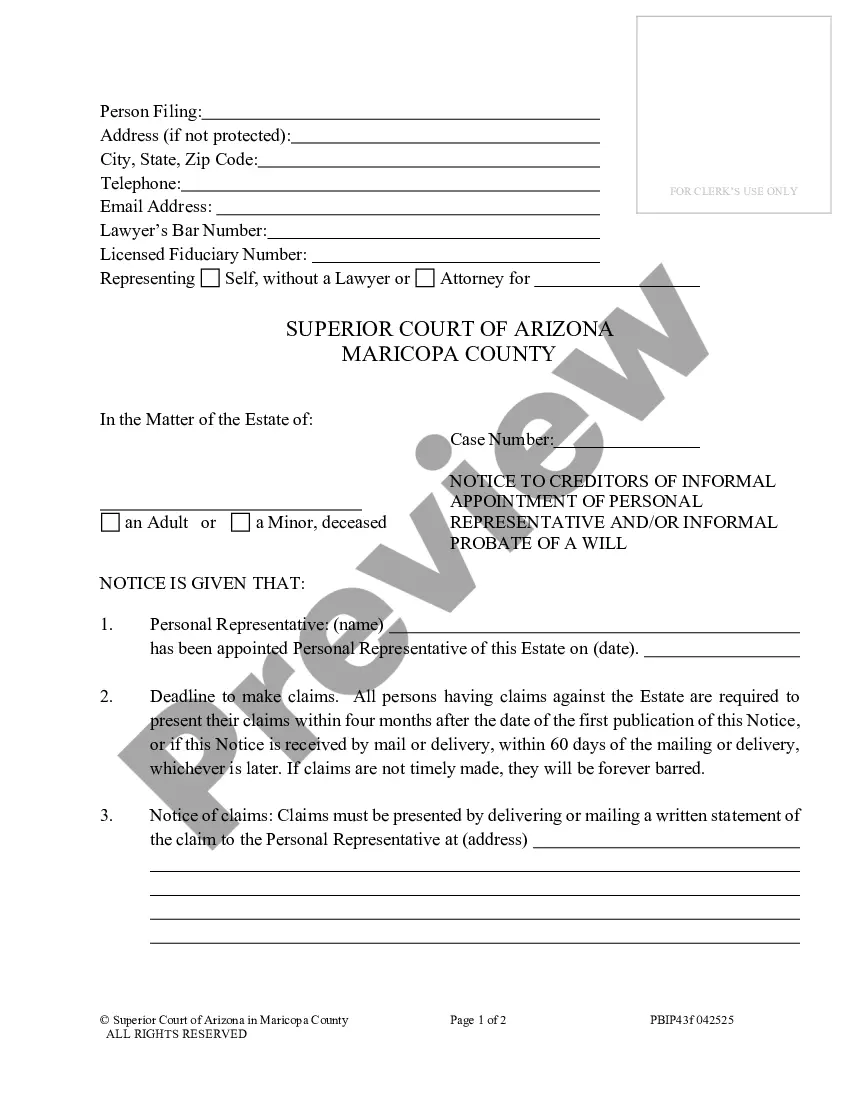

How to fill out Continuing Guaranty Of Business Indebtedness By Corporate Stockholders?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a diverse range of legal document templates that you can obtain or print.

By using the website, you can access numerous forms for business and personal needs, categorized by types, states, or keywords. You can find the latest versions of forms such as the West Virginia Continuing Guaranty of Business Indebtedness By Corporate Stockholders within minutes.

If you already have a subscription, Log In to download the West Virginia Continuing Guaranty of Business Indebtedness By Corporate Stockholders from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, and print/sign the downloaded West Virginia Continuing Guaranty of Business Indebtedness By Corporate Stockholders. Each template you added to your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another version, simply return to the My documents section and click on the form you need. Access the West Virginia Continuing Guaranty of Business Indebtedness By Corporate Stockholders with US Legal Forms, the largest collection of legal document templates. Utilize a multitude of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Ensure that you have chosen the correct form for your city/state.

- Click the Preview button to examine the form's content.

- Review the form summary to confirm that you have selected the appropriate form.

- If the form does not meet your needs, use the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select your preferred payment plan and provide your credentials to register for an account.