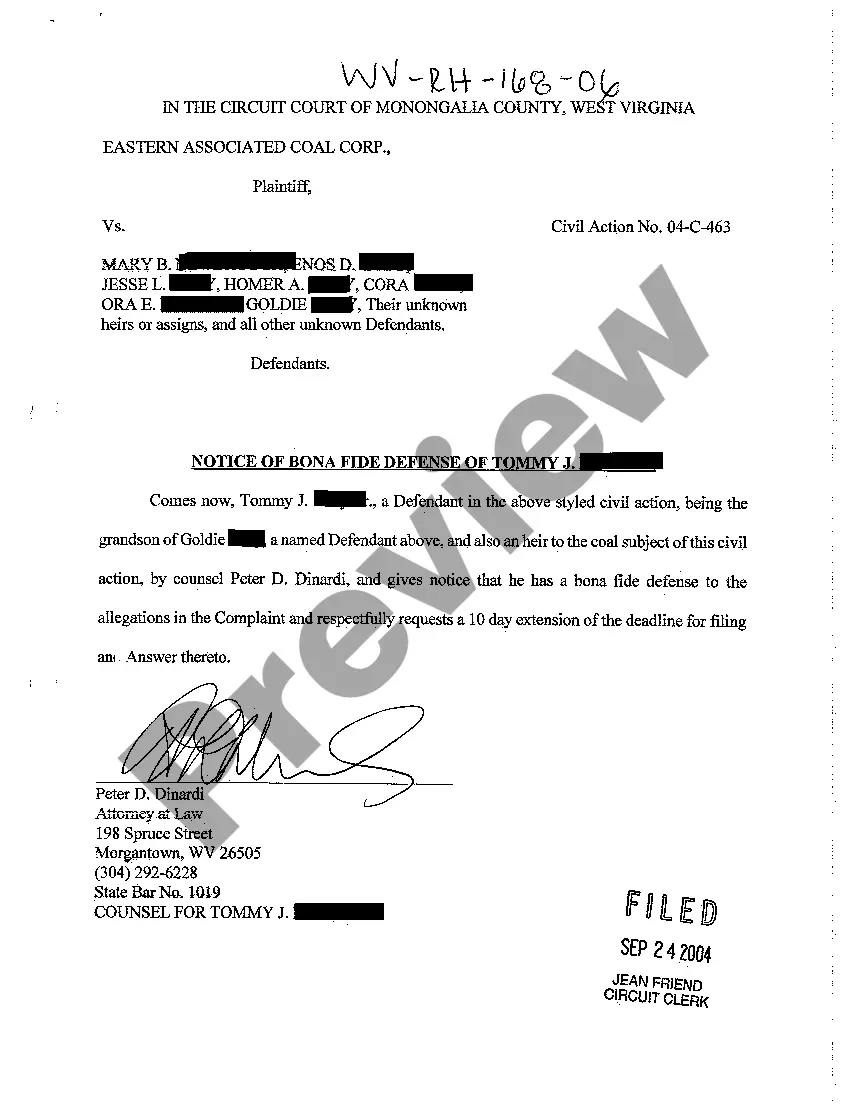

West Virginia Notice of Bona Fide Defense of Grandson of Co-Defendant Who Owned Interest in Subject Property

Description

How to fill out West Virginia Notice Of Bona Fide Defense Of Grandson Of Co-Defendant Who Owned Interest In Subject Property?

Among countless free and paid samples which you find on the web, you can't be certain about their accuracy and reliability. For example, who created them or if they are skilled enough to take care of what you need those to. Always keep calm and use US Legal Forms! Get West Virginia Notice of Bona Fide Defense of Grandson of Co-Defendant Who Owned Interest in Subject Property samples developed by professional legal representatives and get away from the expensive and time-consuming process of looking for an attorney and then paying them to draft a papers for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button next to the file you’re seeking. You'll also be able to access your previously downloaded files in the My Forms menu.

If you are utilizing our service the very first time, follow the guidelines below to get your West Virginia Notice of Bona Fide Defense of Grandson of Co-Defendant Who Owned Interest in Subject Property fast:

- Make certain that the document you discover applies where you live.

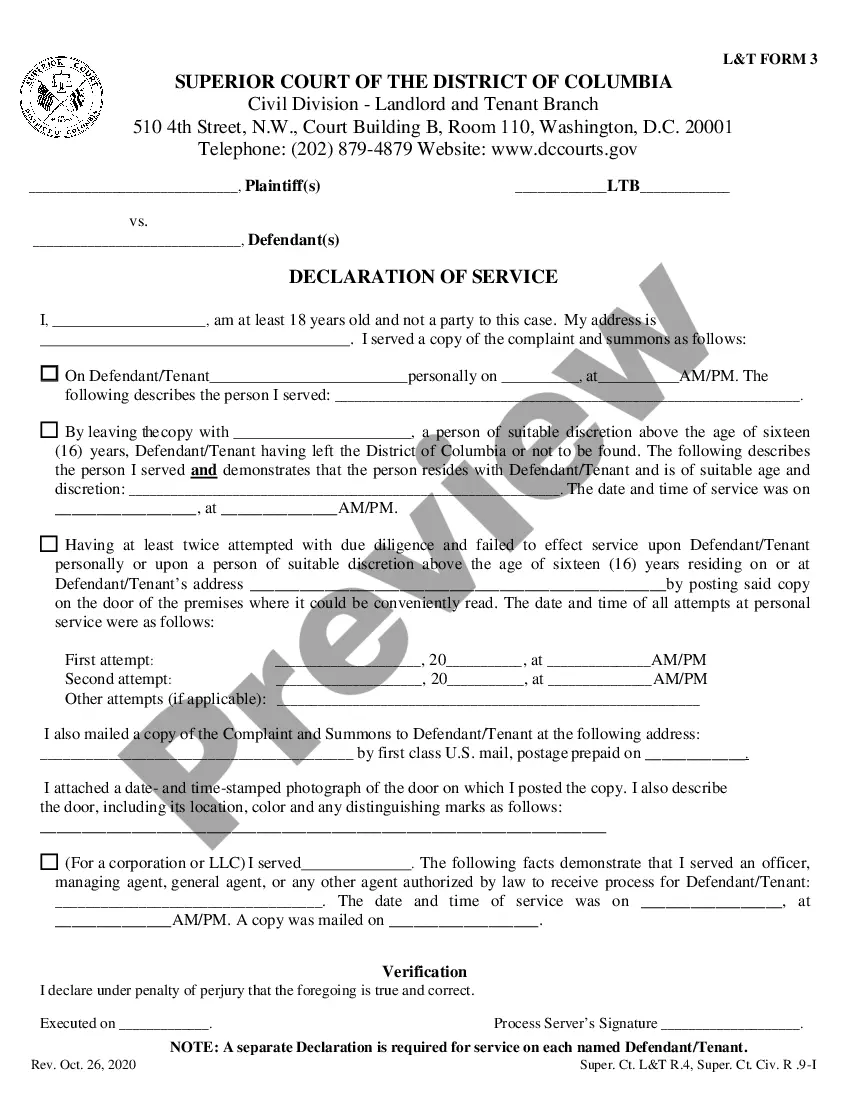

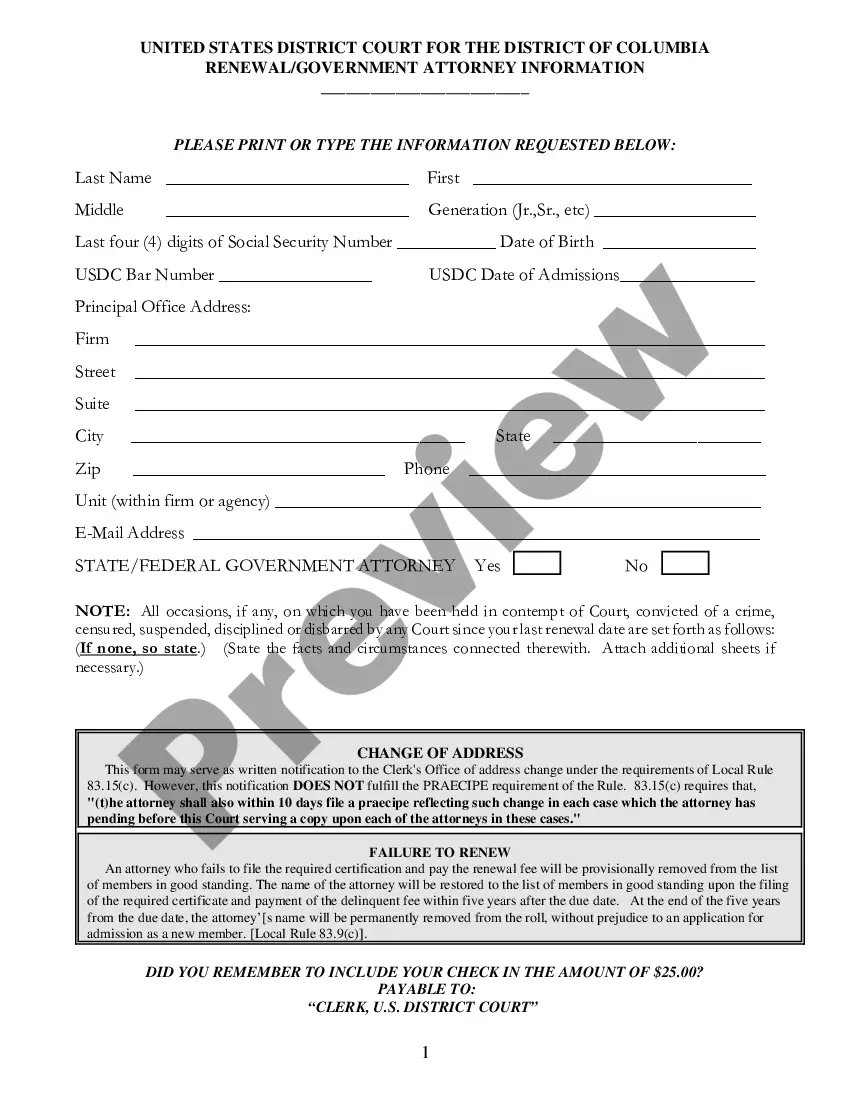

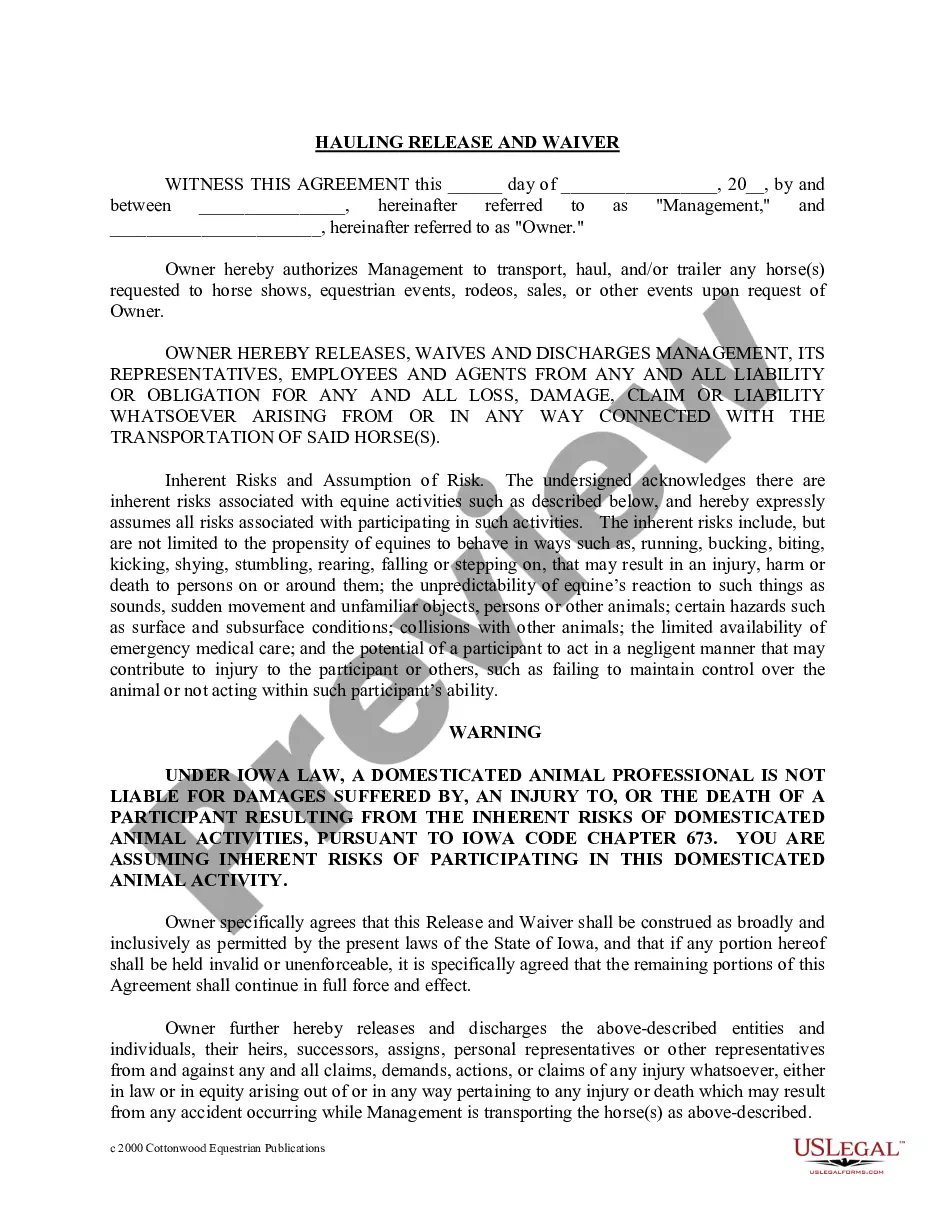

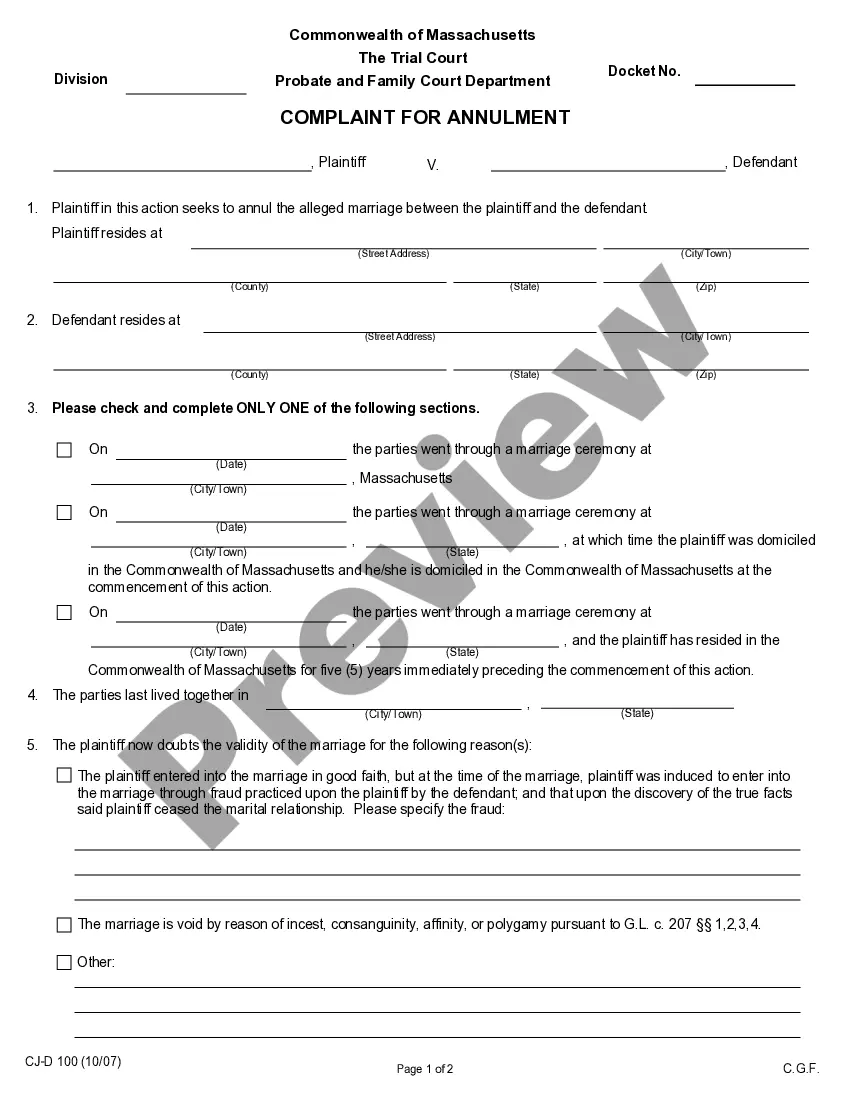

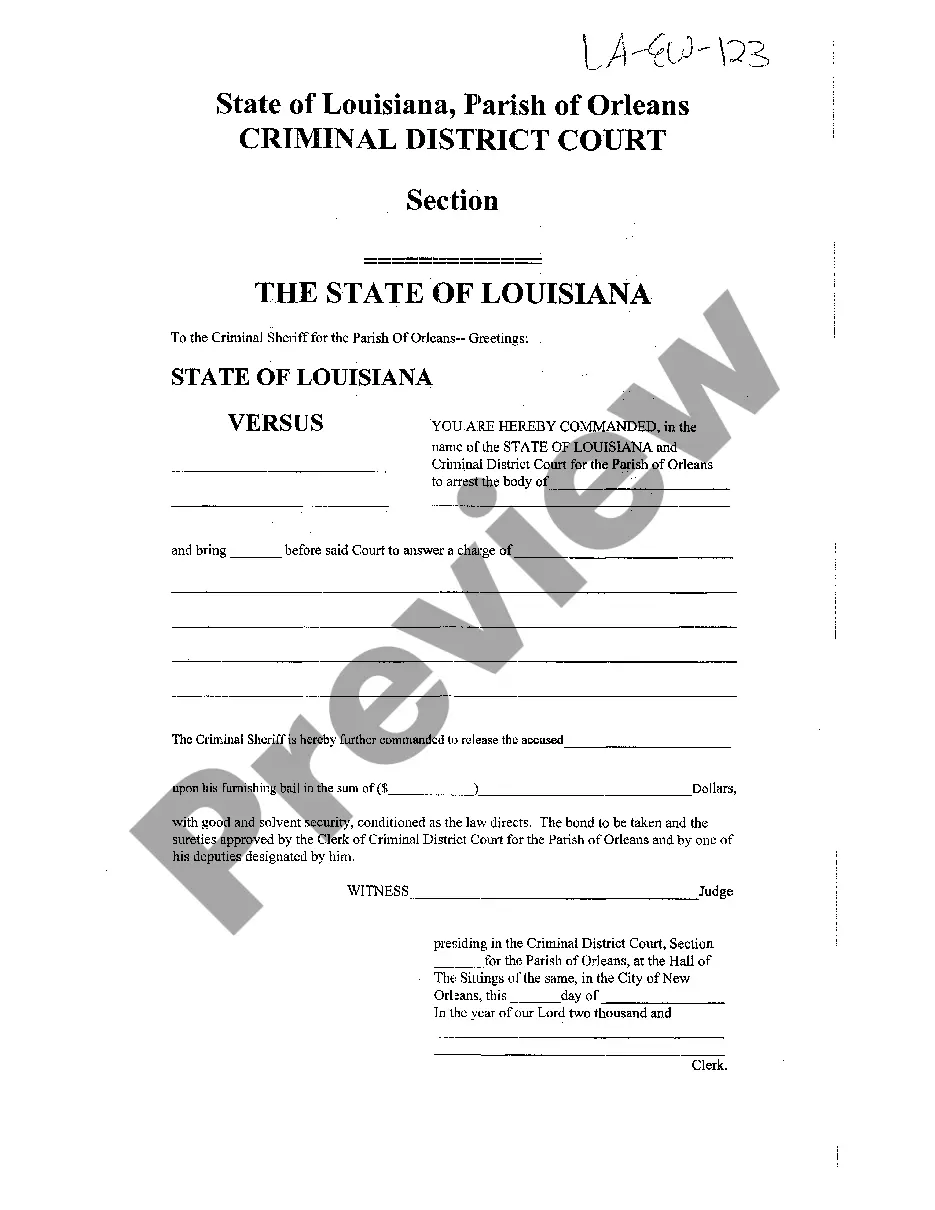

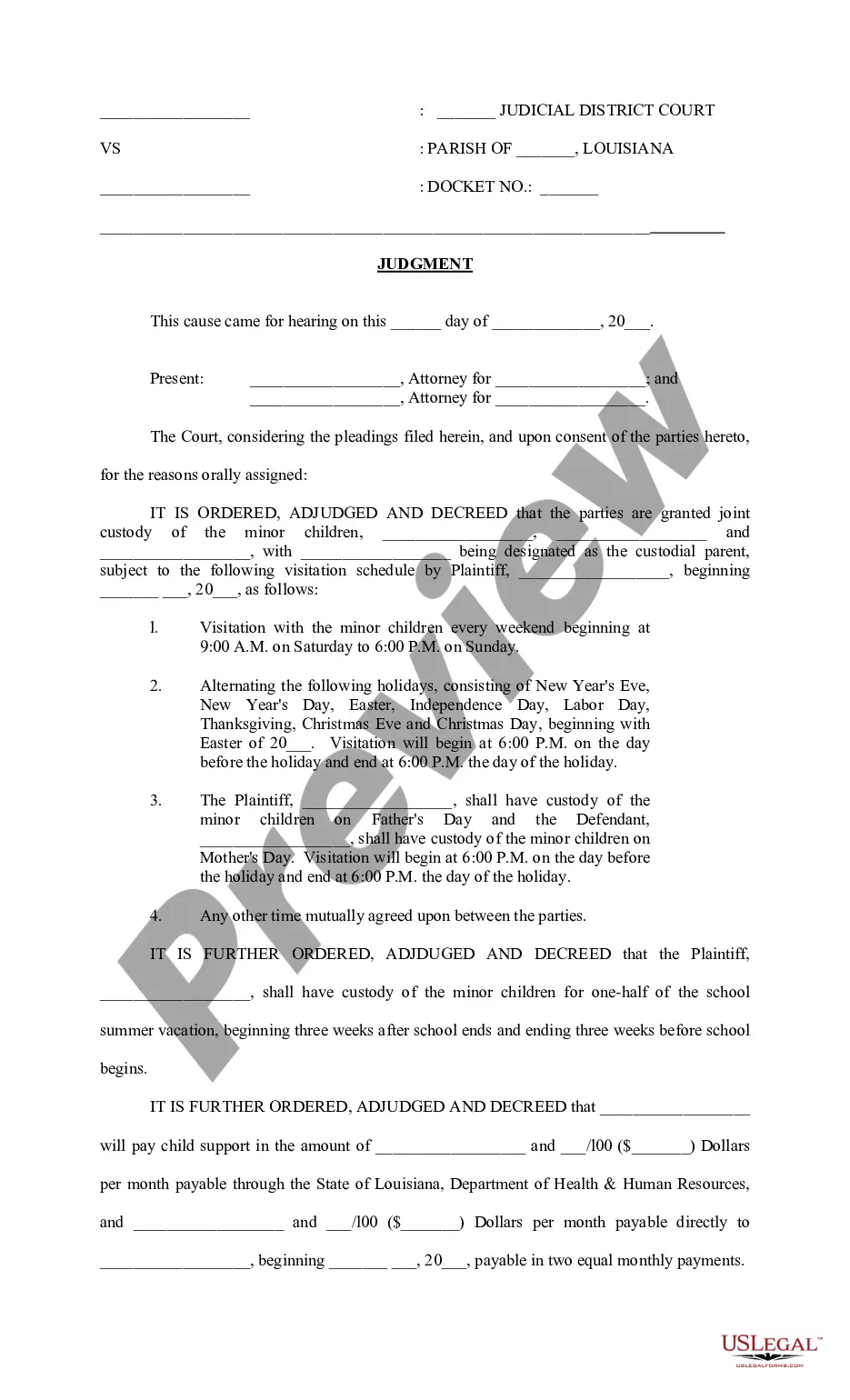

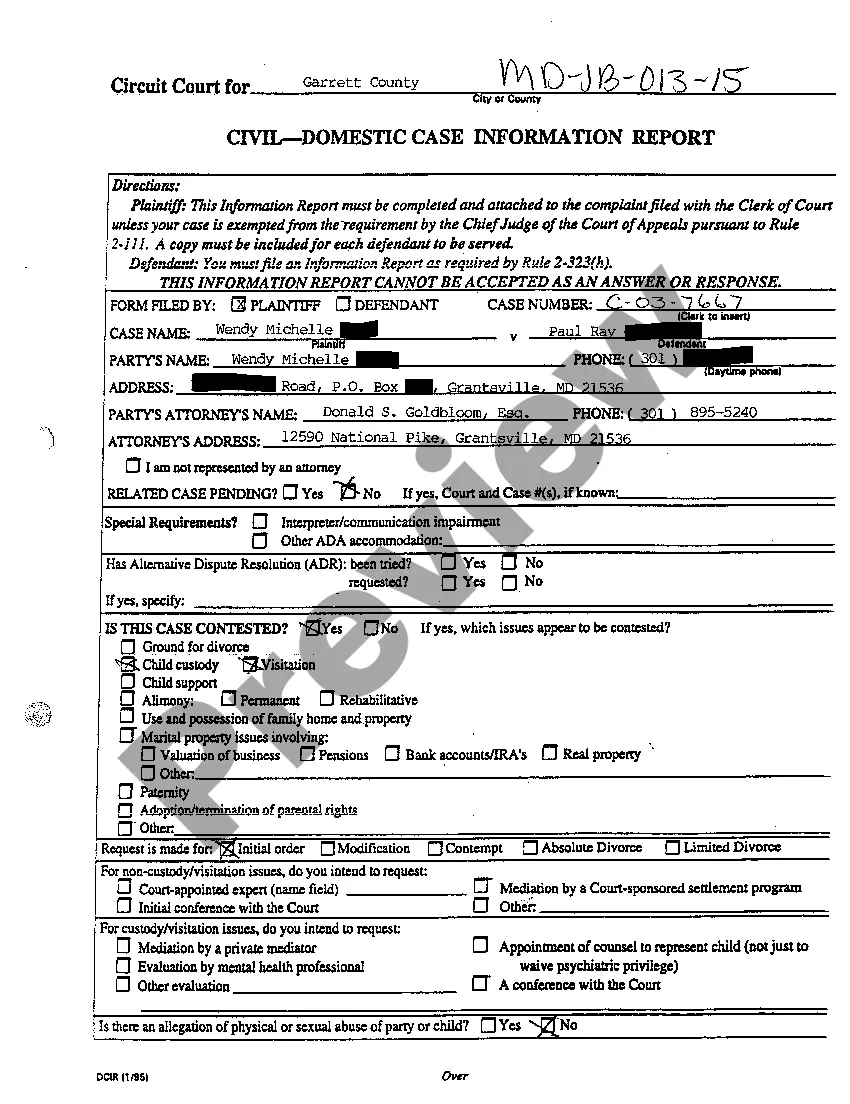

- Review the file by reading the description for using the Preview function.

- Click Buy Now to begin the ordering procedure or look for another example utilizing the Search field located in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you have signed up and paid for your subscription, you can use your West Virginia Notice of Bona Fide Defense of Grandson of Co-Defendant Who Owned Interest in Subject Property as many times as you need or for as long as it stays active in your state. Change it in your favorite editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

IRS penalties are typically assessed for violations of tax laws, such as misreporting income or claiming false deductions or tax credits. The IRS typically assesses penalties along with interest on the balance owed by a taxpayer, and this interest is not tax-deductible.

The late payment penalty is 0.5% of the tax owed after the due date, for each month or part of a month the tax remains unpaid, up to 25%. You won't have to pay the penalty if you can show reasonable cause for the failure to pay on time.

Tax-deductible interest payments According to the IRS, only a few categories of interest payments are tax-deductible: Interest on home loans (including mortgages and home equity loans) Interest on outstanding student loans. Interest on money borrowed to purchase investment property.

Generally, to deduct a bad debt, you must have previously included the amount in your income or loaned out your cash. If you're a cash method taxpayer (most individuals are), you generally can't take a bad debt deduction for unpaid salaries, wages, rents, fees, interests, dividends, and similar items.

The Internal Revenue Service (IRS) allows you to deduct several different types of interest expense, including home mortgage interest and interest related to the production of income. But, it does not allow deductions for consumer interest expense.

Complete a notice of claim form. Click here to obtain a notice of claim form or call (801) 535-7788 to request a claim form to be mailed or emailed to you. File the notice of claim with the Salt Lake City Recorder. Mailing address: File the notice of claim on time.

It is usually a one page document that stipulates that the person submitting the document for recording at the County Clerk's Office has an equitable interest in a property because of a signed purchase and sale contract.

Interest charged by the CRA is also not considered tax-deductible.This included a deduction in respect of any amount, including interest payable under the Act.

The IRS calculates underpayment interest by adding 3 percentage points to the current federal short-term rate, which changes quarterly.As an example, if your underpayment is $500 and the interest rate is 3.30 percent, the interest you owe is $16.50, and the total amount you owe is $516.50.