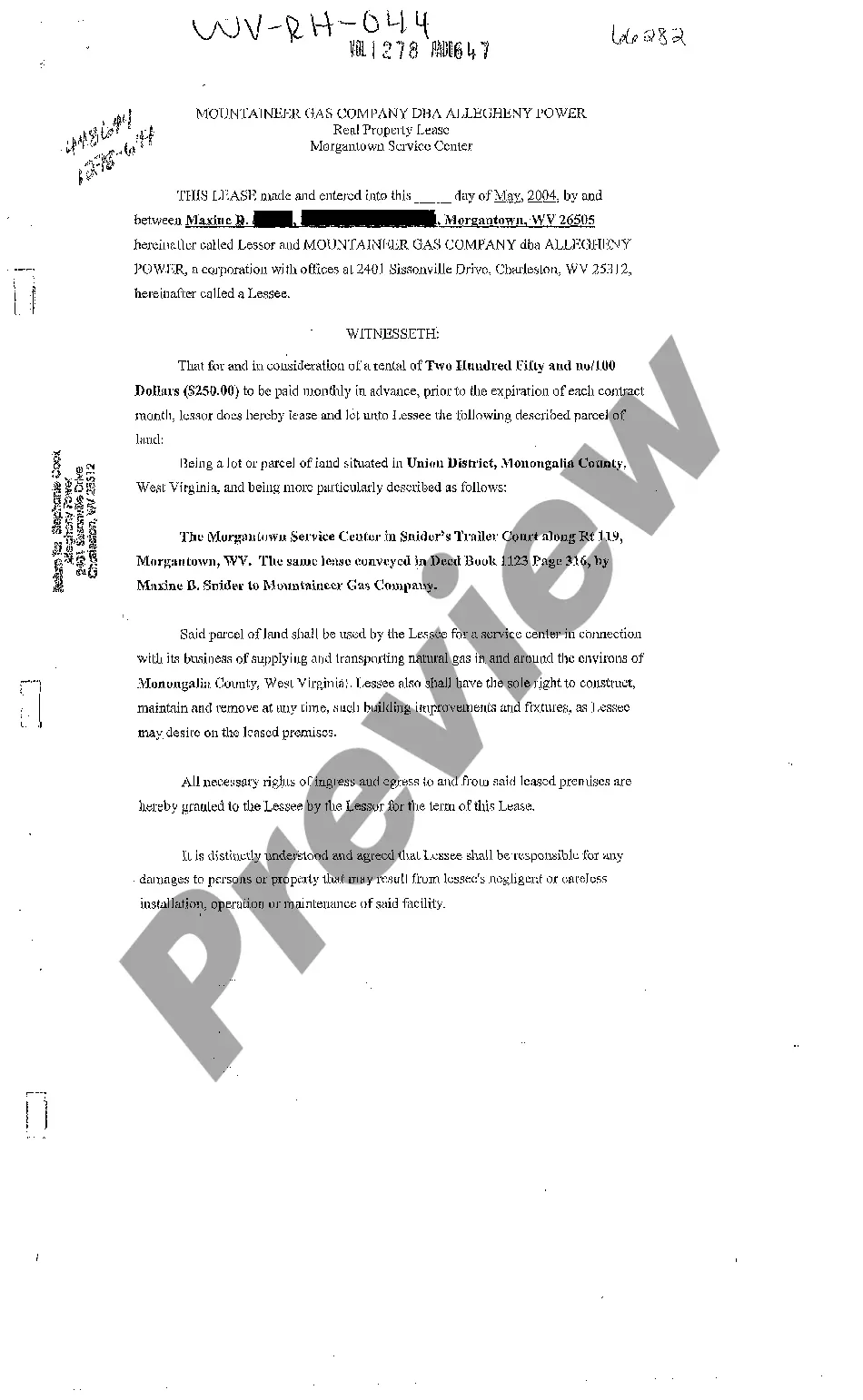

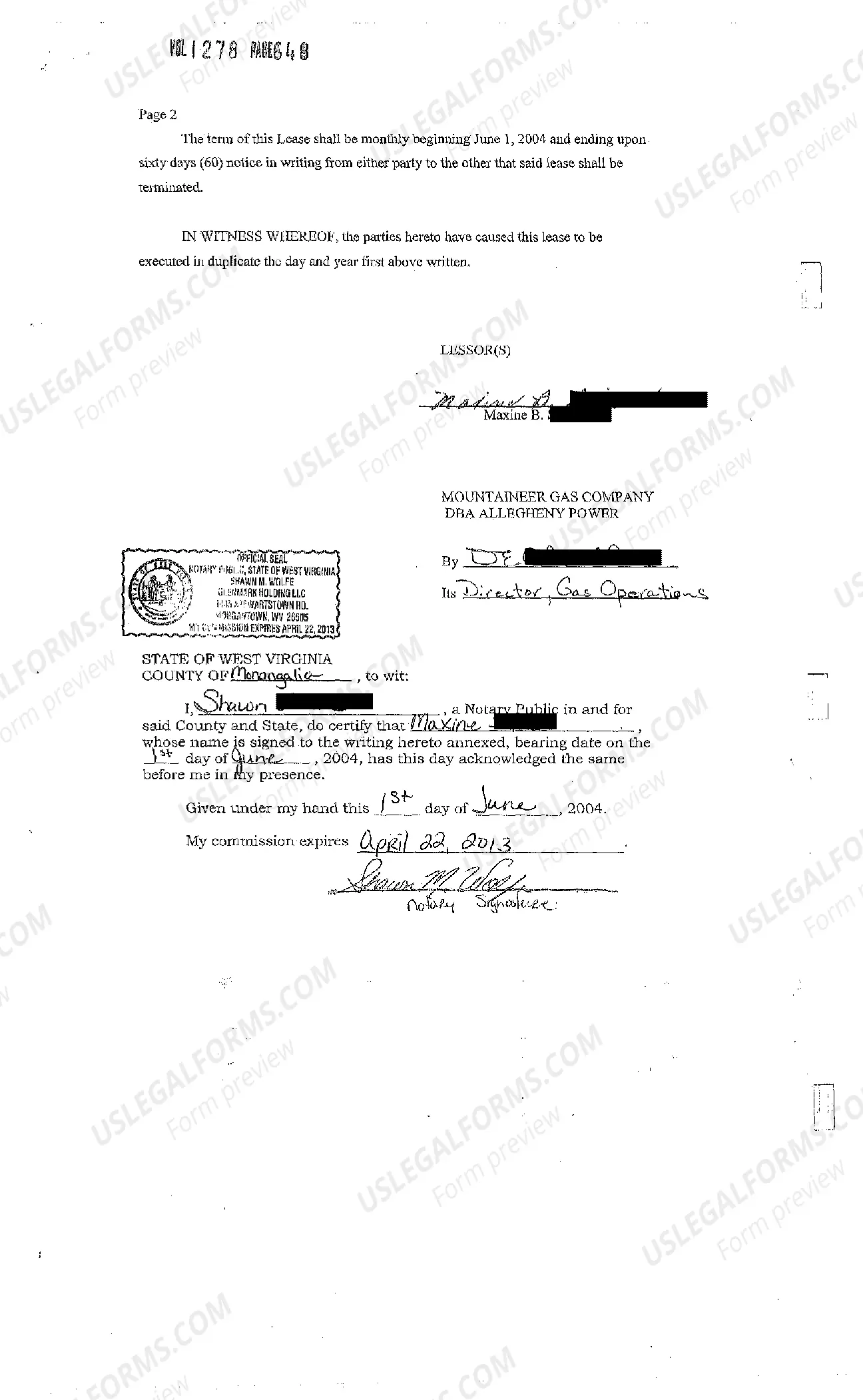

West Virginia Real Property Lease - Lease of Property to Gas Company

Description

How to fill out West Virginia Real Property Lease - Lease Of Property To Gas Company?

Among hundreds of free and paid samples that you find on the internet, you can't be certain about their reliability. For example, who created them or if they are competent enough to take care of what you require these people to. Always keep calm and utilize US Legal Forms! Locate West Virginia Real Property Lease - Lease of Property to Gas Company templates created by professional lawyers and avoid the expensive and time-consuming procedure of looking for an attorney and then paying them to draft a document for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button next to the file you’re seeking. You'll also be able to access your earlier downloaded samples in the My Forms menu.

If you are using our platform for the first time, follow the instructions listed below to get your West Virginia Real Property Lease - Lease of Property to Gas Company quick:

- Ensure that the document you find is valid where you live.

- Review the template by reading the description for using the Preview function.

- Click Buy Now to start the purchasing procedure or find another example using the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

As soon as you have signed up and paid for your subscription, you can use your West Virginia Real Property Lease - Lease of Property to Gas Company as often as you need or for as long as it remains active where you live. Edit it with your preferred editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

Whenever oil or gas production begins, the landowner is entitled to part of the total production. A royalty is agreed upon as a percentage of the lease, minus what was reasonably used in the Lessee's production costs. The royalty is paid by the Lessee to the owner of the mineral rights, the Lessor in the Lease.

If you are ready to list or purchase mineral rights, the best mineral rights value rule of thumb to use is the current market price. Today, your mineral rights may sell for $2,000 an acre, but if the developers drill a few dry wells tomorrow, that value could plummet.

In the event oil and gas were found and the wells produce, then the royalties kick in. So if the oil well produce 100 barrels a day, and the price of oil is $80 per barrel that month, then the cash flow is 100x$80 = $8,000/day The royalty owner, who agreed to 15% royalty, would receive $8,000 x 0.15 = $1,200/day.

Landowners who are considering purchasing, or have already purchased a property can search their county Register of Deeds registry to determine if an oil and gas lease is recorded.A search of the public records at the county register of deeds office is necessary.

Further, annual rental fees for onshore oil and gas leases $1.50 per acre during the first five years and $2 per acre each year thereafter allow drilling companies to hold and explore mineral leases for the price of a cup of coffee.

When it comes to mineral rights, the standard admonition has long been consistent and emphatic: Avoid selling them. After all, simply owning mineral rights costs you nothing. There are no liability risks, and in most cases, taxes are assessed only on properties that are actively producing oil or gas.

A royalty is the portion of production the landowner receives. A royalty clause in the oil or gas title process will typically give a percentage of the lease that the company pays to the owner of the mineral rights, minus production costs. Royalties are free from costs and charges, other than taxes.

Oil & gas royalties are paid monthly, consistent with the normal accounting cycle of the producer, unless the obligation does not meet the minimum check requirement for that particular state. These laws are generally known as aggregate pay laws, usually set at either $25 or $100.

For many years, almost all oil and gas leases reserved a 1/8th royalty. Today, the royalty fraction is negotiable, and is usually between 1/8th and 1/4th. Bonus. The bonus is the amount paid to the Lessor as consideration for his/her execution of the lease.