West Virginia Limited Partnership Agreement Between Limited Liability Company and Limited Partner

Description

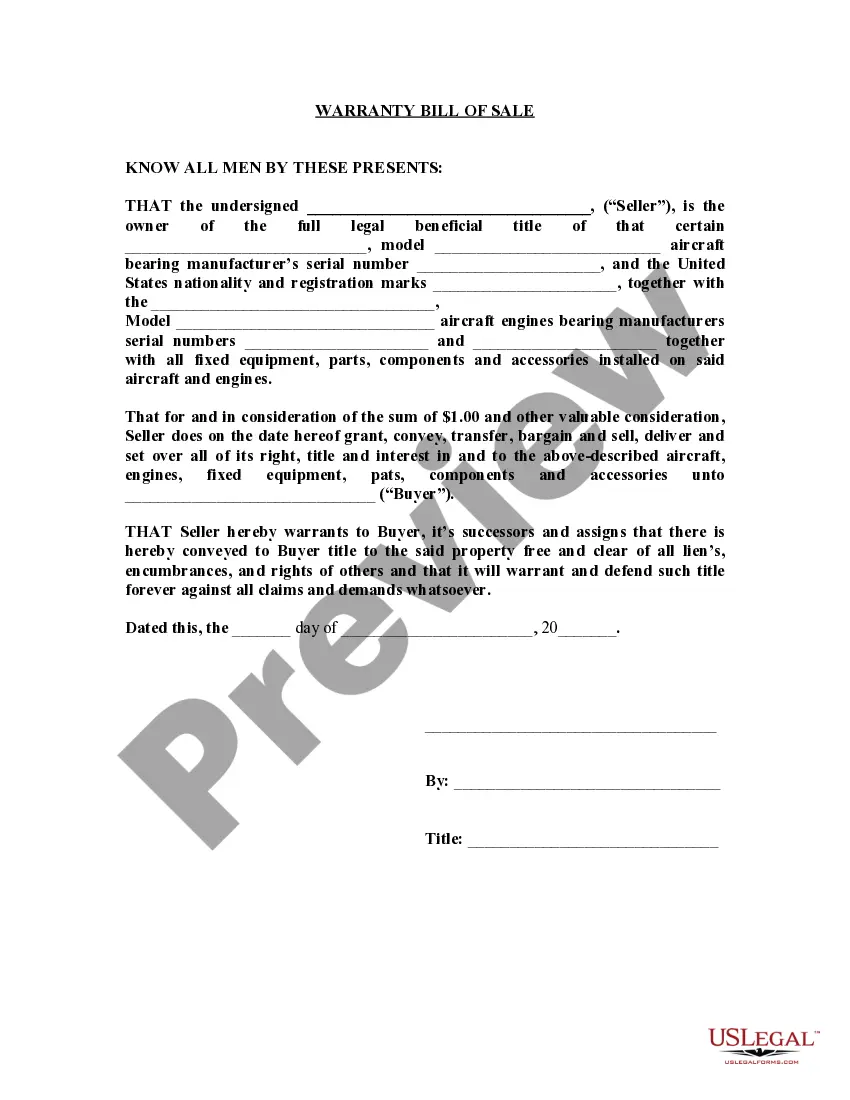

How to fill out Limited Partnership Agreement Between Limited Liability Company And Limited Partner?

It is feasible to invest hours online looking for the valid document template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of legitimate documents that are assessed by professionals.

You can easily obtain or print the West Virginia Limited Partnership Agreement Between Limited Liability Company and Limited Partner from our service.

If available, use the Preview button to view the document template as well. To obtain another version of the form, use the Search field to locate the template that meets your needs and requirements. Once you have found the template you require, click Get now to proceed. Choose the pricing plan you desire, enter your information, and create your account on US Legal Forms. Complete the purchase. You can use your credit card or PayPal account to buy the legal document. Choose the format of the file and download it to your device. Make adjustments to your document if necessary. You can complete, edit, sign, and print the West Virginia Limited Partnership Agreement Between Limited Liability Company and Limited Partner. Obtain and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and then click the Acquire button.

- After that, you are able to complete, modify, print, or sign the West Virginia Limited Partnership Agreement Between Limited Liability Company and Limited Partner.

- Each legal document template you purchase is your personal property forever.

- To get an additional copy of an acquired form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your area/town that you choose.

- Review the document details to confirm you have selected the right form.

Form popularity

FAQ

Yes, a limited company can have partners, but they are typically referred to as shareholders or members instead of traditional partners. Each shareholder has a stake in the company and benefits from limited liability for business debts. It is important to draft a West Virginia Limited Partnership Agreement Between Limited Liability Company and Limited Partner that accurately reflects the ownership and management structure, ensuring clarity and protecting everyone's interests.

In a limited partnership, there are two types of partners: general partners and limited partners. General partners manage the business and have unlimited liability, while limited partners contribute capital and enjoy limited liability, protecting their personal assets. Crafting a West Virginia Limited Partnership Agreement Between Limited Liability Company and Limited Partner is crucial to define these roles and responsibilities, paving the way for a clear and effective partnership.

A limited liability partnership (LLP) combines elements of both a partnership and a corporation. In an LLP, partners enjoy limited personal liability for business debts, unlike a general partnership where all partners share liability. The West Virginia Limited Partnership Agreement Between Limited Liability Company and Limited Partner helps clarify these distinctions, ensuring that all parties understand their rights and responsibilities within the partnership structure.

Indeed, a partnership can exist between two companies. A West Virginia Limited Partnership Agreement Between Limited Liability Company and Limited Partner serves as the foundation for such collaborations. This agreement can detail the responsibilities, profit distributions, and liabilities for both companies involved. It is a strategic way to combine resources and expertise for mutual benefit in the marketplace.

Yes, you can form a partnership with a company. Through a West Virginia Limited Partnership Agreement Between Limited Liability Company and Limited Partner, businesses can establish a collaborative relationship. This agreement clarifies the terms of partnership, ensuring all parties understand their contributions and profit-sharing structures. Many companies use this strategy to leverage complementary strengths and expand their market reach.

Limited companies can face more regulatory and reporting requirements compared to partnerships. When considering a West Virginia Limited Partnership Agreement Between Limited Liability Company and Limited Partner, it is important to recognize that a limited company may involve higher costs and complexity in compliance. Additionally, the structure may limit how profits are distributed among owners. Understanding these disadvantages aids in making informed decisions.

Choosing between a limited company and a partnership depends on your specific business needs. A West Virginia Limited Partnership Agreement Between Limited Liability Company and Limited Partner offers liability protection while allowing for flexibility in management. In a limited company, owners benefit from limited liability and reduced risk, but partnerships may offer simpler tax structures and operational freedom. Evaluating your goals can guide you in making the best choice.

Yes, a partnership can accommodate multiple limited partners, allowing for varied investment levels and contributions. Each limited partner shares in the profits according to the partnership agreement, enhancing collaboration. The West Virginia Limited Partnership Agreement Between Limited Liability Company and Limited Partner will define the specifics of these roles and responsibilities.

If a limited partner withdraws from the partnership, their investment may be affected, and the remaining partners may need to reassess the business structure. Such events can lead to potential financial implications and operational challenges. It is vital to refer to the provisions in your West Virginia Limited Partnership Agreement Between Limited Liability Company and Limited Partner for guidance.

Yes, Limited Partnerships (LPs) must have a partnership agreement that outlines the roles, rights, and responsibilities of all partners. This agreement typically includes details on profit-sharing and dispute resolution. A well-crafted West Virginia Limited Partnership Agreement Between Limited Liability Company and Limited Partner will reinforce the framework for a successful business relationship.